Datasource: Finviz

Be in the know. 20 key reads for Tuesday…

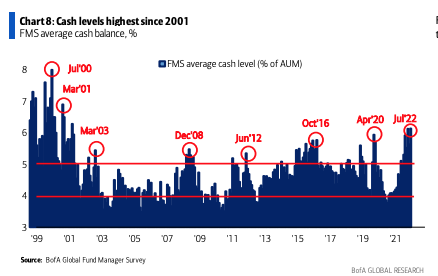

- BofA Survey Shows Full Investor Capitulation Amid Pessimism (bloomberg)

- Shanghai bourse to name market makers for tech stocks in boost for liquidity (scmp)

- Citigroup sees another 20 per cent upside in Chinese stocks this year on spending stimulus (scmp)

- Rich Chinese Worth $48 Billion Want to Leave — But Will Xi Let Them? (bloomberg)

- Chinese Regulator to Fine Didi More Than $1 Billion Over Data-Security Breaches. Move ends yearlong investigation and will free firm to pursue a second listing in Hong Kong (wsj)

- Boeing Nears 787 Dreamliner Order With Aircraft Lessor (wsj)

- Why There’s a Chance the Stock Market Has Hit Bottom (barrons)

- How to Explain the Metaverse, According to Its Biggest Booster (barrons)

- Natural-Gas Stocks Are Beating Oil Names. Here’s Why. (barrons)

- Netflix Is Serious About Cracking Down on Password Sharing. It’s Trying Out a New Test. (barrons)

- Full capitulation: Fund managers have never been this pessimistic on growth or profits (marketwatch)

- ‘Hot inflation is over.’ Here’s what that means for investors, says portfolio manager. (marketwatch)

- Senate Votes on Semiconductor Bill Today. What It Means for Intel and Other Chip Stocks. (barrons)

- No Deals, No Problem on Wall Street (wsj)

- Barclays bankers kvetch over ‘skimpy’ bonuses, say their morale is ‘killed’ (nypost)

- Apple reportedly to slow hiring, spending in some divisions next year (nypost)

- Valuable wheat stuck in Ukraine may soon be on a ship (foxbusiness)

- Euro Surges On Report ECB Looking “Closely” At 50bps Rate Hike As Lagarde Rushes To Complete “Italian Bond Purchase” Mechanism (zerohedge)

- The Big Read. European economy: Lagarde wrestles with an ‘impossible situation’ (ft)

- Incyte gets FDA approval for a new vitiligo treatment (marketwatch)

Tom Hayes – CGTN America Appearance – 7/18/2022

CGTN America – Thomas Hayes – Chairman of Great Hill Capital – July 18, 2022

Watch FULL interview in HD directly on CGTN America

Where is the money flowing?

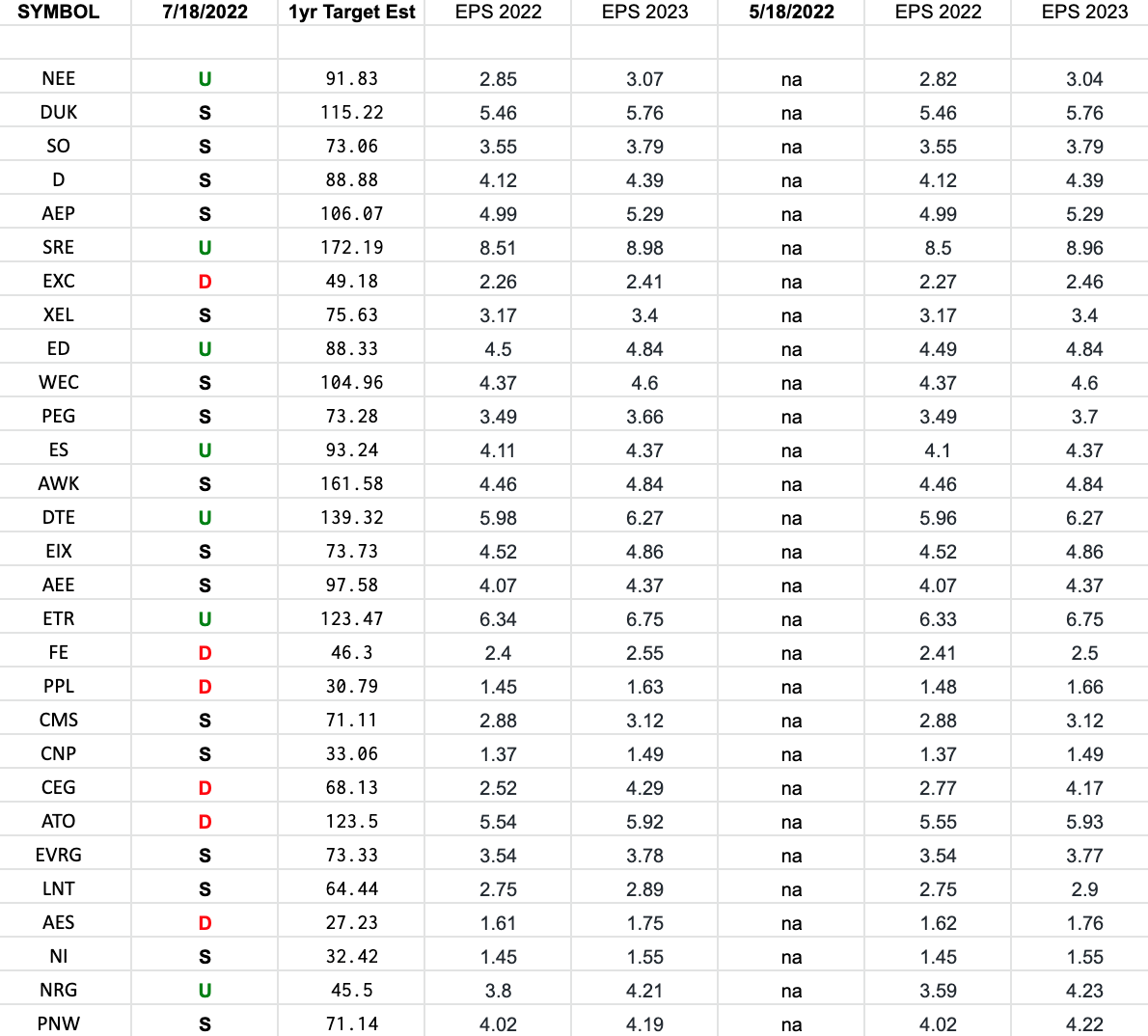

Utilities Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Utilities Sector ETF (XLU) top weighted stocks.

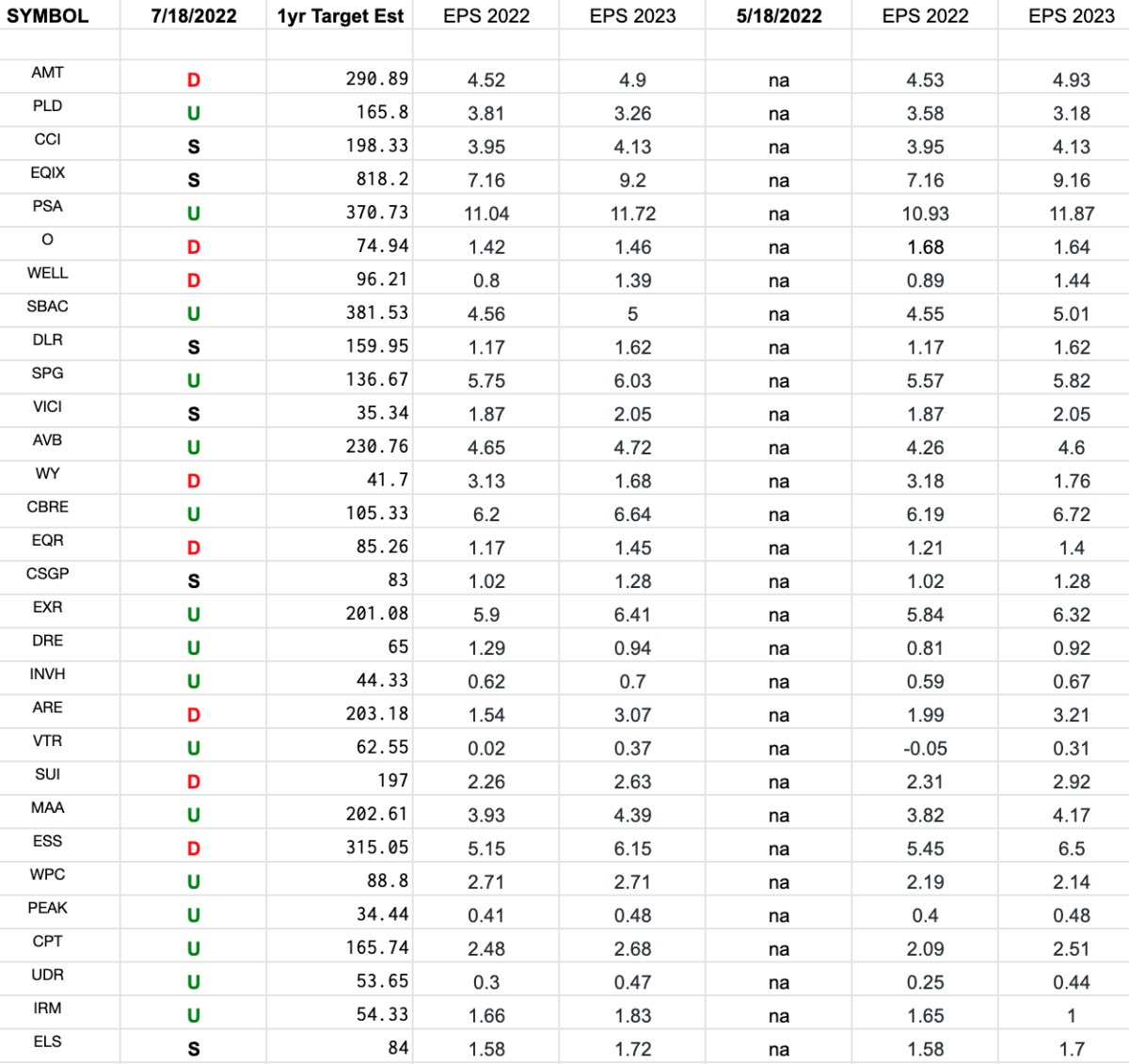

REIT Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Real Estate (REIT) Sector ETF (IYR) top 30 weighted stocks. Continue reading “REIT Earnings Estimates/Revisions”

Be in the know. 30 key reads for Monday…

- Auto Stocks Are Down. They Could Be a Great Recession-Recovery Play. (barrons)

- China Central Bank Governor Pledges Stronger Support to Economy (blooberg)

- GOLDMAN SACHS: Buy these 21 low-downside stocks because history shows their profits will hold up during a potential recession (businessinsider)

- Supply Chains Inching Back to Normal Brace for Headwinds of Softer Demand (bloomberg)

- Brussels urges EU to turn down heat to resist Russian gas curbs (ft)

- Finding Opportunity in the Tech Wreck—Especially in China (barrons)

- Cameron Smith Overtakes Rory McIlroy to Win the 150th British Open (nytimes)

- Boeing Stock Rises as Delta Orders 100 Boeing MAX 10 Jets (barrons)

- What Tech Earnings Will Tell Us About a Second-Half Recession (barrons)

- Here’s why the 60/40 model suddenly has life again (marketwatch)

- Don’t fear the bear. It gives you chances to pick winning stocks and beat the market. (marketwatch)

- Fed officials signal 75-basis-point rate hike likely at upcoming meeting (marketwatch)

- Delta Selloff Has Gone a ‘Little Too Far,’ Analyst Says. The Stock Could Rally Soon. (barrons)

- Europe Fears Widespread Economic Fallout if Russian Gas Outage Drags On (wsj)

- China orders banks to open the credit taps to help developers deliver (scmp)

- The Big Read. Europe’s defence sector: will war in Ukraine transform its fortunes? (ft)

- Russian gas cuts threaten to shutter Germany industry (ft)

- Royal Caribbean to buy Endeavor cruise ship at ‘significantly below’ construction cost (yahoo)

- With Bearish Sentiment Off The Charts, $5.5 Billion In Daily Stock Buybacks Set To Flood Markets (zerohedge)

- China Adds Liquidity for First Time Since June (bloomberg)

- The Andy Jassy Way at Amazon (nytimes)

- Chip Investment Decisions Await Congressional Action on $52 Billion Funding Bill (wsj)

- China Tries to Jump-Start Its ETF Market With Foreign Money (wsj)

- Is a recession improbable or inevitable? JPMorgan, Goldman Sachs, and 10 other top investing firms reveal their predictions for the economy for the rest of 2022 (businessinsider)

- BofA’s Loan Revenue Rises as Rates Increase; Costs Climb (bloomberg)

- Did Buffett and Munger See BYD’s One Problem? (bloomberg)

- Russian gas holds the keys to the euro as the energy crisis weighs on Europe’s economy and currency (businessinsider)

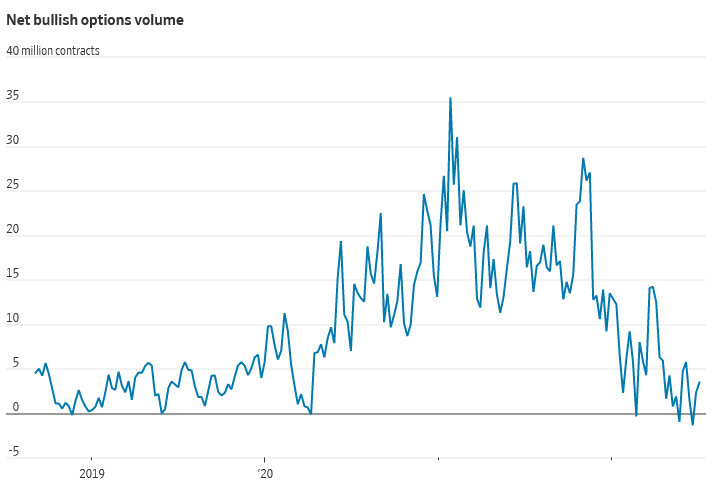

- The Fed’s escalating inflation fight is taking the last bit of air out of meme-stock-style speculation, trading expert says (businessinsider)

- It’s a matter of ‘when and not if’ Europe gets hit by power crunch as Russia chokes off energy supplies, Rystad Energy says (businessinsider)

- Ford unveils new F-150 Raptor R pickup with 700 horsepower (cnbc)

Be in the know. 15 key reads for Sunday…

- After Biden Rehabs MbS’ Image, Saudis Announce Increase In Oil Production Capacity (zerohedge)

- Crown Prince MBS hints at increasing Saudi oil production (nypost)

- Shanghai Reports 26 New Covid Cases, Number of Risky Areas Falls (bloomberg)

- Manchin in Driver’s Seat Again After Inflation Fears Vindicated (bloomberg)

- British Open Latest: Day of Low Scoring at Sunny St. Andrews (bloomberg)

- First Drive: McLaren’s Agile New Hybrid, the 671 HP Artura, Feels Like the Marque’s First Daily Driver (robbreport)

- The Old Course at St. Andrews Is Much More Than the Home of Golf (mensjournal)

- TSMC’s revenue increases 43.5% to $18.2 billion in 2022 Q2 (technode)

- China issued 67 new gaming licenses for July, including one from ByteDance (technode)

- Shanghai wants top companies to explore NFT trading platforms (technode)

- Celebrate Ferrari’s 75th Anniversary With Their Most Iconic Cars (maxim)

- Ferrari’s 75th Anniversary: Meet The Daytona SP3 Halo Hypercar (maxim)

- Why Biden’s Broadband Agenda Is at a Do-or-Die Moment (cnet)

- From Earth to the cosmos, indicators of the week (npr)

- Why Sriracha Is Everybody’s Favorite Hot Sauce (howstuffworks)

Be in the know. 12 key reads for Saturday…

- Stock Investors Have Rarely Been This Bearish (wsj)

- Amazon’s Earnings Outlook Could Be Better Than Feared, Analyst Says (barrons)

- What to Buy Right Now: 42 Picks From Barron’s Roundtable Pros (barrons)

- Fears About Tech May Be Peaking. These Cheap Stocks Look Attractive. (barrons)

- Jeremy Siegel on Why Today’s Inflation Is Different From the 1970s (barrons)

- Don’t Buy the Hype. The Fed Is Unlikely to Do a Full-Point Rate Hike. (barrons)

- Ex-Disney boss Iger regrets tapping Bob Chapek as CEO: report (nypost)

- Biden expects Saudi Arabia to take ‘further steps’ to boost oil supply (ft)

- US inflation expectations survey eases fears of 1% rate rise from Fed (ft)

- Wheat Falls to Pre-War Low With Food Shipments Surging in Crimea (bloomberg)

- 2022 British Open: Five things we learned in Friday’s second round at St. Andrews (usatoday)

- Here’s why Britain’s Warren Buffett is sticking with Facebook’s parent and other beaten-down techs (marketwatch)

Tom Hayes – Yahoo! Finance Appearance – 7/15/2022

Yahoo! Finance Appearance – Thomas Hayes – Chairman of Great Hill Capital – July 15, 2022