- Fed Officials Signal Divide Over Whether to Hike Rates Again (bloomberg)

- Tencent, BYD slam Hong Kong stocks in US$26 billion sell-off (scmp)

- Good News for Alibaba and Other Chinese Stocks. UBS Sees 3 Reasons to Be Bullish. (barrons)

- Today’s Fed Minutes Could Hold Clues to Future Moves (barrons)

- Bank Earnings Are a Big Test. Wall Street Is Banking On a Passing Grade. (barrons)

- Warren Buffett says more banks may fail, but he’s willing to bet $1 million that depositors won’t lose money (marketwatch)

- 3M, Danaher, and Kellogg Are Spinoff Stock Plays (barrons)

- Warren Buffett Is Bullish on Japan. Why Other Investors Should Be Too. (barrons)

- Top US Banks to Reveal Biggest Deposit Drop in a Decade (bloomberg)

- JPMorgan Calls Managing Directors Into Office Five Days a Week (bloomberg)

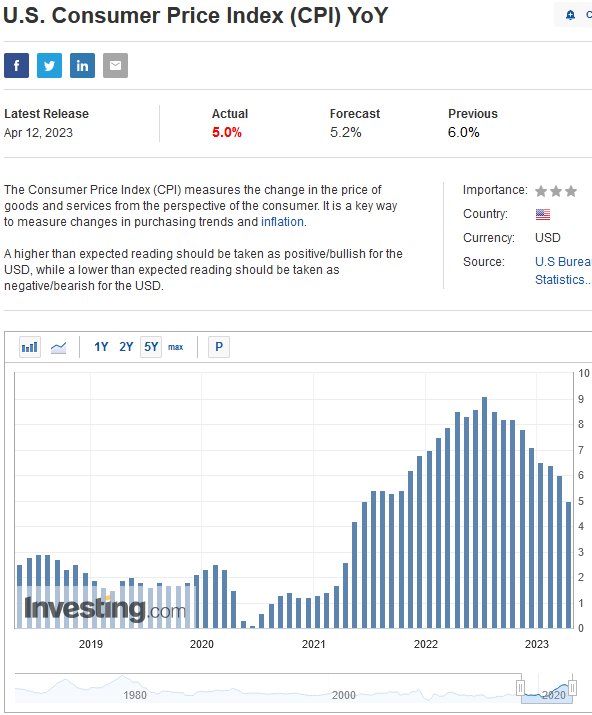

- Traders Boost Bets on Fed Rate Cuts by Year End After CPI (bloomberg)

- Wall Street is wrong: Former Pimco chief economist Paul McCulley sees rate hikes ending next month (cnbc)

- Wharton professor Jeremy Siegel reveals his investment plan if a recession hits and reiterates his view that the stock market bottom is in (businessinsider)

- “Probably Means The Fed Is Done Hiking”: Wall Street Reacts To “Cooler” CPI Report (zerohedge)

- US inflation eased to lowest level in nearly two years in March (ft)

- Top Fed officials debate need for further rate rise amid bank stress (ft)

- China still a key market for Intel, CEO says in Beijing trip (scmp)

- Spring Refining Capacity Fever. The Energy Report 04/12/2023 (Phil Flynn)

- Fed Official: ‘We Need to Be Cautious’ on Raising Rates After Bank Failures (wsj)

- AI Can Write a Song, but It Can’t Beat the Market (wsj)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Tips (PCN) – Position Completion Notification

Hedge Fund Tips (PCN) – Position Completion Notification

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 22 key reads for Tuesday…

- China Bets $1.8 Trillion of Construction Will Boost Economy (bloomberg)

- Alibaba Stock Rises on Launch of ChatGPT Rival. China’s AI Race Is Heating Up. (barrons)

- Fintech Jack Henry Is Safe From Banking Turmoil. Buy the Stock While It’s Cheap. (barrons)

- Left for dead, the traditional 60/40 investment strategy is about to make a comeback (marketwatch)

- Hedge funds have switched out of onshore stocks over the past two months in favour of Chinese stocks listed in Hong Kong and New York: Goldman report (scmp)

- Warren Buffett Visits Japan, Boosts Shares In Trading Houses, Weighs Buying More (zerohedge)

- Meet Tongyi Qianwen, Alibaba’s chatbot rival to ChatGPT (marketwatch)

- Can artificial intelligence reverse the tech downturn? Startups are hiring for the next big thing. (marketwatch)

- Why a long, shallow recession is more likely than ‘deep and long credit crunch contraction,’ says Mizuho (marketwatch)

- 12 charts show a global recession has already begun (marketwatch)

- Warren Buffett to Bolster Stakes in Japan’s Big Trading Houses. Stocks Jump. (barrons)

- Warner Bros. Discovery Stock Will Climb on DC Superhero Films: Analyst (barrons)

- The $76 Billion Diet Industry Asks: What to Do About Ozempic? (wsj)

- Occidental Makes a Billion-Dollar Climate Moonshot—So It Can Keep Pumping Oil (wsj)

- Tumbling Money Supply Alarms Economists Who Foresaw Inflation (bloomberg)

- CarMax Jumps as Profit on Used Vehicles Drives Earnings Beat (bloomberg)

- Intel’s Foundry Bet May Split The Market in Three (bloomberg)

- Nobel economist Paul Krugman says this is the best job market in decades, and the Fed doesn’t need high unemployment to bring down inflation (businessinsider)

- It’s time for the Fed to pause its war on inflation before it starts dragging down the US economy, top Moody’s economist says (businessinsider)

- ‘Succession’ and ‘Dr. Pimple Popper’ Together in New Warner Streaming App (nytimes)

- The BOJ Is Collecting Tens Of Billions In Dividends From ETFs It Owns (zerohedge)

- Boeing 737 MAX back in service at 11 Chinese airlines, US firm says (scmp)

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 18 key reads for Monday…

- The coming commercial real estate crash that may never happen (cnbc)

- Micron Stock Jumps as Samsung Cuts Chip Output. Why the Sector Is Poised to Rebound. (barrons)

- Ford and GM Stock Are ‘Exceptionally Undervalued,’ Says Value-Investing Star (barrons)

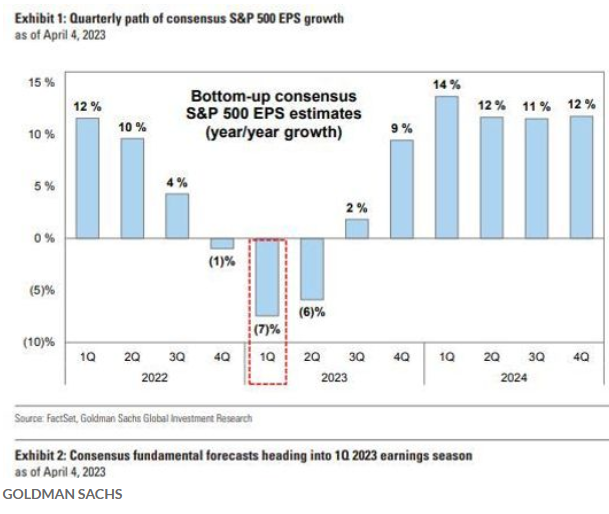

- Here are Goldman’s 4 things to watch for as gloomiest earnings season since pandemic begins (marketwatch)

- Investors looking for further proof of a ‘credit crunch’ just got it, says this strategist. (marketwatch)

- Investors View Corporate Earnings Season as Next Test for Stocks (wsj)

- Argus adds Intel (INTC) stock to its Focus List, sees it as a ‘deep-value opportunity’ (streetinsider)

- The Video Streaming Numbers Game Is Shifting (wsj)

- China’s first batch of shares under new IPO system surge in debut (reuters)

- Occidental Plans to Suck Carbon From the Air—So It Can Keep Pumping Oil (wsj)

- Bond Market Is Overplaying the Risk of a Deep Recession (bloomberg)

- Most of Wall Street is panicking about commercial real estate – but Goldman Sachs says there’s little chance it triggers a financial crisis (businessinsider)

- A $1.5 Trillion Wall of Debt Is Looming for US Commercial Properties (bloomberg)

- What Commercial Real Estate Stress Means for Banks and Bond Funds (bloomberg)

- Apple’s 40% Plunge in PC Shipments Is Steepest Among Major Computer Makers (bloomberg)

- Taiwan Says China Military Drills Similar to Pelosi Response (bloomberg)

- Jon Rahm Comes Back From Behind to Win Masters at Augusta (bloomberg)

- An under-the-radar stock market indicator is pointing to more gains ahead (businessinsider)