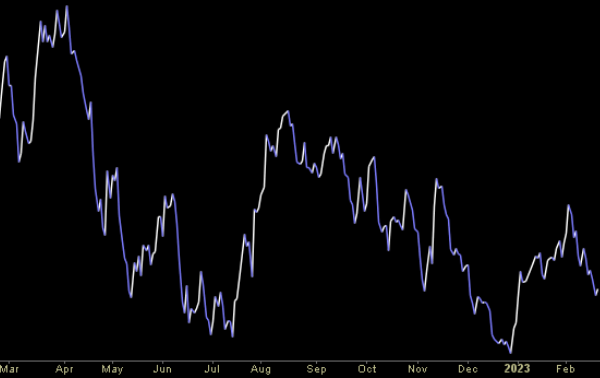

Data Source: Finviz

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 20 key reads for Tuesday…

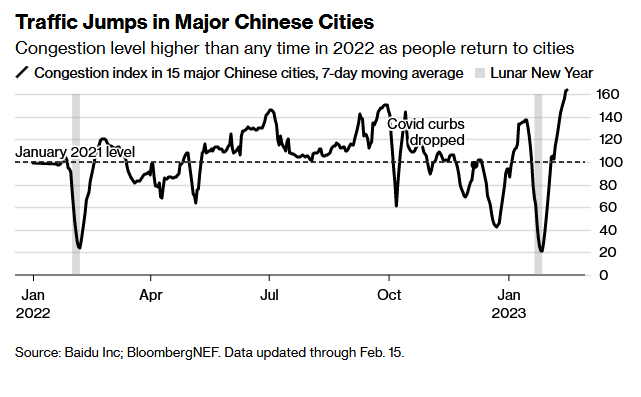

- Chinese Stocks Could Rise Another 20%, Goldman Sachs Says. Here’s How. (barrons)

- China Leaders Pledge Stronger Growth as Recovery Takes Hold (bloomberg)

- China Sets New Rules for Overseas IPOs. (barrons)

- 9 Healthcare Stocks Where the Doubters Are on the Run (barrons)

- Companies Are Getting More Confident About Profits. What It Means for Stocks. (barrons)

- Pfizer Is Moving Beyond Covid. Why Its Stock Is a Buy. (barrons)

- Beware the Fed’s Favorite Inflation Metric Amid Raft of Market-Moving Data (barrons)

- What PayPal and 26 Other Companies Have Said About Layoffs This Year (barrons)

- Investors Stung by Treasuries Rout Brace for Next Blow From Fed (bloomberg)

- Morgan Stanley Says S&P 500 Could Drop 26% in Months (bloomberg)

- From CEOs to Coders, Employees Experiment With New AI Programs (wsj)

- Workers’ Pay Globally Hasn’t Kept Up With Inflation (wsj)

- Hotels, Booking Sites Say Americans Will Keep Traveling in 2023 (wsj)

- Going Private Again Is All the Rage Among Newly Public Companies (wsj)

- Walmart outlook disappoints Wall Street after strong holiday quarter (cnbc)

- ChatGPT recommends 5 books to become a smarter investor – including 2 tied to Warren Buffett (businessinsider)

- Chinese provinces give 30 days’ paid ‘marriage leave’ to boost birth rate (reuters)

- Alibaba shakes up its local consumer services business with a boost to navigation platform Amap as market competition intensifies (scmp)

- A neglected tool of central banks shows its worth (ft)

- Medtronic rises as solid topline points to recovery, analyst sees an encouraging Q4 setup (streetinsider)

Be in the know. 10 key reads for President’s Day…

- China Quietly Pivots From Land Sale Limits to Stem Housing Slump (bloomberg)

- GM CEO Mary Barra Vows Breakout Year for Push to Catch Tesla in EVs (bloomberg) This Is What Happens If the US Actually Hits the Debt Ceiling (bloomberg)

- What Happens Now to All the Laid Off Tech Workers? (bloomberg)

- This 36-year-old scientist is leading the Biden administration’s push for nuclear power (fastcompany)

- 6 Inspirational Movies to Get your Entrepreneurial Juices Flowing (entrepreneur)

- Roblox keeps on building (thehustle)

- Jon Rahm holds off Max Homa to win Genesis Invitational, rises to World No. 1 (golf)

- America’s Best New Courses (golfdigest)

- Formula 1 Will Never Go Electric, Ecclestone Successor Says (bloomberg)

- U.S. officials address mounting tensions between U.S. and China during Munich Security Conference (cnbc)

Be in the know. 10 key reads for Sunday…

- Blinken, China’s Top Diplomat Hold First Meeting Since Balloon Incident (wsj)

- Walgreens CEO Bets on Doctors Over Drugstores (wsj)

- The Super-Rare Lamborghini He Found at the End of an Oregon Dirt Road (wsj)

- Up 7 of Last 11 After Presidents’ Day But Still Weak Long Term (Almanac Trader)

- Microsoft Puts New Limits On Bing’s AI Chatbot After It Expressed Desire To Steal Nuclear Secrets (forbes)

- From Athens To Tunisia, Forbes Travel Guide’s Star Award Winners For 2023 (forbes)

- Meet the Aston Martin DBX707, Robb Report’s 2023 Car of the Year Runner Up (robbreport)

- Beijing city government announces plan to support AI development (technode)

- Hugh Jackman Explains Why He Turned Down The Chance To Be James Bond (digg)

- Economic forecasts are getting revised up, and people aren’t thrilled about it (yahoo)

Tom Hayes – CGTN America Appearance – 2/17/2023

CGTN America – Thomas Hayes – Chairman of Great Hill Capital – February 17, 2023

Watch FULL interview in HD directly on CGTN America

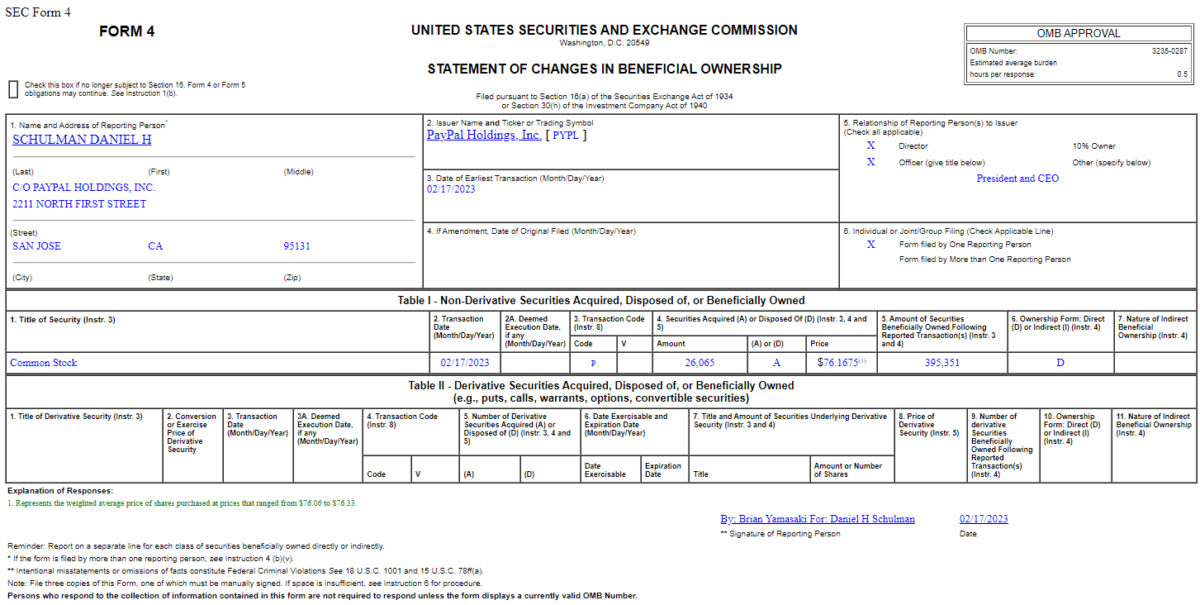

Insider Buying in PayPal Holdings, Inc. (PYPL)

Be in the know. 23 key reads for Saturday…

- Why Wall Street’s growth-heavy Nasdaq Composite is still rallying as Treasury yields rise (marketwatch)

- Investors risk missing next big market move by staying in bonds (foxbusiness)

- Dividends and Share Buybacks Could Fuel High “Total Yield.” (barrons)

- China’s Banks to Overhaul Risk Exposure Rules to Aid Rebound (bloomberg)

- Redfin Is Upbeat About This Year. So Is Wall Street. (barrons)

- Coca-Cola Raises Dividend for 61st Year, and More Payout News (barrons)

- Wharton Professor Jeremy Siegel now sees a stronger economy post-CPI (cnbc)

- As Big Tech cuts workers, other industries are desperate to hire them (marketwatch)

- Amazon wants workers back in the office three days a week (marketwatch)

- The stock market’s pullback is healthy (marketwatch)

- Natural-Gas Slump Could Last, Says Producer EQT (barrons)

- Disney return-to-office plan may cause ‘long-term harm,’ workers say (nypost)

- Hard-up Russia pushes to replenish sagging Viagra supply (nypost)

- The Big Read. Beyond the balloon: the US-China spy game (ft)

- Shein gives investors lofty revenue projections as it prepares for IPO (ft)

- Five Million Carnival Goers Descend on Rio as Brazil Seeks Comeback (bloomberg)

- Wanted: Interns Who Can Make TikTok Hits (nytimes)

- Charlie Munger On BYD, Tesla, Alibaba and Bitcoin — Daily Journal’s Shareholders Meeting — 2/15/2023 (CNBC)

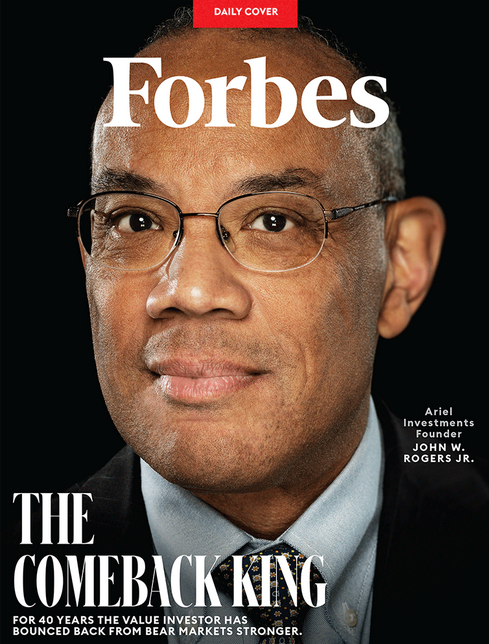

- The Comeback King: For 40 Years, John Rogers Has Come Out Of Bear Markets Stronger (forbes)

- A Practical Guide to Measuring Opportunity Cost (morganstanley)

- 3 Warren Buffett Stocks to Buy (morningstar)

- AutoNation beats profit estimates as new-vehicle demand improves (reuters)

- Factbox: Chinese tech firms working on ChatGPT-style technology (reuters)

Tom Hayes – The Claman Countdown – Fox Business Appearance – 2/17/2023

Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – February 17, 2023

Watch FULL interview in HD directly on Fox Business