Schwab Network Appearance – Thomas Hayes – Chairman of Great Hill Capital – April 16, 2025

Where is money flowing today?

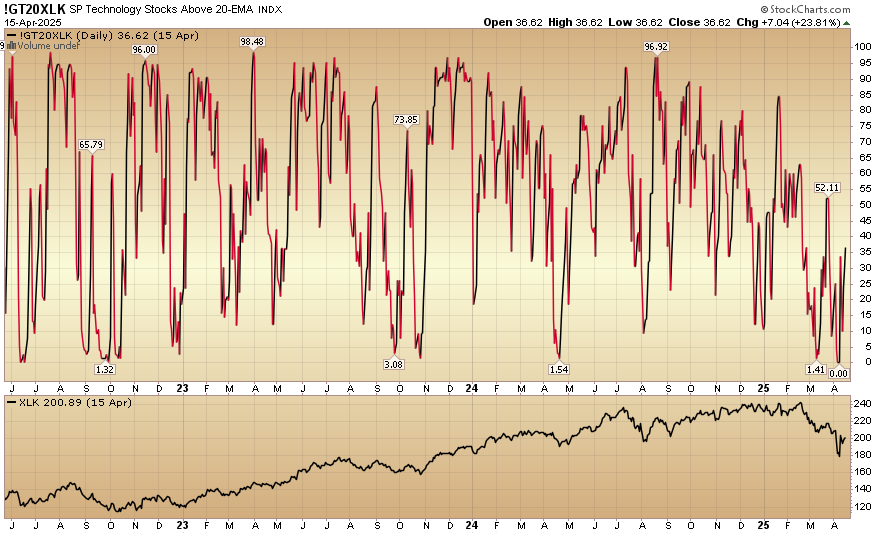

Indicator of the Day (video): S&P Technology Stocks Above 20 EMA

Quote of the Day…

Be in the know. 24 key reads for Wednesday…

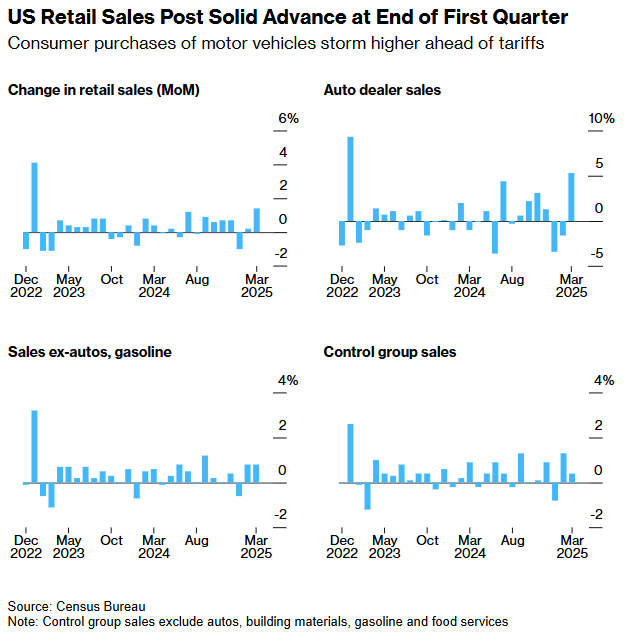

- US Retail Sales Jump by Most in Two Years on Car-Buying Rush (bloomberg)

- Big Banks Show Consumers Remained Resilient Heading Into Tariff Turmoil (wsj)

- U.S. vehicle supply is falling amid tariff fear-buying (cnbc)

- Strong China GDP Growth Fails to Stem Calls for Urgent Stimulus (bloomberg)

- Domestic Consumption Stays Resilient (chinalastnight)

- China Open to Talks If US Shows Respect, Names Point Person (bloomberg)

- China Names New Trade Envoy as Tariff War With US Escalates (bloomberg)

- Watch in full: Jamie Dimon urges US to engage with China (ft)

- Why China Has Room to Boost Economy After Strong GDP Figures (youtube)

- Chinese exporters on Rednote ask local consumers to buy goods meant for US (reuters)

- American Shoppers Flock to Chinese Apps on Tariff Fears (bloomberg)

- The Dollar Has Been Tumbling. How Much Further It May Fall. (barrons)

- What the Weak Dollar Means for the Global Economy (wsj)

- Dollar bearishness reaches highest level since 2006, says survey (ft)

- 3 reasons why Boeing’s stock will be fine even with China halting airplane orders (marketwatch)

- Goldman: “China Doesn’t Move Needle For Boeing Right Now” (zerohedge)

- Why You Shouldn’t Panic Over Daily Market Swings (morningstar)

- Corporate Insiders Flash Bullish Stock Sign by Buying Into Rout (bloomberg)

- Retail Investors Who’ve Only Known Bull Markets Are Buying the Dip (bloomberg)

- Honda to Shift Production of Civic From Japan to US on Tariffs (bloomberg)

- The Trade War Has Crushed Energy; Two Stocks That Could Still Win (barrons)

- Trump Seeks to Boost Use of Technology to Speed Up Permitting (bloomberg)

- Nvidia Says U.S. Implements Chip Export Restrictions to China, Warns of $5.5 Billion Charge (wsj)

- Cooper Standard Recognized as 2024 Supplier of the Year by General Motors (cooperstandard)

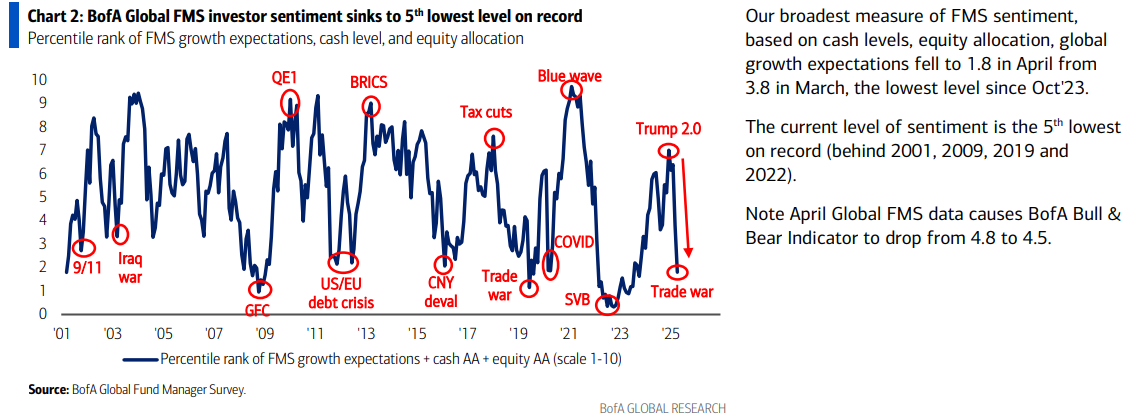

April 2025 Bank of America Global Fund Manager Survey Results (Summary)

The April survey covered 195 institutional fund managers with $444 billion under management. Continue reading “April 2025 Bank of America Global Fund Manager Survey Results (Summary)”

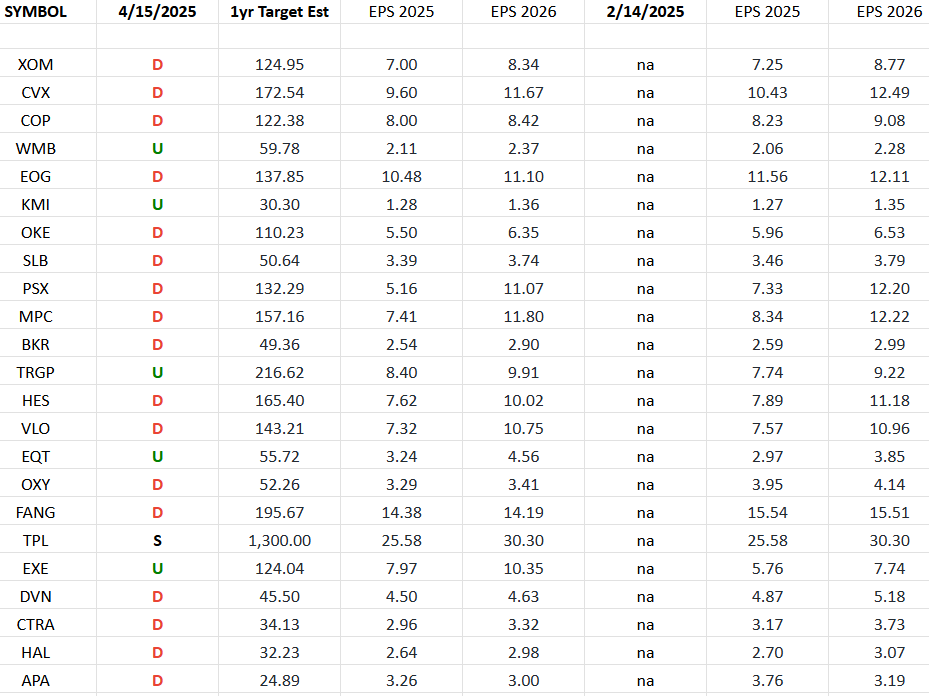

Energy Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Energy Sector ETF (XLE). Continue reading “Energy Earnings Estimates/Revisions”

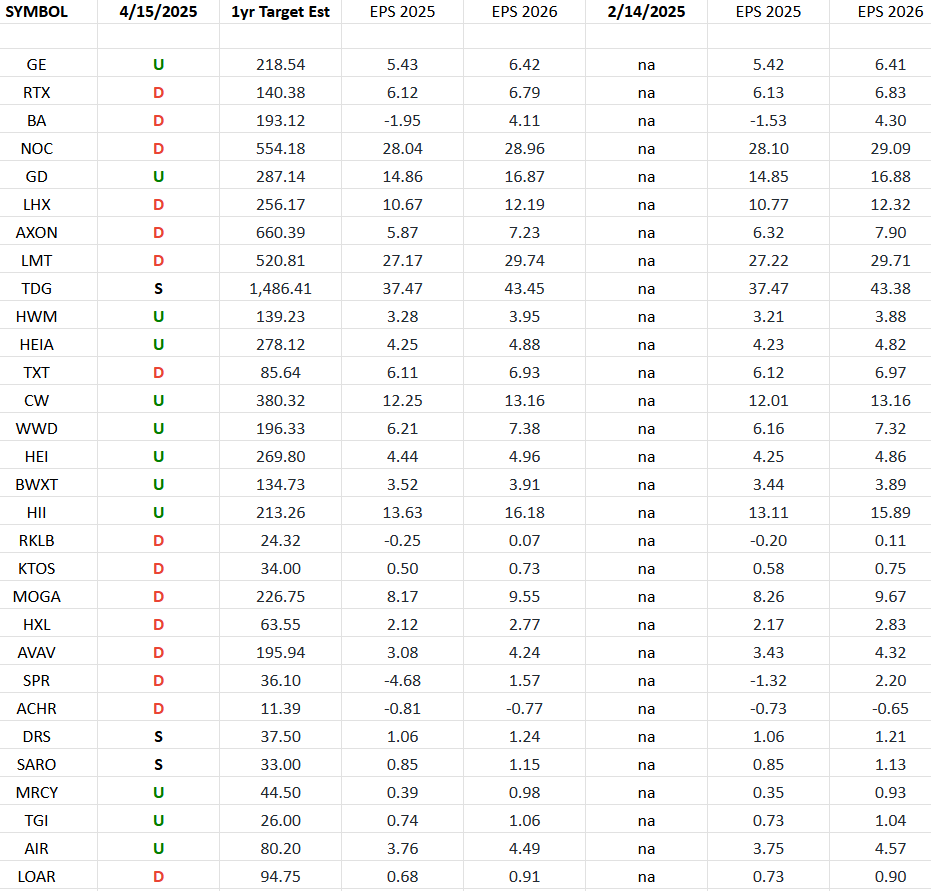

Defense & Aerospace Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Defense & Aerospace ETF (ITA). Continue reading “Defense & Aerospace Earnings Estimates/Revisions”