Datasource: Finviz

Hedge Fund Tips with Tom Hayes – Podcast – Episode 135

Who are the 50 people influencing markets the most this year? Tell MarketWatch what you think here: (marketwatch)

The “Better Than Feared” Stock Market (and Sentiment Results)…

Hedge Fund Tips (PCN) – Position Completion Notification

Be in the know. 30 key reads for Thursday…

- I Beg to Differ (Howard Marks)

- Alibaba, Meituan are top picks at Daiwa in sector upgrade as internet stocks to benefit most from China stimulus (scmp)

- The Fed is no longer behind the curve, says DoubleLine CEO Jeffrey Gundlach (cnbc)

- US enters technical recession after contraction in second-quarter growth (ft)

- Second straight quarterly decline meets a common definition of recession (wsj)

- Jack Ma to Reportedly Cede Control of Ant Group, Seen as a Boost for Alibaba’s Stake (streetinsider)

- How the Fed Could Lose Its Nerve (wsj)

- China Leaders Call for ‘Best’ Growth Outcome at Key Meeting (bloomberg)

- Grocery Bill Inflation Might Have Peaked (wsj)

- Teva Tries to Put an End to the Opioid Wars (wsj)

- The global recession drum beat is getting louder (reuters)

- Pfizer reports big profit and revenue beats, as COVID drug sales increase by nearly $9 billion (marketwatch)

- Southwest predicts third-quarter revenue above pre-pandemic levels (reuters)

- Merck stock ticks up after profit more than triples to beat expectations (marketwatch)

- Chinese Property Shares Rise as Investors Bet on State Support (bloomberg)

- Energy on Agenda as Saudi Crown Prince to Meet Macron (bloomberg)

- Boeing Reports Drop in Profit but Sees ‘Momentum’ for Turnaround (nytimes)

- Amazon’s Quarter Will Be Bad. What Happens Next? (barrons)

- Intel’s Profitability Outlook (barrons)

- Honeywell Earnings Rise. More People Are on Planes and in the Office. (barrons)

- Jack Ma To Cede Control Of Ant Group Control (zerohedge)

- Facebook Parent Meta Platforms Reports First Ever Revenue Drop (wsj)

- Senate Approves $280 Billion Bill to Boost U.S. Chip Making, Technology (wsj)

- Joe Manchin Reaches Deal With Chuck Schumer on Energy, Healthcare, Tax Package (wsj)

- CBO Expects Significant Rise in Public Debt Burden, Deficit (wsj)

- Ford’s Profit Rises on Higher Sales, More Inventory (wsj)

- US Jobless Claims Fall Slightly, Hold Near Eight-Month High (bloomberg)

- Royal Caribbean beats revenue estimates on pent-up demand (reuters)

- China’s central bank seeks to mobilise $148bn bailout for real estate projects (ft)

- Fed’s Jay Powell calls time on running commentary for rate rises (ft)

- Macau opens for casino licence renewals until September 24 (scmp)

The “Better Than Feared” Stock Market (and Sentiment Results)…

Philip Vassiliou, the CIO of Legatum (who we interviewed a few weeks ago here), thoughtfully sent me this great note on Wednesday – written by another investing legend Howard Marks. I’ve read Howard’s notes over the years, but this was one of the best. The most important lines for me were: Continue reading “The “Better Than Feared” Stock Market (and Sentiment Results)…”

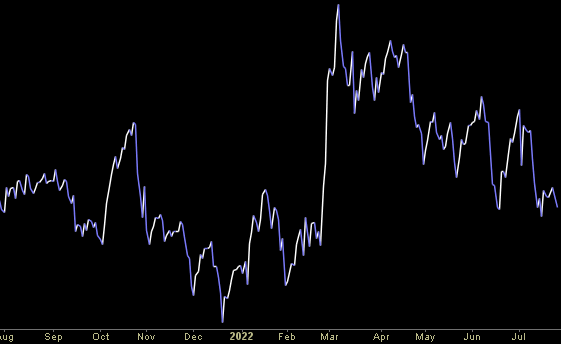

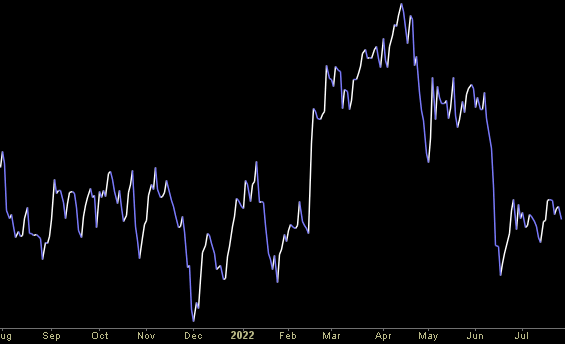

Where is the money flowing?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Tips (PCN) – Position Completion Notification

Be in the know. 25 key reads for Wednesday…

- Alphabet’s Google posts higher quarterly revenue, easing worries (nypost)

- Biden Will Speak With Xi on Thursday as US-China Ties Worsen (bloomberg)

- It’s Fed Day. Powell to Walk a Fine Line. (barrons)

- Why Activist Elliott Management Is Targeting PayPal (barrons)

- Automakers See Some Relief From Chip Shortages (thestreet)

- ‘Operating With Increased Intensity’: Zuckerberg Leads Meta Into Next Phase (nytimes)

- Bank on Amazon, ‘this time will be no different’ (foxbusiness)

- Alphabet, Microsoft Spur Hope Tech Can Handle Slow Economy (bloomberg)

- If the Market Rally Resumes, Cyclicals Such as Bloomin’ Brands Will Outperform (barrons)

- Kraft Heinz Tops Earnings Expectations and Raises Organic Sales Guidance (barrons)

- Walmart’s Warning Wrecked Retail Stocks. Some Were Unfairly Punished. (barrons)

- Carvana Has Dropped Nearly 90% This Year. It’s Time to Have a Look at the Stock, Says Analyst. (barrons)

- Teva Stock Soars After Reaching $4.25 Billion Opioid Settlement (barrons)

- Walmart Wreaked Havoc on Retail. Grab These Unfairly Punished Stocks Now. (barrons)

- Uber, Rivian, and 9 More ‘Busted IPOs’ That Could Still Have Value (barrons)

- Boeing Reverses Drain on Cash, Signaling Progress in Turnaround (bloomberg)

- How Pessimistic Americans Could Worry the Economy Into Recession (barrons)

- Texas Instruments Earnings Tops Estimates. The Stock Is Rising. (barrons)

- For Investors and a Buffer, Alibaba Seeks a Hong Kong Primary Listing (nytimes)

- Here’s What to Expect From the Fed’s Policy Review Today (bloomberg)

- A $9.4 Trillion Results Day Looms in a Test for Stock Market (bloomberg)

- Traders Who Bet on Friendlier Fed Are About to See If They’re Right (bloomberg)

- Mercedes Sees Car Demand Continuing to Outrun Supply (bloomberg)

- Rolls-Royce picks Tufan Erginbilgic to succeed Warren East as CEO (ft)

- Alibaba Applies For Primary Listing In Hong Kong (chinalastnight)