Be in the know. 30 key reads for Wednesday…

- Pfizer Says Its Covid-19 Pill Likely Works Against Omicron (wsj)

- China adds new incentives for banks to lend to small businesses (reuters)

- Investors Are Most Bullish on Dollar Since 2015, BofA Says (bloomberg)

- Campbell Is Getting Warmer (wsj)

- Central Bankers Are the Biggest Risk to Stocks in 2022, Survey Finds (bloomberg)

- Even when the Fed starts hiking rates, stocks could keep rising for 10 months, according to Deutsche Bank (fortune)

- The “New Energy Economy”: An Exercise in Magical Thinking (manhattan-institute)

- Here’s Why Stocks Are 80% Likely To Jump Again Next Year (investors)

- 5 Stocks to Hide Out in During Fed-Related Volatility (barrons)

- Why Wall Street Isn’t Freaking Out Over Omicron (barrons)

- China’s Factories Keep Running as Domestic Economy Slows Down (barrons)

- Nike Is Entering the Metaverse. What’s Ahead for Investors. (barrons)

- China’s Anti-Monopoly Crackdown Is Just an Excuse (barrons)

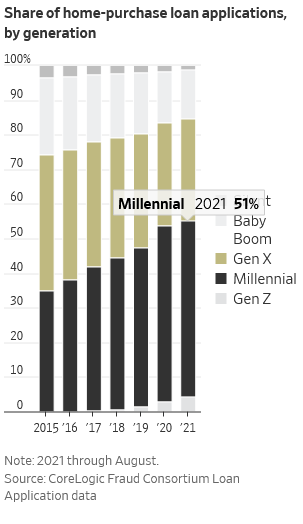

- Millennials Are Supercharging the Housing Market (wsj)

- Sears, Struggling to Sell Goods, Markets a Valuable Asset: Real Estate (nytimes)

- Cash Glut in Eurozone Drives Dollar Demand (wsj)

- China’s Economy Needs More Help (wsj)

- How Is Omicron Affecting Air Travel? (wsj)

- Boeing on Track to Double Aircraft Deliveries in 2021 (barrons)

- Boeing (BA) November Orders/Deliveries ‘Somewhat Encouraging’ but Still Lagging Airbus – Cowen (streetinsider)

- Disney (DIS) Stock Selling Overdone Says Morgan Stanley and Sees Over 20% Upside (streetinsider)

- S. Retail Sales Climbed by Less Than Forecast in November (bloomberg)

- The Big Read. Elon Musk: Interview with FT’s Person of the year (ft)

- Investors pour billions of dollars into inflation-linked assets (ft)

- US to extend China blacklist by 8 more companies (foxbusiness)

- Trader Bet $65 Million in Options on Stock Rebound Into Holiday (bloomberg)

- China’s Economic Slump Fuels Calls for More Stimulus (bloomberg)

- Sinovac Study Spurs Bets on Further China Policy Easing (bloomberg)

- China’s Surging Currency Is a False Signal (bloomberg)

- The Pro-Immigrant Case Against Noncitizen Voting (Michael Bloomberg)

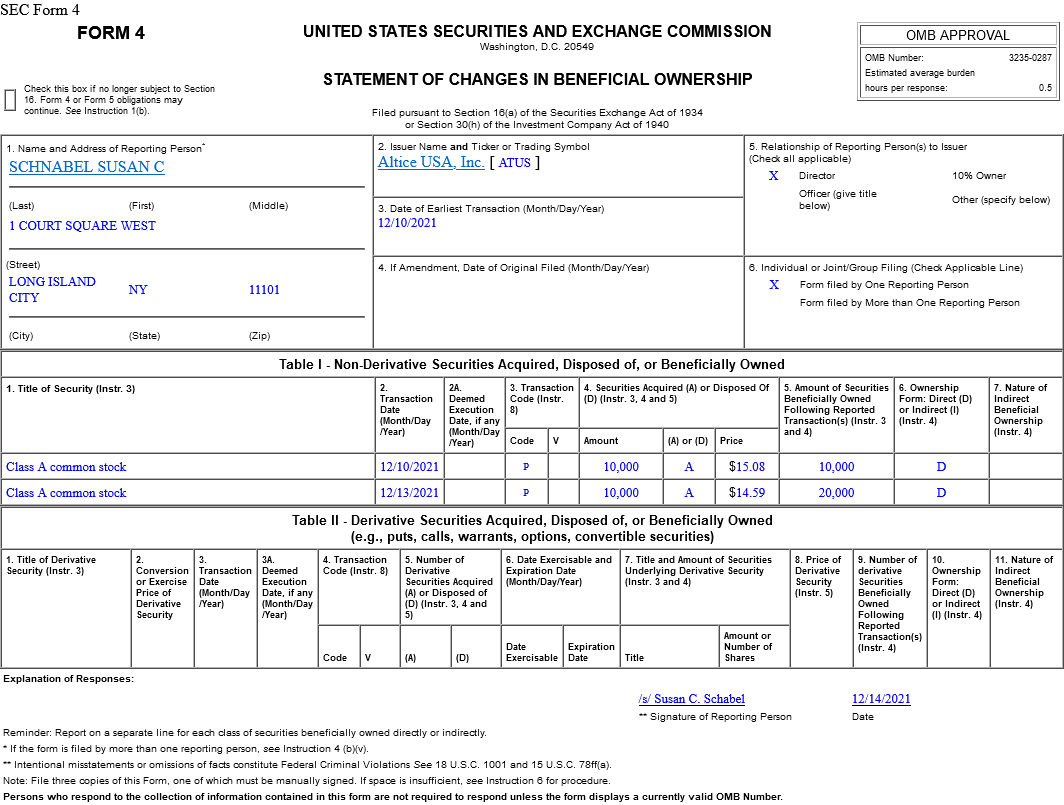

Insider Buying in Altice USA, Inc. (ATUS)

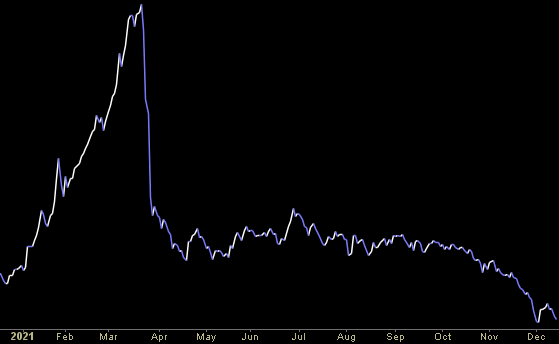

Unusual Options Activity – Teva Pharmaceutical Industries Limited (TEVA)

Data Source: barchart

Today some institution/fund purchased 12,780 contracts of June $14 strike calls (or the right to buy 1,278,000 shares of Teva Pharmaceutical Industries Limited (TEVA) at $14). The open interest was 8,454 prior to this purchase. Continue reading “Unusual Options Activity – Teva Pharmaceutical Industries Limited (TEVA)”

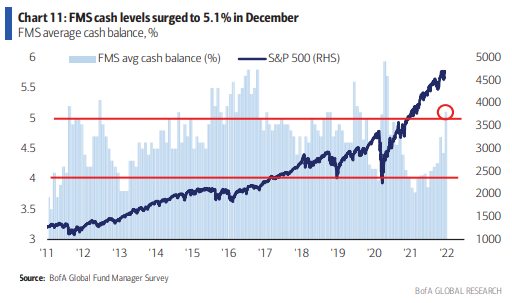

December Bank of America Global Fund Manager Survey Results (Summary)

The December survey covered 371 managers with $1.1 trillion in assets under management. Continue reading “December Bank of America Global Fund Manager Survey Results (Summary)”

Tom Hayes – Cheddar TV Appearance – 12/14/2021

Cheddar TV Appearance – Thomas Hayes – Chairman of Great Hill Capital – December 14, 2021

Watch Directly on Cheddar in HD

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Hedge Fund Tips (PCN) – Position Completion Notification

Be in the know. 20 key reads for Tuesday…

- Huawei, Tencent lose cloud market share as Alibaba, Baidu extend their lead, report shows (scmp)

- Pfizer says final data from late-stage trial of COVID-19 antiviral shows it reduces risk of hospitalization or death by 89% (marketwatch)

- Goldman Sachs Says 3 Aerospace and Defense Stocks May Be the Best Offense in 2022 (247wallst)

- Wall Street Gets Increasingly Bullish on China (bloomberg)

- Stocks’ Rough Patch Could End Soon. The Fed’s Next Move May Be Priced In. (barrons)

- The Fed Meeting Could Be D-Day for Bitcoin and Other Cryptos (barrons)

- How a $6 Bass Pro Shops Hat Became a Fashion Trend (wsj)

- Red-Hot Chip Stocks Are Cooling (bloomberg)

- Fund managers dash for cash ahead of Fed decision (marketwatch)

- Pfizer Stops 70% Omicron Hospitalizations in South Africa Study (bloomberg)

- Mariah Carey’s ‘Queen of Christmas’ Crown Is Worth Far More Than the Royalties (bloomberg)

- Wholesale prices measure rises 9.6% in November from a year ago, the fastest pace on record (cnbc)

- Fed taper will have little impact on Asia markets, UOB strategist says (cnbc)

- The Fed will halt asset purchases by March and hike rates in June, CNBC survey predicts (cnbc)

- These are the 50 top stocks that members of Congress own (businessinsider)

- Opinion: Odds of being a stock market winner in 2022 are in your favor for this one big reason (marketwatch)

- White House scrambles to salvage $1.75tn Build Back Better bill by Christmas (ft)

- Patrick Drahi’s Altice raises stake in BT to 18% (ft)

- Fed Meeting: Stock Market Ready For Faster Taper — But Not This (investors)

- Goldman, Morgan Stanley Say Any Drop in Stocks Likely to Be Small (yahoo)