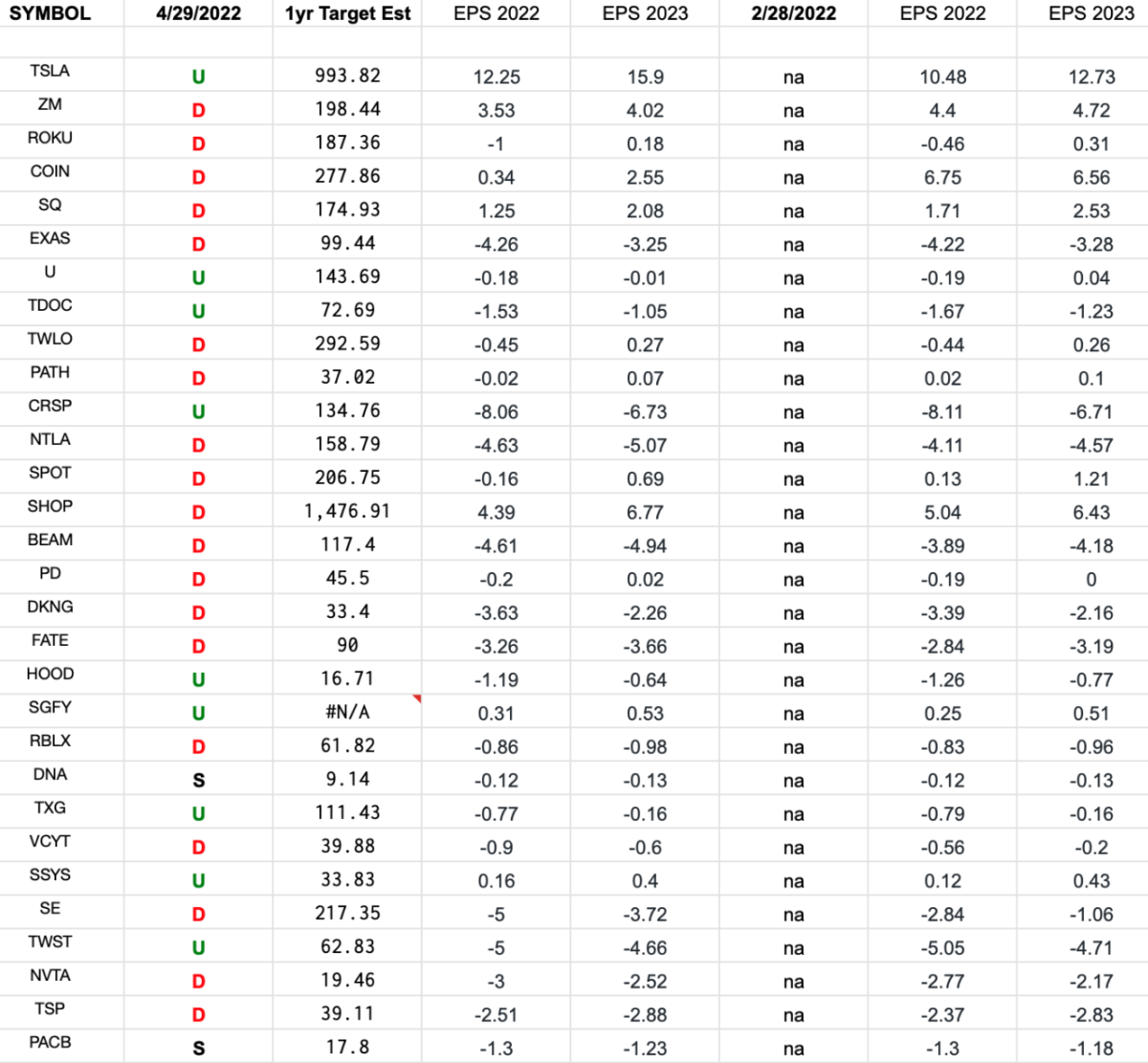

In the spreadsheet above I have tracked the earnings estimates for the Ark Innovation Fund top 30 weighted stocks. Continue reading “ARKK Innovation Fund Earnings Estimates/Revisions”

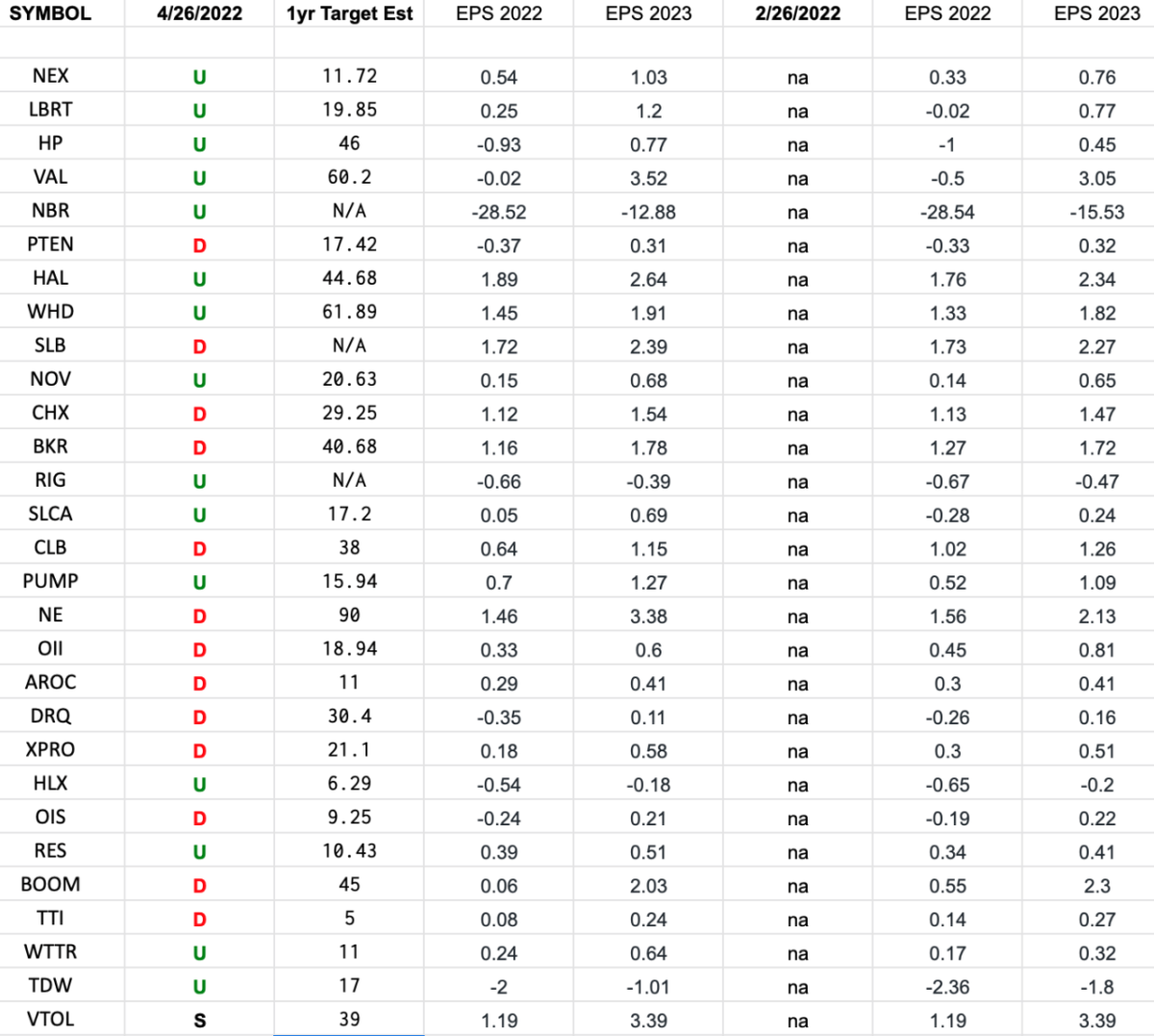

Oil & Gas Equipment & Services Earnings Estimates and Revisison

In the spreadsheet above I have tracked the earnings estimates for the Oil & Gas Equipment & Services ETF (XES) top 30 weighted stocks. Continue reading “Oil & Gas Equipment & Services Earnings Estimates and Revisison”

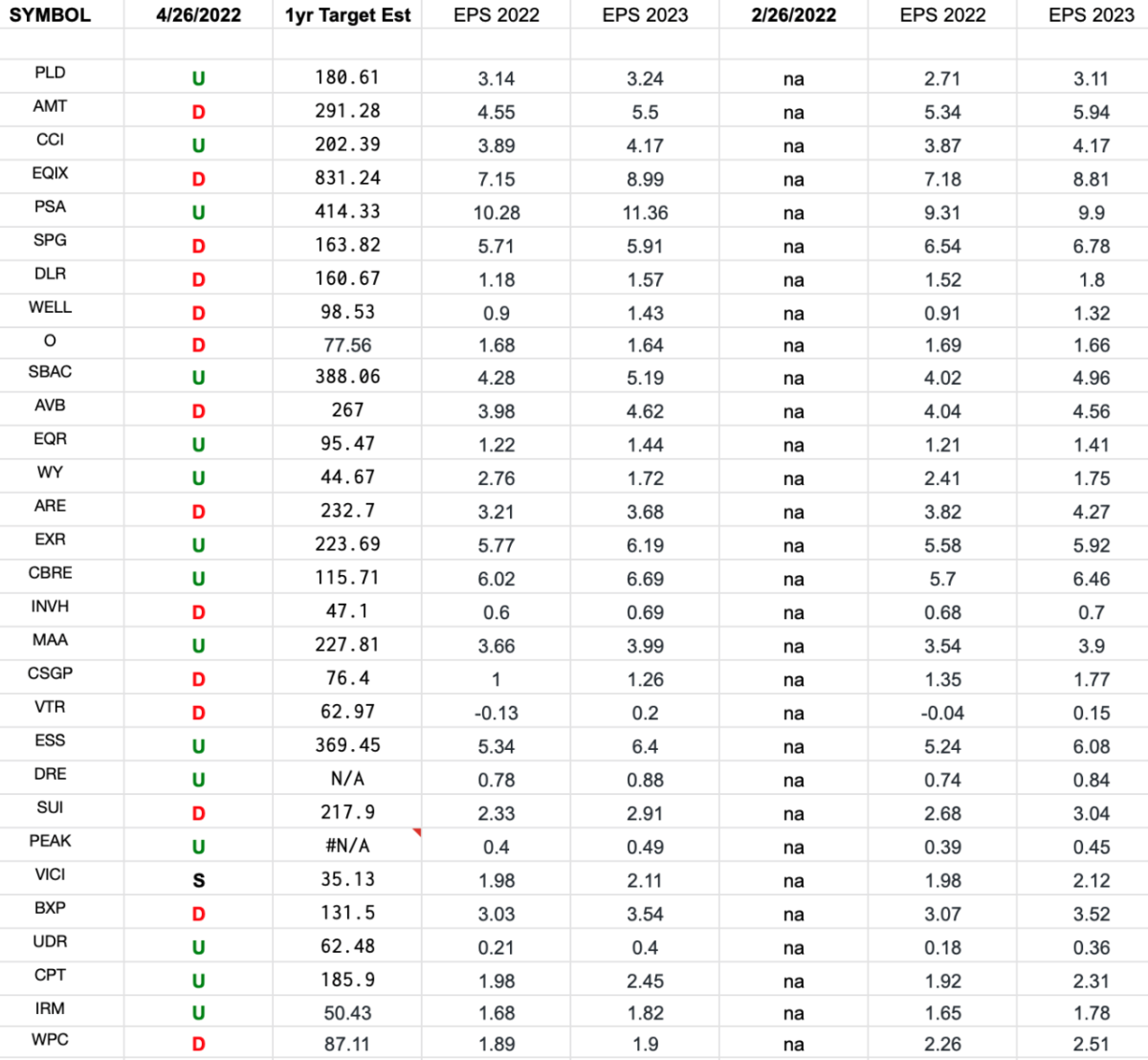

REIT Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Real Estate (REIT) Sector ETF (IYR) top 30 weighted stocks. Continue reading “REIT Earnings Estimates/Revisions”

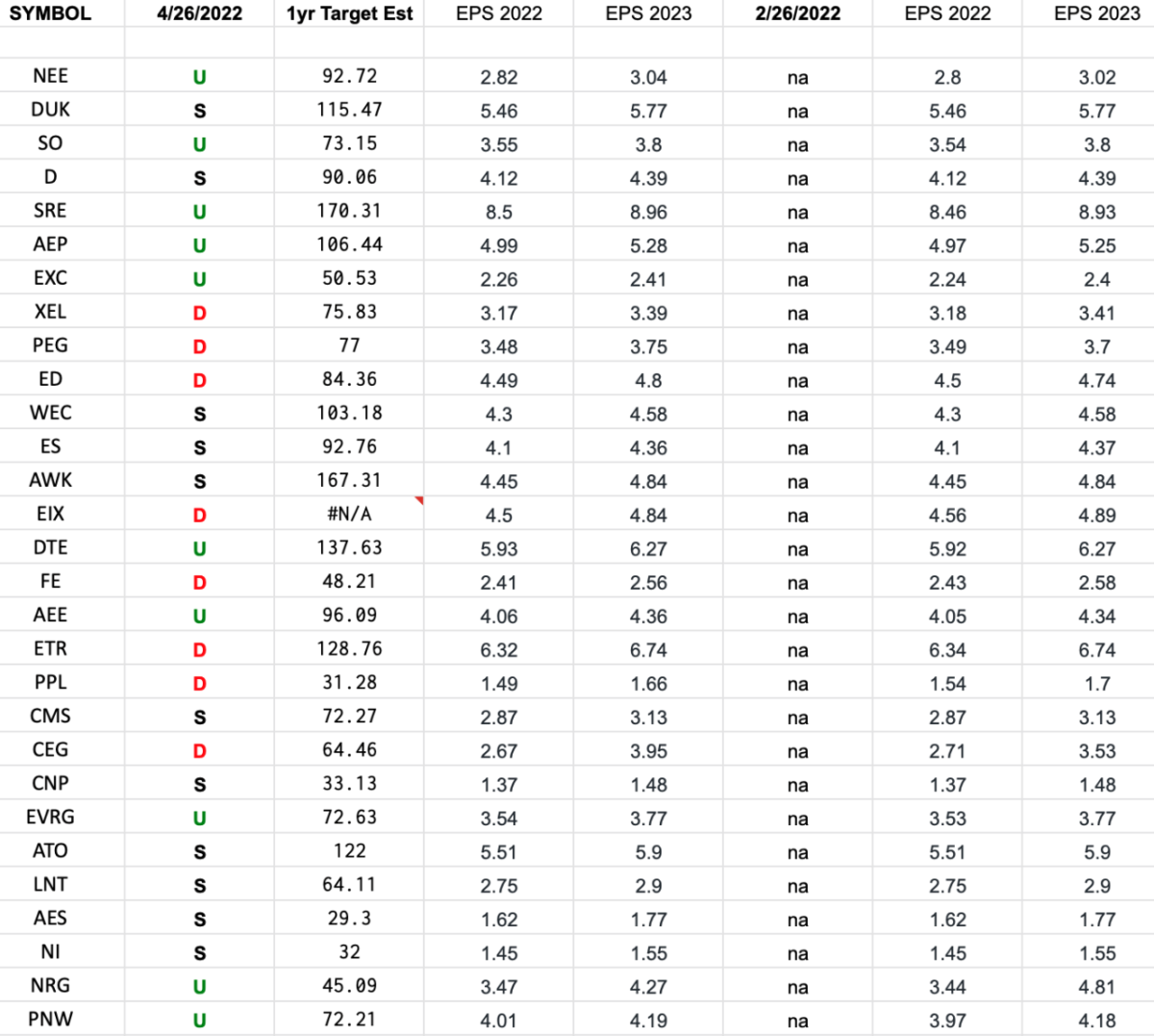

Utilities Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Utilities Sector ETF (XLU) top weighted stocks. Continue reading “Utilities Earnings Estimates/Revisions”

Where is the money flowing?

Be in the know. 38 key reads for Friday…

- China Plans Reprieve for Tech Giants, Including Delaying New Rules, as Economy Slows (wsj)

- Alibaba, JD.com Jump as China Pledges Stimulus to Rescue Economy (bloomberg)

- China’s Politburo Ignites Market Rally With Vows on Growth (bloomberg)

- China and U.S. Negotiate On-Site Audit Checks as Delistings Loom (bloomberg)

- China in ‘deep crisis’, says Hong Kong private equity chief (ft)

- This Is How a Locked-Down Shanghai Apartment Gets Food (bloomberg)

- Chinese Stocks Surge After Beijing Vows New Tools, Policies To Spur Growth (zerohedge)

- Covid Cases Rolling Over In China. (zerohedge)

- Nomura Warns Of “Huge Fodder For Mechanical Short Squeeze” As ‘Event Risks’ Clear (zerohedge)

- 12 Questions for Warren Buffett at Berkshire Hathaway’s Annual Meeting (barrons)

- Cruising Is Back. Time for Investors to Take a Plunge? (barrons)

- Europe Is Stepping Up Its Defense Spending. This Company Stands to Profit. (barrons)

- The Travel Boom: Which Companies Will Leave the Gate First (barrons)

- ‘So bad, it’s good.’ This beleaguered stock market has one big asset on its side, say strategists. (marketwatch)

- Amazon Stock Sinks. But This Part of the Business Could Help Shares Fly Again. (barrons)

- Bridgewater’s first major European short in two years is $12m bet against oil tanker firm Euronav (fnlondon)

- Exxon Stock Slips on Earnings Miss. Quarter Includes $3.4 Billion of Russia Charges. (barrons)

- Fed-favored inflation gauge shows signs of a cooldown in price increases in the U.S. (marketwatch)

- America’s CEOs are signaling they don’t expect a long bear market in stocks (marketwatch)

- I-bonds are all the rage — what’s the best way to use them? (marketwatch)

- Opinion: Warren Buffett’s investing prowess will go on forever after researchers cracked his investing code (marketwatch)

- Auto Giant Magna Crushes Earnings but the Stock’s Down. There Aren’t Enough Cars. (barrons)

- Consumer Spending Rose in March (wsj)

- Supply disruptions weighed on the economy, but consumers and businesses continue to spend (wsj)

- As Europe Thirsts for Natural Gas, U.S., EU Signal Support for Long-Term Deals (wsj)

- Shanghai Uses Crowdsourcing to Survive Covid-19 Lockdown as Social Support Breaks Down (wsj)

- The GDP Mirage (wsj)

- Intel CEO Sees Chip Shortage Lasting Into 2024 (wsj)

- Biden Seeks New Aid for Ukraine as Russia Makes Slow Progress in Seizing East (wsj)

- A Heart-Pounding Supercar Aims to Upend How Cars Are Built (nytimes)

- Powell Seen Slowing Rate Hikes After May and June Front-Loading (bloomberg)

- Bank of America’s Hartnett Sees ‘Pain and Exit’ If S&P 500 Dips Below 4,000 (bloomberg)

- Mark Cuban says TikTok is ‘the future of sports media’ — here’s why (cnbc)

- Jefferies: A recession won’t happen immediately. A chief economist shares 37 stocks poised for gains in a market where investors are being too defensive. (businessinsider)

- Berkshire Hathaway’s annual meeting is here: What to expect from Warren Buffett and Charlie Munger (cnbc)

- Baidu Gets Green Light for Autonomous Beijing Taxis, Premier Li Highlights Internet Companies (chinalastnight)

- exclusive | China to end tech clampdown as economy slows: sources (scmp)

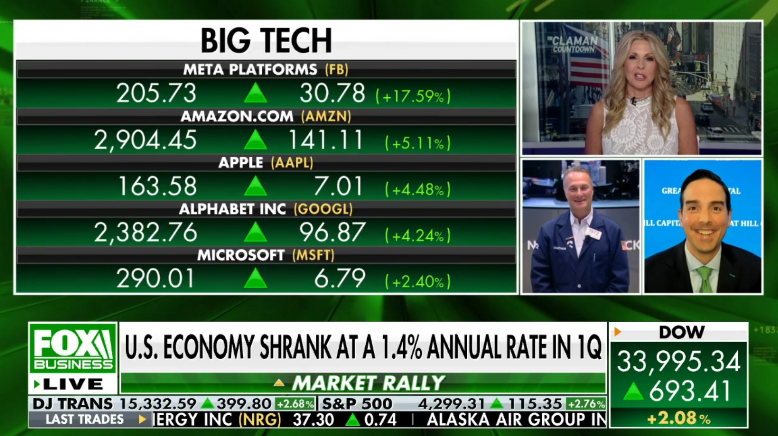

Tom Hayes – The Claman Countdown – Fox Business Appearance – 4/28/2022

Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – April 28, 2022

Watch in HD directly on Fox Business

Where is the money flowing?

Be in the know. 22 key reads for Thursday…

- The Economy Shrank Last Quarter as Inflation Hit (barrons)

- Boeing Earnings Were a ‘Big Old Mess.’ Why Wall Street Can’t Seem to Get Them Right. (barrons)

- 9 Electric Cars Worth the Wait (barrons)

- Why This Strategist Thinks Emerging Markets Are the Place to Be (barrons)

- Mastercard’s Earnings Handily Beat Expectations. Spending on Travel Is the Driver. (barrons)

- Nokia Stock Rises as Strong 5G Demand Leads to an Earnings Beat (barrons)

- Meta Stock Soars on User Growth. What Wall Street Thinks. (barrons)

- ServiceNow Gains as Companies Keep Spending. Earnings Were Strong. (barrons)

- Expect Amazon’s Earnings to Show Cloud and Ad Strength, but E-tailing Challenges (barrons)

- What’s Needed for a Sustained Recovery in China’s Stocks (barrons)

- Home Builders Can’t Keep Up. The Paradox of Soaring Home Prices and Mortgage Rates. (barrons)

- What Record Consumer Credit Says About Inflation—and Recession (barrons)

- Record trade deficit blamed for U.S. economy’s contraction in first quarter (marketwatch)

- Facebook parent Meta Platforms is a ‘classic dislocated high-quality stock,’ analyst says after latest earnings report (marketwatch)

- Opinion: Berkshire and Buffett have 5 words for sellers who want their money: ‘Take it or leave it’ (marketwatch)

- S. Economy Unexpectedly Shrinks for First Time Since 2020 (bloomberg)

- Xi in a Bind Over Who to Blame for Shanghai’s Covid Outbreak (bloomberg)

- PayPal (PYPL) Reports In-line Results, Analyst Sees Lowered Guidance as ‘Likely Final Cut’ (streetinsider)

- Twitter admits overstating audience figures for 3 years (ft)

- Yen slides to 20-year low as BoJ defies global shift to higher rates (ft)

- China Gov’t Goes “All-Out” while Q1 Earnings Power Rebound (chinalastnight)

- Twitter adds 30 million new users in run up to Musk sale (bbc)

“Heartache on the Dance Floor” Stock Market (and Sentiment Results)…

Here’s what everyone feels like doing after the last few weeks of market action:

Here’s what it felt like holding most equities over the past week:

@sportsnet Nurse said SEE YA, JAMIE. 💥👋 #nhl #nhlonsn #hockeytiktoks #hockeyhits ♬ original sound – Kate 💥

Take two…

@user1737488226 bad day to be a golf club #onlyinmycalvins #PringlesCanHands #TalkingTree ♬ original sound – user1737488226

In 2017, Country Star Jon Pardi released his hit “Heartache on the Dance Floor.” It peaked at #3 and #5 on both the Billboard Country Airplay and Hot Country Songs charts respectively. It also reached number 47 on the Hot 100 chart. Continue reading ““Heartache on the Dance Floor” Stock Market (and Sentiment Results)…”