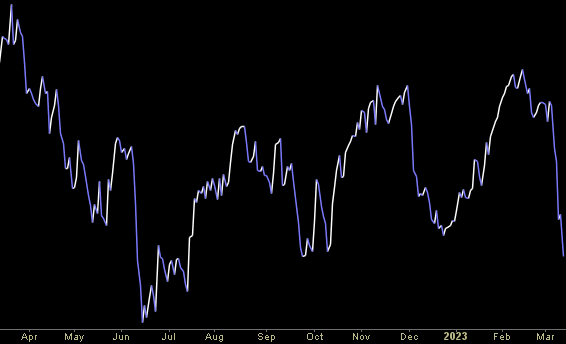

CNBC Indonesia “Closing Bell” Appearance – Thomas Hayes – Chairman of Great Hill Capital – March 14, 2023

Tom Hayes – Quoted in Yahoo! Finance article – 3/14/2023

Thanks to Dave Briggs for including me in his article on Yahoo! Finance. You can find it here:

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Tom Hayes – Quoted in New York Post article – 3/13/2023

Thanks to Lydia Moynihan, David Propper and Bruce Golding for including me in their article in the New York Post. You can find it here:

Click Here to View The Full Article at the New York Post

Be in the know. 15 key reads for Monday…

- Regulators close Signature Bank, second shuttered by feds after SVB disaster (nypost)

- JPMorgan analysts warned about Silicon Valley Bank’s $16B in ‘unrealized losses’ in November (nypost)

- Some Democrat-donor investors furious over Biden’s handling of SVB (nypost)

- SVB’s rescue means the Fed won’t hike rates in March, says Goldman Sachs (marketwatch)

- Pfizer to Buy Cancer Biotech Seagen for $43 Billion (barrons)

- Icahn Takes Aim at Illumina (barrons)

- All That Talk About a Wage-Price Spiral? It’s Wrong. (barrons)

- Fed Now Expected to Rein in Rate Hikes. Market Pricing Shows Shift Amid Banks Crisis. (barrons)

- Treasury yields plunge as SVB fallout seen slowing Fed rate hikes (marketwatch)

- SVB, Signature Bank Depositors to Get All Their Money as Fed Moves to Stem Crisis (wsj)

- China’s Xi to Speak to Zelensky, Meet Next Week With Putin (wsj)

- Treasuries Surge as Traders Recalibrate Rate Bets: Markets Wrap (bloomberg)

- Treasury Two-Year Yields Drop Half a Point as Fed Bets Slashed (bloomberg)

- KBW recommends buying these 11 financial stocks, including First Republic, following federal backstop for banks (marketwatch)

- Tencent, Alibaba, AIA fuel Hong Kong market rally while BeiGene erases loss amid Silicon Valley Bank fallout (scmp)

Be in the know. 27 key reads for Sunday…

- SVB’s collapse is not a harbinger of another 2008 (ft)

- Silicon Valley Bank: A major bank failed. Here’s why it’s not 2008 again. (usatoday)

- Just like that: Market pricing swings back to quarter-point Fed rate hike (cnbc)

- Meta plans new job cuts that could match 2022 tally of 11,000: report (nypost)

- Mark Zuckerberg’s Meta exploring plans to launch Twitter rival (nypost)

- Cheap deposits have become a painful pandemic hangover for US banks (ft)

- Li Qiang becomes China’s premier, tasked with reviving economy (cnbc)

- From wooing Tesla to Xi’s right-hand man: Li Qiang’s road to China’s premiership (ft)

- Carl Icahn, “You have to buy things where the rest of the world is looking at you and thinking you’re a little bit crazy. You’re going against the trend. A lot of times, events are overblown. Overblown on the good side, overblown on the bad side.” (businessinsider)

- “Importantly, we don’t believe this is anything like 2008-09. The largest and most systematically important banks have been heavily regulated and stress tested for years. However, to me this is a warning to the Fed about the impacts on a forward basis that their aggressive rate hikes are having.” (businessinsider)

- Falling Survey-Response Rates Undermine Economic Data (wsj)

- What’s Going on With Silicon Valley Bank? (wsj)

- 2024 Ferrari Purosangue: A Touring Wagon That Howls (wsj)

- SVB’s failure could be the thing that keeps the Fed from wrecking the economy, Cramer says (cnbc)

- 31% of new cars sold for above sticker price last month. These 10 models have the biggest premiums (cnbc)

- 106-year-old and 103-year-old sisters share longevity tips: ‘Be happy, be healthy, and have love in your life’ (cnbc)

- U.S. Employers Keep Hiring, but Signs of Easing Are Seen (nytimes)

- Yellen Says Bank System Remains Resilient in Wake of SVB Failure (bloomberg)

- Blue Chip Classic Car Prices Soften at Amelia Island Auctions (bloomberg)

- Liquefied natural gas will continue to lead growth in U.S. natural gas exports (eia)

- Is Amazon Stock a Buy After Stores Set to Close? (morningstar)

- 3 Undervalued, High-Quality Cyclical Stocks (morningstar)

- 25 Golden Rules for Investing by Peter Lynch (dgi)

- Wharton professor Jeremy Siegel says the Fed’s rate hikes and ‘monomaniacal’ focus on the labor market are ‘misguided’: ‘Workers are way behind’ (fortune)

- Alibaba targets South Korean market with $75.7 million investment in 2023 (technode)

- We found the ‘missing workers’ (planetmoney)

- Swap and credit spreads say no recession (scottgrannis)

Be in the know. 12 key reads for Saturday…

- Fed Rate Outlook Overshadowed as SVB Collides With Jobs Report (bloomberg)

- Silicon Valley Bank’s Failure May Lead to Smaller Fed Rate Hike (barrons)

- China Consumer Spending Shows Strong Rebound Signs (bloomberg)

- Marc Benioff Is Fighting to Put Salesforce Back on Top. The Ultimate Salesman Has to Learn a New Game. (barrons)

- Dell Could Be Tech’s Cheapest Stock. The Discount Is Unlikely to Last. (barrons)

- What Happened at SVB Financial, and What It Means for the Rest of Us (barrons)

- Domino’s Pizza CEO Buys Up Stock (barrons)

- Don’t Fret About a Wage-Price Spiral (barrons)

- Buying an EV? Here’s How Long Until It Will Pay Off. (barrons)

- Stock Buybacks Aren’t Slowing Down. Here’s Why. (barrons)

- After Disney and Salesforce, What Activists May Target Next (barrons)

- Buy bank stocks now? You could get a bargain as Silicon Valley Bank collapses. (marketwatch)