Hedge Fund Tips (PCN) – Position Completion Notification

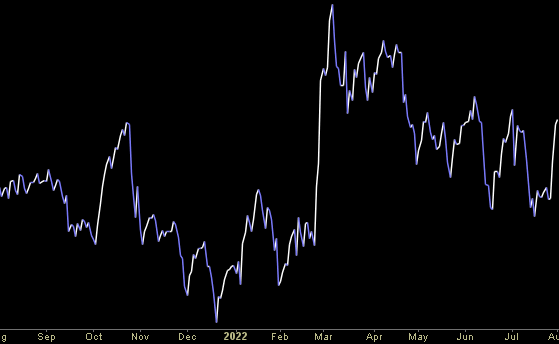

Hedge Fund Trade Tip (PIN) – Position Idea Notification

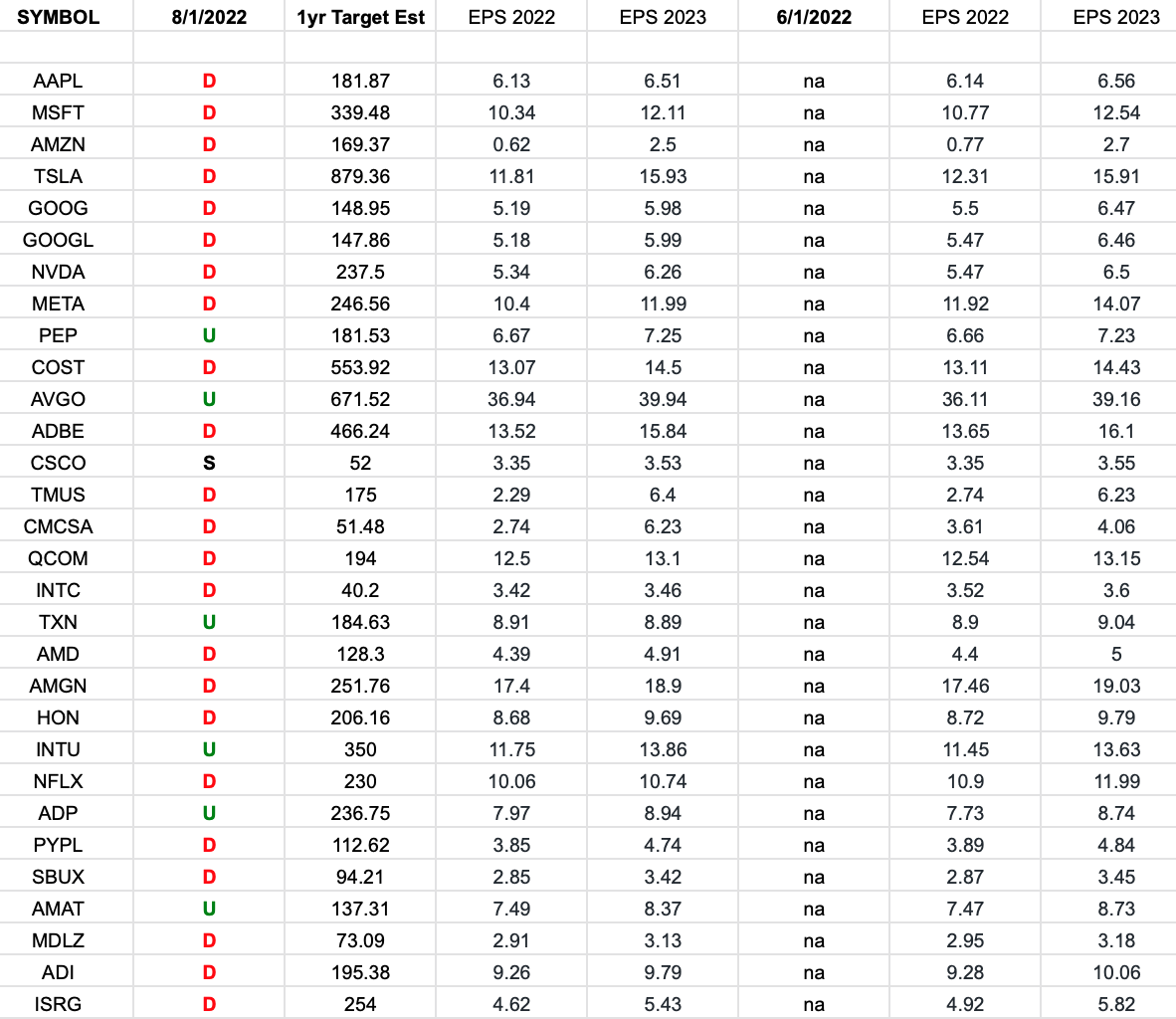

Nasdaq (top 30 weights) Earning Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the top 30 weighted Nasdaq stocks. I have columns for what the 2022 estimates were on 6/1/2022 and today.

Continue reading “Nasdaq (top 30 weights) Earning Estimates/Revisions”

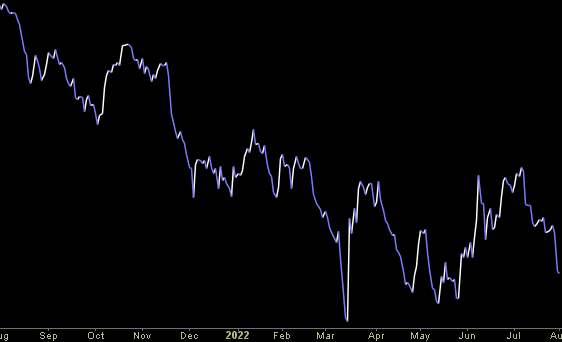

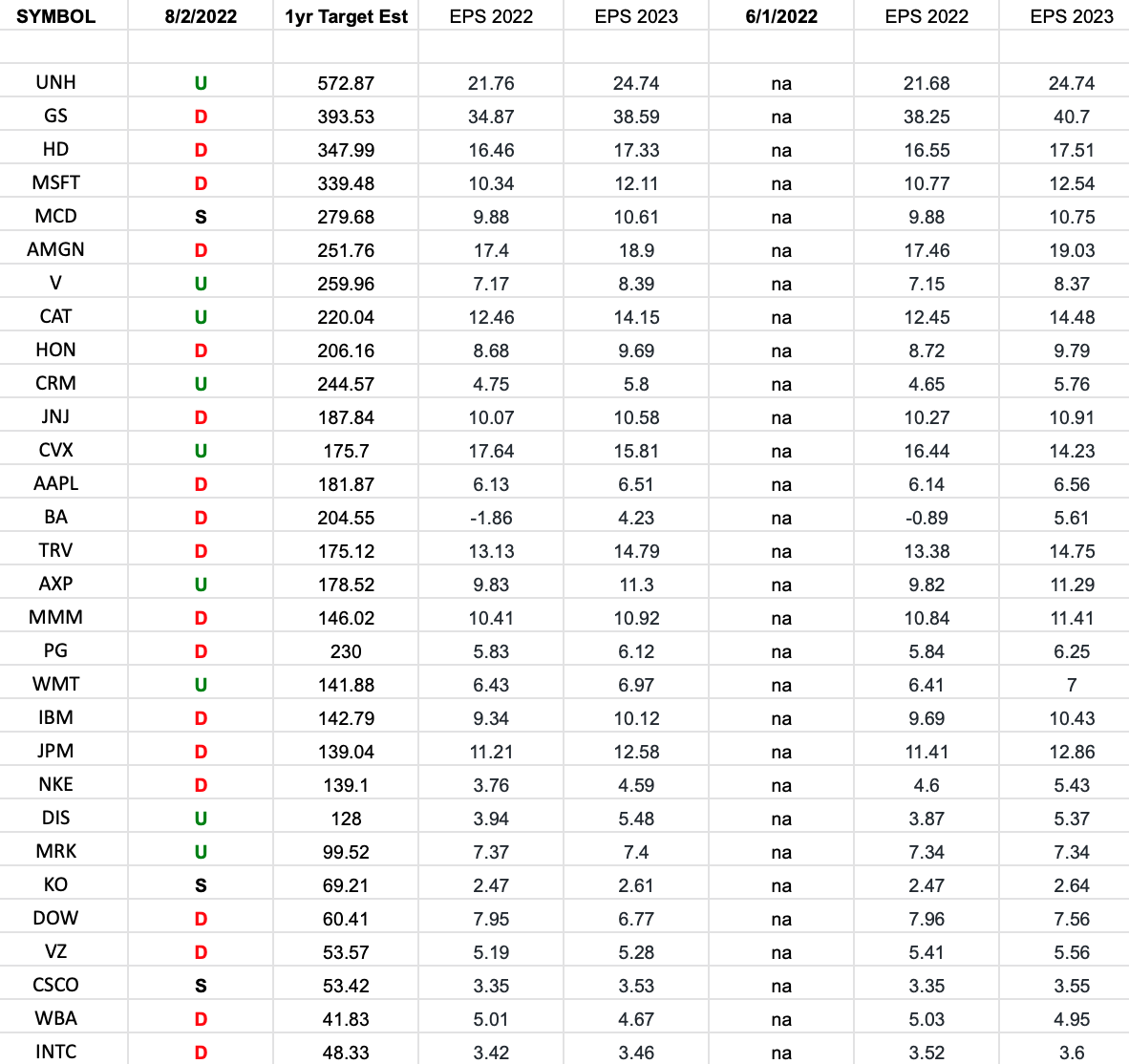

DOW 30 Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Dow Jones Industrial Average 30 stocks. Continue reading “DOW 30 Earnings Estimates/Revisions”

Hedge Fund Tips (PCN) – Position Completion Notification

Be in the know. 17 key reads for Monday…

- Alibaba to ‘strive’ to keep New York listing despite addition to SEC watchlist (ft)

- Big Tech’s Reign Isn’t Over (barrons)

- Boeing Stock Jumps as 787 Deliveries Can Resume (barrons)

- Alibaba Stock Rises as E-Commerce Giant Resolves to Maintain U.S. Listing (barrons)

- Bernanke: Why the Fed Didn’t Act Faster to Rein In Inflation (barrons)

- Key Lime Pie Fans Whipped Up Over Dessert Snub (wsj)

- Falling Food Prices Ease Upward Pressure on Global Inflation (wsj)

- China’s Economy Tested by Strained City Finances (wsj)

- Can a ‘Magic’ Protein Slow the Aging Process? (nytimes)

- Bank of America Says a 2% US 10-Year Treasury Yield Is Possible (bloomberg)

- Apple Starts Four-Part Bond Sale to Fund Buybacks, Dividends (bloomberg)

- Tom Brady-Backed Hero Bread in Talks to Raise Convertible Note (bloomberg)

- Shares of Chinese EV makers Nio, Xpeng and Li Auto rise as July car deliveries jump (cnbc)

- The stock market could surge 18% to new highs by year-end as the 2022 bear market is over, Fundstrat says (businessinsider)

- China’s PBOC Pledges Stable Financing for Property Sector (bloomberg)

- Vast majority will pay more in taxes as result of inflation bill (foxbusiness)

- CSRC, China’s securities watchdog, pledges to prevent ‘abnormal fluctuations’ in embattled stock market (scmp)

Be in the know. 22 key reads for Sunday…

- Auto Makers Say Car Sales Will Defy Economic Gloom (wsj)

- Big Tech’s Reign Isn’t Over Yet. These Stocks Look Like Strong Buys. (barrons)

- Amazon Stock Has Gotten Crushed. There’s a Case It Could Double, or Even Triple, From Here. (barrons)

- Smaller Stocks Have Been Big Winners. Why Their Streak Can Continue. (barrons)

- Sarepta Will Seek Approval of Gene Therapy Before Completing Phase 3 Trial (barrons)

- China’s Xi Promotes Team of Allies to Influential Posts, Fortifying His Power (wsj)

- Kyrsten Sinema Is Critical Vote on Manchin-Schumer Climate and Tax Deal (wsj)

- ‘We’ve never seen anything like this’: US retailers compete to clear stock (ft)

- ‘Gumming up’: unwanted debt from buyout boom stuck at investment banks (ft)

- Rolls-Royce’s new CEO says focus will be on opportunity and strategic clarity (ft)

- Boeing Gets FAA Clearance to Restart 787 Dreamliner Delivery (bloomberg)

- SEC Adds Alibaba to List of Chinese Companies Facing Delisting (wsj)

- The Crypto Collapse Has Flooded the Market With Rolex and Patek (bloomberg)

- Tom Lee says the 2022 bear market is over, stocks could hit new highs before year-end (cnbc)

- ECRI Weekly Leading Index Update (advisorperspectives)

- Crops ‘Stored Everywhere’: Ukraine’s Harvest Piles Up (nytimes)

- Liv Boeree, Poker and Life — Core Strategies, Turning $500 into $1.7M, Cage Dancing, Game Theory, and Metaphysical Curiosities (#611) (blog)

- Bloomberg Wealth: Nelson Peltz (bloomberg)

- Nevis Is a Zen Paradise—and One of the Best Undiscovered Caribbean Islands (mensjournal)

- 10 Best Luxury Hotels in the World for a No-Expense-Spared Getaway (mensjournal)

- Can the Iran Nuclear Deal Survive? (cfr)

- Drugs, electric cars, taxes (npr)

Be in the know. 10 key reads for Saturday…

- Negotiated drug prices will only apply to a narrow category of expensive drugs with no generic competition, and then only in relatively small numbers. (washingtonpost)

- Alibaba Chairman and CEO’s Letter to Shareholders (alibabagroup)

- SEC added Alibaba Group Holding Ltd. to a list of Chinese companies at risk of being delisted from the U.S. exchanges if their auditors can’t be inspected before spring 2024. (wsj)

- Amazon stock surges toward biggest monthly gain in 15 years (marketwatch)

- Billionaire investor Ray Dalio warns US can’t keep spending and bring down inflation (foxbusiness)

- Shale Drilling Climbs to Levels Not Seen Since Early Weeks of Pandemic (bloomberg)

- Intel’s Gelsinger Says Stock Deserves to Be Down, Rebound Coming (bloomberg)

- China Evergrande Breaks Silence on Debt-Restructuring Plan (wsj)

- Carried-Interest Change Would Hit Top Wall Street Brass, but Could Be Hard to Make Stick (wsj)

- What Did Joe Manchin Get for $433 Billion? (wsj)