- China Considers $220 Billion Stimulus With Unprecedented Bond Sales (Bloomberg)

- China’s Li Urges Coastal Powerhouses to Roll Out Growth Policies (bloomberg)

- Alibaba’s Jack Ma shows up at Dutch university as he keeps low profile (scmp)

- Buy the dip in China markets despite Covid concerns: Bank of America Securities (cnbc)

- Merck Is Now in Advanced Talks to Buy Cancer Biotech Seagen for $40 Billion: Report (barrons)

- Meridian Bioscience agrees to $1.5 billion buyout by SD Biosensor, SJL Partners (marketwatch)

- Samsung’s ‘better than feared’ earnings spur chip stock rally (cnbc)

- Wharton professor Jeremy Siegel says there’s ‘no question’ the US is already in a recession and the Fed could shock markets with a much smaller rate hike this month if data weakens (cnbc)

- The stock market is gearing up for a strong recovery in the 2nd half as ‘transitory’ inflation begins to cool, Fundstrat says (cnbc)

- China ETFs Attract Billions as Investors Hope Selloff Is Over (wsj)

- Do You Have Biotech FOMO? It Might Be Time To Pay Attention To These Names (investors)

- Norwegian Cruise to Drop Preboarding Covid Testing at Some Ports (barrons)

- This strategist warned investors not to chase momentum at the top. Now he says it’s time to be a contrarian. (marketwatch)

- Bank stocks are super cheap — even with the risk of recession (marketwatch)

- Yield curve inverts further after Fed’s hawkish minutes (marketwatch)

- Wall Street profit expectations for megabanks cooled slightly ahead of earnings despite deep freeze in stocks (marketwatch)

- Ford’s F-150 Electric Truck Is Red-Hot. What It Means for the Stock. (barrons)

- The Fed is Nimble. It May Change Tack Again in July. (barrons)

- Why a rally in growth stocks could signal ‘peak’ Fed hawkishness has passed (marketwatch)

- The Economy Could Take 3 Paths, J.P. Morgan Says. Only One Is a Soft Landing. (barrons)

- Inflation Isn’t Recession. The Chances of a Downturn Are Lower Than People Think. (barrons)

- Inflation Fears Drove Larger Fed Rate Increase in June (wsj)

- Amazon and Grubhub Strike Deal to Bring Restaurant Delivery to Prime Members (wsj)

- Consumers Say 2022 Is the Worst Economy Ever (wsj)

- Job openings eased, in a sign of the cooling labor market. (nytimes)

- US Jobs Report to Show ‘Natural Slowdown’ But Not Broad Weakness (bloomberg)

- Oil Plummets Below $100 as Recession Risks Come to Forefront (bloomberg)

- A stock market bottom could be near as short-sellers become hesitant to press bets after making nearly $300 billion in profits this year, S3 Partners says (businessinsider)

- Charts suggest the market could find a bottom after a little more weakness, Jim Cramer says (cnbc)

- China unveils plans to spur car demand, may extend EV tax break (reuters)

- China Prepares $220 Billion Stimulus With Tsunami Of Bond Sales (zerohedge)

- Bed Bath & Beyond’s new CEO bets big with her own money (yahoo)

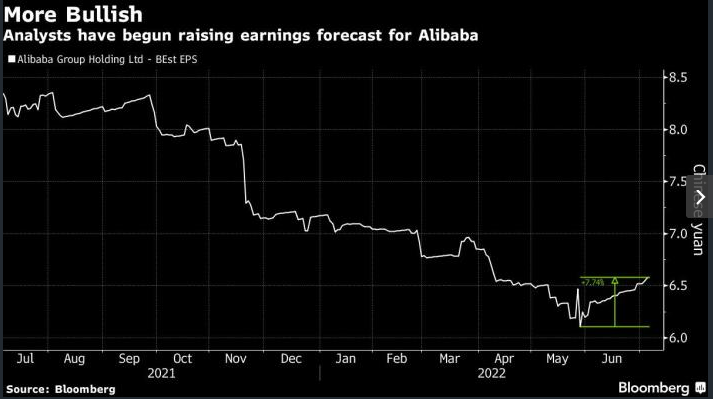

- Alibaba Earnings Turnaround Hopes Revived After Shares Rise 60% (yahoo)

- Betting Against Tech Is Finally a Winning Trade as Short Sellers Sit on $20 Billion Profit (yahoo)

- China’s first domestically made Covid-19 drug enters commercial use (scmp)

- Hong Kong stocks gain as city seen easing air travel in boost for businesses (scmp)

- China embarks on state-led search for ‘disruptive’ innovations (scmp)

The Billionaire Investors You Have Never Heard Of…

Today we released the interview I completed with Philip Vassiliou – Partner and Chief Investment Officer of Billionaire Christopher Chandler’s Legatum. Philip is in charge of all investment activities for the firm. Continue reading “The Billionaire Investors You Have Never Heard Of…”

Where is the money flowing?

Be in the know. 18 key reads for Wednesday

- Alibaba Earnings Turnaround Hopes Revived After Shares Rise 60% (yahoo)

- UBS joins bull camp with call for China stocks to outrun global peers (scmp)

- China ETFs Attract Billions as Investors Hope Selloff Is Over (wsj)

- China and India Funnel $24 Billion to Putin in Energy Spree (bloomberg)

- China’s Auto Sales Boom. Can the Rebound Last? (barrons)

- Amazon Takes Stake in Food Delivery Service Grubhub (barrons)

- Fed Minutes Are Coming. Here Are 4 Things to Watch. (barrons)

- Meta Is the Best Internet Stock to Buy Going Into a Recession, Says Analyst (barrons)

- Google’s Ad-Sales Drop Will Hit Alphabet Stock. Why the Tech Giant Will ‘Emerge Stronger.’ (barrons)

- The U.S. Might Cut Tariffs on China. It Could Help. (barrons)

- Oil Falls Below $100. Prices Could Drop Even Further. (barrons)

- Defund the Police Has Become Re-Fund the Police. Buy This Stock to Profit From the Trend. (barrons)

- Citi Says Oil May Collapse to $65 by the Year-End on Recession (bloomberg)

- Not lovin’ it Russians served moldy burgers in McDonald’s replacement restaurants (nypost)

- Nuclear Power Gets New Push in U.S., Winning Converts (nytimes)

- Ford Sales Jump in June on Big Gains for F-Series Pickup Trucks (bloomberg)

- 6 Fallen Angel Stocks to Buy Now Will Continue to Pay Fat Dividends (247wallst)

- Janet Yellen and China’s Top Trade Negotiator Discuss Tariffs on Call (wsj)

Where is the money flowing?

Tom Hayes – The Claman Countdown – Fox Business Appearance – 7/5/2022

Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – July 5, 2022

Watch in HD directly on Fox Business

Hedge Fund Tips (PIN) – Position Idea Notification

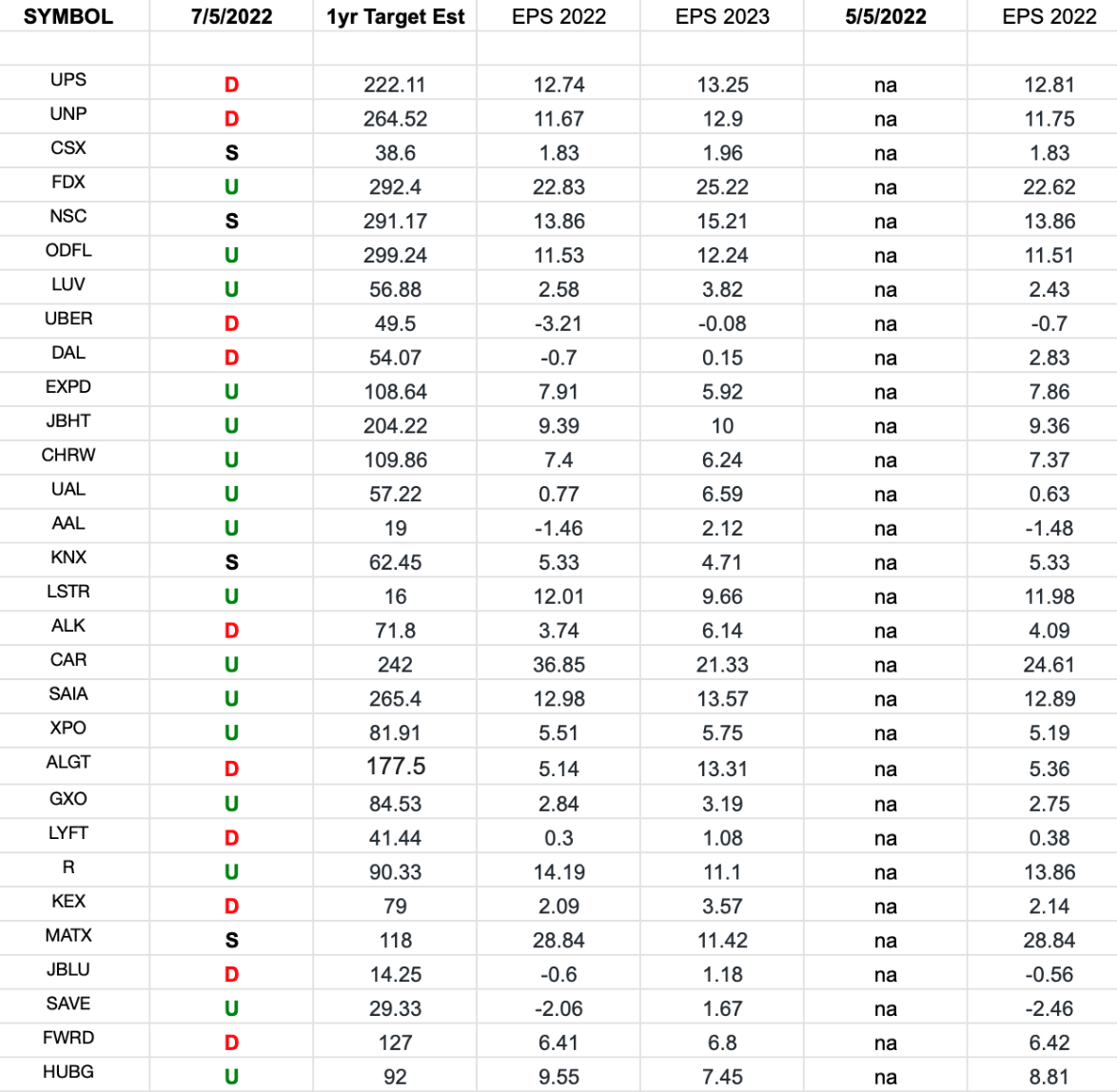

Transports Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Transportation Sector ETF (IYT) top 30 holdings. Continue reading “Transports Earnings Estimates/Revisions”

Be in the know. 27 key reads for Tuesday…

- Alibaba Stock Is Back in Its Groove. Why Chinese Tech Could Keep Outperforming. (barrons)

- Alibaba: Ant listing approval would help China stocks return to normality (ft)

- BofA’s Bull and Bear Indicator is at ‘Maximum Bearish’ For a Third Week In a Row (streetinsider)

- AstraZeneca to buy biotech firm TeneoTwo for up to $1.27 billion (foxbusiness)

- Biotech Stocks Finally Rose in June. What Does It Mean? (barrons)

- Why China’s Stock Market Looks Like It Can Keep Going Strong (barrons)

- Biden Dropping China Tariffs Could Be Good News for Tech Stocks (barrons)

- Biden Might Soon Ease Chinese Tariffs, in a Decision Fraught With Policy Tensions (wsj)

- Cutting Tariffs Would Ease Inflation. What Are We Waiting For? (barrons)

- Consumers’ Inflation Psychology Worries Fed (wsj)

- Short Sellers Pull Back on Their Bets Against the Stock Market (wsj)

- Secrets of Sovereign (institutionalinvestor)

- Earnings Season Will Be All About Vibes From Management (barrons)

- Tesla Is No Longer the World’s Largest EV Seller. Here’s Who Is. (barrons)

- Ray Dalio attacks U.S. populists and warns Russia may be ‘lesser loser’ in Ukraine war (marketwatch)

- Here’s how far house prices are set to fall as rates go up, according to this forecasting firm (marketwatch)

- Euro to reach parity against the U.S. dollar unless natural-gas crisis ends, Citi strategists warn (marketwatch)

- If the U.S. Is in a Recession, It’s a Very Strange One (wsj)

- Nuclear Power Gets New Push in U.S., Winning Converts (nytimes)

- Liquefied Natural Gas Comes to Europe’s Rescue. But for How Long? (nytimes)

- NHL mock draft: Projected first-round picks for Thursday in Montreal (usatoday)

- China’s Liu He and U.S. Treasury Secretary Janet Yellen hold virtual talks (cnbc)

- Citi Says Oil May Collapse to $65 by the Year-End on Recession (bloomberg)

- American Factories Are Making Stuff Again as CEOs Take Production Out of China (bloomberg)

- Consumer Debt Isn’t Stressing Banks — Yet (bloomberg)

- Ford U.S. sales jump in June (marketwatch)

- China to Set Up a $75 Billion Infrastructure Fund to Reaccelerate Economy Growth (streetinsider)

Retail Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Retail Sector ETF (XRT) top 30 weighted stocks. Continue reading “Retail Earnings Estimates/Revisions”