- China Steps Up Stimulus With Infrastructure Bond Sales Quota (bloomberg)

- China Stocks Storm Back on Bets of Policy Support, Covid Shift (bloomberg)

- GOLDMAN SACHS: Buy these 18 deeply oversold stocks that have upside of at least 50% over the next year (businessinsider)

- CSRC renews call that firms buy back shares to boost prices amid sluggish market (scmp)

- Hong Kong stocks climb from 4-week low as China ends freeze on online games (scmp)

- What Record Consumer Credit Says About Inflation—and Recession (barrons)

- Looking for a Stock Boost? Just Wait for Earnings Season (bloomberg)

- China Starts Approving Videogame Licenses Again (wsj)

- The Number of Small Businesses Raising Prices Just Hit Another Record High (bloomberg)

- Elon Musk, Again an Outsider at Twitter, Emerges as Unshackled Wild Card for Company (wsj)

- Charlie Munger’s Daily Journal Slashed Its Stake in Alibaba Stock (barrons)

- This Is How an Elon Musk Twitter Takeover Could Work (bloomberg)

- Airports Clogged With Queues as Travel Rebound Strains Resources (bloomberg)

- This value fund manager is sticking with Netflix and Facebook’s parent — and has a new position in another megacap tech stock (marketwatch)

- EasyJet Summer Bookings Above 2019 Levels: The London Rush (bloomberg)

- Apple Poised to Boost Buybacks by $90 Billion, Citi Analyst Says (bloomberg)

- Oil Rebounds as Investors Assess China’s Easing Virus Lockdown (bloomberg)

- China’s Goal in Covid Zero Pursuit Shifts Amid Omicron Outbreak (bloomberg)

- China Tech Stocks Rise as Gaming Approval Lifts Sentiment (bloomberg)

- Chairman Yi Huiman’s Weekend Speech Positive (chinalastnight)

- Investors Turn Cautious on Consumer Debt (wsj)

- If Crypto Can’t Be Used to Evade Russian Sanctions, What Is the Point? (wsj)

- European Companies Plead China To Revise “COVID Zero” As Beijing Vows Stronger Policies To Reverse Economic Collapse (zerohedge)

- Twitter (TWTR) Staff ‘Super Stressed’ Over Elon Musk’s Decision Not to Join Board (streetinsider)

- Mark Zuckerberg says Meta will test selling virtual goods in the metaverse (cnbc)

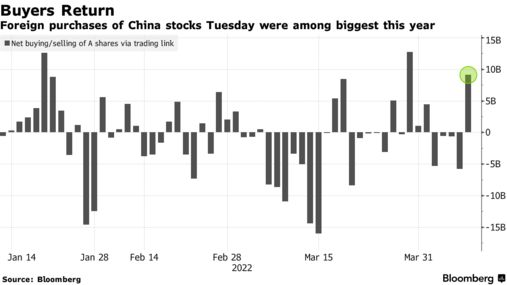

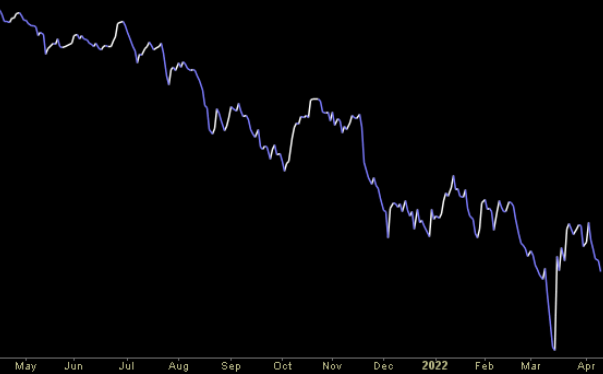

Where is the money flowing?

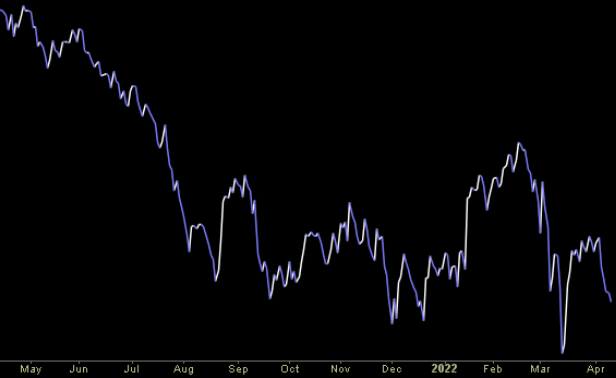

Hedge Fund Trade Tip (PIN) – Position Idea Notification

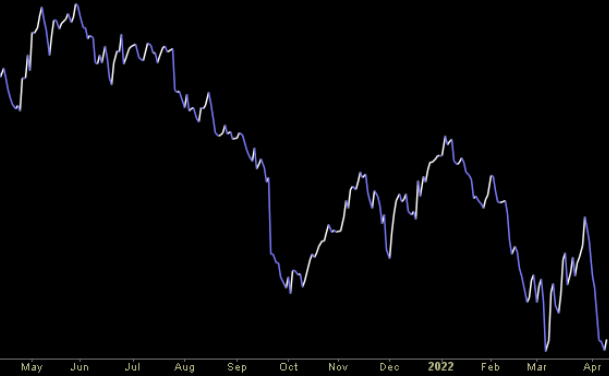

Hedge Fund Trade Tip (PIN) – Position Idea Notification

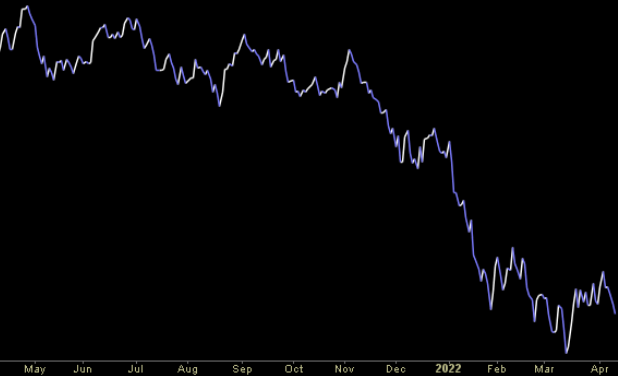

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 22 key reads for Monday…

- NetEase, Bilibili Jump in U.S. as China Ends Video Game Freeze (bloomberg)

- These 33 cheap stocks look like second-quarter bargains, according to Morningstar (businessinsider)

- Coronavirus: Shanghai declares 7,565 areas ‘low-risk,’ easing lockdowns in selected zones as symptomatic cases dip after six rounds of tests (scmp)

- Chinese delivery giant Meituan axes jobs as tech lay-offs mount (scmp)

- Why Stocks Are Rallying in the Midst of a War and Soaring Inflation (wsj)

- Investors Turn Cautious on Consumer Debt (wsj)

- What Happened at Tesla’s ‘Cyber Rodeo’—and Why It Mattered (barrons)

- Costco Is Challenging Amazon as the Most Richly Valued Retailer (barrons)

- JetBlue Just Got Upgraded, but Not Because Someone Likes the Spirit Offer (barrons)

- AT&T Stock Set to Rise After Completion of WarnerMedia Spinoff (barrons)

- Warren Buffett Loves Cheap Stocks. The HP Stake Is Proof. (barrons)

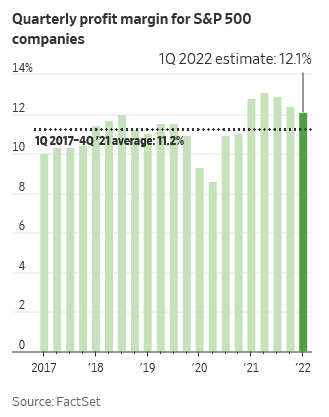

- Profit Margins Will Be Down in Earnings Season. When Buying Beaten-Up Stocks Makes Sense. (barrons)

- Pfizer’s New CFO Negotiated One of the Biggest Healthcare Deals in History. Is It a Sign of Things to Come? (barrons)

- ‘Impossible’ Rory McIlroy finishes historic Masters round with unreal bunker shot (nypost)

- Elon Musk Rejects Twitter’s Offer to Join Board in Surprise Twist (bloomberg)

- Recession Risk Is Rising, Economists Say (wsj)

- The Mystery of the Missing Georgia Peach Ice Cream Sandwiches at the Masters (wsj)

- Citigroup Claws Its Way Back Into Saudi Arabia (wsj)

- SoftBank Leads $185 Million Round in Pax8 at $1.7 Billion Value (bloomberg)

- End of ECB Bond Purchases Not Priced In, Goldman Strategists Say (bloomberg)

- KB Home sets new stock repurchase program representing 11% of market cap (marketwatch)

- The Chinese companies trying to buy strategic islands (ft)

Be in the know. 12 key reads for Sunday…

- Billionaire Trader Ken Griffin Navigates A Flock Of Black Swans (forbes)

- Elon Musk Has a Disturbing Question About Twitter (thestreet)

- April’s Stellar Track Record (Almanac Trader)

- China Is Accelerating Its Nuclear Buildup Over Rising Fears of U.S. Conflict (wsj)

- ECRI Weekly Leading Index Update (advisorperspectives)

- Watch: You Can Now Take a Drone Tour of Tesla’s New Berlin Gigafactory (robbreport)

- Elon Musk Says Tesla Will Start Selling the Cybertruck Next Year (robbreport)

- Check Into The Most Exclusive New Resort In Mexico’s Riviera Maya (maxim)

- Here’s Your First Look At The New All-Electric DeLorean (maxim)

- Mental Models: The Best Way to Make Intelligent Decisions (~100 Models Explained) (fs)

- Transcript: This Is Zoltan Pozsar’s Vision For Bretton Woods III (bloomberg)

- Move Over, Tennis: How Pickleball Became the Preferred Sport of The One Percent (townandcountrymagSS)

Be in the know. 28 key reads for Saturday…

- 99% of Buffett’s Wealth Came After Age 56 (dgi)

- Alibaba Stock Is Getting Hit by China’s Latest Covid Outbreak. 4 Reasons for Optimism. (barron’s)

- Fintech Stocks Look Good to One Analyst. Here Are His 14 Picks. (barron’s)

- Tiger Woods bounces back from poor start to make cut at Masters (usatoday)

- Retail Crime Is Hurting Companies and Making Inflation Worse. What Investors Should Know. (barron’s)

- NYC’s best new restaurants: power lunches, hot scenes and date spots (nypost)

- Tesla May Start Mining Lithium as Musk Cites Battery Metal Cost (bloomberg)

- Tesla’s ‘Cyber Rodeo’ Was a Recruiting Event in a Party Hat (bloomberg)

- Hollywood Gets a New Giant (nytimes)

- Maker of $777,000 Flying Motorbike Prepares for IPO in Japan (bloomberg)

- Here’s What Happened at the Tesla ‘Cyber Rodeo’ in Austin (barron’s)

- Stocks Are Better Than Homes to Build Wealth (barron’s)

- U.S. recession indicator is `not flashing code red’ yet, says pioneering yield-curve researcher (barron’s)

- Why Carlyle Group Moved Beyond Private Equity (barron’s)

- The Legend of Li Lu (allocatorsasia)

- Stock Splits Actually Work—Just Not for the Reason Everyone Thinks (barron’s)

- HP Stock Got a Buffett Boost. Why It’s Still a ‘Screaming Buy.’ (barron’s)

- Shanghai’s Omicron Outbreak Corners Chinese Leader (wsj)

- Global regulatory body warns on liquidity risks in corporate debt (ft)

- 2 top strategists at $2.6 trillion UBS break down why housing bubble concerns could be overblown — but also advise buyers against trying to time the market (businessinsider)

- Ron Insana: Peter Thiel’s ‘sociopaths’ know something he doesn’t (cnbc)

- The Huge Endeavor to Produce a Tiny Microchip (nytimes)

- Yield Curve Inversions and SPX Returns (quantifiableedges)

- Why Utilities Stocks Look Risky Today (morningstar)

- Why Citigroup’s Stock Is a Top Pick (morningstar)

- Oaktree Capital’s Howard Marks on Globalized Markets and the Impact of Russia’s Invasion of Ukraine (Wharton)

- 10 Value Investing Books That Makes You As Smart as Warren Buffet (medium)

- Jamie Dimon letter to Shareholders (jpm)