- “Understandably, really outstanding businesses are very seldom offered in their entirety, but small fractions of these gems can be purchased Monday through Friday on Wall Street and, very occasionally, they sell at bargain prices.” (ap)

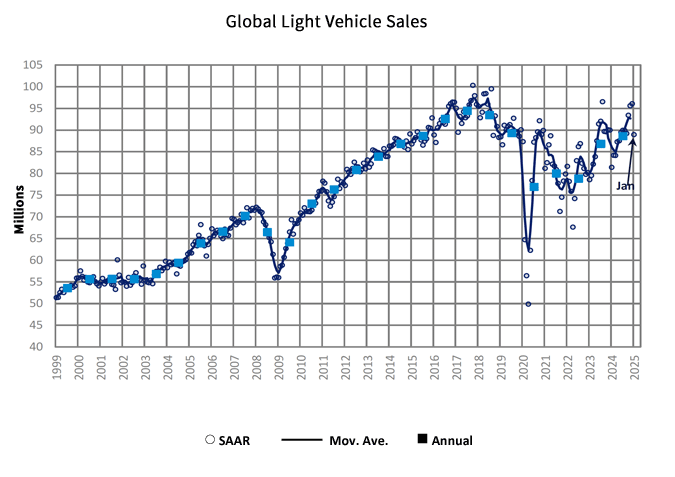

- GlobalData Global Light Vehicle Sales Update (January 2025) (marklines)

- S. Market: New Vehicle Sales Recover, BEV Expansion Slows (marklines)

- Options Traders Line Up Hedges Before Pivotal Nvidia Earnings (bloomberg)

- The Three Names You Need to Know to Understand the Future of the International Monetary Order (bloomberg)

- China Developers Buy Land at 20% Premium in Bet on Market Bottom (bloomberg)

- This Chinese AI Bet Has Outperformed Magnificent Seven Names Like Meta and Google This Year. Alibaba stock soared after a strong earnings beat, bringing its year-to-date gains to 60 percent. (inc)

- The rise and fall of Long Term Capital Management (npr)

- Can the president override Congress on spending? (npr)

- The Brain Science of Elusive ‘Aha! Moments’ (scientificamerican)

- James Bond Works for Jeff Bezos Now. What Does That Mean For 007’s Future? (gq)

- Ferrari’s Classiche Division Is the Master of Rebuilding Icons, Even Wrecked F40s (rt)

- Alibaba’s Core Businesses Reignite Growth as AI Strategy Delivers Strong Results (alizila)

- AliViews: Eddie Wu on Alibaba’s Q3 Earnings (alizila)

- Oil Speculators Turn Sour as Bullish Wagers Get Trimmed Back (bloomberg)

- Trump Targets China With Biggest Salvo So Far in Second Term (bloomberg)

- Zelenskiy Says He Would Be Ready to Quit for Sake of Ukraine Peace (bloomberg)

- Alibaba to Spend $53 Billion on AI Infrastructure in Big Pivot (bloomberg)

- Alibaba CEO Wu Says AGI Is Now Company’s ‘Primary Objective’ (bloomberg)

- Shein’s annual profit down by more than a third, FT reports (nypost)

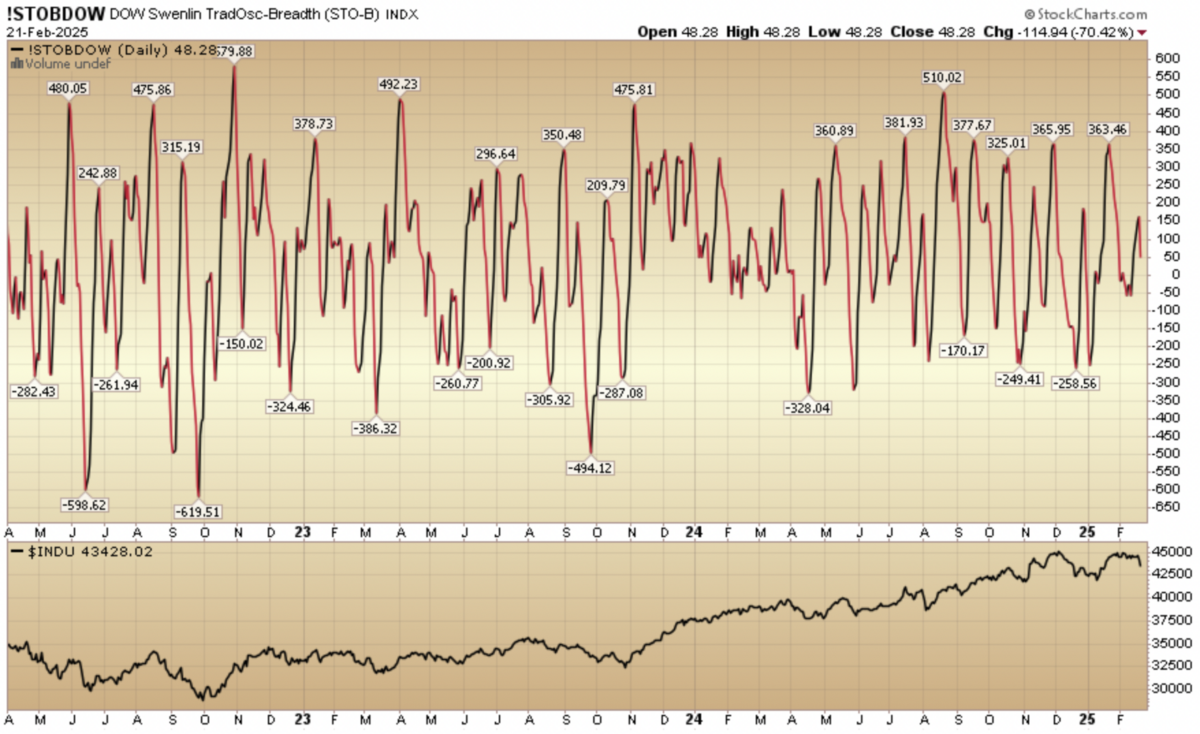

Indicator of the Day (video): DOW Swenlin Trade Oscillator – Breadth

Quote of the Day…

Be in the know. 14 key reads for Sunday…

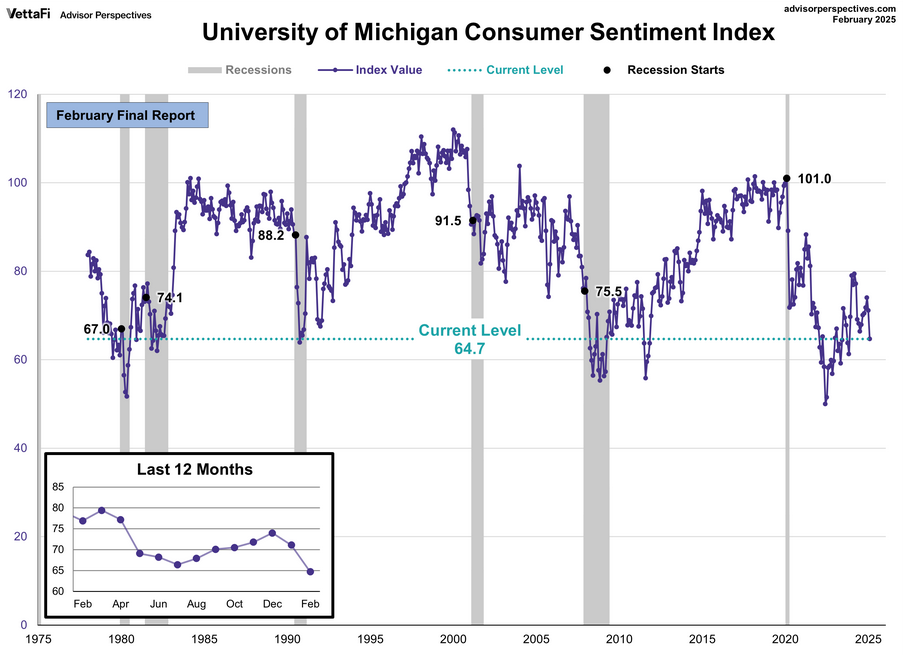

- United States Michigan Consumer Sentiment (tradingeconomics)

- What does Jack Ma’s return to the spotlight mean? (bbc)

- Short sellers are closing in on some shocking tech stocks (thestreet)

- When S&P 500 is Up in January and February Full-Year Record Nearly Perfect (almanactrader)

- About all this ‘Mar-a-Lago Accord’ chatter (ft)

- Hedge funds are feeling their oats (ft)

- Here’s What Ukraine Possesses In Natural Resources—As US Reportedly Nears Deal To Secure Minerals (forbes)

- Buffett says Berkshire ‘will forever’ deploy most of its capital in equities and never prefer cash over good businesses (fortune)

- Why Xi Jinping is making nice with China’s tech billionaires (economist)

- Sotheby’s Wants You to Buy Classic Cars, and They’ll Lend You Millions to Make It Happen (robbreport)

- 13 Best Cowboy Boot Brands for Men Prove Western Wear Is Timeless (mensjournal)

- Big Ford F-150 Lightning Lease Deal Lops Off $10,500 and Tosses in Home Charger (thedrive)

- Ant Group hires for development of embodied intelligence humanoid robots (technode)

- What A PGA Tour-LIV Reunification Could Look Like (mygolfspy)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 279

Hedge Fund Tips with Tom Hayes – Podcast – Episode 279

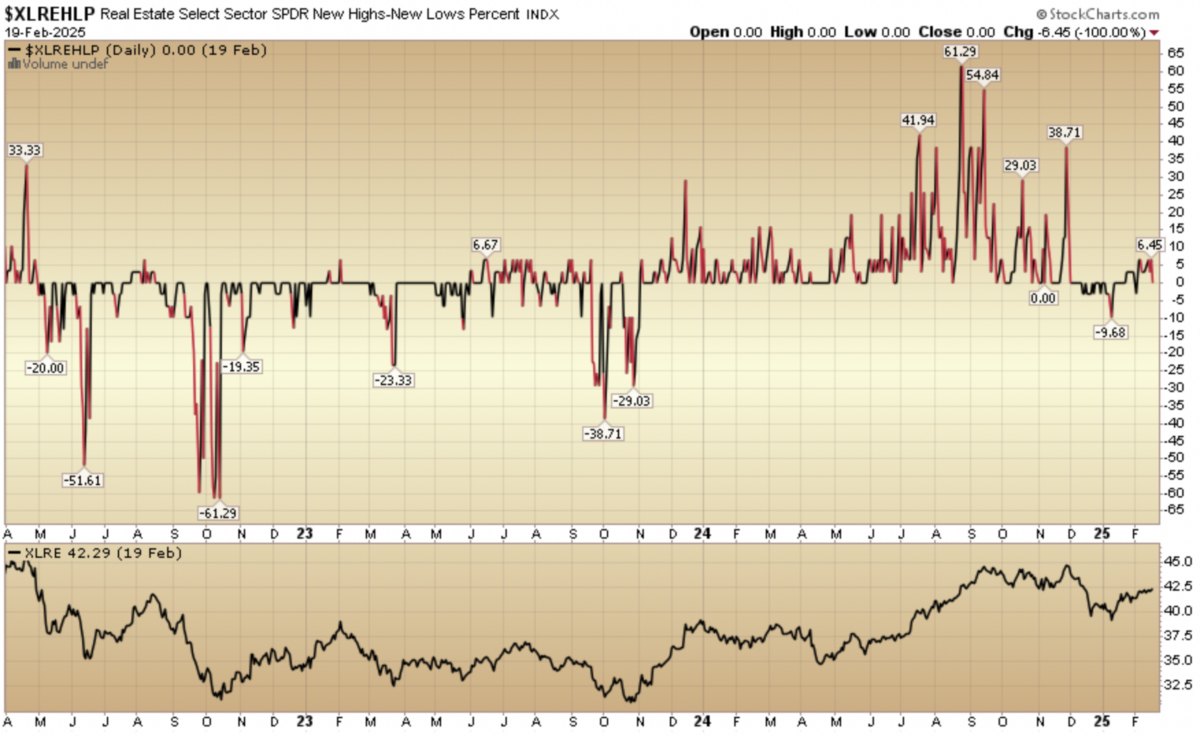

Indicator of the Day (video): Real Estate New High New Low %

Quote of the Day…

Be in the know. 8 key reads for Saturday…

- Alibaba will be the big winner when it comes to AI in China, says Wedbush’s Dan Ives (cnbc)

- Palantir Insiders Keep Selling Shares After $4 Billion Windfall in 2024 (bloomberg)

- Is Miami’s FII the hottest conference for billionaires? ‘It’s way better than Davos’ (nypost)

- Consumer Sentiment Soured at the End of February (barrons)

- Treasury Yields Weaken on Slow U.S. Activity Data (barrons)

- Chinese Tech Stocks Rally After Upbeat Earnings (bloomberg)

- Bessent, China’s He Swap Objections Over Tariffs, Growth Model (bloomberg)

- All 27 James Bond movies ranked, according to critics (businessinsider)