- China’s Economy Improves in June From Lockdown-Induced Slump (bloomberg)

- Sellers Are Getting Anxious (barrons)

- The Colorado Avalanche Win the Stanley Cup (wsj)

- Value Investors Bet Recent Market Leadership Is Just the Start (wsj)

- Shanghai Has Reopened, but Not Disneyland (wsj)

- The Alzheimer’s Cure Conundrum (wsj)

- Pension Funds Plunge Into Riskier Bets—Just as Markets Are Struggling (wsj)

- G-7 Latest: France Wants Iranian, Venezuelan Oil Back on Market (bloomberg)

- GE CEO Culp Takes Reins of Aviation Unit as Slattery Loses Top Post (bloomberg)

- US Durable Goods Orders Exceed Forecast in Broad Advance (bloomberg)

- Homebuilders Still Find Plenty of Demand in a Cooling Market (bloomberg)

- Legendary investor Howard Marks says to snap up cheap assets now, as “waiting for the bottom is a terrible idea” (businessinsider)

Tom Hayes – Quoted in Reuters article – 6/27/2022

Thanks to Amruta Khandekar and Shreyashi Sanyal for including me in their article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

Be in the know. 25 key reads for Sunday…

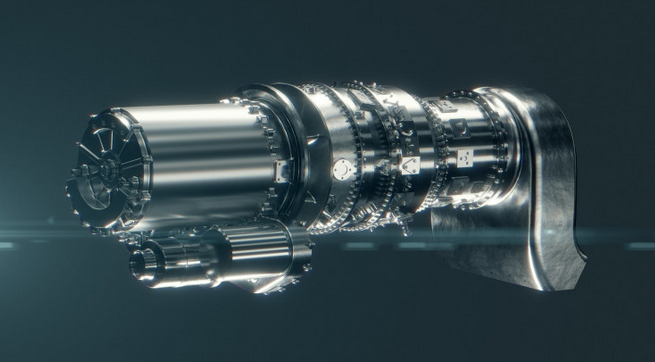

- Rolls-Royce unveils its new ‘turbogenerator’ with a new small engine (interestingengineering)

- Did the Fed’s preferred measure of inflation cool in May? (ft)

- Top 10 Holdings of Our Ultimate Stock-Pickers’ Index (morningstar)

- 3 Solid Stock Picks for an Unsteady Market (morningstar)

- Mega Questions | Ray Dalio (Ray Dalio)

- ExxonMobil At The Crossroads | CNBC Documentary (CNBC)

- Don’t just look at moats, keep an eye on crumbling castles too (morningstar)

- Do Bear Markets Lead to Recessions? (morningstar)

- Alibaba-Backed Delivery Startup GogoX Navigates a Tough IPO Market (wsj)

- What’s Holding Back Boeing’s 787 Dreamliner? (wsj)

- Air Travel Is Expensive, Messy—and Booming (wsj)

- Beijing Offers Cash Subsidies to Spur Demand for New Energy Cars (bloomberg)

- Beijing Reopens Schools for More Students as Covid Cases Ease (bloomberg)

- Who Has The Highest Debt In The EU? (zerohedge)

- “First Real Buying In 3 Weeks”; Goldman Trader Explains Why Friday’s Surge Is The Start Of The Next Big Move Higher (zerohedge)

- Greenwashed: Electric Pickup Trucks Are Dirtier Than You Think (thedrive)

- Used-Car Sellers Not Running Out of Gas Just Yet (wsj)

- 2022 Ford Bronco Raptor Test: Shock And Awe At King Of The Hammers (forbes)

- Chinese chip maker Loongson Technology goes public in Shanghai (technode)

- A lesson from Stan Druckenmiller: position sizes really matter (moneyweek)

- Elon Musk Is Launching A Humanoid Robot Called ‘Tesla Optimus’ (maxim)

- Car Culture Isn’t Dead and a Weekend With a Lamborghini Urus Proved That (thedrive)

- ECRI Weekly Leading Index Update (advisorperspectives)

- Two CT restaurants make ‘America’s 30 Best Lobster Rolls’ list (newstimes)

- A Concrete Plan to Bring the Price of Oil Down Right Now (bloomberg)

Be in the know. 15 key reads for Saturday…

- Lightning keep three-peat hopes alive with Game 5 win vs. Avalanche (usatoday)

- Why Starbucks Stock Could Be Ready to Run (barrons)

- Carnival Stock Surges as Second-Quarter Revenue Rises Sharply (barrons)

- A 1955 Ferrari Could Fetch More Than $25 Million at Auction (barrons)

- Sellers Are Getting Anxious as Home Sales Slow Down (barrons)

- United Airlines Stock Has Slumped. Director Edward Shapiro Bought Up Shares. (barrons)

- Stocks Rally as Fears Over Aggressive Rate Hikes Ease (barrons)

- What Do You Call the Market’s Cheapest Stocks? Bargains. (barrons)

- GM Stock Has Been Hammered, Which Makes Owning a Piece of Its EV Future a Bargain (barrons)

- Netflix in a Race Against Time With Advertising (wsj)

- How Far Do Putin’s Imperial Ambitions Go? (wsj)

- Five Best: Books on Pursuing Impossible Dreams (wsj)

- China Asks Foreign Business Leaders How to Revive Hong Kong in Rare Move (bloomberg)

- SoftBank’s Son backs Nasdaq listing for Arm despite UK pressure (ft)

- In Russia’s War, China and India Emerge as Financiers (nytimes)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 140

Hedge Fund Tips with Tom Hayes – Podcast – Episode 130

Where is the money flowing?

Be in the know. 14 key reads for Friday…

- P. Morgan Thinks the Darkest Days for China Have Passed. Allocators Remain Cautious. (institutionalinvestor)

- Merck Pushes Forward With Potential Deal for Seagen (wsj)

- Stocks Keep Rising as Fears Over Aggressive Rate Hikes Ease (barrons)

- Southwest and 2 More Stocks Could Soar (barrons)

- High-Yield Bonds Are Looking Like Bargains After an Awful First Half (barrons)

- The Fed Gives Banks a Clean Bill of Health. The Stock Market Hasn’t. (barrons)

- IPOs From 2021 Have Crashed. It May Be Time to Buy Some of Them.

- EVs & Internet Gain On Policy News, China Markets Outperform In Asia (chinalastnight)

- The high-flying energy sector is suffering one of its worst streak of losses in 40 years as oil prices pull back (businessinsider)

- China’s Xi Jinping Knows He Needs the Fintechs (bloomberg)

- Stocks Rise as Rate-Hike Expectations Cool (wsj)

- Facebook, Netflix and PayPal Are Value Stocks Now (wsj)

- Nuclear Power Is Poised for a Comeback. The Problem Is Building the Reactors. (wsj)

- America’s Cash Hoard Could Cushion a Downturn (wsj)

Where is the money flowing?

Be in the know. 27 key reads for Thursday…

- Xi Reaffirms Growth Target That Analysts Say Is Out of Reach. Premier Li Keqiang urged authorities to roll out as many policies as possible to boost consumption, saying it’s an important driving force to get the economy back on track. (bloomberg)

- Big Options Bet Is Positioning for More Gains in Chinese Stocks (bloomberg)

- China’s payments, fintech sectors to ‘play bigger role’ in boosting economy, President Xi says, in positive signal for Big Tech (scmp)

- Xi says China will use ‘more forceful’ tools to achieve economic goals (cnbc)

- Buy these 13 cheap stocks that will outperform in a recession-fuelled bear market, according to Morningstar (businessinsider)

- The Stock Market Has Fallen, but Earnings Expectations Haven’t. Why That’s a Problem. (barrons)

- A Shocking Number of Stocks Are in the Red. Here’s Why That’s a Bullish Sign. (barrons)

- Rite Aid Stock Gains on Boost to Revenue Forecast, Smaller Loss Than Expected (barrons)

- Powell Dropped Some Hints In His Testimony. The News Isn’t All Bad. (barrons)

- Facebook, Netflix, PayPal Are Value Stocks Now (wsj)

- TikTok Grabs More Ad Dollars, as Marketers Look to Attract Gen Z and Millennials (wsj)

- Inflation Surge Earns Monetarism Another Look (wsj)

- KB Home Stock Jumps on Earnings. The Builder Sees a Moderating Housing Market. (barrons)

- AMD Is the Chip Stock to Buy on the Dip, Morgan Stanley Says (barrons)

- High Gas Prices Hit Demand as Drivers Cut Back at the Pump (wsj)

- Biden Got the Energy Market He Wanted (wsj)

- More Companies Start to Rescind Job Offers (wsj)

- Is Opendoor the Amazon of Buying Homes or Just Another Carvana? (bloomberg)

- Powell Says Soft Landing ‘Very Challenging;’ Recession Possible (bloomberg)

- Cramer says a ‘bull market within a bear market’ situation is possible if these 6 things happen (cnbc)

- Musk says Tesla’s factories in Berlin and Texas are ‘gigantic money furnaces’ (cnbc)

- Value investor Seth Klarman explains how he finds bargains, prepares for a bear market, and limits his losses in a new interview. Here are the 12 best quotes. (businessinsider)

- This star hedge-fund manager says some major tech names are now value plays, as he shorts one meme-stock favorite (marketwatch)

- Wall Street Faces Billion-Dollar Losses on Sinking Buyout Debt (bloomberg)

- Initial Jobless Claims At 5-Month Highs As Layoffs Accelerate (zerohedge)

- What You Need to Know About Recessions — Including Whether We’re in One (bloomberg)

- Ukraine takes tentative step toward EU membership (reuters)