- European Stocks See Most Inflows in Decade Amid Defense Splurge (bloomberg)

- Hong Kong stocks cap best week in 2 months on China policy support (scmp)

- CEO Bracken Darrell Brings VF Corp.’s Reinvention Back to Wall Street (wwd)

- Eurozone Grew More Strongly Than Thought at End of 2024 (wsj)

- Euro Set for Best Week Since 2009 as BofA Boosts Forecast (bloomberg)

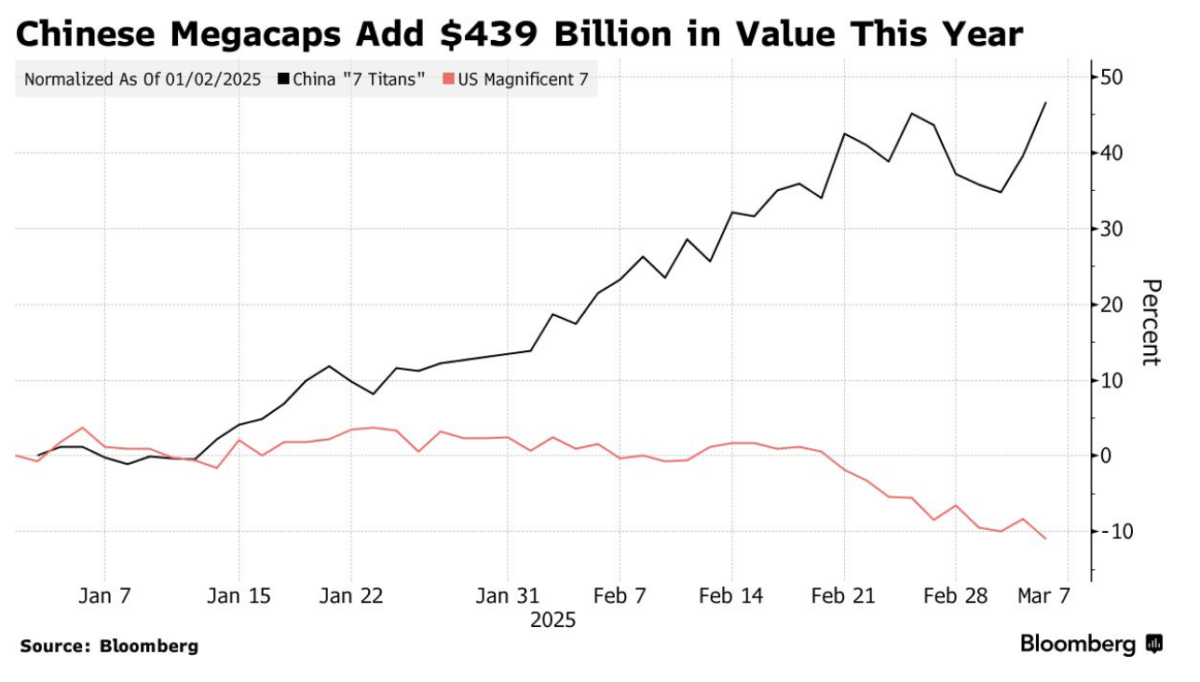

- China’s Top Tech Stocks Add $439 Billion as ‘Mag Seven’ Sink (bloomberg)

- Mortgage Rates Fall to Lowest Level Since December. What It Means for Buyers. (barrons)

- What Automakers’ Tariff Reprieve Means for Car Buyers (wsj)

- The AI Trade Got Crushed. It May Take Time to Rebuild. (barrons)

- 10 Stocks That Could Gain as Dollar Weakens (barrons)

- Sorry, American firms, the AI trade has moved to China (businessinsider)

- NPC Press Conference Signals Upcoming Consumption Boost Plan (chinalastnight)

- Investors push money market assets over $7tn as US equities wobble (ft)

- US Hiring Rises at Solid Pace, Unemployment Unexpectedly Higher (bloomberg)

- China’s Growth Focus, Stable Yuan Fan Hopes of Better Liquidity (bloomberg)

- China Had Record $540 Billion of Exports in Rush to Beat Tariffs (bloomberg)

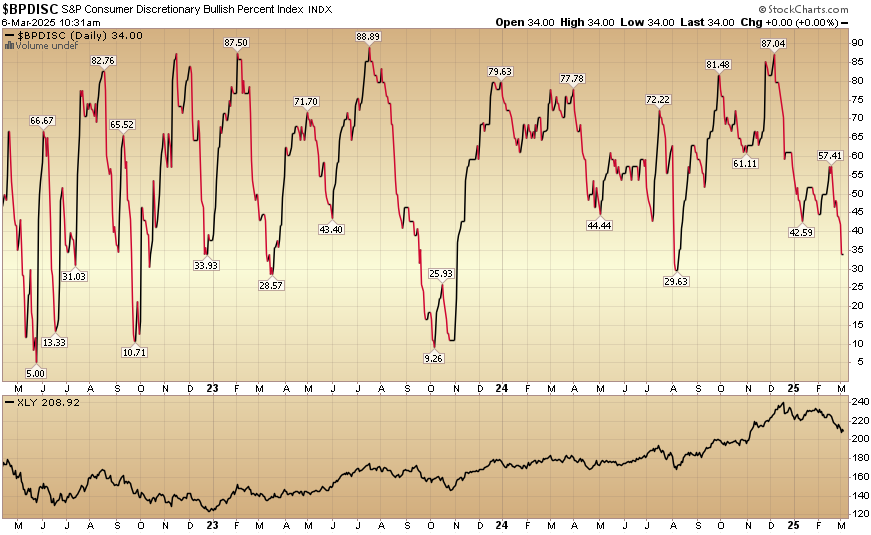

Where is money flowing today?

Indicator of the Day (video): Nasdaq Stocks Above 200 Day MA

Quote of the Day…

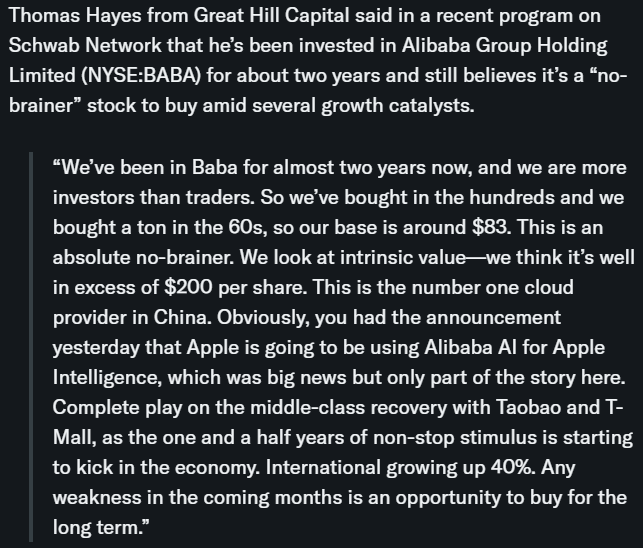

Tom Hayes – Quoted in Yahoo! Finance article – 3/6/2025

Thanks to Fahad Saleem for including me in his article on Yahoo! Finance. You can find it here: