- Huawei, Tencent lose cloud market share as Alibaba, Baidu extend their lead, report shows (scmp)

- Pfizer says final data from late-stage trial of COVID-19 antiviral shows it reduces risk of hospitalization or death by 89% (marketwatch)

- Goldman Sachs Says 3 Aerospace and Defense Stocks May Be the Best Offense in 2022 (247wallst)

- Wall Street Gets Increasingly Bullish on China (bloomberg)

- Stocks’ Rough Patch Could End Soon. The Fed’s Next Move May Be Priced In. (barrons)

- The Fed Meeting Could Be D-Day for Bitcoin and Other Cryptos (barrons)

- How a $6 Bass Pro Shops Hat Became a Fashion Trend (wsj)

- Red-Hot Chip Stocks Are Cooling (bloomberg)

- Fund managers dash for cash ahead of Fed decision (marketwatch)

- Pfizer Stops 70% Omicron Hospitalizations in South Africa Study (bloomberg)

- Mariah Carey’s ‘Queen of Christmas’ Crown Is Worth Far More Than the Royalties (bloomberg)

- Wholesale prices measure rises 9.6% in November from a year ago, the fastest pace on record (cnbc)

- Fed taper will have little impact on Asia markets, UOB strategist says (cnbc)

- The Fed will halt asset purchases by March and hike rates in June, CNBC survey predicts (cnbc)

- These are the 50 top stocks that members of Congress own (businessinsider)

- Opinion: Odds of being a stock market winner in 2022 are in your favor for this one big reason (marketwatch)

- White House scrambles to salvage $1.75tn Build Back Better bill by Christmas (ft)

- Patrick Drahi’s Altice raises stake in BT to 18% (ft)

- Fed Meeting: Stock Market Ready For Faster Taper — But Not This (investors)

- Goldman, Morgan Stanley Say Any Drop in Stocks Likely to Be Small (yahoo)

Tom Hayes – The Claman Countdown – Fox Business Appearance – 12/13/2021

Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – December 13, 2021

Watch Directly on Fox Business

Where is money flowing today?

Be in the know. 15 key reads for Monday…

- Bristol Myers Squibb raises quarterly dividend and adds $15 billion to share buyback program (marketwatch)

- China Seen Adding Fiscal Stimulus After Setting 2022 Targets (bloomberg)

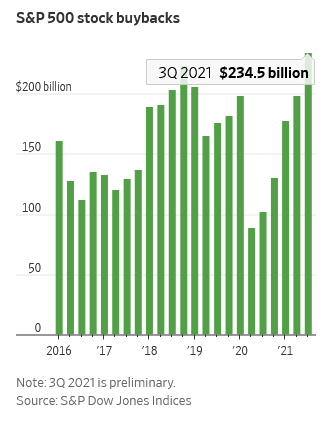

- Buybacks Hit Record After Pulling Back in 2020 (wsj)

- Southwest Air’s Skeptics Are ‘Missing the Point,’ CEO Says (bloomberg)

- Own everything but ‘bubble assets’ tech and crypto, recommends Institutional Investor hall of famer Rich Bernstein (cnbc)

- Buy these 38 stocks to profit as inflation spikes to its highest level in nearly 40 years — and avoid pain from future disruptions, Jefferies says (businessinsider)

- Beijing Signals Growth-Pain Threshold Is Reached (zerohedge)

- Disney (DIS) Stock Remains ‘Significantly Undervalued’, KeyBanc Analyst Sees Over 40% Upside (streetinsider)

- Dan Niles on Apple and China Internet Stocks (cnbc)

- The Bond Market Is Watching for a Fed Mistake. Check the Yield Curve. (barrons)

- As Inflation Roars, the Fed Faces a Thorny Choice (barrons)

- Here Are the Cheapest Stocks in Each Sector of the S&P 500 (barrons)

- Pfizer Booster Shots Are Effective Against Omicron Variant, Israeli Study Says (wsj)

- Traders Delay Bets for U.K. Rates Rising to 1% Amid Omicron Woes (bloomberg)

- Bond Traders Stare at Worst Real Returns Since Paul Volcker Era (bloomberg)

Be in the know. 20 key reads for Sunday…

- China Shifts Back to Emphasizing Economic Stability (wsj)

- Opinion: These 6 overvalued stocks are making the S&P 500 look more pricey than it really is (marketwatch)

- The Big Vaccine Pivot: Merck Falters on Covid-19 Shots, Then Makes One for Rival J&J (wsj)

- This Supercar Pays Tribute to Ford’s Le Mans History (wsj)

- Americans put aside their economic fears to spend again (ft)

- Democrats push Fed for tougher action against inflation (ft)

- Four top travel destinations for 2022 (ft)

- Cramer: Stay invested when Fed hikes rates, history shows stocks can still rally (cnbc)

- How far will ‘Powell’s new hawkish tilt’ go? Here’s what investors will be looking for from the Fed’s meeting next week (marketwatch)

- Two Weeks Into the Omicron Outbreak: Where to From Here? (bloomberg)

- SALT Talks Continue as Senate Democrats Release Tax Plan (bloomberg)

- What You Need to Know About Web3, Crypto’s Attempt to Reinvent the Internet (bloomberg)

- Best Buy Stock Has Slumped. Chairman J. Patrick Doyle Bought Shares. (barrons)

- bluebird bio Has Good News on Its Gene Therapies (barrons)

- Iran Bets Its Economy Will Hold as It Takes Tough Stance on Nuclear Program (wsj)

- Solid Year So Far, But Q4 Rally Destiny up to Fed (Almanac Trader)

- Intel shows research for packing more computing power into chips beyond 2025 (reuters)

- ECRI Weekly Leading Index Update (advisorperspectives)

- ASML, the Obscure Powerhouse at the Cutting Edge of Chip Technology (bloomberg)

- GaryVee’s Guide to Inventing the Future With NFTs (inc)

Be in the know. 12 key reads for Saturday…

- California Utilities Are Worth Another Look (morningstar)

- Skate to where the puck is going (dividendgrowthinvestor)

- Evergrande bondholders settle in for lengthy restructuring process (ft)

- How to Invest Like Warren Buffett (morningstar)

- Bill Miller: One Of The Best Ways To Find Opportunities (acquirersmultiple)

- S. liquefied natural gas export capacity will be world’s largest by end of 2022 (eia)

- GMO: Growth Traps Are Worse Than Value Traps (acquirersmultiple)

- Scientists Call for Making Pluto a Planet Again (futurism)

- Gabelli: How to profit from ‘corporate lovemaking’ (foxbusiness)

- Interview With Oaktree Capital Founder Howard Marks on the Company Further Expansion in China (yicaiglobal)

- Charlie Munger goes off on crypto, says China made the right decision when they banned it (fortune)

- Sumner Redstone: Winning Above All Else. (neckar)

Hedge Fund Tips (PCN) – Position Completion Notification

Where is money flowing today?

Be in the know. 18 key reads for Friday…

- Here Are the Cheapest Stocks in Each Sector of the S&P 500 (barrons)

- JPMorgan markets guru Marko Kolanovic unveils his 20 global ideas for investors to maximize their returns in 2022 (businessinsider)

- Comeback Battle Royal. The Energy Report 12/10/2021 (Phil Flynn)

- Lockheed Martin to Sell 64 Fighter Jets to Finland in a $9.5 Billion Deal (barrons)

- How Hong Kong Is Stepping Up to Attract U.S.-Listed Chinese Companies (barrons)

- China’s Latest Challenge Is Engineering a Soft Landing for a Sputtering Economy (wsj)

- China’s Factory-Gate Inflation Softens in November (wsj)

- China Reopens a Funding Spigot for Property Developers (wsj)

- Rupert Murdoch Buys $200 Million Montana Ranch From the Koch Family (wsj)

- Elon Musk, Other Leaders Sell Stock at Historic Levels as Market Soars, Tax Changes Loom (wsj)

- The Billion-Dollar Property Portfolios of Queen Elizabeth and Prince Charles (wsj)

- Bets on 2022 Fed Rate Hikes Dented as CPI Matches Expectations (bloomberg)

- Inflation Is Here. The Big Debate Is, Will It Stay? (bloomberg)

- China Shifts Focus to Economic Stability as Growth Weakens (bloomberg)

- Why bank stocks still have room to grow, according to this portfolio manager (cnbc)

- An exclusive look at JPMorgan Asset Management’s 2022 investment outlook reveals which 4 stock sectors the firm is most bullish on — and why rich US valuations and inflation aren’t worth worrying about (businessinsider)

- China Battles Against Hot Money With Swift Yuan Intervention (bloomberg)

- Here’s a list of favored dividend stocks with room to pay more for investors worried about 2022 (marketwatch)

Tom Hayes – Quoted in Reuters articles – 12/10/2021

Article 1:

Thanks to Devik Jain and Bansari Mayur Kamdar for including me in their articles on Reuters today. You can find them here:

Click Here to View The Full Article on Reuters

Article 2: