Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

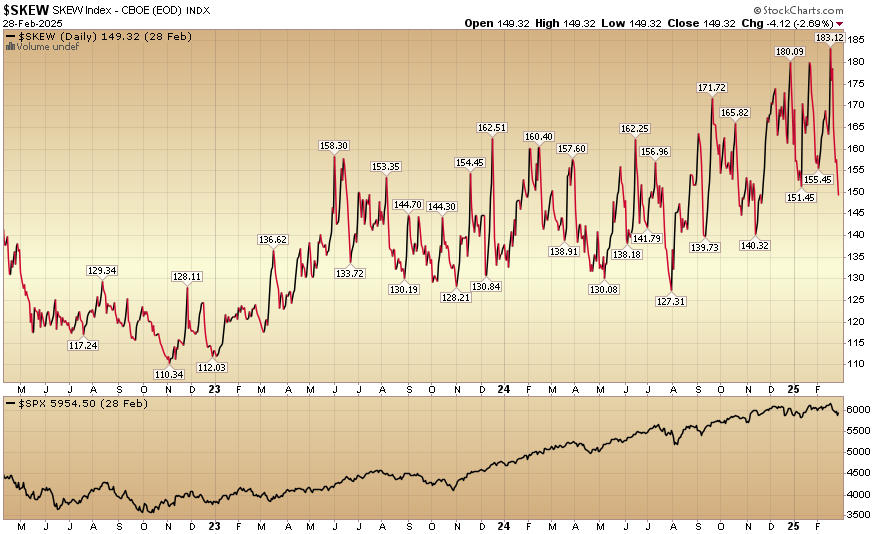

Indicator of the Day (video): CBOE Skew Index

Quote of the Day…

Be in the know. 15 key reads for Monday…

- Exclusive: Nvidia and Broadcom testing chips on Intel manufacturing process, sources say (reuters)

- Mainland China Investors’ Sway Over Hong Kong Stocks Is Growing (bloomberg)

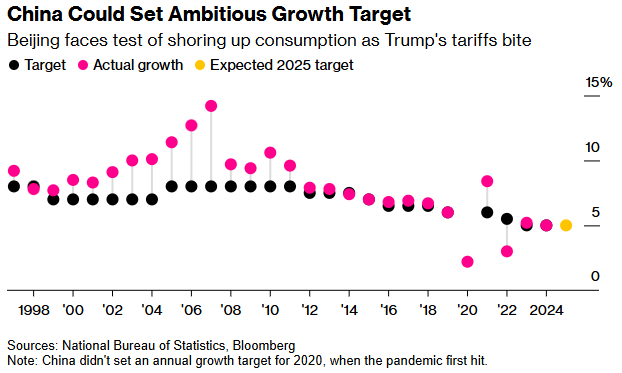

- Xi Prepares to Unveil China Stimulus Plan as Trade War Heats Up (bloomberg)

- Big Tech Pain Is Mounting as Risk-Wary Traders Dump Winners (bloomberg)

- Alibaba-Backed Zhipu Raises $140 Million as DeepSeek Heats Up AI (bloomberg)

- Wall Street can’t stop talking about the ‘Mar-a-Lago Accord.’ Here’s how the currency deal would work. (marketwatch)

- Alibaba’s open-source Sora-like AI video model tops third-party rankings (scmp)

- Taking stock: all eyes on China’s ‘two sessions’ for catalysts to drive AI-fuelled rally (scmp)

- Mortgage rates are falling, but it’s not helping sell more homes. Are lower house prices next? (marketwatch)

- Here’s How Government Spending Has Grown—and Where the Money Is Going (wsj)

- China EV Sales Were Hot in February. Tesla Needs a Rebound. (barrons)

- Chinese Buyers Are Ordering Nvidia’s Newest AI Chips, Defying U.S. Curbs (wsj)

- Disney Cruise Line reveals new details on its two new ships (thestreet)

- Alibaba Cloud’s Industry Leadership Recognized by Top Global Research Firms (alizila)

- Dollar Falls After U.S. Tariff Remarks (barrons)

Indicator of the Day (video): Nasdaq – Cumulative Volume Ratio – 10 Period

Quote of the Day…

Be in the know. 20 key reads for Sunday…

- Intel is back—stop talking about breaking it up: Craig Barrett (fortune)

- Things to watch at China’s 2025 ‘two sessions’ (globaltimes)

- U.S. CEOs Signal Highest Confidence in Two Years (seeitmarket)

- Finally for homebuyers: ‘A step in the right direction’ (yahoo)

- Alibaba completes full acquisition of Cainiao’s minority shares, implements employee exit plan (technode)

- McKinsey sees lithium demand stabilising and expects next upcycle (yahoo)

- Alibaba begins spring hiring with 3,000 internship roles focused on AI (scmp)

- That Escalated Quickly (carsongroup)

- Alibaba’s research arm launches new RISC-V processor for high-performance computing (scmp)

- Shop The North Face Windbreaker All Our Favourite Celebrities Are Coveting (elle)

- Disney Sees Sell-Out for Oscars Ads — And Not Just on TV (variety)

- Do You Know How Much Energy ChatGPT Actually Uses? (digg)

- In James Bond, Amazon gains a thrilling new asset (economist)

- The business of second-hand clothing is booming (economist)

- Whatever You Do, Don’t Cancel Disney Plus or Max in March (cnet)

- Macau Gaming Revenue Beats Estimates in Sign Slowdown Is Easing (bloomberg)

- Inside TGL, Tiger Woods and Rory McIlroy’s Grandiose Indoor Golf League Experiment (gq)

- 5 collector cars to put into your garage this week (classicdriver)

- How Ferrari’s 290 MM Became One Of The World’s Most Coveted Cars (maxim)

- The 50 Greatest Luxury Cars of All Time (robbreport)