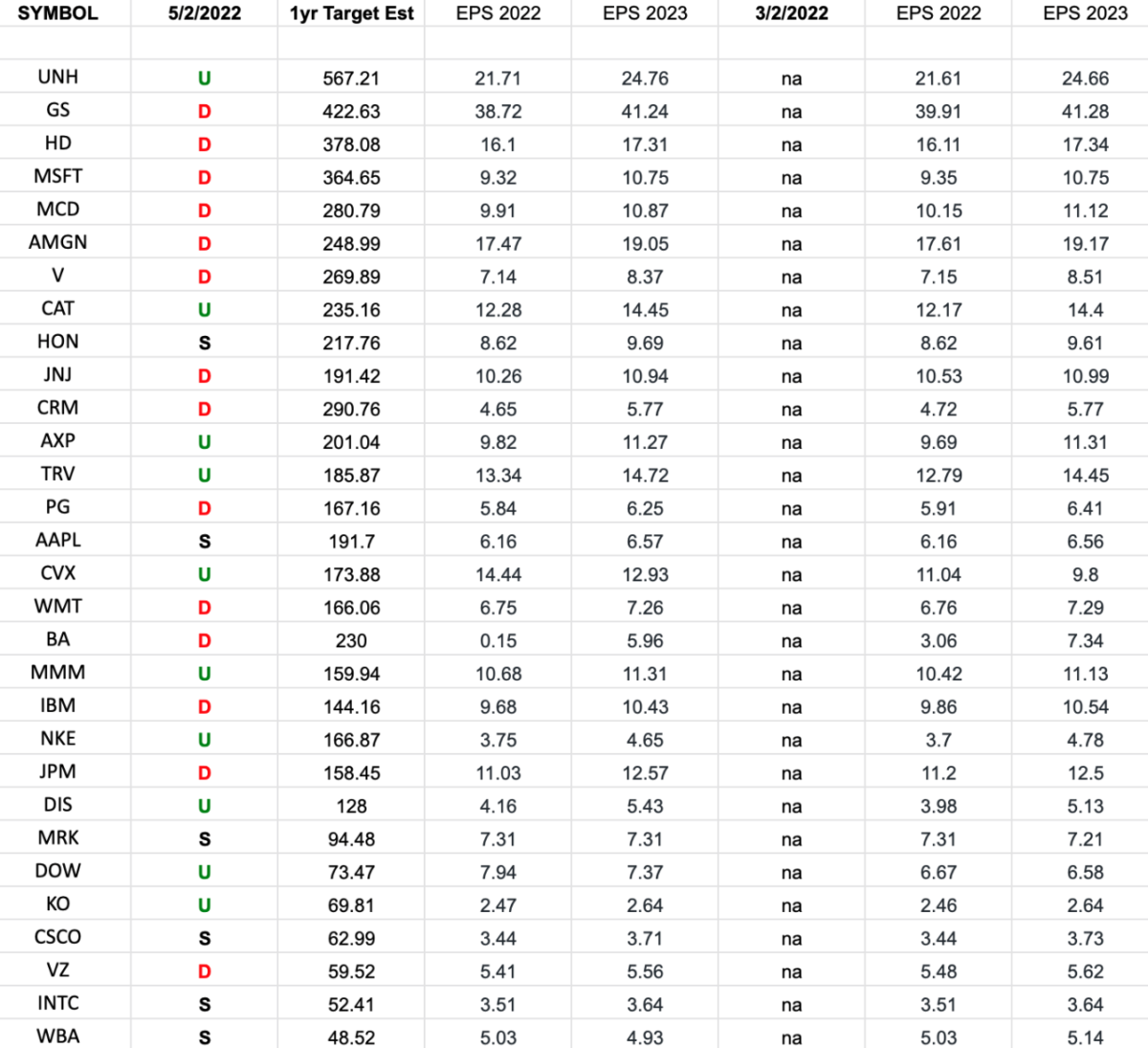

DOW 30 Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Dow Jones Industrial Average 30 stocks. Continue reading “DOW 30 Earnings Estimates/Revisions”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is the money flowing?

Be in the know. 38 key reads for Monday…

- Buffett bought more Apple last quarter and says he would have added more if the stock didn’t rebound (cnbc)

- Core PCE Inflation Has Been Slowing Down (cato)

- China Lockdowns Wreak Havoc on Economy as Xi Pledges Support (bloomberg)

- Powell’s Fed Set to Go Big and Keep Going Until Inflation Tamed (bloomberg)

- Porsche Nears Agreement to Join Formula 1, VW CEO Says (bloomberg)

- Milken Unmasked: Frivolity and Fear as Elite Descend on LA (bloomberg)

- End of Easy Money Brings a $410 Billion Global Financial Shock (bloomberg)

- Buffett Lures Fans to Omaha With Stock Buys, Inflation Talk (bloomberg)

- Michael Lewis on His Journey to Wall Street (bloomberg)

- A New Texas Oil Boom Is Coming, Finally (texasmonthly)

- The Federal Reserve’s Tough Spot (nytimes)

- ECRI Weekly Leading Index Update (advisorperspectives)

- Warren Buffett gives his most expansive explanation for why he doesn’t believe in bitcoin (cnbc)

- Guggenheim’s Minerd says beaten up fintech, homebuilders are rebound candidates (cnbc)

- Warren Buffett bought another $600 million worth of Apple (cnbc)

- Watch: This One-Person eVTOL Floats Above the Tuscan Hillside Like a Flying Jet Ski (robbreport)

- Here’s What 260 MPH On The Autobahn In A Bugatti Chiron Looks Like In Real Time (digg)

- Vacation Like James Bond At This Legendary Hotel in Sardinia (maxim)

- snap launches mini flying camera ‘pixy’ for snapchat (designboom)

- C8 Corvette ZR1 Could Pack 850 Horsepower From Twin-Turbo V8: Report (thedrive)

- Ford F-150 Lightning Backup Power Home Integration System Will Cost $3,895 (thedrive)

- Alphabet and Microsoft look like gems in the rubble of the tech sector (moneyweek)

- BYD sees first-quarter sales jump 180% while Covid hits other Chinese automakers (technode)

- Buyback Blackout Period Is Over, And 10 More Reasons Why Goldman Calls The End Of The Market Carnage (zerohedge)

- How Russia’s grim demographics could thwart Putin’s global ambitions (aei)

- Econ Exploder: GDP (npr)

- Javier Blas Explains How Commodity Trading Shops Really Work (bloomberg)

- The Wiesmann Project Thunderball Is 680 HP of All-Electric Fury (roadandtrack)

- The strange business of hole-in-one insurance (thehustle)

- 4 Takeaways From the Berkshire Hathaway Annual Shareholders Meeting (barrons)

- Pickleball Takes Its Place as the Must-Have Luxury Amenity (barrons)

- How to Buy a Classic Car Online (bloomberg)

- Pucks Are Flying in the NHL’s Highest-Scoring Season Since 1996 (wsj)

- A 26-year market vet lays out 3 indicators that show stocks could be making a near-term bottom — and shares 7 stocks and 2 bond ETFs to watch in the months ahead (businessinsider)

- Intel is optimistic about its second-half prospects, but Wall Street isn’t (marketwatch)

- Investors Moved $60 Billion to Cash Last Week, the Largest Inflow in 7 Months – BofA (streetinsider)

- Buffett’s advice for beating inflation: ‘Be exceptionally good at something’ (yahoo)

- Internet Regulation Cycle Eases as Domestic Consumption Becomes Job #1 (chinalastnight)

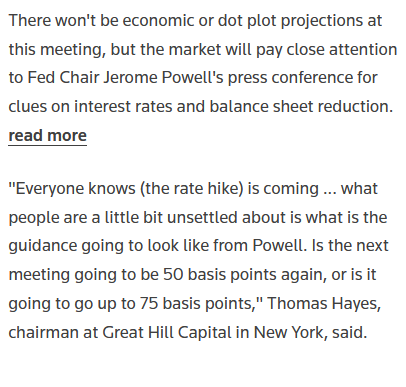

Tom Hayes – Quoted in Reuters article – 5/2/2022

Thanks to Devik Jain for including me in his article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

Be in the know. 20 key reads for Saturday…

- Charlie Munger (from Berkshire Meeting yesterday), “The reason that I invested in China is I get so much better companies at so much lower prices” (CNBC)

- China Plans Reprieve for Tech Giants, Including Delaying New Rules, as Economy Slows (wsj)

- Warren Buffett’s Berkshire bets big on US stock market (ft)

- With Berkshire Hathaway’s Annual Meeting Back in Person, Buffett Cracks Jokes and Explains His Latest Investments (marketwatch)

- Charlie Munger says he doesn’t like bitcoin because its ‘stupid,’ ‘evil,’ and makes people look bad (marketwatch)

- Chinese Tech Stocks Lead Market Rebound (wsj)

- Buffett Is Back With One of His Biggest Buying Sprees in Years (bloomberg)

- Warren Buffett on Investments, Inflation, Politics, and More (barrons)

- Mario Gabelli, John Rogers, and other elite investors discussed Warren Buffett’s $23 billion of new bets at Berkshire Hathaway’s annual weekend meeting. Here are the best quotes. (businessinsider)

- Alibaba soars 10% as Chinese tech stocks rally after Beijing signals it will pause crackdown on the sector and bolster economic growth (businessinsider)

- Warren Buffett says inflation ‘swindles almost everybody,’ Munger rails against bitcoin, market ‘mania’ (cnbc)

- Buffett gives most expansive explanation for why he doesn’t believe in bitcoin (cnbc)

- At the Berkshire Hathaway annual meeting, Warren Buffett aims to assure shareholders (marketwatch)

- China’s Xi Vows Healthy Development of Capital, Deeper Reforms (bloomberg)

- Has inflation reached a peak? Three signs that prices could soon come down (cnn)

- Fed Prepares Double-Barreled Tightening With Bond Runoff (wsj)

- When the Corvette Got a Major Change, It Revved His Engine (wsj)

- JPMorgan Expects S&P 500 Earnings to Blow Past Gloomy Estimates (bloomberg)

- Activist Investor Daniel Loeb Sees Roughly $1 Trillion of Untapped Value in Amazon (wsj)

- Utility Companies Between 1929 and 1992 (DGI)

Be in the know. 10 key reads for Saturday…

- Alzheimer’s Drugs Face a Crucial Test (barrons)

- Cruising Is Back. Time for Investors to Take a Plunge? (barrons)

- Many Retailers Are Already Pricing In a Recession (barrons)

- Elon Musk Needs to Make Twitter a Financial Success. Here’s How He Can Do It. (barrons)

- A rough 4 months for stocks: S&P 500 books the worst start to a year since 1939. Here’s what pros say you should do now. (marketwatch)

- Yes, GDP Shrank. No, It Isn’t the Start of a Recession. (barrons)

- As Time Passes, and the Weather Warms, Putin’s Power Play in Europe Loses Force (barrons)

- Warren Buffett Is Still Setting Berkshire’s Direction. For How Much Longer? (wsj)

- China’s Manufacturing Activity Pummeled by Covid Restrictions (wsj)

- The Job That Taught Me the Power of Work (wsj)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 132

Article referenced in VideoCast above:

“Heartache on the Dance Floor” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 122

Article referenced in podcast above:

“Heartache on the Dance Floor” Stock Market (and Sentiment Results)…