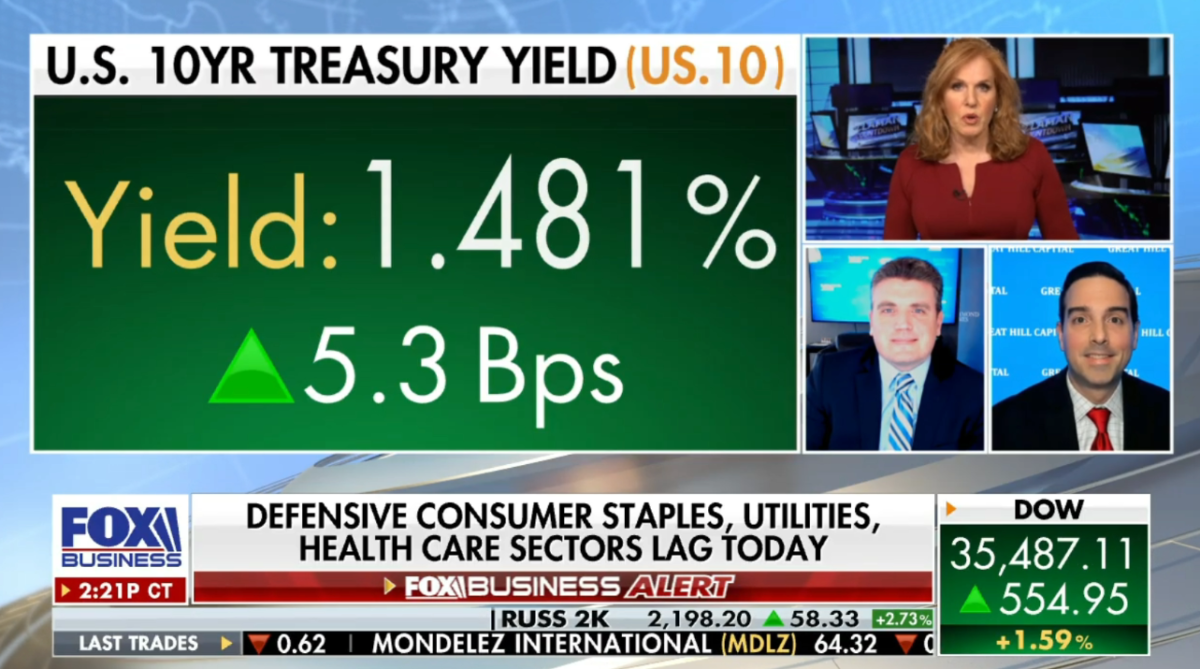

Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – December 21, 2021

Where is money flowing today?

Indicator of the Day (video): Commitments of Traders S&P 500

Hedge Fund Tips (PCN) – Position Completion Notification

Hedge Fund Tips (PCN) – Position Completion Notification

Be in the know. 21 key reads for Tuesday…

- GOLDMAN SACHS: These 27 stocks are set to return at least 32% in 2022 and have minimal risk compared to the rest of the market (businessinsider)

- Alibaba investor day highlights ‘ample’ room to drive revenue growth, Morgan Stanley says (seekingalpha)

- US-China gas deals defy tensions between world powers (ft)

- Jack Dorsey Stirs Uproar by Dismissing Web3 as a Venture Capitalists’ Plaything (bloomberg)

- Investors Panicked in 2020. Why Omicron Will Be Different. (barrons)

- If Biden’s Spending Package Is Toast, Then so Are These Tax Hikes (barrons)

- Omicron Won’t Knock Carnival Off Course for the Long Term (barrons)

- Bitcoin’s ‘One Percent’ Controls Lion’s Share of the Cryptocurrency’s Wealth (wsj)

- Is the Fed Deflating Prospects for Speculative Stocks? (wsj)

- Nuclear Power Has a Second Chance to Prove Itself (wsj)

- Behind a New Pill to Treat Covid: A Husband-and-Wife Team and a Hunch (wsj)

- How the 2020s Economy Could Resemble the 1980s (nytimes)

- Chinese Developer Stocks Jump Most in a Month: Evergrande Update (bloomberg)

- Ray Dalio’s China Fascination Predates His Ties to Beijing’s Billions (bloomberg)

- Hong Kong’s zero-Covid approach is main frustration for businesses, analyst says (cnbc)

- Buy these 11 overlooked stocks with an average upside of 23% as inflation rises in 2022, Bank of America says (businessinsider)

- Boeing says UPS has ordered 19 of its 767 Freighters, adding to a record year for the aircraft (marketwatch)

- SEC demands more risk disclosure for Chinese companies listing in US (ft)

- Turkey’s currency surges after Erdogan unveils lira savings scheme (ft)

- Rolls-Royce to Get Qatari Funding For Small Nuclear Reactors (yahoo)

- How Erdogan’s Plan to Halt the Lira’s Fall Is Meant to Work (yahoo)

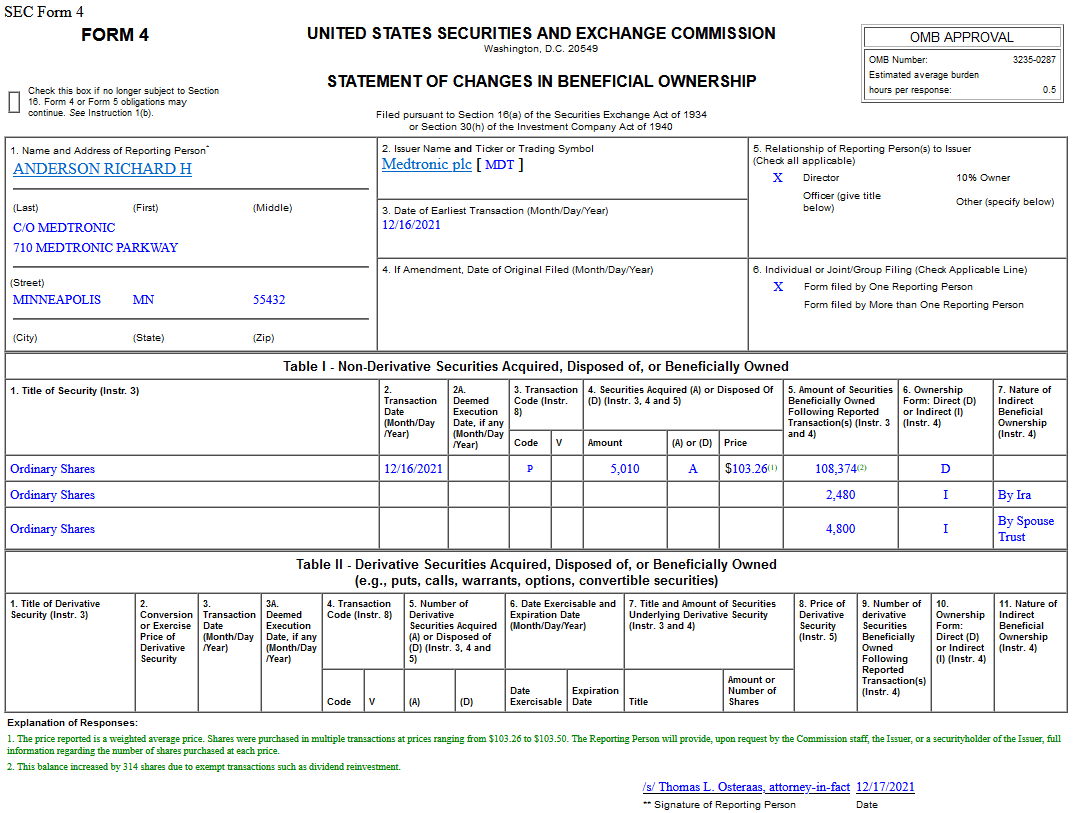

Insider Buying in Medtronic plc (MDT)

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 20 key reads for Monday…

- China’s securities regulator ready to communicate with US counterparts on audit oversight cooperation (shine)

- China’s central bank cuts a benchmark rate for the first time since the pandemic (cnbc)

- China asks lenders to step up bond issuances, loans to boost property sector M&A (scmp)

- Stocks will roar higher into year-end and January as an ‘overshoot’ in selling leads to a short squeeze, JPMorgan’s quant guru says (businessinsider)

- Manchin Says ‘No’ on Biden’s Build Back Better Plan (barrons)

- Goldman Sachs Cuts U.S. Growth Forecast After Manchin Rejects Build Back Better Plan (barrons)

- Interest Rates Are Rising—but the Fed’s Actions Could Make It Easier to Get a Mortgage (barrons)

- Carnival Cruise CEO’s Goal: A Full Fleet Sailing by Summer (barrons)

- Rising Interest Rates and a Growing Economy Will Lift Bank Stocks (barrons)

- Stock buybacks can keep surging next year after a potential record for 2021, analysts say (marketwatch)

- Omicron For Christmas. The Energy Report 12/20/2021 (Phil Flynn)

- Tiger Woods looks ready to win again — and he will (nypost)

- Two industrials stocks caught up in market weakness look like buys heading into 2022, traders say (cnbc)

- Biogen to lower price of Alzheimer’s drug aduhlem by 50% starting Jan. 1 to about $28,200 a year (marketwatch)

- Opinion: Inflation-adjusted Treasury yields are lower than they’ve been in 70 years. Here’s why that isn’t a bigger negative for stocks (marketwatch)

- UPDATE: Bluebird Bio announces partial clinical hold for patients under 18 in sickle cell gene therapy program (marketwatch)

- BofA Securities Out With Its 11 Top Stock Picks for 2022 (247wallst)

- China cuts lending benchmark, market sees more easing in 2022 (reuters)

- The Bond Market Isn’t Buying Fed’s Sketch of Rate Hike Plans (bloomberg)

- The Big Read. Supply chains: companies shift from ‘just in time’ to ‘just in case’ (ft)