- Emerging Markets Took a Beating Last Year. Now They Could Be the Smart Play. (institutionalinvestor)

- AT&T to Spin Off WarnerMedia, Plans Deep Cut to Its Dividend (barrons)

- UPS Smashes Earnings and Guidance Is Even Better. Shares Are Rising. (barrons)

- Winter Olympics spotlights Beijing’s digital yuan: Will China’s CBDC plans push others to move faster? (fnlondon)

- Small-Caps Avoided Their Worst January in Decades. It Might Be Time to Buy. (barrons)

- JPMorgan’s Kolanovic is again pounding the table for stocks — but one market is close to triggering an ominous signal (marketwatch)

- Bears beware. Past corrections for the S&P 500 are only 15% on average, outside of recessions (marketwatch)

- Fed Nominee Has Focused His Research on Monetary Policy and Poverty (wsj)

- California Single-Payer Healthcare Plan Shelved at Last Minute (wsj)

- Qatar Airways Launches New Boeing Cargo Jet (wsj)

- Domino’s to ‘tip’ customers $3 for placing pickup orders as labor shortage continues (nypost)

- Stocks had a lousy start to the year, but Wall Street expects good times ahead. (nytimes)

- Rents are declining in several major US cities. Is yours on the list? (usatoday)

- Goldman Slashes 2022 GDP Forecast Again, Warns Of “Sharp Deceleration” In Growth” (zerohedge)

- Blackstone, Carlyle Mull Joint Bid for Novartis Generics Arm (bloomberg)

- Europe Is Losing Nuclear Power Just When It Really Needs Energy (bloomberg)

- Goldman Sachs’ Kostin Says Correction is a Buying Opportunity (streetinsider)

- Aston Martin launches the DBX707, says it’s the most powerful luxury SUV in the world (cnbc)

- Legendary investor George Soros says China’s real-estate crisis is a major threat to Xi Jinping’s grip on power (businessinsider)

- Ultra-rare 1955 Mercedes-Benz Gullwing auctioned for record $6,825,000 (foxbusiness)

- Nelson Peltz wins board seat at Janus Henderson (ft)

Hedge Fund Tips (PCN) – Position Completion Notification

Where is money flowing today?

Tom Hayes – Cheddar TV Appearance – 1/31/2022

Cheddar TV Appearance – Thomas Hayes – Chairman of Great Hill Capital – January 31, 2022

Watch in HD directly on Cheddar

Be in the know. 17 key reads for Monday…

- China and Japan are Citi’s top picks for Asia markets (cnbc)

- Four Ways the Iranian Nuclear Talks Could Upend Oil Markets (bloomberg)

- Market corrections are good buying opportunities, says Goldman Sachs — but only when this happens (marketwatch)

- Hong Kong’s Covid-Zero Strategy Is on the Brink of Collapse (bloomberg)

- The Auto Chip Shortage May Be Improving, According to This Company’s Earnings (barrons)

- China Manufacturing Slips in Latest Sign of Slowing Economy (bloomberg)

- Dollar to Peak After Fed Starts Hiking in March, JPMorgan Says (bloomberg)

- Goldman Strategist Sees Risk of Further Stock Market Pullback (bloomberg)

- Then and Now: How This Fed Liftoff Is Nothing Like That of 2015 (bloomberg)

- Dollar to Peak After Fed Starts Hiking in March, JPMorgan Says (bloomberg)

- Netflix Co-CEO Reed Hastings Bought $20 Million of Stock (barrons)

- Can music on Spotify shed light on stock market returns? A study says yes. (usatoday)

- BANK OF AMERICA: Buy these 28 unheralded ‘best ideas’ stocks now for upside of 20% to 180% as they make dramatic turnarounds in 2022 (businessinsider)

- UBS says to buy these 15 growth stocks that still look attractive amid the sell-off and could surge by at least 32% based on price targets (businessinsider)

- Crashing Pot Stocks Are Flush With Cash (wsj)

- Boeing to sign Qatar freighter deal on Monday – U.S. officials (reuters)

- Minneapolis Fed President: March rate hikes on the table (finance.yahoo)

Be in the know. 15 key reads for Sunday…

- Flight From Risk Drives Biotech Stocks to Worst Start Since 2016 (bloomberg)

- Drugmakers Raised Prices by 6.6% on Average Early This Year (wsj)

- Move Over, Meme Stocks: Retail Investors Go Back to the Blue Chips (wsj)

- Wall St Week Ahead Bargain hunters study stock valuations after big declines (reuters)

- ECRI Weekly Leading Index Update (advisorperspectives)

- Simply the best Tom Brady’s greatness undeniable whenever retirement day comes (nypost)

- 22 Fascinating Facts You Didn’t Know About Bugatti (robbreport)

- Chevrolet Reveals Corvette Z06 70th Anniversary Edition (maxim)

- 2022 Maserati MC20 Review: A Powerful Yet Nimble Track Sweeper (thedrive)

- Intel wants to get ‘millions of Arc GPUs’ to gamers every year (techradar)

- Winning by points: Putin’s judo match with the West (aei)

- Europe Fears Kremlin Will Cut Off Its Gas Supply (cfr)

- Led Zeppelin Gets Into Your Soul (newyorker)

- Walgreens Is Said to Kick Off Boots Sale as Sycamore Joins Fray (bloomberg)

- China Manufacturing Loses Steam as Growth Risks Mount (bloomberg)

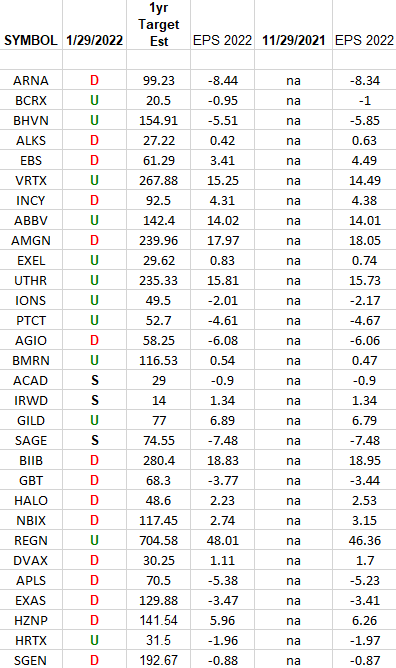

(Equal Weight) Biotech Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Equal Weighted Biotech ETF (XBI) top 30 holdings. Last week I tracked the Market Cap Weighted Biotech ETF (IBB) to 30 weights here:

Continue reading “(Equal Weight) Biotech Earnings Estimates/Revisions”

Be in the know. 20 key reads for Saturday…

- Fed’s Kashkari says rate hike ‘pause’ conceivable in spring (reuters)

- Boeing Is Set to Launch Its First New Jet in Nearly Five Years With Qatar Deal (bloomberg)

- Netflix Co-CEO Hastings Buys $20 Million of Shares After Drop (bloomberg)

- These Airline Stocks Could Take Flight in 2022 (barrons)

- A Year After It Began, Meme-Stock Mania Is on Life Support (barrons)

- Consumer Sentiment Slips (barrons)

- Stocks Have Had Their Worst January Since 2008. That’s Creating Buying Opportunities. (barrons)

- This Is What an Earnings Slowdown Looks Like. (barrons)

- Alphabet’s Earnings Are Coming. All Eyes Are On the Google Parent’s Outlook. (barrons)

- Why Bill Ackman Sees More Play in Netflix Stock (barrons)

- S. Wages, Benefits Rose at Two-Decade High as Inflation Picked Up (wsj)

- Hedge Fund Melvin Lost $6.8 Billion in a Month. Winning It Back Is Taking a Lot Longer. (wsj)

- News in-depth. Masayoshi Son and Marcelo Claure: inside the expensive divorce at SoftBank (ft)

- Oaktree takes control of sprawling Evergrande building project near Shanghai (ft)

- Wall Street split on ‘buying the dip’ in whipsawing US stock market (ft)

- Chinese documentary prompts rare criticism of Xi’s anti-corruption campaign (ft)

- Turkey’s Erdogan Vows to Continue Lowering Interest Rates (bloomberg)

- A Stock Trader’s Guide to China’s Week-Long New Year Holiday (bloomberg)

- The stock market slump is raising recession fears but the actual data isn’t so ‘ominous,’ analyst says (businessinsider)

- Netflix is still a very cheap stock: Oakmark Funds’ Bill Nygren (cnbc)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 119

Article referenced in VideoCast above:

“Go Where the Fish Are” Stock Market (and Sentiment Results)…