- China Cuts Policy Interest Rate for First Time Since April 2020 (bloomberg)

- China’s Xi says countries must abandon ‘Cold War mentality,’ warns against confrontation (cnbc)

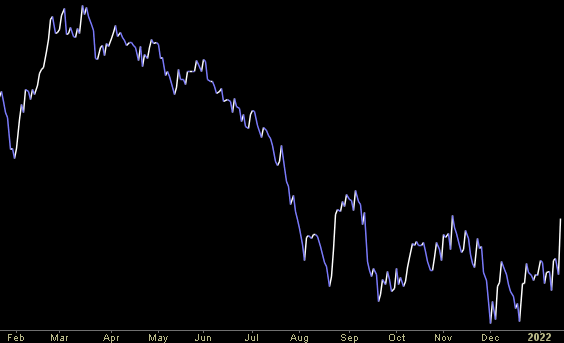

- A quiet comeback is starting in emerging markets (ft)

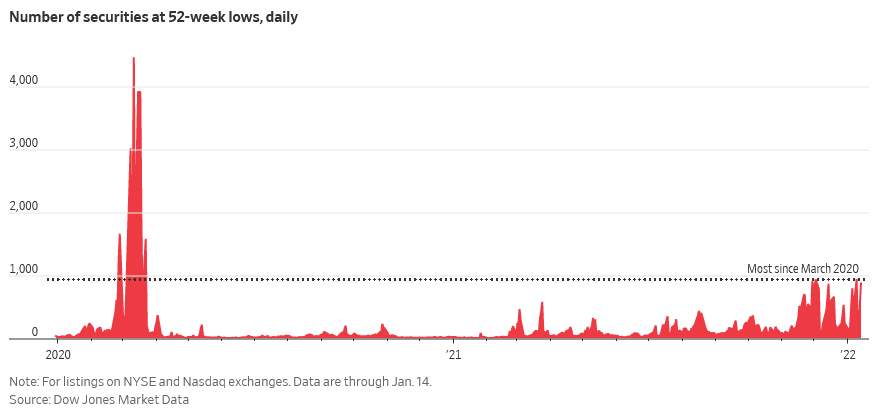

- Hundreds of U.S.-listed companies are off more than 20% from highs. (wsj)

- Tom Brady surprises 10-year-old cancer survivor with Super Bowl tickets (nypost)

- China’s Population Stalls With Births in 2021 the Lowest in Modern History (wsj)

- China’s Population Crisis Is Complicated. What It Means for the Country’s Economy. (barrons)

- Angi Could Be the Next Uber. Its Stock Looks Too Cheap. (barrons)

- Here Are 13 Stocks Whose Pandemic Dividend Suspensions Remain (barrons)

- China Seeks to Cushion Blow of Economic Pain as Momentum Slows (wsj)

- China GDP Grew 8.1% in 2021, but Momentum Slowed in Quarter (wsj)

- Big Tech Braces for a Wave of Regulation (wsj)

- These TikTok Stars Made More Money Than Many of America’s Top CEOs (wsj)

- Why China’s Central Bankers Are Still Worried (wsj)

- Amazon Scraps Plan to Stop Accepting Visa’s U.K. Credit Card (barrons)

- Day Traders as ‘Dumb Money’? The Pros Are Now Paying Attention (wsj)

- How to Use a Free Password Manager—and Make Your Logins Safer (wsj)

- Analysis: China’s ‘zero-COVID’ campaign under strain as Omicron surges (reuters)

- Boom Times for Classic Car Auctions Conducted Online (nytimes)

- Wells Fargo price target raised to $67 from $57 at Keefe Bruyette (thefly)

Be in the know. 10 key reads for Sunday…

- January Monthly Option Expiration Week Mixed Last 23 Years (almanactrader)

- The Campbell Soup Company Is A Lot Bigger Than You Ever Realized (digg)

- Bank Investors Must Wait for the Benefits of Rising Interest Rates (wsj)

- Welcome To “Billionaires’ Dirt Road”: This Pastoral Town Is Home To Larry Fink, Georgina Bloomberg, David Letterman, Richard Gere And More (forbes)

- ECRI Weekly Leading Index Update (advisorperspectives)

- Disney’s CEO reveals his strategy for 2022 and beyond—including creating a metaverse with your favorite characters (fortune)

- Understanding the Metaverse and Web 3.0 (goldmansachs)

- 5G’s next big launch could make its improved speed promises a reality (cnet)

- TikTok made me buy it (npr)

- Disappointing Decade for European Bank Stocks Gives Way to Rally (bloomberg)

Be in the know. 28 key reads for Saturday…

- 10 key debates on, and reasons to buy, China in 2022 (Goldman Sachs)

- Expect a Tough Year for Stocks but Lots of Opportunities for Bargain Hunters, Barron’s Experts Say (barrons)

- Retail Sales Fell in December. Why Some Economists Say the Decline Will Be Short-Lived. (barrons)

- In Proof That Irony Is Dead, People are Trying to Make Beanie Babies NFTs (futurism)

- Banks’ Earnings Show Lenders Aren’t All the Same. It’s Time to Pick and Choose. (barrons)

- The Misery Index Is Rising. What That Says About Rates. (barrons)

- Macau Reveals Casino Law Changes. Las Vegas Sands, Wynn Are Soaring. (barrons)

- Get ready for the climb. Here’s what history says about stock-market returns during Fed rate-hike cycles. (marketwatch)

- Las Vegas Sands Stock Could See Better Luck Ahead (barrons)

- After Scramble to Replace NHL Players, USA Hockey Reveals Men’s Olympic Team (wsj)

- How Game Theory Changed Poker (wsj)

- Wells Fargo profits soar thanks to increase in loans, cost-cutting steps (nypost)

- The Big Read. Zero-Covid policies threaten Hong Kong’s place in the world (ft)

- Opinion: Four reasons why value stocks are poised to outperform growth in 2022 — and 14 stocks to consider (marketwatch)

- JPMorgan plots ‘astonishing’ $12bn tech spend to beat fintechs (ft)

- opinion content. Person in the News. Ken Griffin, financial prodigy turned industry giant (ft)

- US accuses Russia of planning ‘false-flag operation’ in eastern Ukraine (ft)

- Elon Musk’s Tunnel System Works, but the Real Test Is Still to Come (bloomberg)

- The Virus Has Changed. Maybe We Should, Too. (bloomberg)

- Here Are the Most Eye-Popping Cars at the 2022 Tokyo Auto Salon (bloomberg)

- As bond yields spike to their highest levels of the recovery, a Wall Street firm shares exactly how investors can maximize their hunts for yield — and how to adjust portfolios now (businessinsider)

- GE suspends Covid vaccine, testing rules after high court nixes Biden mandate (cnbc)

- How Olympic gold medalist Tara Lipinski stays motivated: ‘I’m competitive’ (cnbc)

- Opinion: Nasdaq near a 10% correction isn’t the sell signal you probably think it is (marketwatch)

- Opinion: Why interest rates aren’t really the right tool to control inflation (marketwatch)

- Netflix is raising prices (cnn)

- Selling Out (oaktreecapital)

- Legendary investor Mario Gabelli breaks down auto, aerospace stocks to watch (youtube)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 117

Hedge Fund Tips with Tom Hayes – Podcast – Episode 107

Tom Hayes – The Claman Countdown – Fox Business Appearance – 1/14/2022

Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – January 14, 2022

Watch in HD directly in Fox Business

Hedge Fund Tips (PCN) – Position Completion Notification

Where is money flowing today?

Be in the know. 20 key reads for Friday…

- Macau Reveals Casino Law Changes. Las Vegas Sands, Wynn Are Soaring. (barrons)

- JP Morgan Says US Casinos in Macau Already Seen the Worst (gamblingnews)

- Macau keeps casino licences limited to six, halves duration (reuters)

- Macau Cuts Casino License Tenure, Caps Public Float in New Law (bloomberg)

- China reforms securities settlement system to attract foreign capital (reuters)

- Retail Sales Fell in December as Omicron and Inflation Stymied Spending (barrons)

- JPMorgan Earnings Beat Expectations. But the Stock Falls After Higher Expenses and Slower Trading. (barrons)

- Citi’s Trading Revenue Disappoints (barrons)

- Wells Fargo’s Quarterly Profit Soars 86% (wsj)

- 83 Squeeze. The Energy Report 01/14/2022 (Phil Flynn)

- S. industrial production edges lower in December as automobile production stumbles (marketwatch)

- With Biden Mandate Blocked, Many Companies Won’t Impose Covid-19 Vaccine Rules (wsj)

- Fed’s Brainard Says Reducing Inflation Is Top Priority (wsj)

- Omicron Appears to Have Peaked in U.K., Offering Hope the Wave Is Receding (wsj)

- Tom Brady Tackled These Guys. They Still Can’t Believe It. (wsj)

- Nike and Adidas Are Dipping Toes Into the NFT Market. The Sneakerheads Are Into It. (com)

- After Scramble to Replace NHL Players, USA Hockey Reveals Men’s Olympic Team (wsj)

- As Fintech Eats Into Profits, Big Banks Fight Back in Washington (bloomberg)

- China’s Trade Surplus Hit a Record $676 Billion in 2021 (bloomberg)

- Here’s the full list of the best-selling electric cars in China for 2021 (cnbc)