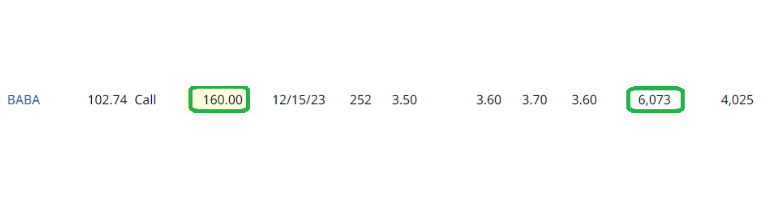

Data Source: Barchart

On Friday some institution/fund purchased 6,073 contracts of Dec. 2023 $160.00 strike calls (or the right to buy 607,300 shares of Alibaba Group Holding Limited (BABA) at $160.00). The open interest was just 4,025 prior to this purchase.

Continue reading “Unusual Options Activity – Alibaba Group Holding Limited (BABA)”