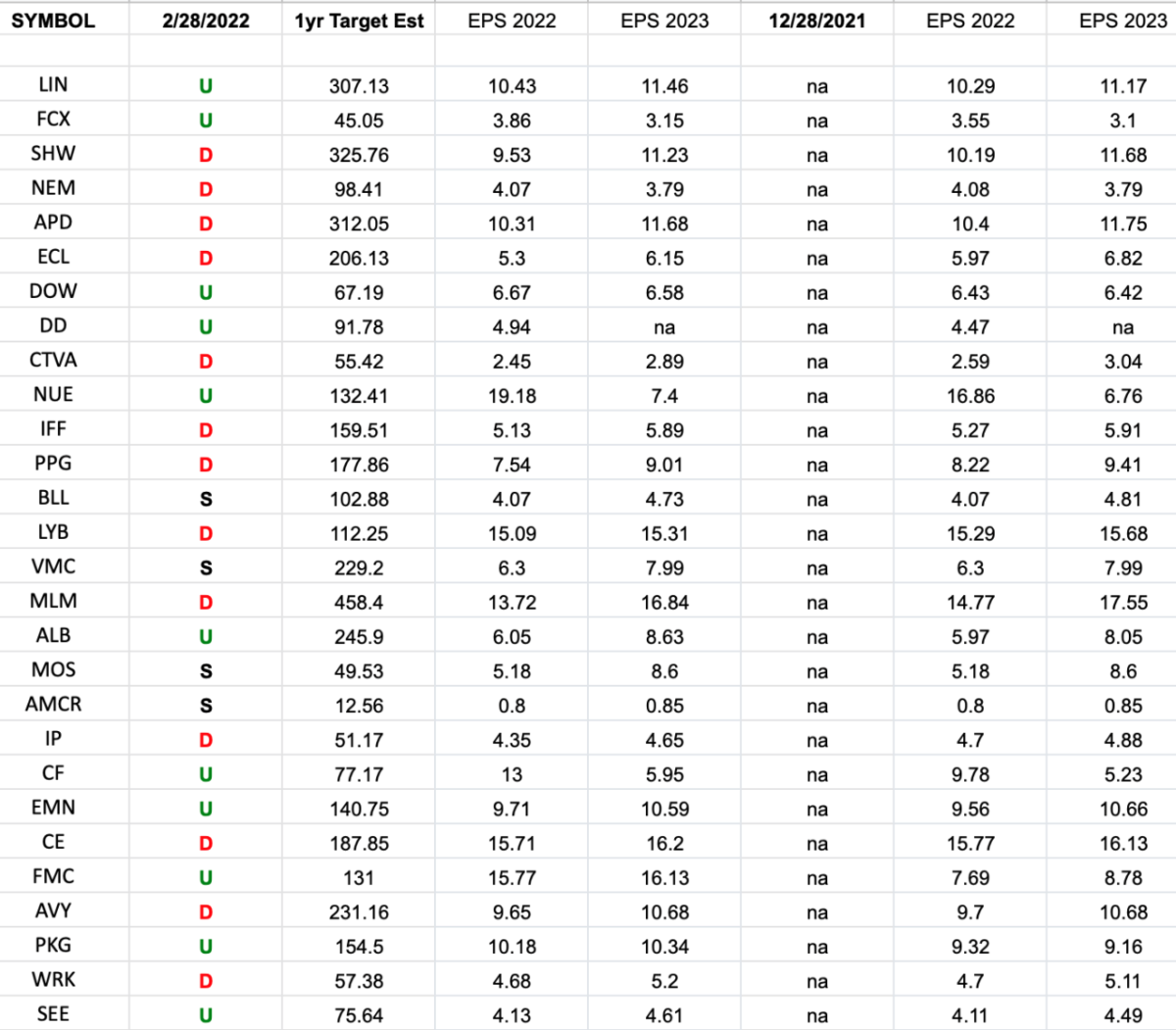

Basic Materials (XLB)- Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Basic Materials Sector ETF (XLB). I have columns for what the 2022 and 2023 estimates were: 12/28/2021 and today.

Continue reading “Basic Materials (XLB)- Earnings Estimates/Revisions”

Where is the money flowing?

Be in the know. 25 key reads for Tuesday…

- Tencent Jumps on Report of Chinese Billionaire’s Big Buy Order (bloomberg)

- Baidu Stock Jumps Even as Earnings Miss Estimates. Here’s What to Like. (barrons)

- A pair of Amazon analysts debate whether the company should spin off its undervalued cloud business — and share why the stock has up to $500 billion in untapped value (businessinsider)

- BYD to use Baidu’s autonomous driving technology as it takes on Tesla (scmp)

- Chinese Developers Are Buying Back Their Bonds at a Discount (bloomberg)

- Ukraine Heading for More Brutal Phase of War as Russia Regroups (bloomberg)

- Hong Kong stocks erase losses as Chinese manufacturing data fuels optimism amid Ukraine crisis (scmp)

- Berkshire Hathaway Owner’s Manual (berkshirehathaway)

- Warren Buffett quietly boosted his Japan bets, warned about Fed rate hikes, and defended his tax contributions. Here are 12 key insights from his annual letter. (businessinsider)

- Why SWIFT Ban Is Such a Potent Sanction on Russia (bloomberg)

- Warren Buffett’s Preferred Equity Allocation Is 100%. Why the Berkshire CEO Hates Bonds. (barrons)

- China Shunning Russian Coal With Banks Nervous Over Sanctions (yahoo)

- Ukrainians Return Home to Fight Russia: ‘I Have to Go’ (wsj)

- Buyout Group Nears $4 Billion Deal for China’s 51job (bloomberg)

- JPMorgan’s Kolanovic Says ‘Worst Might Be Behind Us’ on Selloff (yahoo)

- Billionaire investor Carl Icahn says Russia’s invasion of Ukraine isn’t as big a deal for markets as inflation (businessinsider)

- The Coder Supply Chain Runs Through Ukraine (bloomberg)

- The Metaverse Finally Has a Killer App: Poker (bloomberg)

- Sea Predicts Growing E-Commerce Sales in Bid to Soothe Investors (bloomberg)

- Traders Abandon Bets on a Half-Point Fed Rate Hike in March (bloomberg)

- Tech Giants Stage Their First All-Out Brawl in the Metaverse (bloomberg)

- What to Watch During Biden’s First State of the Union Address (barrons)

- Recession 2023? Why the Fears of a Fed-Induced Hard Landing Are Overblown. (barrons)

- Why China Is Unlikely to Escalate Any Conflict With Taiwan Right Now (barrons)

- Germany Goes For Full Energy Policy Overhaul Amid Ukraine Crisis (zerohedge)

Tom Hayes – Stocks For Beginners Podcast Appearance – 2/28/2022

Stocks For Beginners Podcast – Thomas Hayes – Chairman of Great Hill Capital – February 28, 2022

Listen Directly on Stocks For Beginners (The Podcast)

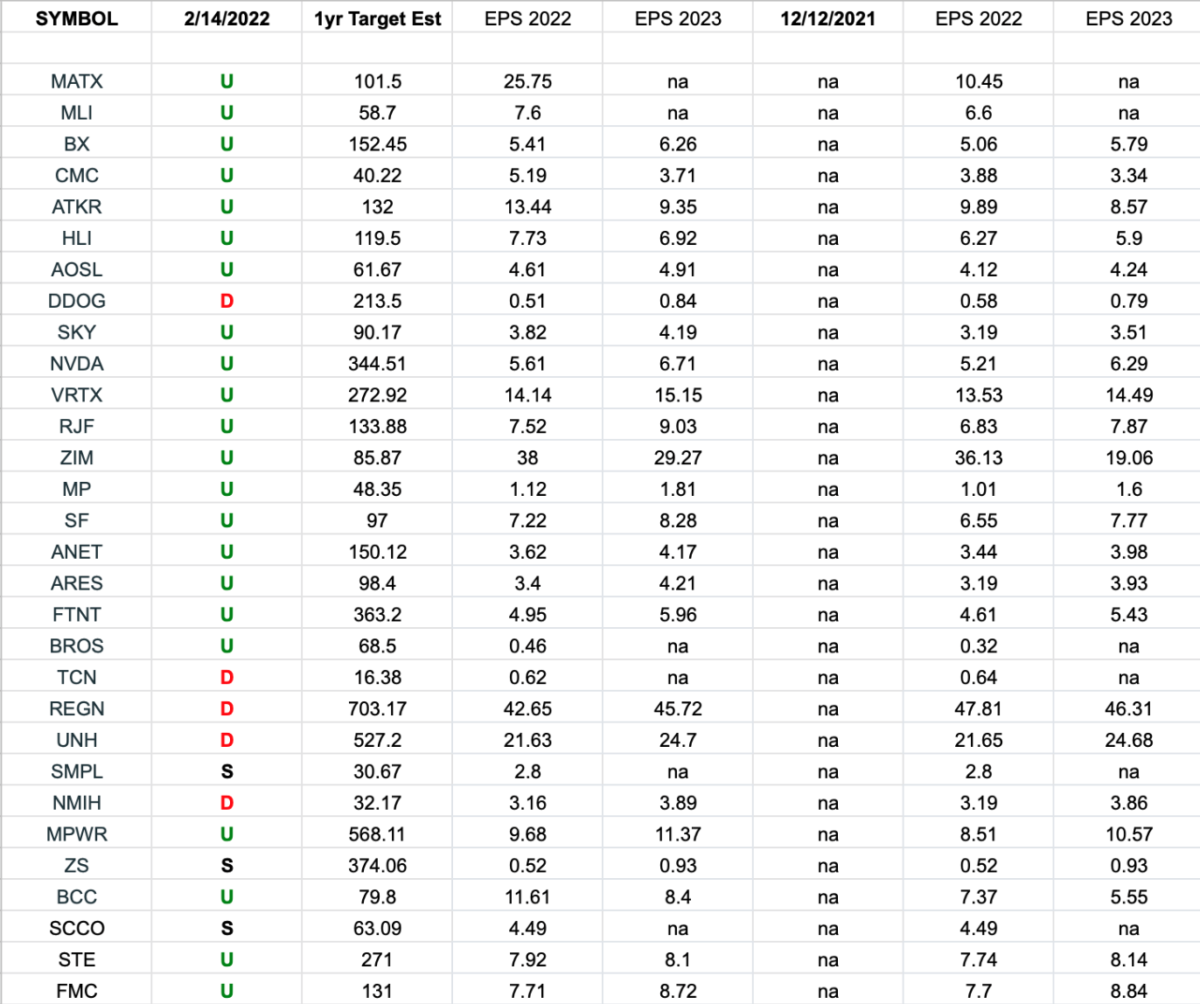

IBD 50 Growth Index (top 30 weights) Earnings Estimates

In the spreadsheet above I have tracked the earnings estimates for the top 30 weighted stocks in the IBD 50 Growth Index (ETF: FFTY) Continue reading “IBD 50 Growth Index (top 30 weights) Earnings Estimates”

Where is the money flowing?

Be in the know. 12 key reads for Monday…

- Cigna board adds $6 billion to company’s share buyback authorization, boosting it to $10 billion (marketwatch)

- PayPal, Intel and Paramount Stock Hit Multiyear Lows. Insiders Scooped Up Shares. (barrons)

- An Iran Nuclear Deal Looks Close. What That Means for Oil Markets. (barrons)

- Putin played Powell — and US pays the price (nypost)

- Lockheed, Defense Stocks Jump as Germany Boosts Military Spending (barrons)

- Taiwan Is Not Ukraine (barrons)

- JPMorgan Says Selling Stocks Now Carries Too Much Risk (bloomberg)

- S., Allies Considering 60 Million Barrel Oil Reserve Release (bloomberg)

- Ukrainians Return Home to Fight Russia: ‘I Have to Go’ (wsj)

- Germany to Boost Military Spending in Latest Historic Shift (yahoo)

- Russia Central Bank Increases Interest Rate to 20% After Ruble Plunged, Introduces Capital Controls; Defense Stocks ‘Top of Mind’ for Investors (streetinsider)

- Before he was Ukraine’s president, Zelensky voiced Paddington Bear (nypost)

Be in the know. 10 key reads for Sunday…

- How Volodymyr Zelensky found his roar (economist)

- Sebastian Mallaby on How VC Made Silicon Valley (bloomberg)

- Elon Musk says Starlink is active in Ukraine amid internet disruptions (foxbusiness)

- S. And Allies To Remove Some Russian Banks From SWIFT, Sanction Central Bank (forbes)

- Former Miss Grand Ukraine joins fight against Russian invasion (nypost)

- Germany to step up plans to cut dependence on Russia gas (reuters)

- ‘Ozark’ Season 4, Part 2: Netflix Releases Teaser Trailer (mensjournal)

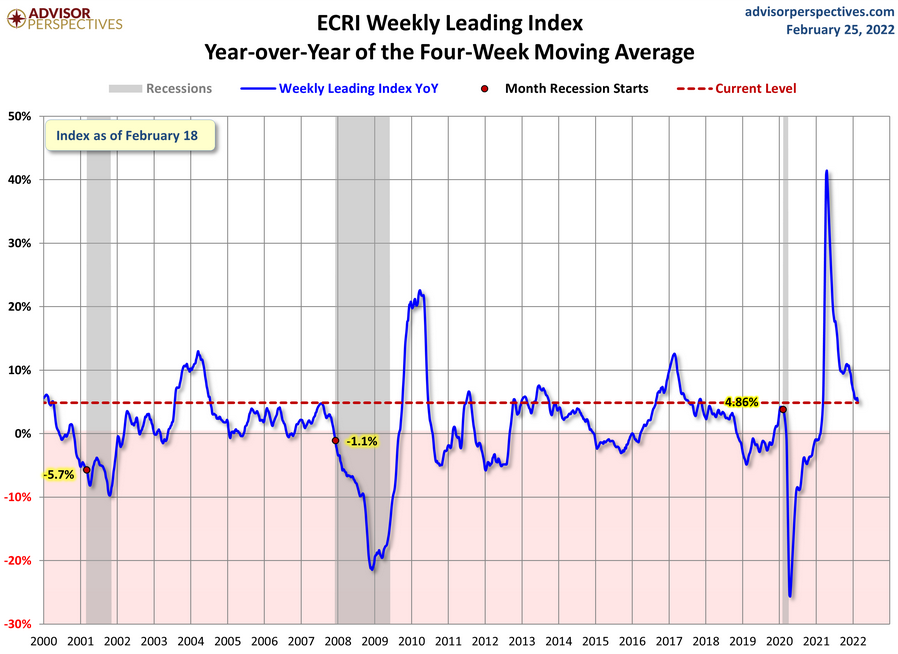

- ECRI Weekly Leading Index Update (advisorperspectives)

- Nuclear fusion is coming — and we should be jumping with glee (thenextweb)

- This Is What Needs to Happen for Oil Prices to Finally Come Down (bloomberg)

Be in the know. 18 key reads for Saturday…

- Three countries provided almost 70% of liquefied natural gas received in Europe in 2021 (eia)

- Warren Buffett’s Berkshire Hathaway Shows Big Operating Gains for Quarter (barrons)

- Vincent van Gogh’s ‘Champs près des Alpilles’ Will Make Auction Debut in May, Estimated at $45 Million (barrons)

- Is Now the Time to Buy or Sell? 7 Stocks to Consider During Turbulent Times. (barrons)

- Emerging Markets Are on the Mend. The Ukraine Conflict Won’t Derail Them. (barrons)

- GE Has Hydrogen Turbine Experience. Airbus Has Planes. Can They Cut Carbon Emissions to Zero? (barrons)

- Buy Goodyear. Its Stock Could Rise 50% Thanks to EVs. (barrons)

- 3M Stock Is Soaring. Thank Johnson & Johnson. (barrons)

- Small-Cap Growth Stocks Have Stumbled. Now, They’re Getting Ready to Run Again. (barrons)

- Street Battles Rage in Kyiv as Russia Presses Assault (wsj)

- ‘I need ammunition, not a ride’: Zelensky declines US evacuation offer (nypost)

- China Distances Itself From Russia, Calls for Halt to Violence (bloomberg)

- Warren Buffett calls out a spike in deceptive earnings, bemoans a lack of bargains, and trumpets Berkshire Hathaway’s ‘Four Giants’ in his shareholder letter (businessinsider)

- ‘Bullish engulfing’ chart patterns abound after stock market’s big bounce (marketwatch)

- The surprising reason why Wendy’s burgers are square (cnn)

- Scientists Recorded the Brain Activity of a Person as They Died, and the Results Are Astonishing (futurism)

- 15 Undervalued Stocks That Crushed Earnings (morningstar)

- Mohnish Pabrai Calls Meta Platforms (FB: US) an “Easy Double” (SumZero)