- China’s Stocks Had a Rough 2021. Watch for a Turnaround in the Year of the Tiger. (barrons)

- Goldman, Citi Strategists Say It’s Now Time to Buy Stocks Rout (bloomberg)

- Warren Buffett’s great-nephew just completed a SPAC deal. He clearly shares the billionaire investor’s taste in businesses. (businessinsider)

- AT&T Earnings Guidance Missed Forecasts. The Stock Is Rising. (barrons)

- Post-Omicron Boom Is Coming. Workers Are the Wildcard. (barrons)

- A Rare Oil Bear Thinks $100 Predictions Are Premature (barrons)

- Intel Wins Appeal of $1.2 Billion EU Antitrust Fine (berrons)

- Microsoft’s Earnings Delivered. The Market—and These 11 Stocks—Could Gain. (barrons)

- Boeing Cash Gain Dulls Pain of $5.5 Billion Dreamliner Costs (bloomberg)

- Fed will raise its policy interest rate above the inflation rate ‘sooner rather than later,’ says ex-governor Quarles who resigned last month (marketwatch)

- Opinion: Whenever the Dow and the S&P 500 fall below this key support level, stocks typically come roaring back (marketwatch)

- You can still find a haven in tech stocks: These 20 offer the safety net of highly stable profits (marketwatch)

- Fed Day Is Here as Volatility Hits Fever Pitch. What to Watch. (barrons)

- S. Plans Sanctions, Export Controls Against Russia if It Invades Ukraine (wsj)

- Investors Lose Appetite for Stocks of Unprofitable Companies (wsj)

- Ukrainian mom buys powerful hunting rifle, vows to ‘fight for Kiev’ (nypost)

- Amazon Go heads to the suburbs: Talking Tech podcast (usatoday)

- Billionaire Paul Marshall’s Hedge Fund Just Made This Historic Move on Value Stocks (bloomberg)

- Scottsdale Classic Car Auctions Find a Lot Riding on Results (bloomberg)

- Boeing takes $3.5 billion charge on 787 Dreamliner but generates positive cash flow (cnbc)

- Goldman Sachs says buy these 24 stocks with solid balance sheets, healthy margins, and reasonable valuations as the market selloff intensifies (businessinsider)

- GE and Raytheon Are in It for the Long Haul (wsj)

- AmEx Has Runway as Travel Recovers (wsj)

- In Catastrophic Month For “Smart Money”, Goldman Saw Biggest Hedge Fund Buying Since 2020 On Monday (zerohedge)

- Buy Any Further Significant Pullback in Equities – Goldman Sachs (streetinsider)

Tom Hayes – The Claman Countdown – Fox Business Appearance – 1/25/2022

Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – January 25, 2022

Watch in HD directly on Fox Business

Tom Hayes – CGTN America Appearance – 1/25/2022

Hedge Fund Trade Tip (PIN) – Position Idea Notification

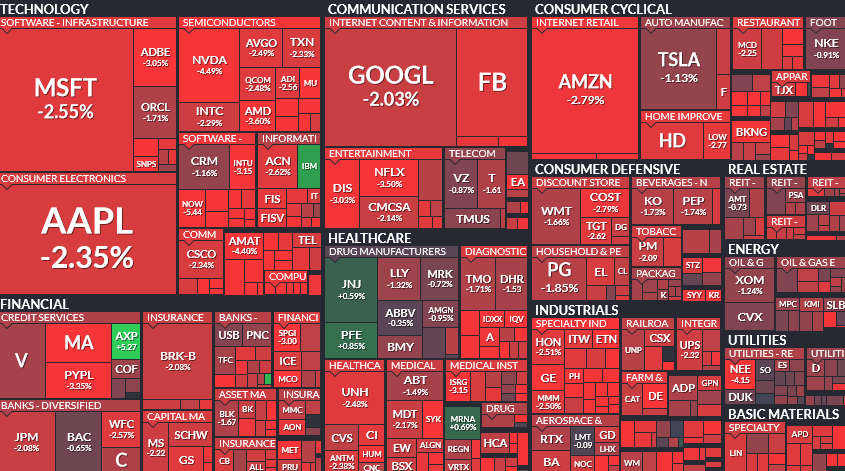

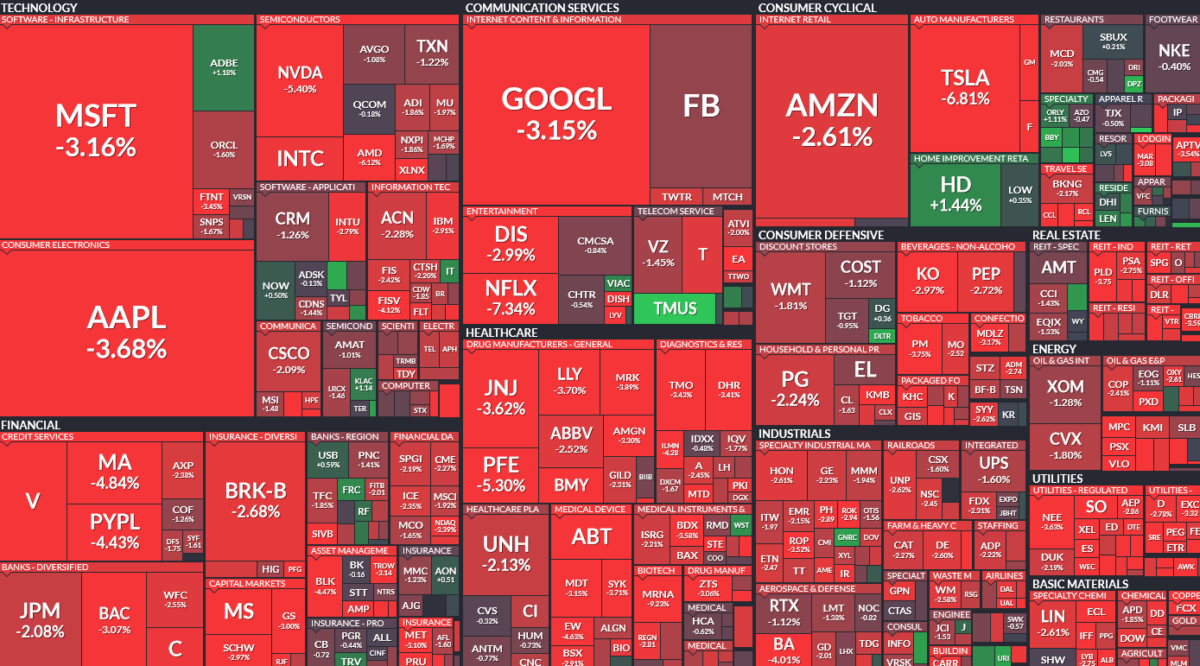

Where is money flowing today?

Be in the know. 20 key reads for Tuesday…

- Goldman Shrugs Off Rate Hikes to Bet on Emerging Stocks (bloomberg)

- 10 Cheap Stocks for Volatile Markets (barrons)

- New Study Finds CFA Charterholders Are Actually Worse At Investing (zerohedge)

- Berkshire Hathaway plans to hold its next annual meeting in person. (nytimes)

- High Alert. The Energy Report 01/25/2022 (Phil Flynn)

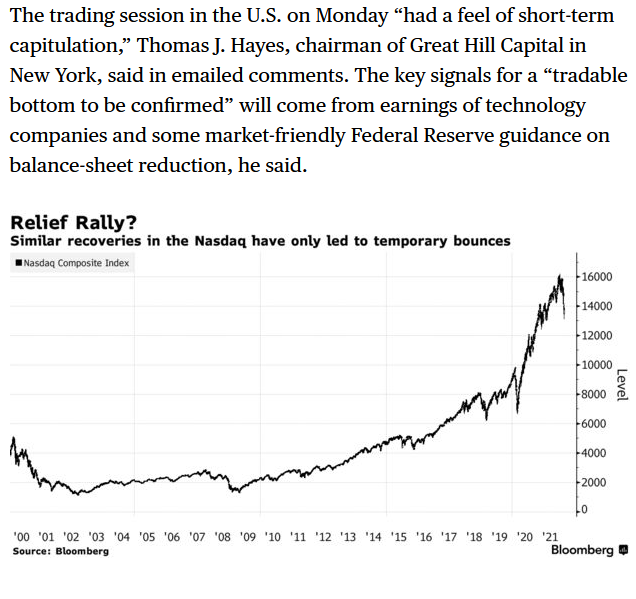

- Nasdaq Composite’s Wild Swing Precursor to Bounce, History Shows (bloomberg)

- Junk Loans Shine Amid Market Rout (wsj)

- An Anxious Market Awaits the Fed Meeting (barrons)

- American Express Boosts Forecasts as Credit Card Spending Sets Record (barrons)

- Throwing up the white flag? Retail investors dumped stocks at Monday’s open, JPMorgan analysis finds (marketwatch)

- IBM’s Earnings Signal Good News for Microsoft Stock—and Maybe the Whole Market (barrons)

- 3M Reports Better-Than-Expected Earnings. (barrons)

- Tech Crash or Bargain Season? It’s an Open Question. (barrons)

- Omicron Slows the Global Economy, Hitting the U.S. Particularly Hard (wsj)

- Fed Steps Up Deliberations on Shrinking Its $9 Trillion Asset Portfolio (wsj)

- Russia Cuts Key Oil Flows Just as Demand Looks Set to Jump (bloomberg)

- American Express CEO: We aren’t seeing any consumer cautiousness (yahoo)

- The Big Read. Citadel Securities: how the Wall Street outsider became ‘the Amazon of financial markets’ (ft)

- US antitrust head will look to block deals that ‘lessen competition’ (ft)

- Home prices surged in November, but at a slower rate than in October, S&P Case-Shiller says (cnbc)

Tom Hayes – Quoted in Bloomberg article – 1/25/2022

Thanks to Akshay Chinchalkar, CMT, CFTe, EPATian and Abhishek Vishnoi for including me in their article on Bloomberg. You can find it here:

Click Here to View The Full Article on Bloomberg

Where is money flowing today?

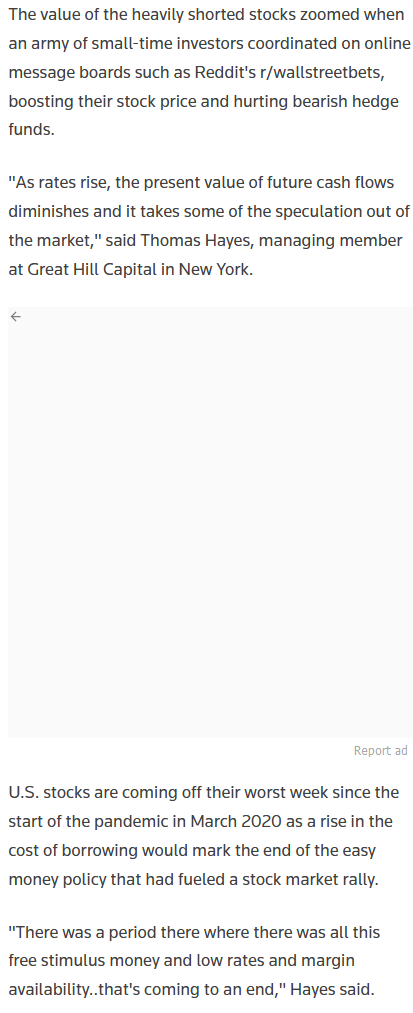

Tom Hayes – Quoted in Reuters article – 1/24/2022

Thanks to Anisha Sircar and Medha Singh for including me in their article on Reuters today. You can find it here: