In the spreadsheet above I have tracked the 2023 earnings estimates for the Healthcare Sector ETF (XLV) top 30 weighted stocks. Continue reading “Healthcare (top 30 weights) Earnings Estimates/Revisions”

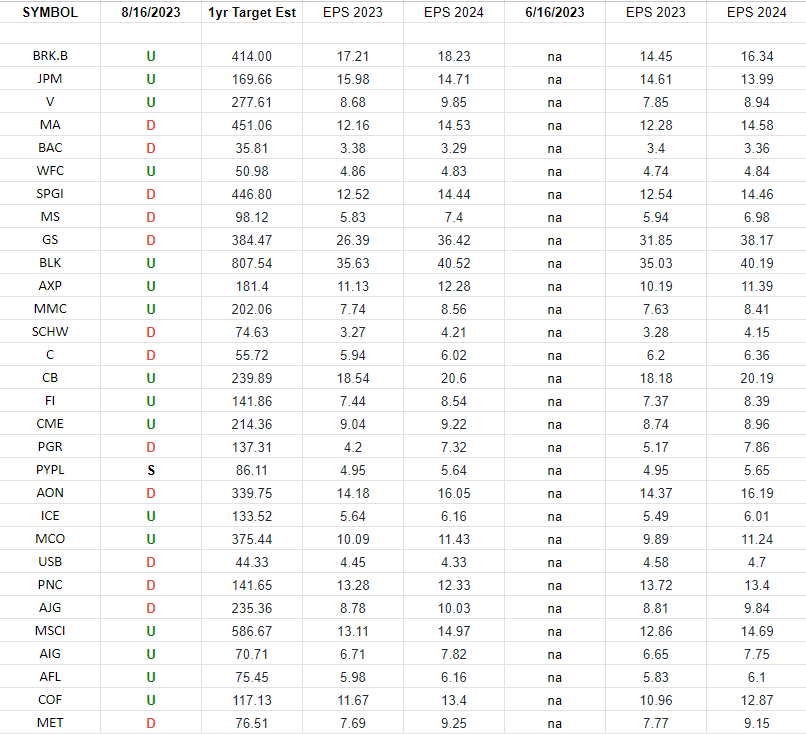

Financials (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Financials Sector ETF (XLF) top 30 weighted stocks. Continue reading “Financials (top 30 weights) Earnings Estimates/Revisions”

Be in the know. 18 key reads for Thursday…

- Alibaba, JD.com Stocks Rebound. China Sets Out Plan to Hit Growth Targets. (barrons)

- China’s premier says country will work to achieve growth targets (cnbc)

- Some Fed Officials Are Turning Cautious about Raising Rates Too High (wsj)

- It’s a matter of ‘when not if’ Apple buys ESPN, says Wedbush’s Dan Ives (cnbc)

- Fed signals more scepticism over need for further rate rises (ft)

- I’m not that worried about a strike by the UAW, it’s not a reason to sell, says Jim Cramer (cnbc)

- PayPal Stock Can’t Catch a Break. A Big Investor Cut Its Stake. (barrons)

- Google-Parent Alphabet Wants to Rein In Costs. The Unit Housing Waymo Is in Its Sights. (barrons)

- K. Inflation Slows, but Still a Worry (wsj)

- A Big Health Insurer Is Ripping Up the Playbook on Drug Pricing (wsj)

- Walmart raises full-year forecast as grocery, online growth fuel higher sales (cnbc)

- Pharma stocks are typically shunned by Wall St. when people feel confident about economy: Jim Cramer (cnbc)

- China’s state banks seen selling dollars for yuan in London and New York hours (reuters)

- Ant Group’s Alipay widens support for Visa, Mastercard, other major credit cards (scmp)

- China Shadow Bank Crisis Sparks Protest by Angry Investors (yahoo)

- Global Yields March to 15-Year Highs as Rate-Hike Worries Build (bloomberg)

- China Police Visit Shadow Bank Investors at Home to Quash Unrest (bloomberg)

- Why is China not rushing to fix its ailing economy? (reuters)

Is that it? Stock Market (and Sentiment Results)…

We don’t know (if that’s it), but in our July 27 note, we put out the following warning:

In our weekly podcast|videocast – we also emphasized the probability of 3-5% pullbacks coming in this normal seasonally weak period – that would be bought by institutions having to play “catch up.” So now we got it, and we think getting close to the point where we should begin to see some institutional cash step in:

Continue reading “Is that it? Stock Market (and Sentiment Results)…”

Tom Hayes – CGTN America Appearance – 8/16/2023

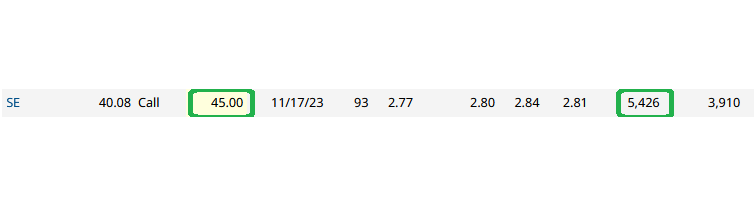

Unusual Options Activity – Sea Limited (SE)

Data Source: Barchart

On Wednesday some institution/fund purchased 5,426 contracts of Nov. 2023 $45.00 strike calls (or the right to buy 542,600 shares of Sea Limited (SE) at $45.00).

Continue reading “Unusual Options Activity – Sea Limited (SE)”

Where is money flowing today?

Be in the know. 14 key reads for Wednesday…

- China Pledges Domestic Consumption Expansion to Boost Growth (bloomberg)

- China Asks Some Funds to Avoid Net Equity Sales as Markets Sink (bloomberg)

- com’s Sales Beat Estimates Despite Chinese Economy Weakness (bloomberg)

- China Digs Deeper Into Toolbag in Grapple With Investor Gloom (bloomberg)

- China Will Have to Put More Fiscal Policy to Work: Leong (bloomberg)

- China Is Buying the Most Iranian Oil in a Decade, Kpler Says (bloomberg)

- Why China’s Reopening Isn’t Providing Enough Youth Employment (bloomberg)

- OMNI PGA Frisco Resort, a new star in golf travel (golfdigest)

- TENCENT (00700.HK) Expects Domestic Games Revenue to Resume YoY Growth in 3Q23 (aastocks)

- Inflation is on a glide path towards sub-2% by the middle of next year, says Fundstrat’s Tom Lee (cnbc)

- Surprise Rate Cut Confirms Economic Support Measures (chinalastnight)

- Furious Investors Protest Outside China’s Insolvent Shadow Banking Giant After It Misses Payments, Warns “Liquidity Has Suddenly Dried Up” (zerohedge)

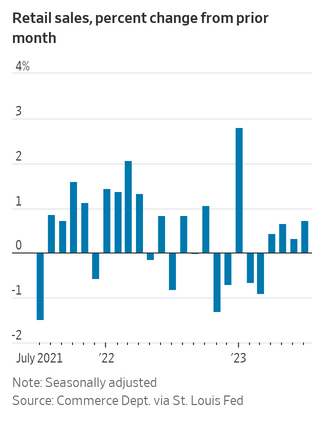

- Shoppers Boost Retail Sales for Fourth Straight Month (wsj)

- Biden’s China Investment Rules Go Far Enough (bloomberg)