- Intel stock jumps on plan to turn foundry business into subsidiary and allow for outside funding (cnbc)

- Intel to Make Custom AI Chip for Amazon (bloomberg)

- Big names like David Tepper and ‘Big Short’ investor Michael Burry are quietly upping their bets on the Chinese economy (cnbc)

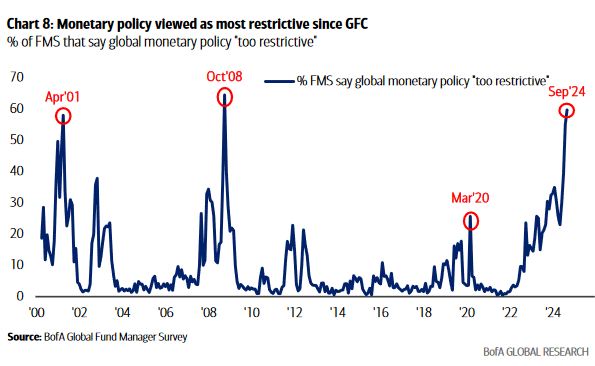

- Fed to cut rates by a quarter point with a soft landing expected, according to CNBC Fed Survey (cnbc)

- China seeks a homegrown alternative to Nvidia — these are some of the companies to watch (cnbc)

- Markets Hinge on Powell Emulating Greenspan’s Soft Landing (bloomberg)

- A Fed interest-rate cut could make small-cap stocks a good investment now (marketwatch)

- Intel, Aiming to Reverse Slump, Unveils New Contracts and Cost Cuts (nytimes)

- Opinion: Why Intel’s latest move for its foundry business is so significant (marketwatch)

- U.S. Officials Jet to Beijing Amid Flood of Cheap Chinese Exports (wsj)

- Amazon Tells Workers to Return to Office Five Days a Week (wsj)

- Boeing, union negotiators to meet as striking workers dig in (reuters)

- This is the only Fed that eased while inflation surged all the way to its peak, says Jim Paulsen (cnbc)

- Intel’s Turnaround Is Working. Buy the Dip. (barrons)

- Intel made 3 big announcements since solvency concerns: Thomas Hayes (foxbusiness)

Hedge Fund Tips (PCN) – Position Completion Notification

Where is money flowing today?

Indicator of the Day (video): Bullish Percent Real Estate

Quote of the Day…

Be in the know. 10 key reads for Monday…

- Life in the Fast Lane for PayPal? New Partnerships Could Boost the Stock. (barrons)

- Markets should trade well into FOMC meeting, and for a few weeks after, says Fundstrat’s Tom Lee (cnbc)

- Yen Strengthens Beyond 140 Per Dollar for First Time Since 2023 (bloomberg)

- The Fed Should Go Big Now. I Think It Will. (bloomberg)

- The 10 Best Hotels in North America, According to the Michelin Guide (bloomberg)

- The Fed Meeting Isn’t the Only Rate Decision to Watch. Why Japan Could Matter More. (barrons)

- Disney Deal With DirecTV Ends Blackout of ESPN, ABC (barrons)

- 13 times this has occurred, the S&P 500 has rallied 18% on average over the next 12 months (marketwatch)

- Boeing labor issue likely to be a final milestone before news turns more constructive: Citi (streetinsider)

- $2.1 Billion Net Flows To Alibaba In First Week of Connect, Week in Review (chinalastnight)

Indicator of the Day (video): Nasdaq Market Thrust

Quote of the Day…

Be in the know. 8 key reads for Sunday…

- It’s Time to Start Wearing Vans Again (gq)

- Vans’ Classic Skate Shoes Look Dapper as Preppy Brogues (highsnobiety)

- Biden Targets Temu With Import Rule. Impact Could Go Beyond PDD Stock. (investors)

- Schlumberger Stock Was Once as Hot as Nvidia. Why It’s a Buy. (barrons)

- The Man Who Made Nike Uncool (bloomberg)

- Peter Lynch on Big Winners and Patience (dgi)

- Price is what you pay, value is what you get (dgi)

- 6-foot-8 Christo Lamprecht’s unique and fascinating golf swing, explained (golfdigest)