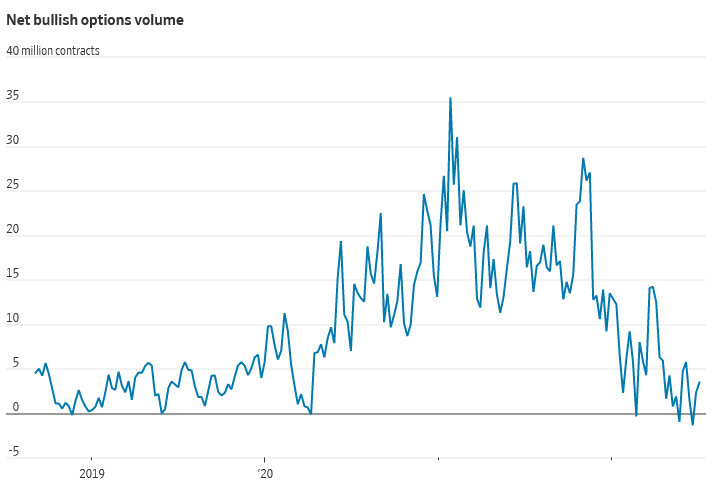

- Stock Investors Have Rarely Been This Bearish (wsj)

- Amazon’s Earnings Outlook Could Be Better Than Feared, Analyst Says (barrons)

- What to Buy Right Now: 42 Picks From Barron’s Roundtable Pros (barrons)

- Fears About Tech May Be Peaking. These Cheap Stocks Look Attractive. (barrons)

- Jeremy Siegel on Why Today’s Inflation Is Different From the 1970s (barrons)

- Don’t Buy the Hype. The Fed Is Unlikely to Do a Full-Point Rate Hike. (barrons)

- Ex-Disney boss Iger regrets tapping Bob Chapek as CEO: report (nypost)

- Biden expects Saudi Arabia to take ‘further steps’ to boost oil supply (ft)

- US inflation expectations survey eases fears of 1% rate rise from Fed (ft)

- Wheat Falls to Pre-War Low With Food Shipments Surging in Crimea (bloomberg)

- 2022 British Open: Five things we learned in Friday’s second round at St. Andrews (usatoday)

- Here’s why Britain’s Warren Buffett is sticking with Facebook’s parent and other beaten-down techs (marketwatch)

Tom Hayes – Yahoo! Finance Appearance – 7/15/2022

Yahoo! Finance Appearance – Thomas Hayes – Chairman of Great Hill Capital – July 15, 2022

Watch FULL interview in HD directly on Yahoo! Finance

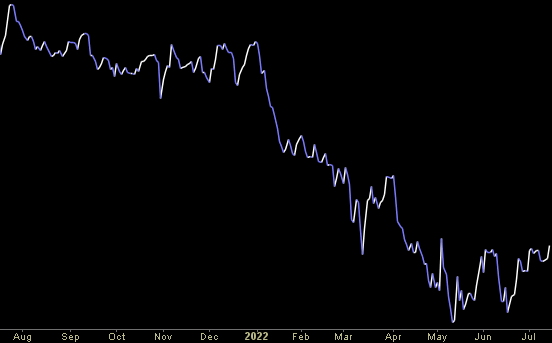

Where is the money flowing?

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Tom Hayes – Quoted in Reuters article – 7/15/2022

Thanks to Mehnaz Yasmin and David Henry for including me in their article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

Tom Hayes – Quoted in Benzinga article – 7/14/2022

Thanks to Zoltan Suranyi, Aj Fabino, and Mitch Hoch for including me in their article on Benzinga. You can find it here:

Click Here to View The Full Article on Benzinga

Be in the know. 22 key reads for Friday…

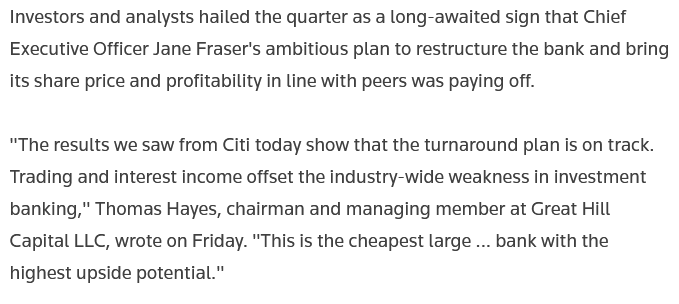

- Citigroup tops profit estimates as bank benefits from rising interest rates, shares pop 5% (cnbc)

- Deutsche Bank Now Modeling German Households Chopping Wood To Keep Warm This Winter (zerohedge)

- Here’s why Britain’s Warren Buffett is sticking with Facebook’s parent and other beaten down techs (marketwatch)

- Fed Official Says 0.75-Point Interest Rate Rise Seems Most Likely in July (wsj)

- Biotech Stocks Strengthen: Here’s How To Find The Real Leaders (barrons)

- Retail sales rose more than expected in June as consumers remain resilient despite inflation (cnbc)

- JPMorgan CEO Dimon sums up U.S. economy in one paragraph (cnbc)

- Exclusive: Great Hill Capital’s Thomas Hayes Says ‘Expect More Pain’ For Energy Longs (benzinga)

- Retail Sales Actually Slowed Down. What It Means for the Fed. (barrons)

- How Apple Could Build Out a $20 Billion Ad Business (barrons)

- Qualcomm Is a Top Stock Pick on Valuation, Says J.P. Morgan (barrons)

- Copper Prices Fall Lowest in 20 Months. (barrons)

- China’s Auto Sales Boom. Can the Rebound Last? (barrons)

- Rail Stocks Are a Bargain Now, Analyst Says. He Upgraded Two. (barrons)

- Citigroup Earnings Show the Bank’s Turnaround Is on Track (barrons)

- Alibaba Executives Called In by China Authorities as It Investigates Historic Data Heist (wsj)

- Once Known as the Land of Hooters and ‘Magic Mike,’ Tampa Has Discovered Its Cool Factor (wsj)

- China’s Economic Comeback From Covid-19 Shutdowns Likely to Be Slow and Bumpy (wsj)

- US Factory Output Declines for a Second Month on Consumer Goods (bloomberg)

- Fed’s Bostic Signals He Doesn’t Favor a 100 Basis-Point July Fed Rate Hike (bloomberg)

- New York Manufacturing Expands for First Time in Three Months (bloomberg)

- Reverse Bullwhip Arrives: Amazon Prime Day Blows Away Record Thanks To “79% Off” Discounts (zerohedge)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 143

Who are the 50 people influencing markets the most this year? Tell MarketWatch what you think here: (marketwatch)

Article referenced in VideoCast above: