Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – July 26, 2022

Where is the money flowing?

Tom Hayes – Cheddar TV Appearance – 7/26/2022

Cheddar TV Appearance – Thomas Hayes – Chairman of Great Hill Capital – July 26, 2022

Watch in HD directly on Cheddar

Be in the know. 30 key reads for Tuesday…

- Alibaba, Ant executives end partnership as fintech unit seeks IPO greenlight (scmp)

- Alibaba Chairman and CEO’s Letter to Shareholders (alibabagroup)

- Alibaba seeks Hong Kong primary listing for Stock Connect access (scmp)

- Is the dollar about to take a turn? (ft)

- Odds of an economic recession are rising, but the stock market has already priced it in and found its bottom, JPMorgan says (businessinsider)

- Stocks have already bottomed, according to a veteran strategist who nailed bear market forecasts in 1982 and 2009 (businessinsider)

- Walmart warns of lower profit due to food, gas inflation (nypost)

- Is Recession Staring Us Down? Already Upon Us? Here’s Why It’s Hard to Say. (nytimes)

- GE posts higher earnings on recovery in aviation industry (cnbc)

- Alphabet Kicks Off Big Tech Earnings. It’s a Key Test. (barrons)

- It’s Microsoft Earnings Day. Focus on the Outlook. (barrons)

- Alibaba Stock Jumps as It Seeks Primary Listing in Hong Kong (barrons)

- Alibaba to seek primary listing in Hong Kong, in addition to to NYSE

- Texas Instruments Results Are Today. What to Expect. (barrons)

- A 3-Day Tech Earnings Deluge Begins. Here Are the Key Issues to Track. (barrons)

- 3M Stock Is Rising. Its Earnings Report Held a Ton of News. (barrons)

- Biogen’s ALS Drug Will Get FDA Review. It’s a Long Shot for the Stock. (barrons)

- Alphabet Kicks Off Big Tech Earnings. It’s a Key Test for the Stock Market. (barrons)

- Walmart Cuts Profit Outlook as It Lowers Prices to Move Goods (wsj)

- Coca-Cola Raises Guidance With Consumers Still Willing to Pay More (bloomberg)

- Billionaire Wharton Dropout Peltz Warns Big Tech Dominance Over (bloomberg)

- Home price growth slowed for the second straight month in May, S&P Case-Shiller says (cnbc)

- IMF slashes global GDP forecast as economic outlook grows ‘gloomy and more uncertain’ (cnbc)

- Seagen shares positive data for bladder cancer drug (marketwatch)

- These 20 stocks still have at least 48% upside, analysts say, despite the S&P 500’s 8% gain from its lows (marketwatch)

- Opinion: We’re probably in the early stages of a new bull market. Nervous? Start with these 5 ‘moat’ stocks (marketwatch)

- What Wall Street is saying about Alphabet ahead of earnings (thefly)

- Conference Board Confidence Tumbles As ‘Hope’ Hits 9-Year-Low (zerohedge)

- New Home Sales Plunged In June As Pulte Admits Order Cancellations Are Soaring (zerohedge)

- Beijing plans three-tier data strategy to avoid US delistings (ft)

Where is the money flowing?

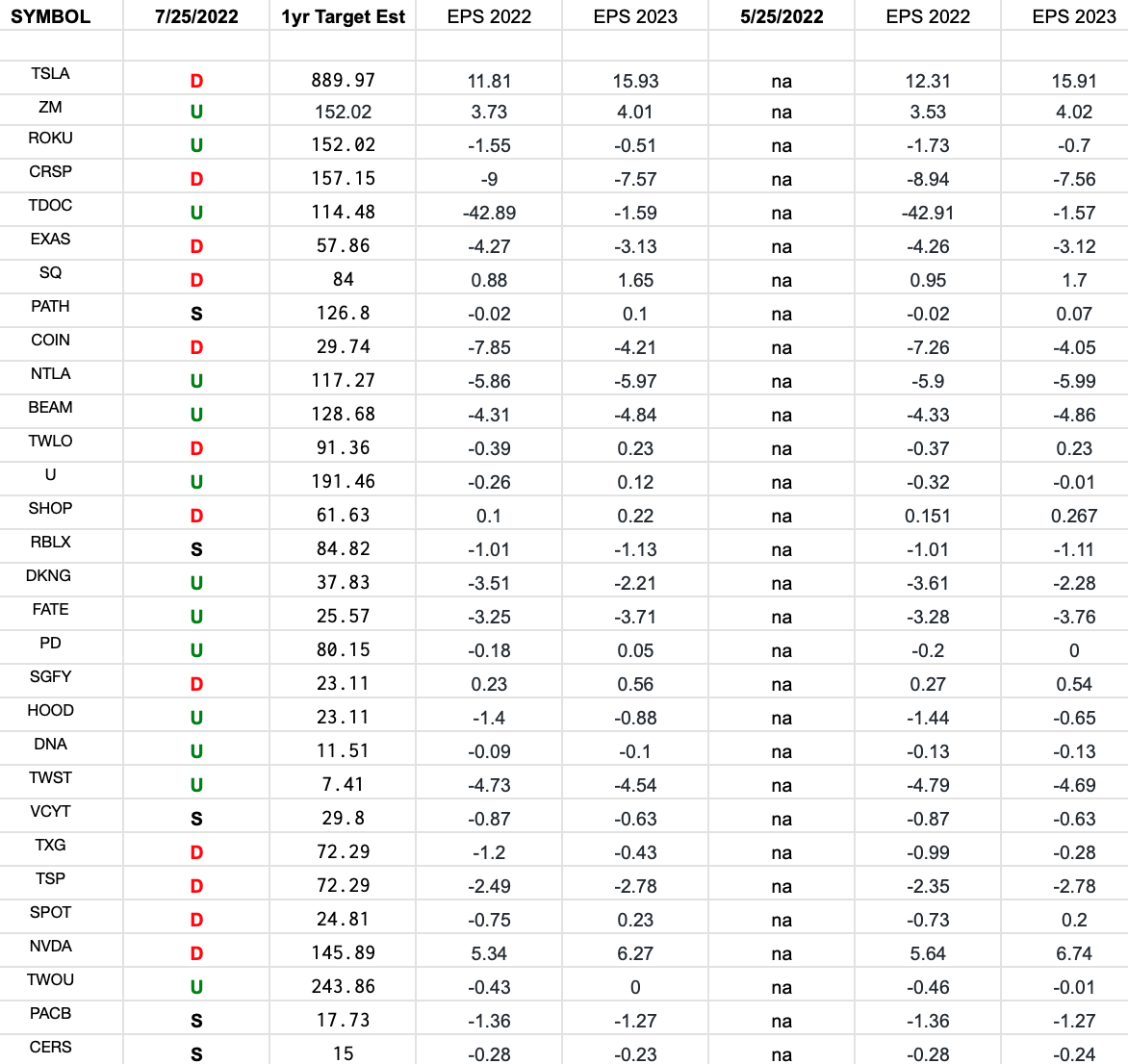

ARKK Innovation Fund Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Ark Innovation Fund top 30 weighted stocks.

Be in the know. 18 key reads for Monday…

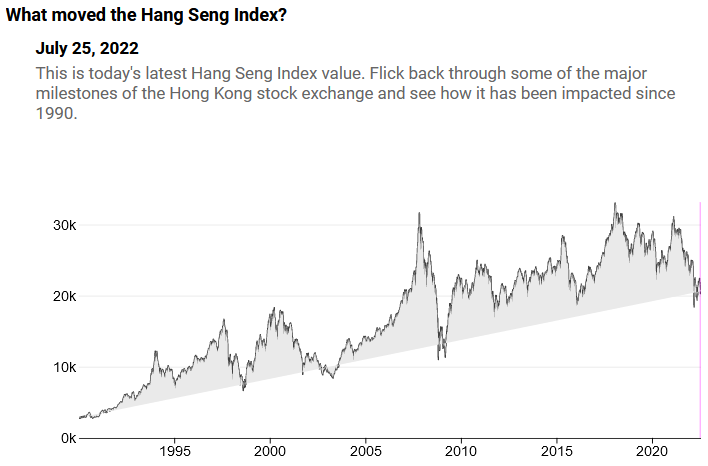

- Hong Kong companies push stock buy-backs to decade-high amid price slump (scmp)

- Investors Bet Fed Will Need to Cut Rates Next Year (wsj)

- Beijing plans strategy to avoid US market delistings: report (foxbusiness)

- China regulator denies report on data strategy to avoid U.S. delistings (reuters)

- Citi’s Contrarian View on China: ‘Economy Is Turning the Corner’ (bloomberg)

- Morgan Stanley Sees More Fed Hikes While JPMorgan Expects Pivot (bloomberg)

- Intel to Help Make Chips for Taiwan’s MediaTek (barrons)

- Weak Earnings Reports Aren’t Fazing Investors After Brutal Year for Stocks (wsj)

- Inside Saudi Arabia’s Plan to Build a Skyscraper That Stretches for 75 Miles (wsj)

- Rich Americans Keep Borrowing, Defying Economic Gloom (wsj)

- China Bets Big on Basic Chips in Self-Sufficiency Push (wsj)

- Ferrari 410 Sport Spider Leads RM Sotheby Pebble Beach Auction (barrons)

- Why Big Tech Is Making a Big Play for Live Sports (nytimes)

- China’s Choice: Covid Zero or Xi’s Three Red Lines (bloomberg)

- BofA’s Suttmeier Sees Stronger Longer-term S&P 500 Returns After NYSE 90% Up Day (streetinsider)

- Strong dollar wipes billions off US corporate earnings (ft)

- Investors bet on redemption for China’s godfather of education (ft)

- Developers’ shares rise on news of China’s US$12 billion bailout fund (scmp)

Be in the know. 20 key reads for Sunday…

- Wait, La Guardia Is Nice Now? Inside New York’s $25 Billion Airport Overhaul (nytimes)

- Macron Tells Iran’s Raisi That a Nuclear Deal Remains Possible (bloomberg)

- The World’s 50 Best Restaurants 2022 Revealed (forbes)

- Bond Traders Regaining Faith That Fed Can Slay Inflation Dragon (bloomberg)

- The Jewish Deli: An American Tale Told in Pickles and Pastrami (nytimes)

- Amazon Wants to Be Your Doctor, Too (nytimes)

- Major Cruise Line Drops Vaccine Requirement From U.S. Ports (thestreet)

- Goldman Makes Morningstar Undervalued Stocks List (thestreet)

- The European Grand Tour Returns With Iconic Rail Journeys Aboard VSOE (forbes)

- Meet the American who invented Buffalo wings and disrupted the entire chicken industry (nypost)

- Rolls-Royce and Hyundai Are Teaming Up to Build Electric Engines for Airplanes and VTOLs (robbreport)

- Boat of the Week: Why the Classic Riva Aquarama Is Still the the Most Beautiful Runabout Ever Made (robbreport)

- These 8 Real Structures Inspired the Castles in Disney Films (architecturaldigest)

- A timeline of Didi and its year-long cybersecurity investigation (technode)

- Netflix starts linking iPhone and iPad users to an external sign-up page (theverge)

- The alchemy behind falling metal prices (npr)

- Jason Calacanis On the Expensive Lesson Coming to Silicon Valley (bloomberg)

- Maserati Is Building a Track-Only MC20 With 740 HP (roadandtrack)

- Cam Smith shows you how to hit a perfect spinny chip — in 14 seconds (golf)

- John Daly Uncensored: An interview with America’s underdog (golfdigest)

Be in the know. 28 key reads for Saturday…

- China Reports Fewer Covid Cases as Gansu Outbreak Eases (bloomberg)

- Wheat Prices Fall After Russia-Ukraine Deal (wsj)

- Biden may scrap choice for Federal Communications Commission (foxbusiness)

- Earnings estimates for China, Hong Kong stocks are on the rise (bloomberg)

- Expectations ‘very low’ for tech earnings: Market expert (foxbusiness)

- Apartment and Warehouse Deals Start to Sputter as Rates Sting (bloomberg)

- Ford Secures Batteries to Build 600,000 EVs a Year by 2023 (bloomberg)

- Europe’s Diesel Market Slides From Mind-Blowing to Amazing (bloomberg)

- Broken Bulls, Big Breadth: Weighing a Case for a Turn in Stocks (bloomberg)

- Are Stocks Near a Bottom? (barrons)

- Unboxing Amazon: The Case for the Stock to Double, or More (barrons)

- It’s a Bear-Market Rally. Whether it Lasts Depends on the Fed. (barrons)

- Is the Stock Market Going Up? It Might Depend on the Definition of Recession. (barrons)

- Shake Shack Founder Danny Meyer Scooped Up Stock (barrons)

- ere are 5 reasons behind the stock market’s recent impressive rally – and why there’s more upside ahead, according to Fundstrat (businessinsider)

- Apple’s new car software could be a trojan horse into the automotive industry (cnbc)

- We Need to Keep Building Houses, Even if No One Wants to Buy (nytimes)

- Is the stock-market bottom in? What the pros say after S&P 500 tests 4,000 (marketwatch)

- It’s time to overweight small caps as ‘they’ve come very close to pricing in recession’: RBC Capital (marketwatch)

- Opinion: Get in front of these three stock market sectors before they blossom into mainstream darlings (marketwatch)

- Opinion: I’ve been building homes for 40 years, and here’s what has to change if the U.S. wants more starter homes (marketwatch)

- Amazon: how ecommerce group became the world’s third largest digital advertising player (ft)

- Amex shrugs off macro fears with huge earnings beat powered by strong spending (marketwatch)

- There Was Never Anything Wrong With Value (institutionalinvestor)

- Electricity Is the New Medical Miracle (wsj)

- Bloomberg Wealth: Sam Zell (bloomberg)

- 8 Newly Undervalued 5-Star Stocks (morningstar)

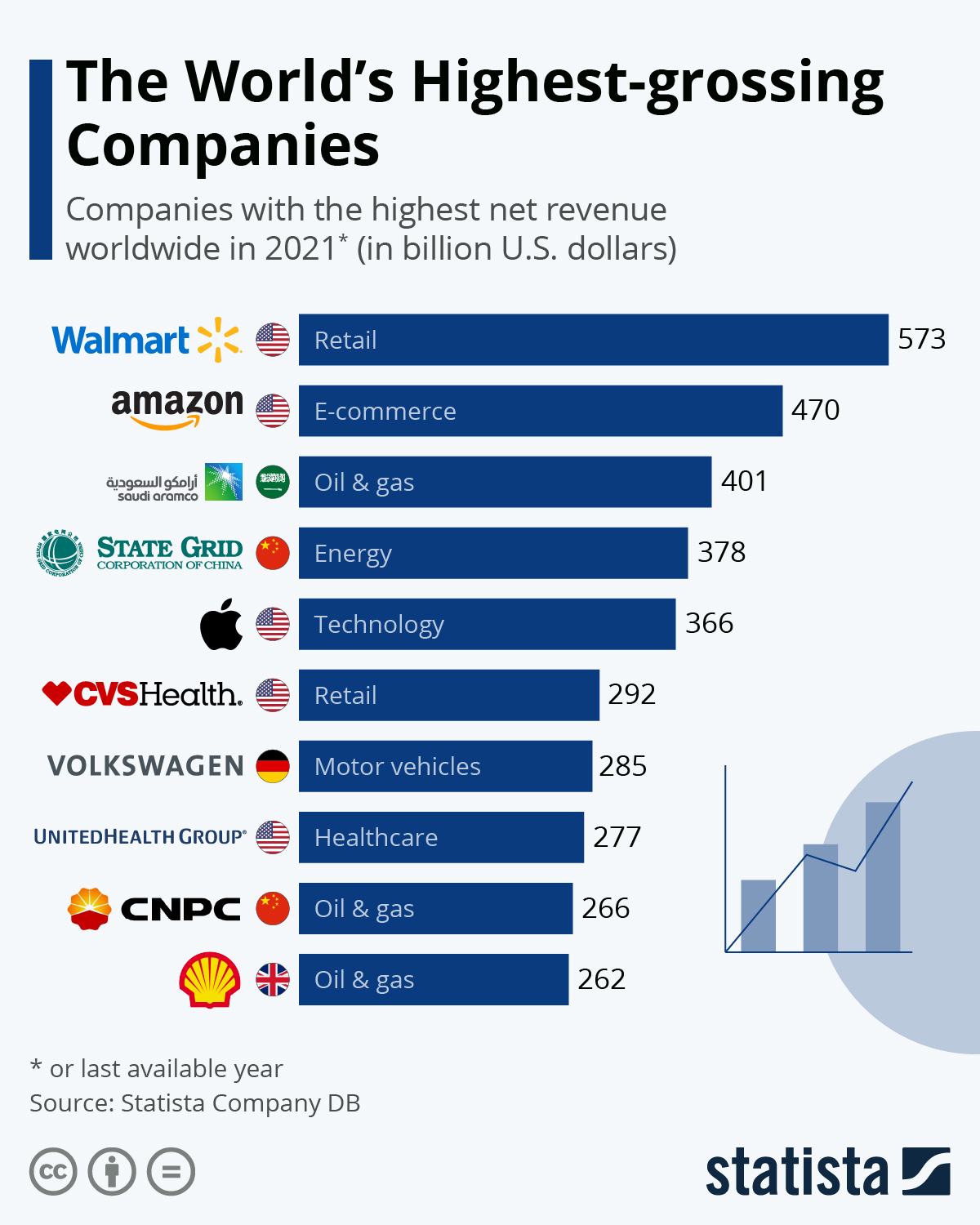

- These Are The World’s Highest-Grossing Companies (zerohedge)

Tom Hayes – The Claman Countdown – Fox Business Appearance – 7/22/2022

Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – July 22, 2022