Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Tips (PCN) – Position Completion Notification

Be in the know. 22 key reads for Monday…

- Alibaba Cloud Debuts Generative AI Model for Corporate Users (alizila)

- China Pumps $25 Billion in Funds to Banks While Keeping Key Rate on Hold (bloomberg)

- The Pig Still Hasn’t Fully Exited the Python (bloomberg)

- The US dollar’s recent slide is flashing a bullish signal for markets (businessinsider)

- Merck to buy Prometheus Biosciences for $10.8 billion (marketwatch)

- The U.S. dollar is under fire from rival nations. What happens to markets if the greenback loses its world dominance? (marketwatch)

- M&T Bank’s Earnings Defy Turmoil to Top Forecasts. The Stock Is Rising. (barrons)

- A Ferrari 275 Originally Owned by the Late Actor Steve McQueen Heads to Auction (barrons)

- Why 5% interest rates might not derail the stock market or the U.S. economy (marketwatch)

- Walmart borrowing $5 billion in debt highlights a thaw in a crucial area of financial markets (marketwatch)

- Banks Are Finally Facing Pressure to Pay Depositors More (wsj)

- Drug and Game Makers Lead M&A’s Latest $20 Billion Bounce (bloomberg)

- Hedge Funds Go All In on Dollar, First Time in Over a Year (bloomberg)

- Moderna and Merck’s combo cancer-vaccine treatment shows ‘significant’ promise (marketwatch)

- Moderna is developing a vaccine against the tick-borne Lyme disease, in a first for the company (marketwatch)

- The U.S. dollar is under fire from rival nations. (marketwatch)

- BlackRock’s Larry Fink says there’s no big recession headed for the US economy, but inflation will be ‘stickier for longer’ (businessinsider)

- Howard Marks says rock-bottom rates are history, bitcoin has its uses, and AI won’t replace the best investors. Here are his 8 best quotes from a new interview. (businessinsider)

- New York Factory Activity Expands for First Time in Five Months (bloomberg)

- Goldman Sachs sees ‘relative outperformance’ for V.F. Corp. (VFC), double upgrades to Buy, raises target (streetinsider)

- Coach CEO latest luxury brand chief to visit ‘growth engine’ China post-Covid (scmp)

- Foreign brands flock to China’s Hawaii as consumption rebounds (scmp)

Be in the know. 12 key reads for Sunday…

- Yellen says US banks may tighten lending and negate need for more rate hikes (reuters)

- Bond Buyers See ‘Best Bang for Buck’ in EM as Hiking Cycles End (bloomberg)

- Aswath Damodaran on the Future of Business Education (bloomberg)

- US Commercial Bank Deposits & Loans Rose Last Week; Small Bank Depos Up Most In 4 Months (zerohedge)

- UMich 1 Year Inflation Expectations Soar The Most In Two Years As Sentiment Inexplicably Rises (zerohedge)

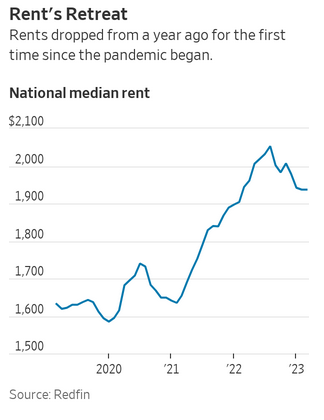

- Rent Drops Annually For First Time In Three Years—Here’s Where Prices Dropped The Most (forbes)

- Introducing the 2024 Lamborghini Revuelto, a 1,001-Horsepower Speed Demon (mensjournal)

- Alibaba to re-separate Tmall and Taobao as restructuring continues (technode)

- Alibaba to embed ChatGPT-like language model into all of its products (technode)

- Transcript: Eight Months In, What Is Happening With Biden’s CHIPS Act? (bloomberg)

- The Coolest Muscle Cars You Can Buy in 2023 (roadandtrack)

- Danny Meyer, Founder of Shake Shack — How to Win, The Art of The Graceful “No,” Overcoming Setbacks, The 6 Traits of Exceptional People, The 4 Quadrants of Performance, Lessons from Hospitality Excellence, and More (#665) (tim)

Be in the know. 15 key reads for Saturday…

- As Bank Earnings Go, So Goes the Stock Market. So Far, So Good. (barrons)

- There Was No Crisis for JPMorgan and Its Big-Bank Peers (wsj)

- Profit Margins Are the Next Big Risk for Stocks (barrons)

- JPMorgan’s Results Show Banks’ Big Losses on Bonds Are Diminishing (barrons)

- Life Insurance Stocks Look Cheap and Inviting (barrons)

- The ‘fuel is there to blow the top off’ the stock market. Here’s what’s missing. (marketwatch)

- ‘Dangerous times’: These aerospace and defense, cybersecurity ETFs are on ‘verge of breakouts’ (marketwatch)

- First Annual Drop in Rents Since Pandemic Began, Redfin Says (wsj)

- McCarthy Planning to Unveil One-Year Debt Ceiling Extension (bloomberg)

- China Home Prices Rise for Second Month as Market Stabilizes (bloomberg)

- China Luxury Boom Returns But LVMH, Hermes Stand Out From Crowd (bloomberg)

- Morningstar: Stocks are historically cheap — buy these 33 top undervalued names to brace for a volatile market today and profit from the recovery later this year (businessinsider)

- Elon Musk is reportedly planning an A.I. startup to compete with OpenAI, which he cofounded (cnbc)

- 10 Of The Best Books On Stock & Business Valuation (2023) (acquirersmultiple)

- Artificial Intelligence Is Teaching Us New, Surprising Things About the Human Mind (wsj)

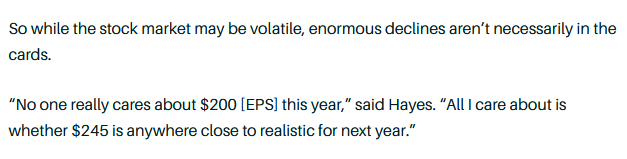

Tom Hayes – Quoted in Barron’s article – 4/14/2023

Thanks to Jacob Sonenshine for including me in his article in Barron’s today. You can find it here:

Click Here to View The Full Article at Barron’s

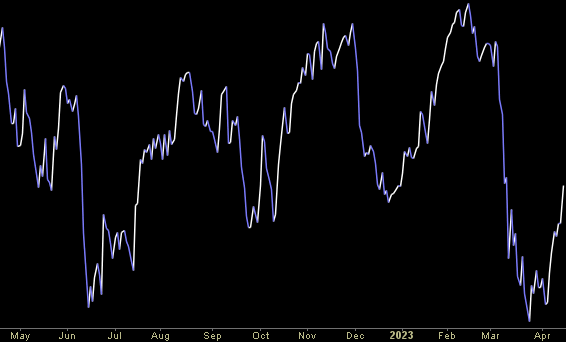

Where is money flowing today?

Tom Hayes – Quoted in Reuters article – 4/14/2023

Thanks to Bansari Kamdar, Tatiana Bautzer and Mehnaz Yasmin for including me in their article on Reuters today. You can find it here:

Click Here to View The Full Reuters Article

Be in the know. 20 key reads for Friday…

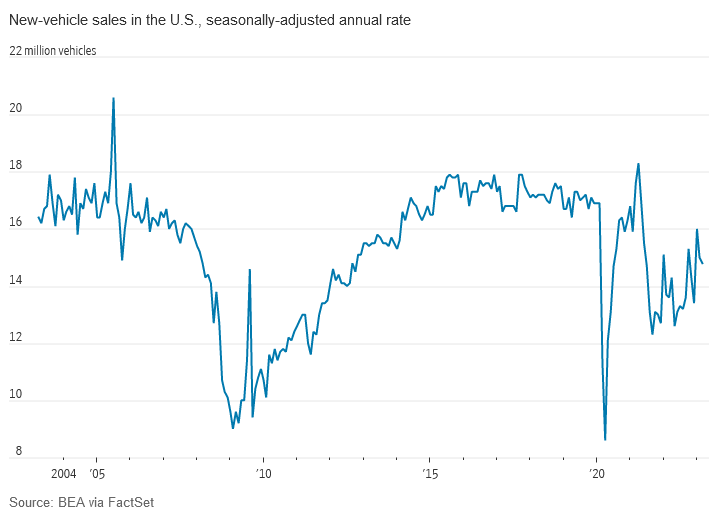

- As Dealerships Get More Stock, Auto Makers’ Sales Rebound. GM, Hyundai and others report a robust start to the year, due in large part to rising inventory levels and easing supply-chain troubles (wsj)

- JPMorgan Chase stock shifts into rally mode after it blasts past earnings and revenue estimates (marketwatch)

- Banking crisis forces ECB policymakers to rethink rate hikes, but focus still firmly on inflation (cnbc)

- Wells Fargo shares rise after bank’s first quarter profit and revenue top the Street (cnbc)

- Can Intel become the chip champion the US needs? (ft)

- Birkin bag maker Hermes sees no U.S. slowdown as sales jump 23% (cnbc)

- For Regional Banks, Surviving Won’t Be the Same as Thriving (wsj)

- JPMorgan Chase posts record revenue that tops expectations on higher interest rates (cnbc)

- Wall Street is wrong: Former Pimco chief economist Paul McCulley predicts rate hikes will end next month (cnbc)

- New-vehicle inventories, discounts rise as the New York Auto Show heralds spring selling season (wsj)

- Hedge Fund 101: You Always Buy Liquidation Events (chinalastnight)

- Big banks kick off earnings season with a bang (yahoo)

- BofA Strategists Prefer Global Stocks to Tech-Heavy US Market (bloomberg)

- PBOC Pledges Stronger Support to Economy (bloomberg)

- Buffett Focus on ‘Quality’ Helps Narrow Hunt for Value in Japan (bloomberg)

- Citigroup profit rises and beats analyst forecasts, shares rise (marketwatch)

- Retail Sales Fell More Than Expected in March (barrons)

- Supplier Prices Fell in March, Adding to Signs of Moderating Inflation (wsj)

- Amazon CEO Andy Jassy Commits to Cost-Cutting, Innovation in Shareholder Letter (wsj)

- The Fed could turn a mild downturn into an ugly recession if it doesn’t stop raising rates soon, market veteran Ed Yardeni says (businessinsider)