- Scholz and Macron urge Putin to cease fire; Zelenskyy shows optimism about talks with Russia (cnbc)

- Millions in Stimulus Aid, and Clashing Over How to Spend It (nytimes)

- Gen. Stanley McChrystal: The Essence of Leadership [The Knowledge Project Ep. #132] (fs)

- Charlie Dreifus: How To Invest In A Falling Market (acquirersmultiple)

- Fashion Nova CEO Richard Saghian Buys ‘The One’ Megamansion For $141 Million (forbes)

- Russian central bank decides not to reopen stock market trading next week (reuters)

- ECRI Weekly Leading Index Update (advisorperspectives)

- Goldman Sachs is ordering employees back to the office 5 days (or more) a week. (fortune)

- 12 Pristine Ferraris Spanning 40 Years of Production Are Heading to Auction (robbreport)

- The Enduring Legacy of Gilded Age Architecture—Now on HBO (architecturaldigest)

- China, U.S. expected to reach consensus soon in audit talks -sources (reuters)

- The Infinite Reach of Joel Kaplan, Facebook’s Man in Washington (wired)

- How “Drive to Survive” Remade Formula 1

- This Is What Sanctions Can Do to the Russian Economy (bloomberg)

- What the war in Ukraine means for the world order (ted)

Be in the know. 20 key reads for Saturday…

- Reuters is reporting that “sources” in China are reporting that a resolution (on de-listing) is making progress. The CSRC release a statement at nearly midnight China time saying that talks with the SEC were making progress. (chinalastnight)

- Stocks Are Full of Fear. How to Cope With an Emotional Market. (barrons)

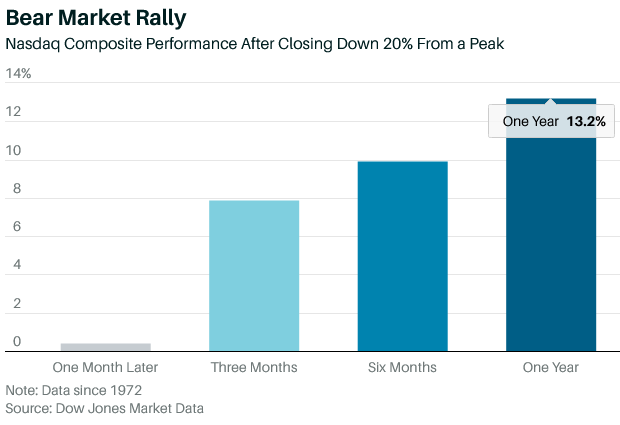

- The Secret to Braving a Wild Market (wsj)

- China Promises More Stimulus to Reverse Economic Slowdown (barrons)

- Legendary investor Mark Mobius says the Russia-Ukraine war will force the Fed to be cautious with rate hikes and that the US should avoid a recession (businessinsider)

- Military Spending Surges in Europe. These Stocks Stand to Benefit. (barrons)

- General Electric, Amazon, and the New Wave of Stock Buybacks (barrons)

- EQT CEO Says Huge Boost in U.S. LNG Exports Needed to Combat Climate Change (barrons)

- Why This Could Be the Golden Age of Active Management (barrons)

- Uber Stock Is a ‘No-Brainer’ Buy (barrons)

- Booking Gets Another Bull. The Recent Selloff Has Gone Too Far, He Says. (barrons)

- Putin’s War Will Change the World. Here’s How. (barrons)

- Latin American stocks shine in gloomy year for global markets (ft)

- Iran Nuclear Talks Break Off Without a Deal (wsj)

- Summers Faults Biden for Tying Inflation to Putin, Company Greed (bloomberg)

- The V-6 Engine Roars Again at Ferrari With Its 296 GTB Supercar (bloomberg)

- Uber Adds Fuel Surcharge to Help Drivers With High Gas Prices (bloomberg)

- Boeing CEO Has $7 Million on the Line to Ship the 777X Next Year (bloomberg)

- 3 trades that cemented Bill Gross as one of the world’s best traders and the original bond king at the investing powerhouse Pimco (businessinsider)

- Bank of America finds that stock splits are followed by a 25% average price return in the following 12 months — and names 20 companies that could announce next (businessinsider)

Where is the money flowing?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 10 key reads for Friday…

- Activist Investor Peltz Builds Up Stake in Unilever. The Stock is Up. (barrons)

- GE Hosted Analysts in South Carolina. Its ‘Lean’ Management Techniques Impressed the Street. (barrons)

- Daughter’s show-stealing HOF speech brings out different side of Tiger Woods (nypost)

- Ukraine Update: Putin Cites ‘Positive’ Developments in Talks (bloomberg)

- Biden’s got a gas and oil crisis on his hands — here are 5 reasons why the Saudis will bail him out (foxbusiness)

- Inside Putin’s circle — the real Russian elite (ft)

- Markets are ‘far more treacherous’ than expected but the S&P 500 could still rally to 5,100 or higher by year’s end, says Fundstrat’s Tom Lee (businessinsider)

- AT&T Outlines ‘New Era’ in Broadband Growth After Spinoff (bloomberg)

- Xi Weighs Tapping Loyalist as China’s Next Economic Czar (wsj)

- Southern California’s Ports Are Catching Their Breath During Import Lull (wsj)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 125

Article referenced in VideoCast above:

The “Horseshoes and Hand Grenades” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 115

Article referenced in podcast above:

The “Horseshoes and Hand Grenades” Stock Market (and Sentiment Results)…

Where is the money flowing?

Be in the know. 20 key reads for Thursday…

- Amazon Stock Split and Buyback Could Deliver Much-Needed Liftoff (bloomberg)

- House Passes $1.5 Trillion Spending Bill (barrons)

- China Supports Tech Firm U.S. IPO Revival, Signaling End to Freeze (bloomberg)

- JD Revenue Rises 23% in Defiance of China’s Consumption Slowdown (bloomberg)

- European Central Bank surprises markets with plan to wind down stimulus sooner than planned (cnbc)

- China’s 5.5% Growth Target Is a Big Reach (wsj)

- Inflation rises 7.9% in February, a new 40-year high (foxbusiness)

- Roblox (RBLX) for PlayStation Appears to Be on the Horizon (streetinsider)

- The Rich List: The 21st Annual Ranking of the Highest- Earning Hedge Fund Managers (institutionalinvestor)

- Russia rejects Ukraine ‘neutrality’ proposals at deadlocked talks (ft)

- The Big Read. The rising costs of China’s friendship with Russia (ft)

- ‘Brutal’ selling in speculative tech stocks knocks Tiger Cub hedge funds (ft)

- S. unemployment claims climb 11,000 to 227,000, but still near pandemic low (marketwatch)

- ‘We can’t stay in a state of panic.’ Forecaster who predicted a series of rolling bear markets has just turned bullish. (marketwatch)

- Walk and Chew Gum. The Energy Report 03/10/2022 (Phil Flynn)

- GE Holds the Line on 2022, Lays Out Its Future at Investor Meeting (barrons)

- These Beaten-Up Closed-End Funds Are Future Bargains (barrons)

- Wall Street Sends Fresh Alarms on Bond Liquidity as QE Era Ends (bloomberg)

- China’s February Auto Sales Get Boost From New-Energy Vehicles (bloomberg)

- United Airlines to Let Unvaccinated Workers Return (wsj)