Be in the know. 26 key reads for Tuesday…

- Central Bankers Should Prioritize Growth Over Their Pride (bloomberg)

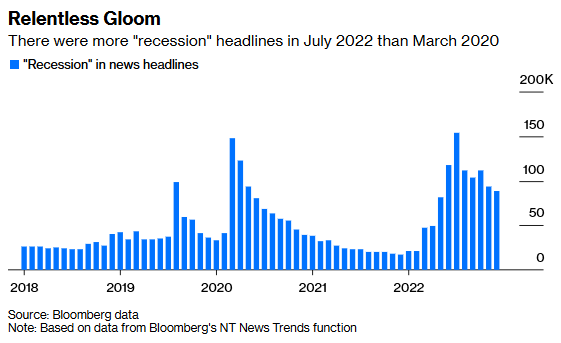

- Dumb, Dumber and Leading Economic Indicators (bloomberg)

- The 2 Trillion Reasons Why Fed Tightening Isn’t So Scary (bloomberg)

- Lockheed’s Solid Results Show the Power of Stock Buybacks (barrons)

- Debt-Limit Fight Risks Early End to Fed Quantitative Tightening (bloomberg)

- Technical strategist DeMark called the euro bottom. Here’s what he says now about the euro, bitcoin and the Nasdaq 100 (marketwatch)

- Verizon Adds Subscribers. (barrons)

- Johnson & Johnson Guides Above Expectations for 2023 (barrons)

- R. Horton Beats Earnings Expectations. Stock Climbs. (barrons)

- GE’s Turnaround Continues (barrons)

- Lyft Rises After Upgrade on ‘Meaningful Opportunity’ for Better Earnings (barrons)

- ‘M2’ Might Shrink for the First Time. What It Says About a Possible Recession. (barrons)

- Why naked short selling has suddenly become a hot topic (marketwatch)

- Amazon launches a subscription prescription drug service (marketwatch)

- SPR Slush Fund. The Energy Report 01/24/2023 (Phil Flynn)

- Why Tech Layoffs Aren’t Alarming Economists—Yet (barrons)

- Layoffs at Tech Giants Reverse Small Part of Pandemic Hiring Spree (nytimes)

- Investors Await Tech Earnings in Next Test for Markets (wsj)

- What’s Behind Fall in US Yields? Fed Hope, Growth Fear (bloomberg)

- 5 reasons why stock market valuations are poised for a rebound in 2023, according to Raymond James (businessinsider)

- “Now Or Never”: Japan PM Warns Of Dire Consequences Over Plummeting Birth Rate (zerohedge)

- S. DOJ poised to sue Google over online advertising dominance – Bloomberg (streetinsider)

- Elliott builds activist stake in 146-year-old Japanese conglomerate (ft)

- Netflix’s Reed Hastings: the ‘system builder’ who brought revolution (ft)

- Arm-Based Chips Make Inroads With Apple, Amazon (wsj)

- Nuclear Power Plants Are Pushed to the Limit as Demand Surges (bloomberg)

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Tips (PCN) – Position Completion Notification

Be in the know. 17 key reads for Monday…

- Salesforce Gets a Second Activist Investor. It’s Part of a Wave of Activism in Tech Stocks. (barrons)

- Roads Less Traveled. The Energy Report 01/23/2023 (Phil Flynn)

- Spotify Stock Rises as It Plans to Cut 6% of Staff (barrons)

- How Climate and Energy Crises Are Giving New Life to Nuclear Power (barrons)

- Wayfair Stock Scores Double Upgrade After Layoffs (barrons)

- Fed Sets Course for Milder Interest-Rate Rise in February (wsj)

- Economists Say the Fed Is Making Another Inflation Mistake. Here’s Why. (wsj)

- China Needs Couples to Have More Babies: Can I.V.F. Help? (nytimes)

- Banks Plan Digital Wallet to Compete With PayPal, Apple Pay (wsj)

- Tech Layoffs Unwind Recent Head-Count Growth, Torpedo Long-Shot Projects (wsj)

- Nvidia to Win Big From ChatGPT Hype, Predicts Wall Street (bloomberg)

- Microsoft Adds $10 Billion to Investment in ChatGPT Maker OpenAI (bloomberg)

- Investors Aren’t Sure When to Dive Back Into US Stock Market (bloomberg)

- Stocks are primed to rally 25% this year as investors still aren’t pricing in falling inflation, Fundstrat’s Tom Lee says (businessinsider)

- Warren Buffett’s ‘most gruesome’ mistake was buying Dexter Shoe with Berkshire Hathaway stock. Here’s a look back at his $12 billion error. (businessinsider)

- Amazon Is a Value Stock in Topsy-Turvy New World of Investing (bloomberg)

- Wall Street Quants Shouldn’t Confuse Luck With Skill (bloomberg)

Be in the know. 15 key reads for Sunday…

- A Growing Bullish Crowd May Supercharge China’s Stock Market (bloomberg)

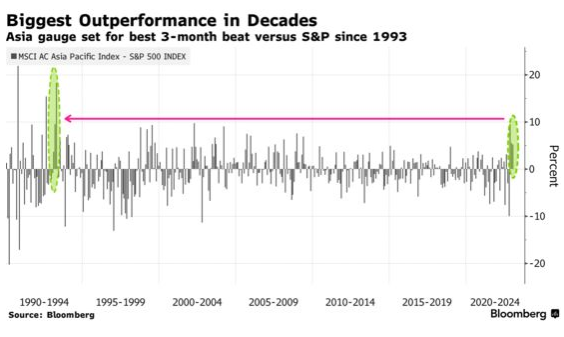

- Bullish Calls Mount as Asian Stocks Go On a Tear in the New Year (bloomberg)

- The Fed’s vice chair says there may be ‘some reassurance that we are not currently experiencing a 1970s-style wage–price spiral’ (fortune)

- Peter Lynch Investing Quotes (dividendgrowthinvestor)

- 3 Undervalued, High Quality Cyclical Stocks (morningstar)

- 10 Undervalued Dividend Stocks for 2023 (morningstar)

- 11 Undervalued Defensive Stocks for 2023 (morningstar)

- 3 Top Growth Stocks to Buy and Hold in 2023 (morningstar)

- US Will Dodge Recession and Markets Will Rally, Ariel’s Rogers Says (bloomberg)

- The Riva Aquarama Is The Most Stylish Boat Of All Time (maxim)

- Hennessey Unveils Insane $2.7 Million, 1,817-HP Venom F5 Revolution Hypercar (maxim)

- Chinese lidar developer Hesai files for $100 million US IPO (technode)

- New Oriental’s Koolearn sees 590.2% increase in revenue thanks to e-commerce (technode)

- Can China save its economy – and ours? (npr)

- New killer CRISPR system is unlike any scientists have seen (bigthink)

Be in the know. 12 key reads for Saturday…

- Toyota, Warner Bros., and 24 Other Stocks Our Roundtable Pros Love This Year (barrons)

- The Fed’s Big Asset Reduction Isn’t Working the Way It’s Supposed To. Here’s Why. (barrons)

- Google joins Intel, Microsoft Amazon, Salesforce and other major companies laying off thousands of people (marketwatch)

- No, interest rates aren’t going back to zero soon, says Apollo economist (marketwatch)

- Activist Investors Will Keep Targeting Big Tech (barrons)

- A Davos First-Timer’s Notes on BorgWarner, Thermo Fisher, Blackstone, and Nasdaq (barrons)

- He Might Be Tech’s Last Bull. Here’s Why the Founder of Thoma Bravo Is Still Buying. (barrons)

- Unemployment Is Lasting Longer as Job Market Cools (wsj)

- The Big Read. Things are looking up for the global economy (ft)

- Fed governor backs quarter-point rate rise at next meeting (ft)

- China says Covid outbreak has infected 80% of population (cnbc)

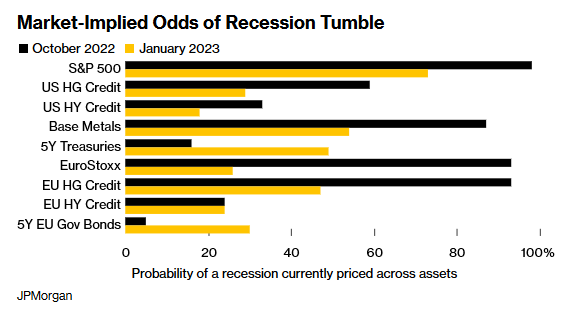

- JPMorgan Model Shows Recession Odds Fall Sharply Across Markets (bloomberg)