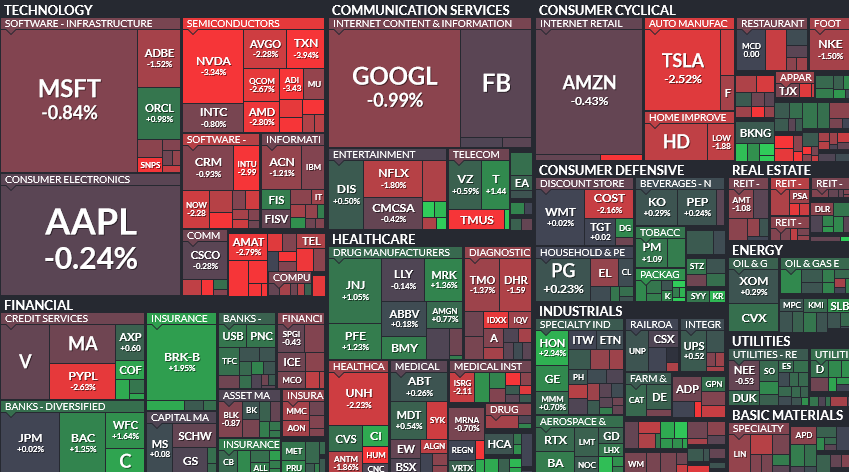

Data Source: Finviz

Quote of the Day…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 106

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 116

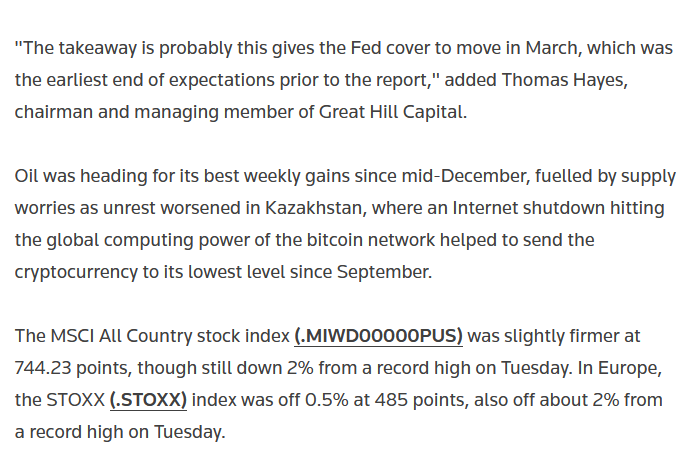

Tom Hayes – Quoted in Reuters article – 1/7/2022

Thanks to Huw Jones and Herb Lash for including me in their article on Thomson Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

Be in the know. 19 key reads for Friday…

- Alibaba’s ‘long-term strategy is intact,’ analyst says as stock rises (marketwatch)

- Alibaba Stock Is on a Tear. Here Are 5 Reasons Investors Are Buying the Dip. (barrons)

- China Regulator Vows Stability After Stock Market’s Rocky Start (bloomberg)

- Billionaire investor Ray Dalio says Fed hikes won’t derail the economy but are likely to hit ‘bubble-type’ tech stocks (businessinsider)

- These tech stocks have fallen 20% to 51% from their 52-week highs. Should you consider buying now? (marketwatch)

- Hiring Was Weak, but Still Expect a Rate Hike in March (barrons)

- AT&T’s Bear Case Largely Has Played Out. The Stock Has Limited Downside Risks. (barrons)

- CES 2022 Is Smaller and Quieter This Year. What I Learned From the Show. (barrons)

- America’s Love of ‘Yellowstone’ Helps Launch Bull Riding as a Team Sport (wsj)

- Tech Selloff Prompts Bets Against U.S. Stock-Market Supremacy (wsj)

- ‘Don’t Look Up’ Breaks Netflix Record for Weekly Viewership (wsj)

- S. Jobless Rate Falls as Wages Jump, Adding Pressure on Fed (bloomberg)

- Wall Street Is Using Tech Firms Like Zillow to Eat Up Starter Homes (bloomberg)

- Hedge Funds Boost Value-Stock Exposure to the Highest in Four Years (bloomberg)

- China has finalized rules that govern the way companies operate algorithms and they will come into effect on March 1. (cnbc)

- This ‘cash cow’ value-stock strategy can fatten your portfolio even if you fear the Fed (marketwatch)

- China to ease debt rules for state-led distressed M&A – source (reuters)

- Alibaba restructures back-end operations of Taobao, Tmall (scmp)

- China eases ‘three red lines’ loan rules for struggling property sector (scmp)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 25 key reads for Thursday…

- The S&P 500 Took Off at Year’s End. Earnings Could Bring More Gains. (barrons)

- Signs That Prices Might Be Heading Back Down Soon (barrons)

- Why Visa, Juggernaut of the Payments Business, Is a Buy (barrons)

- Fed Minutes Suggest More Stock-Market Turmoil Could Lie Ahead (barrons)

- Biggest Tech Selling in a Decade as Rate Rout Spooks Hedge Funds (bloomberg)

- These Pharma Firms Have the Cash for Acquisitions (barrons)

- Netflix’s Subscriber Growth May Fall Short, Analyst Says. Why He’s Still Upbeat. (barrons)

- Tech Stocks Are Having Their Worst Start to a Year Since 2008. What’s Behind the Selloff. (barrons)

- Meme Stocks, Crypto Sink as Possible Rate Hike Looms. GameStop and AMC Led the Slump. (barrons)

- Walgreens Stock Rises on Profit Beat and Guidance Raise (barrons)

- 20 cheap value stocks that Wall Street expects to rise up to 58% (marketwatch)

- Fed Minutes Point to Possible Rate Increase in March (wsj)

- China’s Unpredictable, Heavy-Handed Governance Threatens Growth (wsj)

- Anger at Xi’an Lockdown Spreads in China (wsj)

- AT&T Shed Media Assets in 2021. This Year It Wants to Add Investors. (wsj)

- Goldman Strategists See Haven in Europe Stocks Amid Rate Hikes (bloomberg)

- Boeing stock gains after Atlas Air orders 4 Boeing 777 freighters (marketwatch)

- Big tech stocks will be ‘bumpy’ in 2022: Bob Doll (foxbusiness)

- Wells Fargo, Bank of America draw price target hikes on bullish loan data (marketwatch)

- Wall Street Loves China More Than Ever (bloomberg)

- China’s digital currency comes to its biggest messaging app WeChat, which has over a billion users (cnbc)

- Warren Buffett’s Berkshire Hathaway may be buying Japanese stocks again, based on its latest bond issue (businessinsider)

- Alibaba bets on the metaverse with DingTalk AR glasses (scmp)

- This tech giant will shape the future of the metaverse, buy its stock: analyst (yahoo)

- Could A Graphite Shortage Derail The $3 Trillion EV Boom? (yahoo)