- Taiwan Semi Tops Estimates. Demand for Cars Helped. (barrons)

- China Readies $1.1 Trillion to Support Xi’s Infrastructure Push (bloomberg)

- Get ready for a summer of sales, as prices for everything from department-store goods to high-end watches get deeply discounted as inventory stacks up (businessinsider)

- Pharma Is Place to Hide During Recession (wsj)

- Global Natural-Gas Markets Are Getting Scared (wsj)

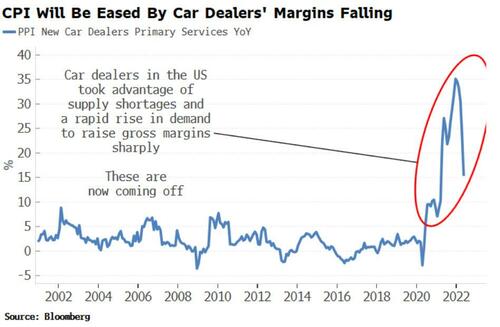

- Inflation May Have Peaked, but the Fed Won’t Back Off (wsj)

- JPMorgan Halts Share Buybacks as Earnings Miss Estimates (bloomberg)

- Hot Inflation Report Puts Pressure on Federal Reserve (wsj)

- S. Economy Slows in Several Parts of the Country, Fed’s Beige Book Says (wsj)

- Why Jeremy Siegel Doesn’t Think We’re in for a Rerun of ’70s Stagflation (barrons)

- Estée Lauder Stock Has Had an Ugly 2022. Why the Next 12 Months Could Be Beautiful. (barrons)

- Tiger Woods becoming team player is transformation no one saw coming (nypost)

- Producer Prices Top Forecasts But Signs of Softening Emerge (bloomberg)

- Two pieces of good news for investors and three moves to make now in the wake of surging CPI, from UBS (marketwatch)

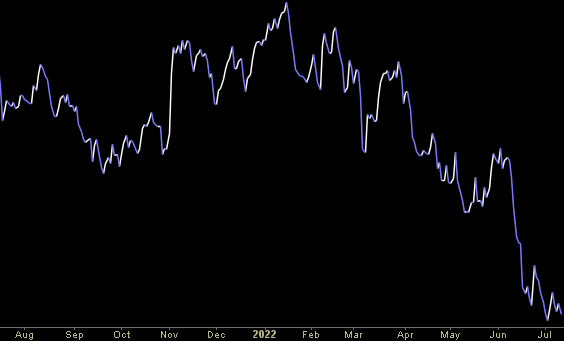

- Oil Plunges To Post-Putin Lows, Breaks Key Technical Support (zerohedge)

- The Big Read. Ukraine: can Russia still win the war? (ft)

- Putin’s stamina for war will test the west’s resolve (ft)

- Liquidity is a bigger worry for investor returns than growth (ft)

“As Bad As It Gets” Stock Market (and Sentiment Results)…

In 1997, Jack Nicholson co-starred with Helen Hunt in a movie called, “As Good As it Gets.” When it comes to markets, you want to be a SELLER when things are “As Good As it Gets.” However, it pays to be a BUYER when things are “As Bad As it Gets.” Continue reading ““As Bad As It Gets” Stock Market (and Sentiment Results)…”

Where is the money flowing?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 18 key reads for Wednesday…

- Chinese gaming stocks jump after Beijing approves new titles in a sign scrutiny is easing (cnbc)

- Brussels calls on EU to turn down heat to resist Russian gas curbs (ft)

- Transport Holds The Key To A Lower CPI (zerohedge)

- S. inflation climbs to 41-year high of 9.1%, CPI data show, as gas prices surge (marketwatch)

- Fed funds futures traders now see 42% chance of full percentage point Fed rate hike on July 27 after June CPI data (marketwatch)

- White House calls attention to falling gas prices not reflected in June CPI data (marketwatch)

- Taiwan National Fund Intervenes to Stop Market Slide (wsj)

- New Video Game Approval Lifts Hong Kong Internet Stocks (chinalastnight)

- Netflix (NFLX) is a ‘Show-me’ Story with a Light Catalyst Path – Goldman Sachs (streetinsider)

- Boeing deliveries reach highest monthly level since March 2019 (streetinsider)

- Citi Offers 5 Reasons Why Investors Should Still Buy Apple (AAPL) Stock (streetinsider)

- 12 Battered Stocks That Could Be the Next Amazon (barrons)

- Bank Earnings Will Give Clues About Possible Recession (wsj)

- These high-yield stocks are down as much as 58% this year. But their inflation-fighting dividends have room to grow. (marketwatch)

- Everything to know as Joe Biden heads to Saudi Arabia (businessinsider)

- Chinese companies are going global as growth slows at home (cnbc)

- Dividend Payouts Hit Record Despite Rocky Stretch in Markets (wsj)

- One of Retail’s Worst Performers Gets a New Bull (barrons)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is the money flowing?

Be in the know. 10 key reads for Tuesday…

- Investor case for Chinese assets rises despite regulatory and geopolitical risks (ft)

- Is Warren Buffett Selling? BYD Stock Is Down (barrons)

- PepsiCo Stock Rises as Earnings, Revenue Beat Forecasts (barrons)

- S. yield curve most inverted in 15 years (marketwatch)

- Money Is Pouring Into Bonds Again. What It Means. (barrons)

- Opinion: ‘A perfect business for an inflationary environment.’ Why this veteran value investor is bullish on a beaten-down telecom stock. (marketwatch)

- NFIB small-business optimism index falls to lowest level since the start of the pandemic (marketwatch)

- Cruises Are the Cheapest Way to Travel This Summer (wsj)

- Crispr for the Masses Gets a Little Closer to Reality (bloomberg)

- Charts suggest the market is poised for an August rebound, Jim Cramer says (cnbc)