- What Recession? Why There Likely Won’t Be a Downturn. (barrons)

- AMC Networks Crushed Earnings Estimates. The Stock Is Rising. (barrons)

- Amazon and Other Quality Stocks Have Been Hit Hard. They Could Be Buys. (barrons)

- U.S. Households Lifting Economy After Being Stung by Inflation Last Year (wsj)

- Two (NON-VOTING) Fed Officials Would Have Supported Larger Rate Increase This Month (wsj)

- It’s a Richcession, Not a Recession (wsj)

- Will Microsoft’s Bing chatbot get you to stop using Google? (usatoday)

- Paramount+ Price Will Increase $2 a Month and Include Showtime (bloomberg)

- China Eases Overseas Listing Rules, Paving Way for IPO Rebound (bloomberg)

- Bad news for the ‘pessimistic bulls.’ Here are 10 reasons why a U.S. recession won’t happen. (marketwatch)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 174

Article referenced in VideoCast above:

Where is “Maximum Pain?” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 164

Where is money flowing today?

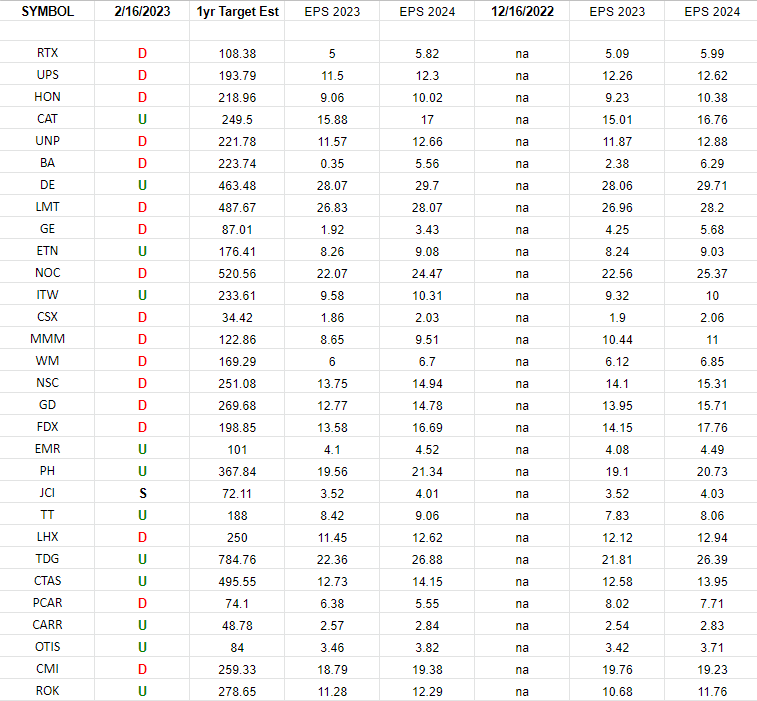

Industrials (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Industrials Sector ETF (XLI) top 30 weighted stocks. I have columns for what the 2023 and 2024 earnings estimates were on 12/16/2022 and today. The column under the date 2/16/2023 has a letter that represents the movement in 2023 earnings estimates since the most recent print (12/16/2022).

Continue reading “Industrials (top 30 weights) Earnings Estimates/Revisions”

Exploration & Production Sector (XOP) – Earnings Estimates/Revisions

Continue reading “Exploration & Production Sector (XOP) – Earnings Estimates/Revisions”

Be in the know. 23 key reads for Thursday…

- Amazon and Other Quality Stocks Have Been Hit Hard. They Could Be Buys. (barrons)

- Spinoffs usually outperform their parent companies, Goldman Sachs research finds (marketwatch)

- China Declared ‘Freeze Is Over,’ Australia’s Trade Chief Says (bloomberg)

- Airbnb Puts Worries to Bed for Now (wsj)

- Biogen Boss Turns Corner on Alzheimer’s Miscues (wsj)

- The U.S. Consumer Bounces Back (wsj)

- Banks Re-Evaluate Ties With Crypto (wsj)

- Indonesia Holds Key Rate as Inflation, Rupiah Pressures Subside (bloomberg)

- Berkshire’s Munger Says Stock Is a ‘Good Bet.’ Company Won’t Be Broken Up. (barrons)

- Department Store Sales Surged in January. Why it Shocked Analysts. (barrons)

- Cisco Stock Rallies on Earnings Beat and Strong Outlook. It’s a Good Sign for Tech. (barrons)

- China Sanctioned Lockheed, Raytheon. It Shouldn’t Hurt the Stocks. (barrons)

- Austan Goolsbee Under Consideration to Serve as Fed’s Vice Chair (wsj)

- Kraft Heinz to Hold Off on Further Food-Price Hikes, Executives Say (wsj)

- Emerging-Market Rally Stalls on Concerns Fed Will Keep Raising Rates (wsj)

- Goldman Strategists See More US Spinoffs With Companies Squeezed (bloomberg)

- A $6 Trillion Wave of Money Revives an Arcane Corner of Wall Street (bloomberg)

- Who Will Be AI’s First Billionaire? It’s a Trick Question (bloomberg)

- Consumers Are Letting the Good Times Roll Again (bloomberg)

- Ferrari and Dodge Fine-Tune Artificial Noise for Electric Cars (bloomberg)

- Generac Holdings (GNRC) fundamentals to improve in H2 – Canaccord (streetinsider)

- Blackstone’s Jonathan Gray sees explosive travel demand from Chinese consumers (scmp)

- Ant’s Alipay+ makes push into Australia on post-Covid travel boom (scmp)

Tom Hayes – Quoted in Reuters article – 2/15/2023

Where is “Maximum Pain?” Stock Market (and Sentiment Results)…

Yesterday I joined Paul Vigna on Public.com to discuss my latest views on the market as well as opportunities/risks moving forward. Thanks to Mike Teich and Paul for having me on: Continue reading “Where is “Maximum Pain?” Stock Market (and Sentiment Results)…”