Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 18 key reads for Thursday…

- What Happens When the Tide Goes Out on the Dollar? (bloomberg)

- China Mobile Says Rumors on Suspending iPhone Sales False, Will Continue to Take Part in Selling iPhone 15 (aastocks)

- China’s trade slump narrows as stabilisation signs emerge (reuters)

- Google Reaches Antitrust Settlement With States Over App Store Practices (wsj)

- Comcast, Disney Move Up Start of Hulu Negotiations (wsj)

- Chinese Corporate Bonds Are Sending a Surprising Message About the Economy (wsj)

- Why Higher Unemployment Is Good News Now (wsj)

- For Some Gen Xers, Skateboarding Is for Life (wsj)

- China’s Export Slump Eases Despite Global Demand Pressures (bloomberg)

- China Seeks to Broaden iPhone Ban to State Firms, Agencies (bloomberg)

- Self-Driving Cars Might Finally Be For Real This Time (bloomberg)

- Disney’s $218 Billion Rout Not Enough For Dip Buyers (bloomberg)

- This bull market is still alive and well, says Carson Group’s Ryan Detrick (cnbc)

- NWD Signs MoU with HK Disneyland Resort (aastocks)

- CEO of fintech giant Ant Group pledges support for digital yuan (scmp)

- What Do Billionaires David Tepper, Ken Griffin, and Warren Buffett Have in Common? Their Companies Own This Unstoppable AI Stock. (fool)

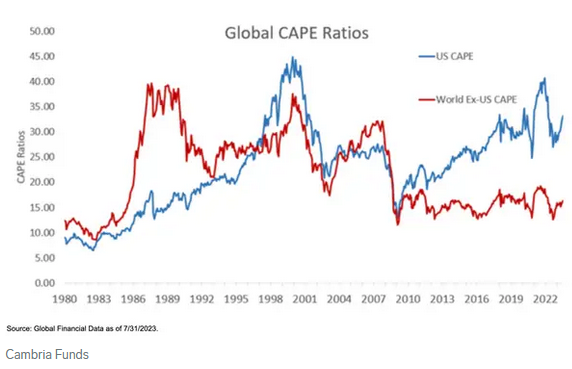

- What equity markets got wrong about China (ft)

- UAW strike would show Biden, other leaders that it’s time to ‘pick a side,’ union boss says (cnbc)

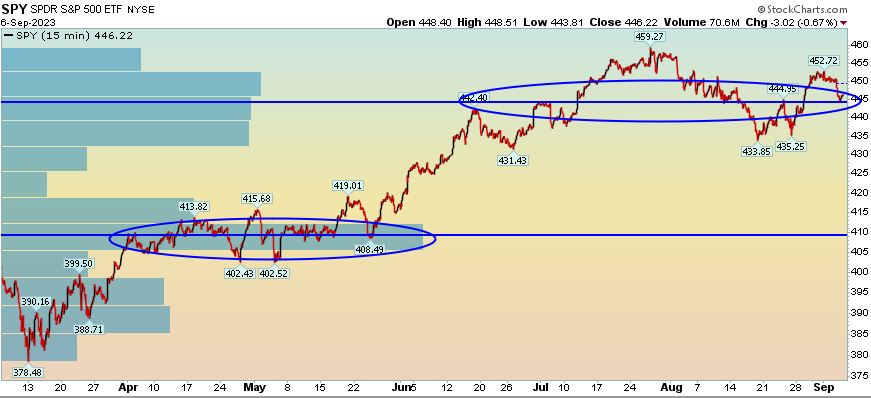

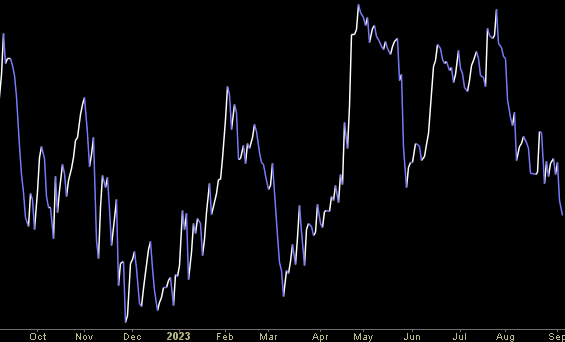

“Steady As She Goes” Stock Market (and Sentiment Results)…

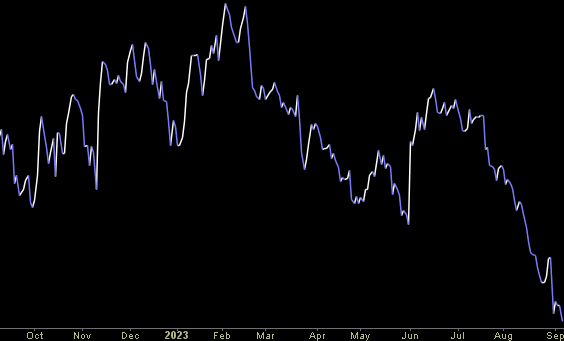

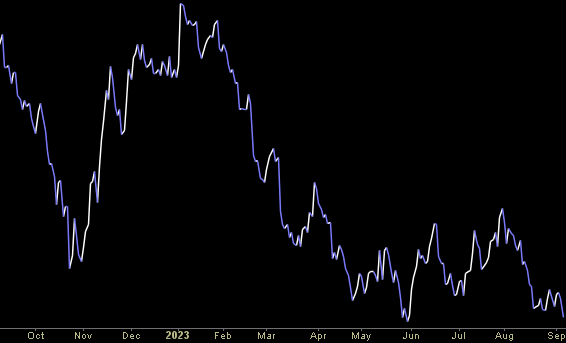

So what’s ailing the market? On August 18, there were big headlines that a “major manager” had just put a huge short on bonds – expecting yields to blow out. On our podcast|videocast that day we said that this particular hedge fund manager probably called the bottom in bonds and the top in rates by “shorting in the hole” one of the most crowded trades in history. Continue reading ““Steady As She Goes” Stock Market (and Sentiment Results)…”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Energy Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Energy Sector ETF (XLE). Continue reading “Energy Earnings Estimates/Revisions”

Defense & Aerospace Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Defense & Aerospace ETF (ITA). Continue reading “Defense & Aerospace Earnings Estimates/Revisions”

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 15 key reads for Wednesday…

- Wells Fargo: Citigroup Stock Is ‘Pricing in Too Much Fear.’ (barrons)

- China’s internet sector posts strong profit growth in first 7 months of 2023 (scmp)

- Ford Isn’t Going to Be the Next Apple. It Could Be a New Deere. (barrons)

- The FTC Could Call for an Amazon Breakup. Why Investors Should Celebrate. (barrons)

- As Instacart IPO Looms, DoorDash CEO Says Grocery Delivery Needs to Improve (barrons)

- Apple wants to be a force in live sports. Buying ESPN could be the answer. (marketwatch)

- China’s Country Garden Makes Overdue Dollar-Bond Payments, Avoiding Default (wsj)

- Fed Set to Double US Growth Forecast After Strong Data (bloomberg)

- Mnuchin’s Liberty 77 Capital Acquires 5.5% Stake in Lions Gate (bloomberg)

- “We believe Disney is the best-positioned traditional Media network to drive long-term margins/returns in DTC given its collection of IP and global scale,” Hodulik wrote. (businessinsider)

- Everyone Is Bearish on China—Except Bond Investors (wsj)

- Goldman Sachs chief economist: US consumer won’t break in 2024 (yahoo)

- China Stocks Latest: Builders Jump on Hopes of More Stimulus (bloomberg)

- com Takes Flight on +180% Revenue Increase YoY, Caixin Services PMI Misses Expectations (chinalastnight)

- Alibaba’s Amap, supported by China’s GPS rival Beidou, expands global coverage to boost Belt and Road plan (scmp)