- Boeing Stock Leaps On Report 737 MAX To Return To Service In China Later This Month (thestreet)

- Delta Air Lines Earnings Beat Expectations. (barrons)

- Shell’s Buybacks and Low-Carbon Energy Shift Make This a Buying Opportunity (barrons)

- Wall Street Is Talking About the Fed’s Balance Sheet. What to Know About ‘QT.’ (barrons)

- Inflation Surge Is on Many Executives’ List of 2022 Worries (wsj)

- Fed’s Brainard to Tell Congress That Reducing Inflation Is Top Priority (wsj)

- U.S. Initial Jobless Claims Rose to Highest Since Mid-November (bloomberg)

- Smaller Gain in U.S. Producer Prices Is Hint of Cooler Inflation (bloomberg)

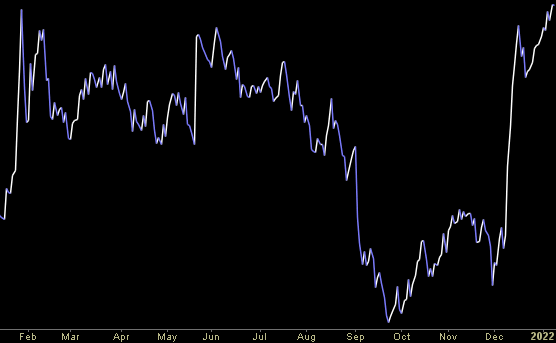

- Sell Dollar for Everything Else Is Echoing Across Trading Rooms (bloomberg)

- Discovery Shares Poised for Gains After Rough 2021 (bloomberg)

- Biogen Prepares to Fight Medicare Over Alzheimer’s Drug Limits (bloomberg)

- Wharton professor Jeremy Siegel sees the S&P 500 jumping 9% this year, saying stocks are the place to be when inflation is rising (businessinsider)

- These are the types of companies Warren Buffett says you should invest in during times of inflation (marketwatch)

- Saudi Sovereign Wealth Fund To Buy $10 Billion In Stocks This Year (zerohedge)

- Wells Fargo expects four U.S. rate hikes this year, cuts growth forecast (streetinsider)

- AT&T (T): UBS Expects WarnerMedia Sale Completed in 2Q, Seen as a Catalyst for Shares and Paving the Way for Buybacks in 2023 (streetinsider)

- Susquehanna Upgrades Delta (DAL) and United (UAL) to Positive, Downgrades Southwest (LUV) and Sprint (SAVE) to Neutral (streetinsider)

- Stabilisation signs emerge after inflation palpitations (reuters)

- J.P. Morgan: Hedge Funds Could Be the Go-To Investment for 2022 (institutional nvestor)

- Short sellers tuck into Beyond Meat (ft)

“The Last Shall Be First” Stock Market…

On Friday I was on Fox Business – The Claman Countdown – with Liz Claman discussing which sector (+company) and which asset class (+company) we are focused on for 2022. Thanks to Ellie Terrett and Liz for having me on: Continue reading ““The Last Shall Be First” Stock Market…”

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Where is money flowing today?

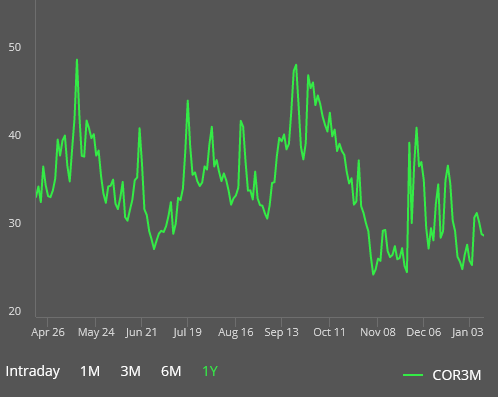

Indicator of the Day (video): Cboe S&P 500 Implied Correlation Index

Be in the know. 20 key reads for Wednesday…

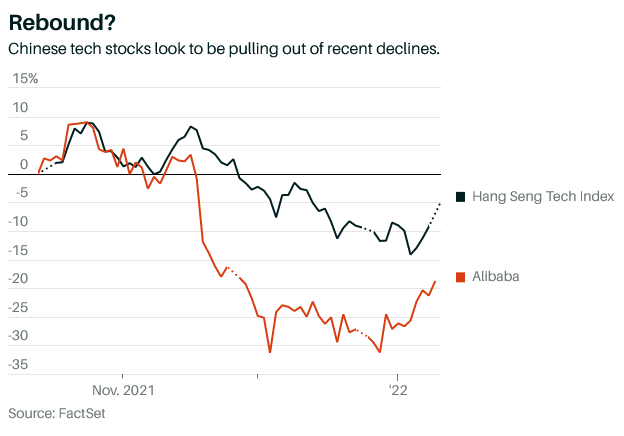

- Alibaba, JD.com, and Other Chinese Tech Stocks Are Soaring. Here’s Why—and Who to Thank. (barrons)

- Hang Seng hits six-week high as Alibaba drives best tech gain in 3 months (scmp)

- For Chinese Tech Stocks, No News Is Good News (wsj)

- Warren Buffett’s champion stock picker is dead at 85. The billionaire ranked Louis Simpson among the best investors ever. (businessinsider)

- Facebook Antitrust Suit Can Move Forward, Judge Rules (barrons)

- Walgreens Begins Strategic Review of Boots Business (barrons)

- Gene-Editing Start-Ups Are Being Courted. Big Pharma Senses a Buying Opportunity. (barrons)

- Nordstrom Stock Is Cheap Compared to Other Retailers (barrons)

- Fed’s Powell Says Economy No Longer Needs Aggressive Stimulus (wsj)

- Boeing wins annual jet order race on adjusted basis (reuters)

- Goldman Sachs Clients Favor European Stocks as U.S. Risks Grow (bloomberg)

- Jerome Powell Pitches Benevolent Interest-Rate Hikes Again (bloomberg)

- Fear of even higher mortgage rates may be heating up winter homebuying (cnbc)

- Tech stocks rally; China’s December inflation slows (cnbc)

- Billionaire trader Paul Tudor Jones rings the bubble alarm, warns the Fed could tank the economy, and predicts pandemic winners will struggle (businessinsider)

- Interest rate hikes by the Fed won’t end the bull market in stocks — but a 10% sell-off is likely, Fundstrat says (businessinsider)

- ‘This is a brilliant move’: Bank of America and Wells Fargo make big changes to overdraft fees — experts explain why (marketwatch)

- Amazon (AMZN) Price Target Raised at Morgan Stanley, Analyst Sees 30% Upside (streetinsider)

- US companies tipped for strong earnings season despite growing threats (ft)

- AT&T Soon Will Catch Up to Rival Verizon. The Stock Is a Buy. (finance.yahoo)

Where is money flowing today?

Be in the know. 25 key reads for Tuesday…

- Alibaba Stock Gets a Target Price Cut. Here’s Why It’s Still a Buy. (barrons)

- GE’s Larry Culp Posted an Open Letter on LinkedIn. He’s Talking to Investors. (barrons)

- Buy the dip, says JPMorgan. ‘Markets can handle higher yields’ (marketwatch)

- Goldman’s David Kostin says a tech disconnect is the ‘single greatest mispricing’ in U.S. stocks (cnbc)

- Cramer warms up to Uber, says it’s an OK time to start a position in the stock (cnbc)

- Powell’s Senate Hearing Holds the Key for Markets (barrons)

- Bets Are Rolling In Again for $100 Oil (barrons)

- Take-Two’s CEO Makes the Case for the Zynga Deal (barrons)

- Nokia Lifts Guidance. The Stock Is Up. (barrons)

- Amazon Is the FAANG Stock With the Most Bite, Analyst Says (barrons)

- Here are dozens of ‘cheap’ stocks that could be poised to outperform as U.S. rates start to rise (marketwatch)

- Delta and Other Top Airline Picks for 2022 (barrons)

- Intel names new CFO and lead PC executive, stock gains in late trading (marketwatch)

- T Cells Triggered by Common Cold Fend Off Covid in Study (bloomberg)

- Wall Street Hails the Great Stock Rotation (bloomberg)

- CVS Health raises 2021 earnings outlook, backs 2022 forecast (cnbc)

- Goldman predicts the euro area will outgrow the U.S. economy over the next two years (cnbc)

- The stock market has been flipped upside down in 2022. Here’s why, and what it means for you. (businessinsider)

- These 32 stocks held by the first listed metaverse fund have all received a buy rating from Wall Street analysts – with 9 offering upside of over 50% (businessinsider)

- American Airlines shares jump 2.2% premarket after airline raises its Q4 guidance (marketwatch)

- Will Beaten Down Chinese Stocks Be 2022’s Best Performers (zerohedge)

- Citi Adds AT&T (T) to Positive Catalyst Watch (streetinsider)

- Alibaba founder Jack Ma shows up at Hainan primary school as his foundation celebrates 7th anniversary of rural teacher’s charity (scmp)

- ‘If we’re lucky,’ the Fed can engineer a ‘soft landing’: Expect more than 4 rate increases in 2022 and a lot of market volatility, says JPMorgan’s Jamie Dimon (marketwatch)

- European LNG Imports Hit Two-Year High As US Flotilla Delivers Much-Needed Supplies (zerohedge)