Where is money flowing today?

Be in the know. 20 key reads for Wednesday…

- Michael Burry and David Tepper snapped up Alibaba during the fourth quarter (marketwatch)

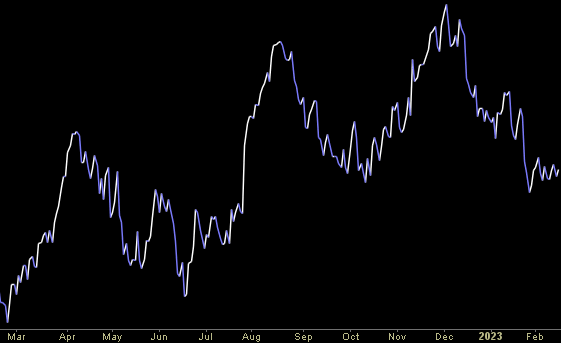

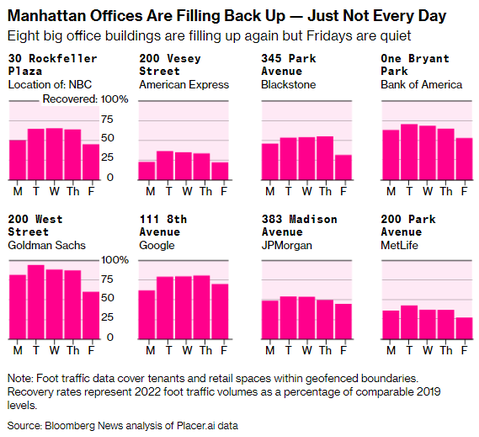

- Remote Work Is Costing Manhattan More Than $12 Billion a Year (bloomberg)

- China’s Xi Urged Stronger Measures to Boost Domestic Demand (bloomberg)

- The Most Crowded Trade Is ‘Long China Stocks,’ Says Bank of America Global Fund Manager Survey (wsj)

- Analog Devices Crushes Quarterly Targets On Strong Auto, Industrial Chip Sales (investors)

- US Retail Sales Jump by Most in Nearly Two Years in Broad Gain (bloomberg)

- ‘Big Short’ Investor Michael Burry Bets on Alibaba and JD. This Time, Wall Street Agrees. (barrons)

- Warren Buffett’s Preferred Equity Allocation Is 100%. Why the Berkshire CEO Hates Bonds. (barrons)

- Power Player Generac Beats Earnings Estimates. The Stock Is Up. (barrons)

- Bain Capital Seeks to Profit From Tech Market Reset With New $2.4 Billion Fund (wsj)

- The Recession Special That Always Satisfies (wsj)

- European Union to Ban Gas-Powered Cars by 2035 (nytimes)

- Ray Dalio Says China’s Winning Trade War With US, But a Clash Is Avoidable (bloomberg)

- New Cars Are Only for the Rich Now as Automakers Rake In Profits (bloomberg)

- China Investors counting on policies from Congress to recharge rally (bloomberg)

- Investors aren’t convinced that the stock market rally can last, Bank of America survey shows (businessinsider)

- Tepper’s Appaloosa adds Disney, Caesars stakes while boosting Salesforce position (marketwatch)

- This Is What Hedge Funds Bought And Sold In Q4: 13F Summary (zerohedge)

- Elon Musk declares cancel culture over since Twitter takeover: ‘You won’t be missed’ (foxbusiness)

- Brookfield Defaults on Two Los Angeles Office Towers (bloomberg)

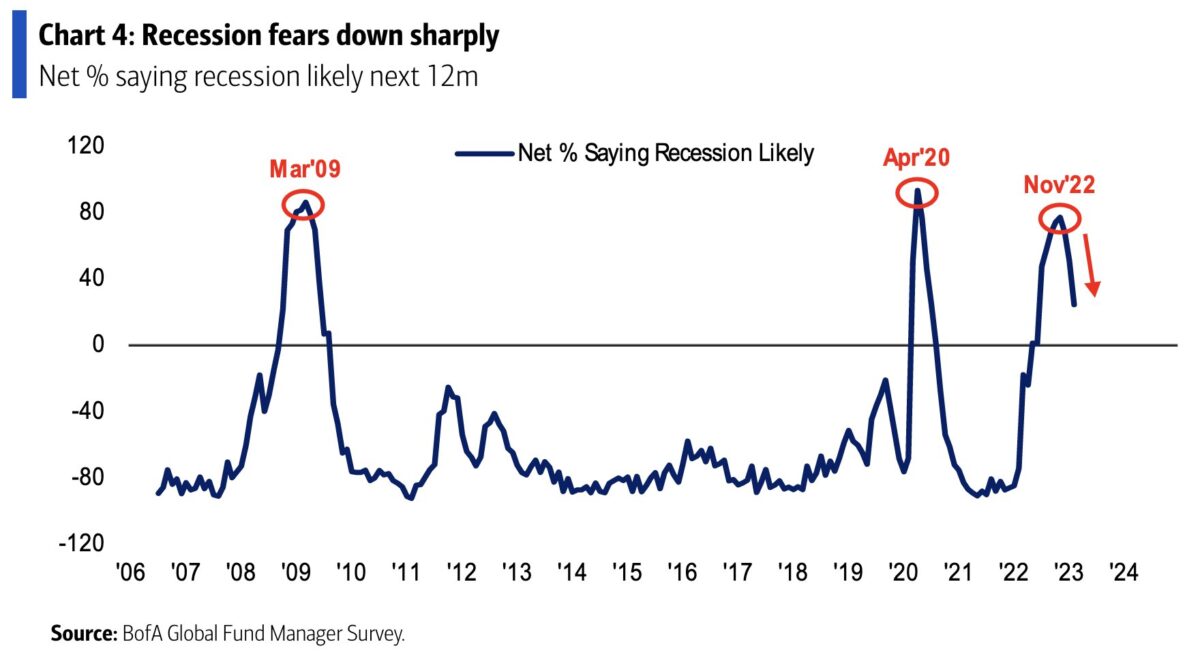

February 2023 Bank of America Global Fund Manager Survey Results (Summary)

The February survey covered ~300 fund managers with ~$750 billion under management.

Continue reading “February 2023 Bank of America Global Fund Manager Survey Results (Summary)”

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

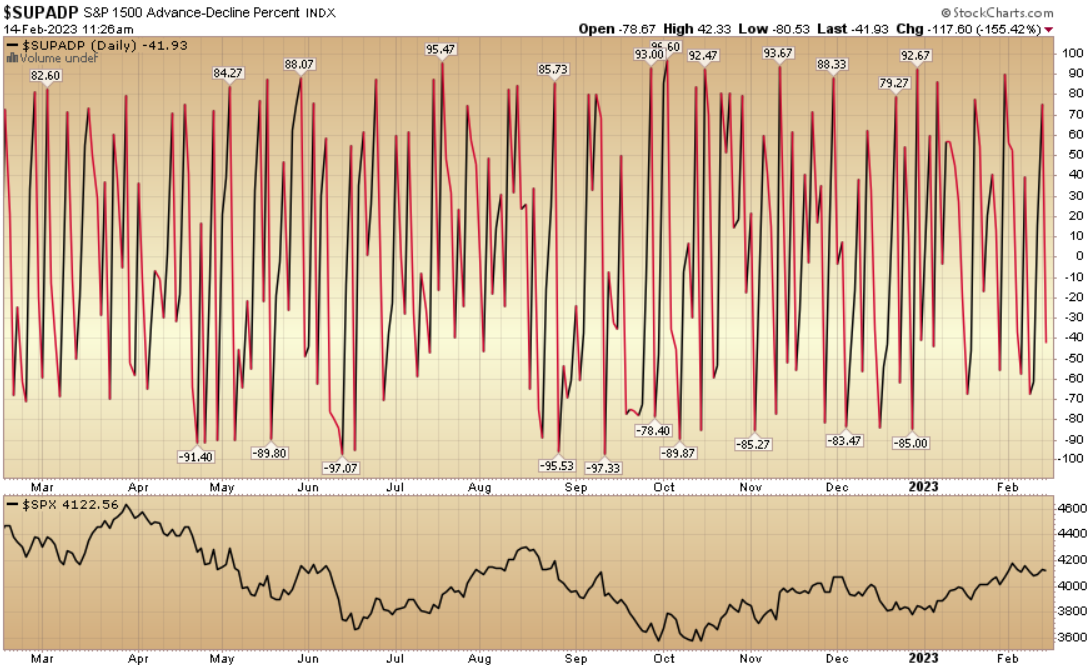

Indicator of the Day (video): S&P 1500 Advance Decline Percent

Be in the know. 24 key reads for Tuesday…

- Fund manager allocation to U.S. stocks in January collapses, BofA survey finds (reuters)

- Hedge-fund legend Seth Klarman pounced on Amazon and parent companies of Google and Facebook in the fourth quarter (marketwatch)

- Investors Pour Into Chinese Stock Funds (wsj)

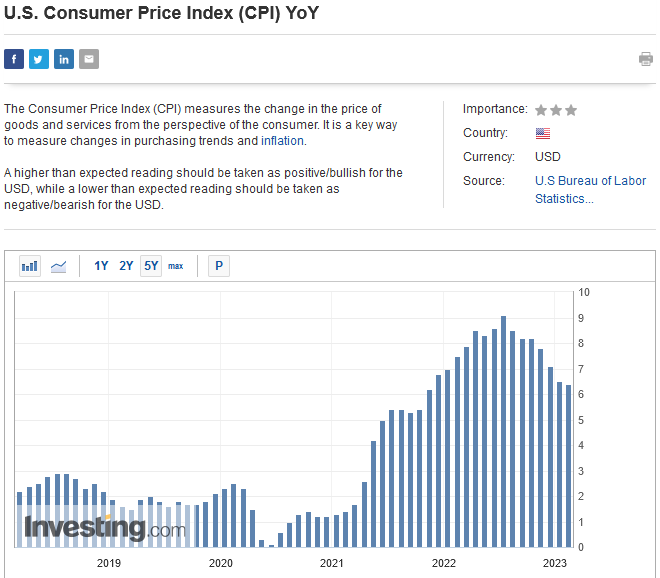

- Inflation Fell for the 7th Straight Month but Picture Is Mixed (barrons)

- The Big Read. Turning offices into condos: New York after the pandemic (ft)

- Coca-Cola sees signs of Powell’s ‘disinflationary process’ (Yahoo! Finance)

- Biotech Went Through Its IPO Boom. Now the Shakeout Is Underway (bloomberg)

- OJ’s Historic Price Squeeze Fades With Improving Supply Outlook (zerohedge)

- Biden Suddenly Orders Release Of Another 26 Million Barrels From Strategic Oil Reserve (zerohedge)

- BofA Survey Shows Investors Don’t Expect the Stock Rally to Last (bloomberg)

- 7 Stocks Generate An Astounding 25% Of The S&P 500’s Profit (investors)

- FT says Meta may lay off more staff soon; BofA praises ‘new efficiency mentality’ (streetinsider)

- George Soros loads up on Tesla and these other beaten-down stocks (marketwatch)

- Disney remains JPMorgan’s ‘favorite name’ for stocks in uncertain media industry (marketwatch)

- ‘A different animal’: The bear market is ‘over,’ but that doesn’t unleash bulls to send stocks on a 2023 tear, according to Wells Fargo (marketwatch)

- Fund managers and corporate executives have sharply reduced their recession expectations (marketwatch)

- ‘Unscripted’ Review: Sex, Lies and Viacom (wsj)

- Goldman’s CEO Says Business Leaders Are More Optimistic on Economy (bloomberg)

- Why Amazon, TikTok and YouTube are betting big on QVC-style livestream shopping (cnbc)

- Father of internet warns: Don’t rush investments into A.I. just because ChatGPT ‘is really cool’ (cnbc)

- Goldman Sachs CEO says odds of a ‘softer landing’ for U.S. economy have improved (cnbc)

- Vodafone rises after Liberty Global stake boosts M&A hopes (reuters)

- Fund managers rush into emerging stocks and cut cash – BofA survey (reuters)

- Amazon chief vows to ‘go big’ on physical stores (ft)