- An Auto-Parts Retailer Crashed—It Can Be Fixed (wsj)

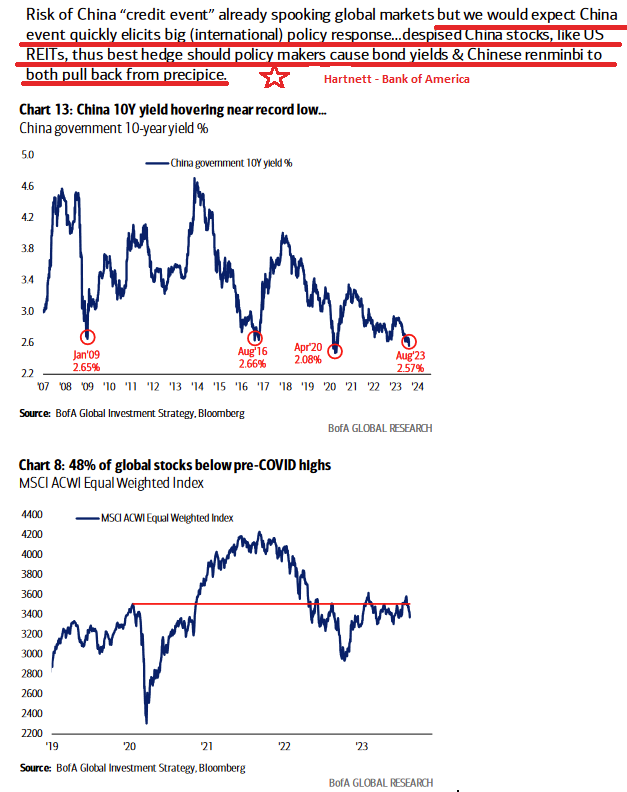

- China unveils measures to revive stock market (reuters)

- China Urges More Loans, Debt Risk Reduction as Woes Compound (bloomberg)

- Lamborghini, Ferrari, Rolls-Royce: The Best Debuts at Monterey Car Week (bloomberg)

- How to Get Rich and Famous From a Stock Market Crash (wsj)

- This New 263-Foot Superyacht Has a Grecian-Inspired Beach Club That Belongs in a 5-Star Hotel (robbreport)

- Aston Martin Goes Topless With DB12 Volante Convertible (maxim)

- Alibaba Cloud launches AI video creation tool Live Portrait (technode)

- China’s internet regulator talks with foreign firms to address concerns over new data law (technode)

- Is the U.S. Economy Really Growing by 5.8%? Not So Fast (barrons)

- China set to cut lending rates as economic recovery drags (ft)

- China Local Governments to Sell $206 Billion of Financing Debt (bloomberg)

- GLP-1 Drugs Are Coming, and They Could Change Everything (bloomberg)

- Is there a ‘life hack’ to break 80 for the first time? 2 top teachers have an idea (golf)

- TIPS vs Gold: which is the better inflation hedge? (scottgrannis)

Be in the know. 15 key reads for Saturday…

- How serious is China’s economic slowdown? (piie)

- China Isn’t Japan in the 1990s. How Its Economic Meltdown Is Different. (barrons)

- Generac Is a Growth Stock at a Value Price. Buy It Before the Storms Start. (barrons)

- Alibaba Unit to Hire 2,000 Graduates as Big Tech Crackdown Eases (bloomberg)

- Alibaba, Tencent renew hiring as Big Tech gears up for growth (scmp)

- CSRC vows to boost ‘vitality, efficiency and appeal’ of stock market (scmp)

- We are close to bottoming from recent market decline, says Fundstrat’s Mark Newton (cnbc)

- A Booster Shot for Your Portfolio (barrons)

- AI Is the Real Deal—if You Understand It. Our 5 Roundtable Pros Are Here to Help. (barrons)

- How Kroger Became the Biggest Sushi Seller in America (wsj)

- China moves to shore up investor confidence in the economy (ft)

- What Wall Street needs to know about UAW talks, a potential strike and what it could all cost (cnbc)

- Will August stock-market stumble turn into a rout? Here’s what to watch, says Fundstrat’s Tom Lee. (marketwatch)

- Italian Scientists Research Whether Eating Pizza Carries Health Benefits (futurism)

- The 10 Best Dividend Stocks (morningstar)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 200

Hedge Fund Tips with Tom Hayes – Podcast – Episode 190

Where is money flowing today?

Be in the know. 10 key reads for Friday…

- China Needs to Engineer a Beautiful Deleveraging (Ray Dalio)

- Amazon’s Pharmacy Deal Shows It Is More Than Tech (barrons)

- What CVS Faces After Being Dropped by Insurer (barrons)

- Opinion: Bears are knocking at the door but bulls still hold the key to this stock market (marketwatch)

- U.S. Mortgage Rates Jump to Highest Level Since 2002 (nytimes)

- Trump Says He’s ‘Not A Fan’ of Powell (bloomberg)

- Despite China’s economic troubles, Cramer says its market won’t collapse (cnbc)

- Would You Spend $60 Million on a Ferrari? (wsj)

- China Evergrande files Chapter 15 bankruptcy in New York (scmp)

- Wage growth won’t mean a new inflationary spiral, says Wharton Professor Jeremy Siegel (cnbc)

Where is money flowing today?

Tom Hayes – Guest on “East West Investment Opportunities” – 8/17/2023

Healthcare (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the 2023 earnings estimates for the Healthcare Sector ETF (XLV) top 30 weighted stocks. Continue reading “Healthcare (top 30 weights) Earnings Estimates/Revisions”

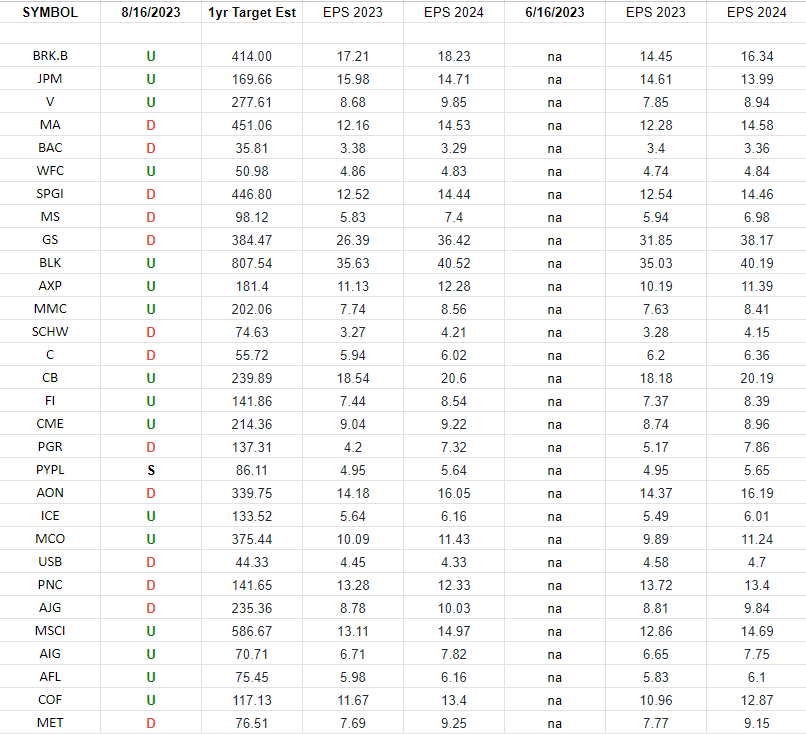

Financials (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Financials Sector ETF (XLF) top 30 weighted stocks. Continue reading “Financials (top 30 weights) Earnings Estimates/Revisions”