Be in the know. 18 key reads for Tuesday…

- China’s Wealthy Shoppers Are Back. These Stocks Could Benefit. (barrons)

- Retail Investors Buy Record Amounts Of Six-Month Bills In Monday’s Auction (zerohedge)

- Xi blames Washington-led ‘containment, encirclement and suppression’ for challenges at home (wsj)

- China says U.S. relations have left ‘rational path’ (cnbc)

- Xi stressed the importance of the private sector to China’s economy, and urged companies to strengthen innovation and play a bigger role in establishing technology independence. (bloomberg)

- China Overhauls Financial Regulatory Regime to Control Risks (bloomberg)

- China rebuffs billionaire investor Mark Mobius’s warning that the government made it harder to get money out, report says (businessinsider)

- JPMorgan CEO Jamie Dimon says that the US can still avoid a recession and that the Russia-Ukraine war is the biggest geopolitical threat since World War II (businessinsider)

- Earnings Watch: ‘Analysts expect earnings declines for the first half of 2023, but earnings growth for the second half of 2023,’ FactSet says (marketwatch)

- Here’s what analysts are saying after China set its growth target at 5% (marketwatch)

- Powell Faces Congress. Inflation and the Debt Ceiling Are in Focus. (barrons)

- Consumer Spending Is Holding Back a Recession (barrons)

- Biden’s Budget Comes This Week. What It Means for the Debt Ceiling Fight and Stocks. (barrons)

- Powell’s Testimony Is About to Start. What History Says the Stock Market Does Next. (barrons)

- Capacity Tapped Out. The Energy Report 03/07/2023 (Phil Flynn)

- Why the Recession Is Always Six Months Away (wsj)

- NPC Begins, Premier Li Indicates China’s Economy Might Not Need Stronger Stimulus (chinalastnight)

- Big Tech Is the Big Artificial Intelligence Winner: Grab These 5 Top Stocks Before It’s Too Late (247wallst)

Tom Hayes – Yahoo! Finance Appearance – 3/6/2023

Yahoo! Finance Appearance – Thomas Hayes – Chairman of Great Hill Capital – March 6, 2023

Watch in HD directly on Yahoo! Finance

Where is money flowing today?

Be in the know. 12 key reads for Monday…

- China Sees ‘Rapid’ Consumer Rebound as UBS Lifts GDP Outlook (bloomberg)

- Xi Vows to Boost High-End Manufacturing in Face of US Pressure (bloomberg)

- Here’s What You Need to Know After Day One of China’s NPC (bloomberg)

- China Markets Await Further Bullish Signs From NPC: In Charts (bloomberg)

- China Sets 5% GDP Growth Target, Seeking a Revival (barrons)

- Apple Stock Is a Buy, Goldman Sachs Says. The Market Is Missing Something. (barrons)

- Fed’s Powell Faces Congress. The Questions Investors Need Answered. (barrons)

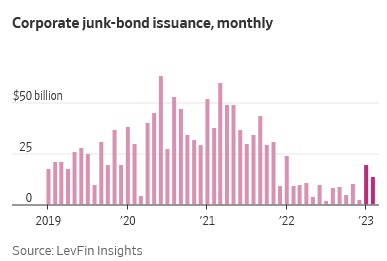

- Junk-Rated Companies Borrow Again (wsj)

- Tesla Slashes Model S and X Prices for the Second Time This Year (bloomberg)

- Here’s what analysts are saying after China set its growth target at 5% (marketwatch)

- Why the stock-market rally can keep going, says Morgan Stanley strategist who just warned of a death zone (marketwatch)

- exclusive | Hong Kong plans to relax valuation and track record rules for ‘specialist Big Tech’ to spur stock offers, sources say (scmp)

Be in the know. 25 key reads for Sunday…

- Ford to increase production of 6 models in 2023 (foxbusiness)

- China Seeks ‘Peaceful Reunification’ With Taiwan in Key Report (bloomberg)

- China sets GDP target of ‘around 5%’ for 2023 (cnbc)

- Here’s how much economists expect China’s GDP to grow this year (cnbc)

- China Central Government to Borrow More: 2023 Budget Details (bloomberg)

- The Economy’s Road to Wellville (wsj)

- Maria Vassalou on the Small-Cap Effect (apple)

- China Says Its Economy Will Expand About 5 Percent, a Cautious Target (nytimes)

- Office REITs Are Down, But They May Not Be Out (thestreet)

- End of Q1 Impacts March Trading (Almanac Trader)

- Full Swing Wrap: An interview with Executive Producer Chad Mumm (golfdigest)

- Bars, Hotels and Restaurants Become the Economy’s Fastest-Growing Employers (wsj)

- China’s Power in Emerging Markets Creates Headache for Global Investors (wsj)

- China’s New Top Troubleshooters (wsj)

- Waymo’s L.A. Robotaxi Fleet Is Going Fully Driverless (forbes)

- ‘Rich People Don’t Use Napkin Rings’: How ‘Succession,’ ‘Billions’ and Other Helipad Dramas Get the Details Just Right (robbreport)

- Alibaba’s T-Head foresees RISC-V to support more advanced scenarios in China (technode)

- 16 Investing Lessons from a Superinvestor the World Forgot (safalniveshak)

- Is the government choosing winners and losers? (npr)

- Why We Don’t Build More Apartments for Families (bloomberg)

- Europe’s Most Luxurious Train Rolls Again! (townandcountrymag)

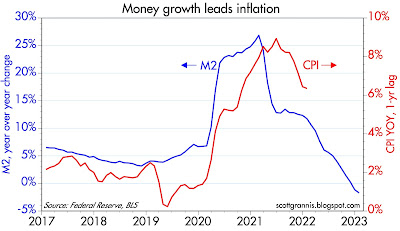

- M2: the smoking gun of inflation (scottgrannis)

- Kelsea Ballerini Performs on SNL (people)

- China to Target ‘Unregulated’ Expansion in Property Market (bloomberg)

- China’s Modest GDP Growth Target Reduces Need for More Stimulus (bloomberg)

Be in the know. 28 key reads for Saturday…

- China’s New Government’s Policies Are Taking Shape (barrons)

- The 10 Best Companies to Invest in Now (morningstar)

- This Week in China: Xi Has a Shot at Restoring Market Confidence (bloomberg)

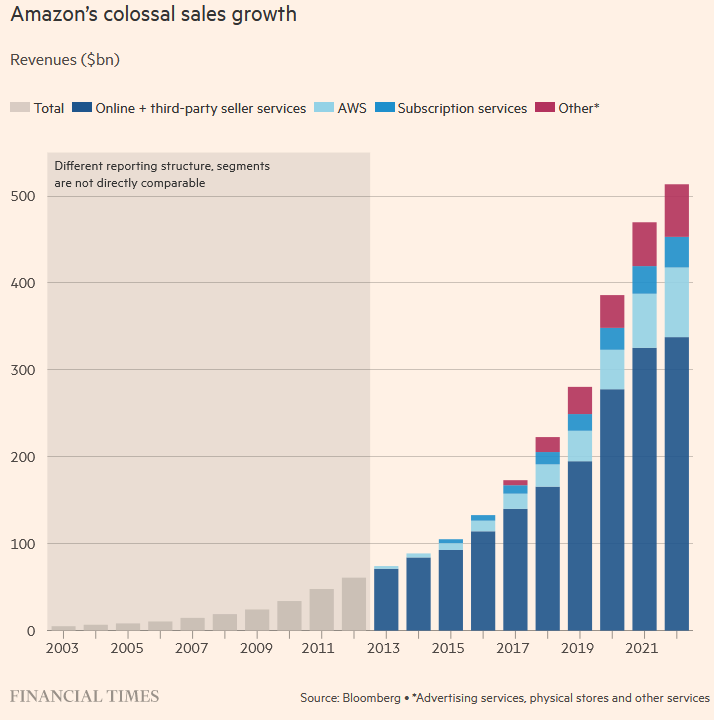

- Can this man turn Amazon around? (ft)

- China Investors Are Finally Getting the Market They Wished For (barrons)

- 12 ‘Dirt Cheap’ Stocks Are Due For A Rally, Analysts Say (investors)

- Cowboy Chic Is Hot, but Boot Barn Is No Passing Fad (barrons)

- Tech Companies Are Still Addicted to Stock Options. These 4 Stocks Could Be Most at Risk. (barrons)

- Warm weather means stock-market investors shouldn’t look for a cooler February jobs report: economist (marketwatch)

- China’s New Government Is Taking Shape. So Are Its Economic Policies. (barrons)

- ‘The housing market is crumbling’ under higher mortgage rates and rock-bottom affordability: Prices fell the most in these states (marketwatch)

- These 24 tech stocks stand out now as the FAANGs fade (marketwatch)

- The U.S. Stock Market Is Undervalued, but It Looks Like a Rough Road Ahead (morningstar)

- 6 Cheap Stocks to Play Long-Term Growth Trends (morningstar)

- Undervalued Defensive Stocks to Buy Now (morningstar)

- The Big Read. Can TikTok convince the world it is not a tool for China? (ft)

- Three-day weekends and more time for love: China’s elite dream up policies for Xi (ft)

- The incredible shrinking equity market (ft)

- We try to find things priced much more attractively than the market, says Oakmark’s Bill Nygren (cnbc)

- What You Can Learn From Warren Buffett’s Mistakes (bloomberg)

- Einhorn explains how to look at ROE( Return on Equity) (twitter)

- Amazon’s Zoox robotaxi drives on public roads in California for the first time (cnn)

- 6 reasons why the stock market is poised to see its strongest rally of 2023 over the next 2 months, according to Fundstrat (businessinsider)

- China to Boost Defense Budget; EV Chiefs Give Advice: NPC Update (bloomberg)

- Texas ranch of late oil tycoon T. Boone Pickens sells after $80M price cut (nypost)

- A Quirky Bond Trade Is Giving Companies a Back Door to Cut Borrowing Costs (bloomberg)

- 2023 Lamborghini Urus Performante: Super-Sport Thrills That Aren’t So Cheap (wsj)

- Goldman Sachs Was Once a ‘Vampire Squid.’ Now It’s Just an Average One. (barrons)