Datasource: Finviz

Be in the know. 16 key reads for Thursday…

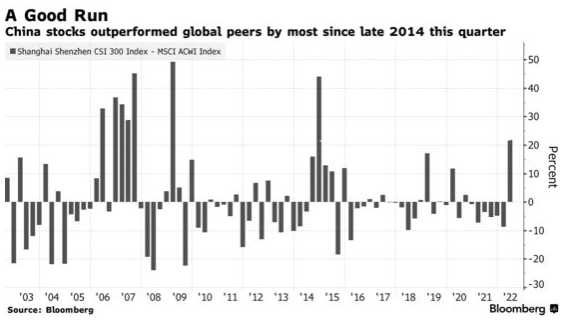

- China’s World-Beating Stock Rally Is Forecast to Strengthen More (bloomberg)

- China’s Tech Stocks Are Most Attractive in World, Invesco Says (bloomberg)

- China’s factory activity expands for first time in four months- official PMI (reuters)

- China’s Home Sales Slump Eases in June After Support Measures (bloomberg)

- Raging U.S. inflation is starting to cool, this Fed-preferred price gauge signals (marketwatch)

- Nike Stock Won’t Stay This Cheap Forever. How to Play Shares Now. (barrons)

- Everyone Needs Car Parts, Even in a Recession. These Stocks Are Good Buys. (barrons)

- S. to Ramp Up Military Presence in Europe to Counter Russia (wsj)

- Markets Head Toward Worst Start to a Year in Decades (wsj)

- Consumer Spending Gains Cooled in May (wsj)

- Home Listings Surge in Turnabout for Supply-Starved US Market (bloomberg)

- China continues to snap up Russian coal at steep discounts (cnbc)

- China Tech Investor Defies Skeptics With $900 Million Fundraise (bloomberg)

- The reinvention of Hong Kong (ft)

- Two Chinese tech firms under cybersecurity probes resume user registrations (scmp)

- Ed Thorp, The Man for All Markets — How to Think for Yourself, A Real Estate Cautionary Tale, Hedge Fund History and Warnings, The Incredible Power of Basic Numeracy (and How to Develop It), Thought Experiments on Risk, Popular Delusions, Cryptocurrencies, and More (#604) (blog)

The G7 “Double Down” Stock Market (and Sentiment Results)…

Einstein once said, “The definition of insanity is doing the same thing over and over and expecting different results.” That’s exactly what the G7 decided to do when they published their communique on Tuesday and drove the Dow down ~500 points and energy prices UP. Continue reading “The G7 “Double Down” Stock Market (and Sentiment Results)…”

Where is the money flowing?

Be in the know. 22 key reads for Wednesday…

- Who are the 50 people influencing markets the most this year? Tell MarketWatch what you think. (marketwatch)

- Stocks Slip as Fed Remains in Focus (barrons)

- Value and Growth Duke It Out. The Fed Is the Referee. (barrons)

- FOX BUSINESS NETWORK OVERTAKES CNBC AS LEADER IN BUSINESS TELEVISION DELIVERING HIGHEST-RATED QUARTER SINCE 2020 (foxbusiness)

- Wall Street’s favorite stock sector has potential upside of 43% as we enter the second half of 2022 (marketwatch)

- How long will will the bear market last? It hinges on recession, says Wells Fargo Institute. (marketwatch)

- Fed’s Powell sees possibility that inflation can come down quickly as demand subsides (marketwatch)

- SOX semiconductor index could double over the next couple of years, analyst says (marketwatch)

- Pessimism on chip stocks is hitting a new high, and the money seems to be flowing toward software (marketwatch)

- Why It Might Be Time to Bet on Las Vegas Sands (barrons)

- Why the S&P 500 may be in for a 1966-style bear market, according to DWS Group (marketwatch)

- Shanghai reopening: restaurants restart offering dine-in services (scmp)

- China removes Covid-19 risk indicator in digital travel passes (scmp)

- Consumers’ Outlook on the Economy Hits Lowest Point in Nearly a Decade (wsj)

- G-7 Bid to Cap Russian Oil Price Faces Hurdle of Global Enforcement (wsj)

- Fed’s Inflation Fight Made Tougher by State Relief Efforts (bloomberg)

- NFTs Have ‘Fallen Off the Cliff’ as Sales Sink to Lowest Levels in a Year (bloomberg)

- The Chief Investment Officer of a $1.1 billion firm says this bear market is a ‘once-in-a-generation entry point’ for investors to get more aggressive — and shares 15 stocks she’s buying now (businessinsider)

- China’s Central Bank Emphasizes Jobs and Controlling Inflation (bloomberg)

- China allows Kanzhun, Full Truck Alliance apps to resume user registration (reuters)

- China to extend tariff exemptions on some U.S. products (reuters)

- The Big Read. Ships going dark: Russia’s grain smuggling in the Black Sea (ft)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is the money flowing?

Be in the know. 25 key reads for Tuesday…

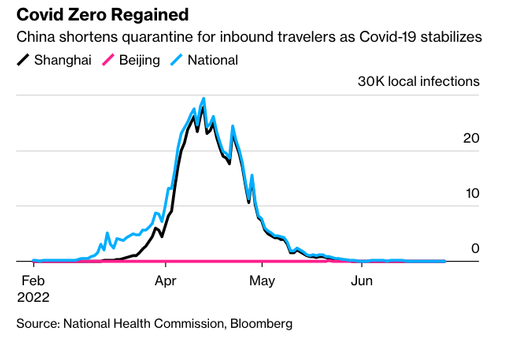

- Stock Futures Rise as China Eases Covid Lockdowns (wsj)

- ECB to Activate First Line of Defense in Bond Market on Friday (bloomberg)

- China Loosens Its Covid Quarantine Rules. These Travel Stocks Are Flying. (barrons)

- S. Eyes Biden, Xi Meeting in Next Weeks, Sees Growing Convergence on China (usnews)

- CRISPR, 10 Years On: Learning to Rewrite the Code of Life (nytimes)

- The Fed is not as behind the curve on inflation as investors think, and that sets the stock market up for more gains ahead, Fundstrat says (businessinsider)

- UPS’s Key to Success? Beards, Tattoos, and Rising Margins. (barrons)

- Oaktree’s Howard Marks is finding bargains. ‘I am starting to behave aggressively,’ he says (marketwatch)

- China Stocks Outperform On Unexpected COVID Shift (zerohedge)

- Nike’s quarterly profit comes in above Wall Street expectations, and $18 billion share buyback is approved (marketwatch)

- Will ‘Decentralized Finance’ Be the Next Disruptive Technology? (barrons)

- Lumber Prices Are Falling With a Thud. (barrons)

- Defund the Police Has Become Re-Fund the Police. Buy This Stock to Profit From the Trend. (barrons)

- Oaktree’s Howard Marks is finding bargains. ‘I am starting to behave aggressively,’ he says (marketwatch)

- Big-Ticket Goods Orders, Pending Home Sales Point to Steady Demand (wsj)

- How Can You Travel for Less Than $100 a Day, Everything Included? Find a Cruise Deal. (nytimes)

- US Profit Margin Estimates Are Too Optimistic, Goldman Strategists Say (bloomberg)

- Widow-Maker Trade Sweeps Tokyo’s Financial Markets Once Again (bloomberg)

- Michael Burry of ‘The Big Short’ Fame Warns Fed May Alter Course (bloomberg)

- Michael Burry’s ‘Bullwhip’ Tweet Deserves Serious Attention (bloomberg)

- Southwest Airlines employs a crack team of 4 fuel traders to hedge energy prices — and they’ve saved the company $1.2 billion this year (businessinsider)

- BANK OF AMERICA: Buy these 8 undervalued technology stocks – 4 of which could be set to surge by over 100% (businessinsider)

- One of China’s Top Tech Investors Sees Crackdown Turning Point (bloomberglaw)

- Hedge Funds Go Bottom Fishing for Biopharma (institutionalinvestor)

- Apple supplier Foxconn launches new hiring spree at world’s largest iPhone factory (scmp)