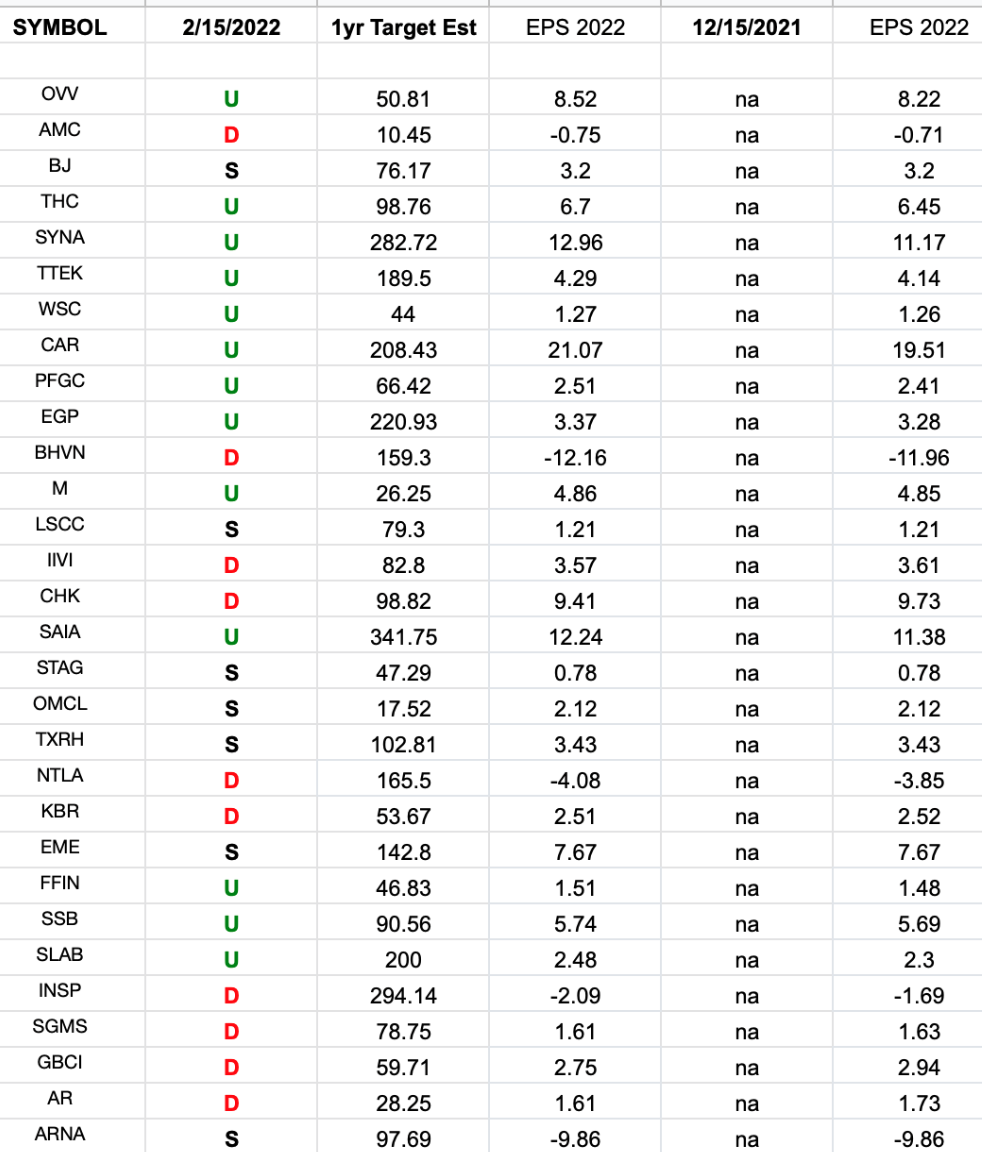

In the spreadsheet above I have tracked the earnings estimates for the top weighted Russell 2000 small cap stocks. I have columns for what the 2022 estimates were on 12/15/2021 and today.

Continue reading “Russel 2000 (top weights) Earnings Estimates”