- U.S. Nears Return to Iran Nuclear Deal (wsj)

- China’s finance ministry talks up tax breaks and spending on homegrown tech (cnbc)

- Chinese Banks in Two Key Cities Cut Mortgage Rates to Boost Housing Sector (wsj)

- Fresh fears over Beijing regulatory crackdown drive China tech rout (reuters)

- The Fed’s Dilemma: Tame Inflation or Avoid a Recession (barrons)

- Stocks Rebound After Putin Orders Russian Troops Into Ukraine (barrons)

- Ukraine and Inflation Are Wild Cards as Western Central Banks Look to Reset Policy (barrons)

- Krispy Kreme Stock Rises on Upbeat Outlook (barrons)

- Retail Is a Tricky Investment. Why Nordstrom Stock Looks Like a Winner. (barrons)

- Frackers Push Into Once-Dead Shale Patches as Oil Nears $100 a Barrel (wsj)

- Russian Troops Enter Breakaway Ukrainian Region; Germany Halts Gas Pipeline (wsj)

- Putin’s Endgame: Unravel the Post-Cold War Agreements That Humiliated Russia (wsj)

- Big Tech Makes a Big Bet: Offices Are Still the Future (nytimes)

- Carnival Cruise Line, Royal Caribbean are dropping their mask mandates (usatoday)

- An Obscure Corner of Wall Street Is Making Billions Trading Inflation (bloomberg)

- Krispy Kreme launches Twix doughnuts in 1st collab with candy brand (foxbusiness)

- News in-depth. After recognising breakaway regions in Ukraine, what are Putin’s options? (ft)

Be in the know. 10 key reads for President’s Day…

- Traders Look Past Ukraine Angst to Load Up on Emerging Assets (bloomberg)

- JPMorgan Strategists Say Stock Pessimism Is ‘In Vogue,’ But Wrong (bloomberg)

- Tencent Quashes Talk of New Crackdown as Tech Wipeout Deepens (bloomberg)

- China Tells Banks, State Firms to Report Exposure to Jack Ma’s Ant (bloomberg)

- Meituan Shows China Tech Isn’t Delivering Yet (wsj)

- Fiscal Stimulus Is Turning Into a Fiscal Drag, in a Big Headwind for Growth (wsj)

- Biden Agrees to Putin Summit Provided Russia Pulls Back From Ukraine Attack (wsj)

- Behind China’s Warning Against a Russian Invasion Is a Desire to Protect Ties With the U.S. (wsj)

- Opinion: These 10 stocks have the right stuff that top investors want in their portfolios (marketwatch)

- Explainer. In charts: can Erdogan’s gamble keep the Turkish lira steady? (ft)

Be in the know. 27 key reads for Sunday…

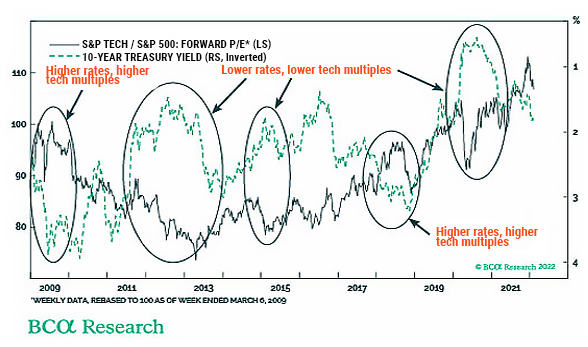

- Everyone Thinks Rising Interest Rates Are Bad for Tech Stocks. But Are They? (Institutional Investor)

- Alibaba goes after JD’s direct retail model with new e-commerce app (technode)

- The World Needs What Intel Makes. Can It Make a Comeback? (nytimes)

- Fed officials lean against large increase to kick off rate hikes (reuters)

- News in-depth. Baltic states fear encirclement as Russia threat rises (ft)

- There are emerging opportunities in the market, says legendary investor Bill Miller (cnbc)

- Interview. Germany fears Russian gas retaliation if war breaks out (ft)

- Carl Icahn: The Fed Can’t Keep Printing Money (bloomberg)

- Two Fed officials back steady rise in interest rates starting in March (ft)

- 15 Undervalued Stocks That Crushed Earnings (morningstar)

- Beijing says it is ‘seriously concerned’ as India cracks down on Chinese companies (cnn)

- Billionaire Space Tourist Buys Three More SpaceX Launches (futurism)

- Charles Munger: Why I Invested In Alibaba And Other Chinese Stocks (acquirersmultiple)

- The Trouble With a Stock-Market Bubble (wsj)

- Goldman Sachs Has 5 Buy-Rated Stocks Under $10 With 100% to 600% Upside Potential (24/7WallSt.)

- Wall Street Looks Over Its Shoulder, but It’s Not Panicking (thestreet)

- Alibaba-Backed Huitongda Gains In Hong Kong Debut, Lifting Fortune Of China E-Commerce Billionaire (forbes)

- ECRI Weekly Leading Index Update (advisorperspectives)

- Mark Wahlberg Is a Master at Playing the Long Game (mensjournal)

- Rolex Watches Gained More Value Than Gold Or Real Estate In Last Decade (maxim)

- 2022 Ford Bronco Everglades Edition Is Ready To Own The Outdoors (maxim)

- Back to Earth or Temporary Setback? Revisiting the FANGAM Stocks (aswathdamodaran)

- Buy Russia – it’s cheap (moneyweek)

- Howard Lindzon on What’s Really Going on in the Tech Plunge (OddLots)

- The Seven Habits That Lead to Happiness in Old Age (theatlantic)

- The Best NHL Teams Are Better Than Usual. So Are The Teams That Might Upset Them In The Playoffs. (fivethirtyeight)

- Ukraine President Zelenskyy proposes to meet with Putin as tensions with Russia grow (npr)

Be in the know. 15 key reads for Saturday…

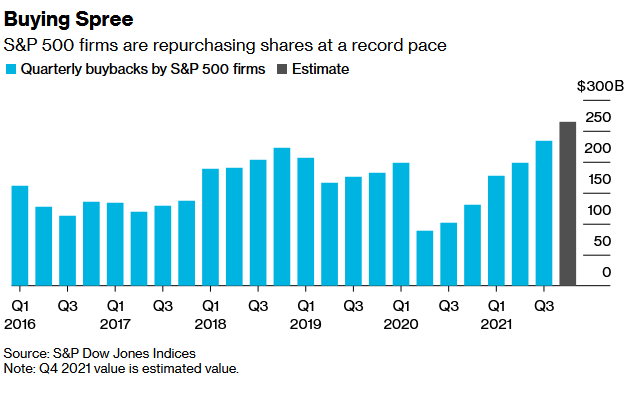

- Surging U.S. Share Buybacks Offer Support to Sputtering Market (bloomberg)

- Multinationals in Ukraine are ready for a conflict but staying put. (nytimes)

- Inside Facebook’s $10 Billion Breakup With Advertisers (wsj)

- Fed Officials Lean Against Expectations of Half-Point Increase in March (wsj)

- March 2020: How the Fed Averted Economic Disaster (wsj)

- Wary of Being Left in the Dark, Americans Produce Their Own Power (wsj)

- How Elon Musk plans to fix ‘soul-destroying traffic’ in these US cities (nypost)

- AriseN Partners up-and-running less than a year after Bill Hwang’s fall (nypost)

- JPMorgan Quant Says Fastest Trend Followers Are Set for Comeback (bloomberg)

- China Vows to Contain Bond Default Risks, Deepen Reforms (bloomberg)

- Can Iran’s Oil Save American Motorists? (bloomberg)

- How Rebounding Oil Is Making U.S. Shale More Viable (bloomberg)

- Opinion: High-flying growth stocks have returned to earth. Are they now undervalued? (marketwatch)

- Opinion: Microcap stocks could rake in the cash from these mega-rich buyers (marketwatch)

- Will Fed rate hikes crush the stock market? Here’s why speed matters (marketwatch)

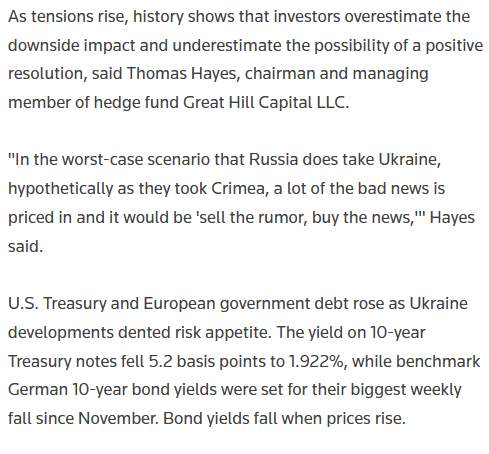

Tom Hayes – Quoted in Reuters article – 2/18/2022

Thanks to Herb Lash for including me in his article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

Unusual Option Activity – Intel Corporation (INTC)

On Friday some institution/fund purchased 3,561 contracts of Jul 2022 $47.5 strike calls (or the right to buy 356,100 shares of Intel Corporation (INTC) at $47.5). The open interest was just 786 prior to this purchase.

Continue reading “Unusual Option Activity – Intel Corporation (INTC)”

Where is the money flowing?

Be in the know. 33 key reads for Friday…

- Biotech Stocks Are Down And Out; Can These 2022 Trends Save Them? (investors)

- Nokia Is Remaking Itself Into a 5G Leader. Now Might Be the Time to Plug Into the Stock. (barrons)

- Americans Are Emerging From the Pandemic Ready to Splurge on Events and Travel (wsj)

- Biotech Is Creating the Jobs of the Future. Give It a Boost. (barrons)

- A $2.2 Trillion Crunch Time Looms for Traders Loaded With Stock Hedges (bloomberg)

- Intel CEO Sees Revenue Growth Gaining Pace Starting Next Year (wsj)

- China Orders Cuts for Food-Delivery Fees, Sparking Tech Selloff (wsj)

- S. Existing-Home Sales Hit One-Year High Ahead of Higher Rates (bloomberg)

- Junk Bonds Aren’t Predicting the Stock-Market Apocalypse You Think They Are (barrons)

- The Best Bargains in Megacap Tech Now (barrons)

- Walmart Withstands Pandemic Blows, Higher Costs to Boost Business (wsj)

- On The Blinken. The Energy Report 02/18/2022 (Phil Flynn)

- Intel Can Be the ‘Next Great Growth Story,’ CEO Pat Gelsinger Says (barrons)

- DuPont Sells Materials Business for $11 Billion. The Stock Rises. (barrons)

- Alibaba and Tencent E-Commerce Sites Added to U.S. Counterfeit and Piracy List (barrons)

- Netflix Could Add More Subscribers Than Expected This Quarter, Says Analyst (barrons)

- Angi Stock Tanked After Earnings. Patient Investors Should Buy the Dip. (barrons)

- Watch these junk bonds for recession signals (marketwatch)

- Bond Yields Close to Flashing Recession Signal: Bank of America (barrons)

- Recession 2023? Why the Fears of a Fed-Induced Hard Landing Are Overblown. (barrons)

- No reversal on China’s tech crackdown in sight as Xi calls for more work on laws (cnbc)

- Inflation Should Moderate in Coming Months, White House Economist Says (wsj)

- A Jeff Koons Paint Job on a BMW Canvas (nytimes)

- A $2.2 Trillion Crunch Time Looms for Traders Loaded With Stock Hedges (bloomberg)

- Hong Kong’s Brain Drain Is Causing Real Pain (bloomberg)

- Recession Risks are Rising, Says BofA’s Hartnett After Seeing Largest Inflow to Treasuries Since Pandemic Started (streetinsider)

- Cisco (CSCO) Stock Gains on Earnings Beat, JPMorgan Sees ‘Strong Move’ Playing Out in Next 12-24 Months (streetinsider)

- Appalachia Shale-Gas Drillers Move to Buy Billions in Own Shares (yahoo)

- JPMorgan Quants Say Sudden Earnings Gloom Spells Market Trouble (yahoo)

- News in-depth. Shari Redstone won the battle for her media empire. Now comes the streaming war (ft)

- Is Los Angeles ready for a billionaire mayor? (ft)

- What Happens When The Yield Curve Flattens And Potentially Inverts? (benzinga)

- Intel Puts a Price on its Leap of Faith (wsj)