Hedge Fund Tips with Tom Hayes – Podcast – Episode 102

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

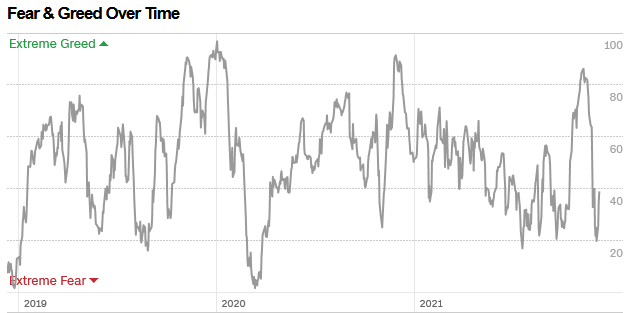

Indicator of the Day (video): CNN Fear & Greed Index

Be in the know. 18 key reads for Thursday…

- China Markets Are Hot Again as Traders Bet on More Policy Easing (bloomberg)

- China’s Credit Growth Rebounds in November After Slowdown (bloomberg)

- Biotech Has Been Crushed: 5 Stocks to Buy Now That Pay Big Dividends (247wallst)

- FDA Authorizes AstraZeneca Drug to Prevent Covid. It’s an Alternative to Vaccines for Some. (barrons)

- Novartis CEO Vasant Narasimhan Sees Consistent Growth While Sitting on Cash (barrons)

- CVS Boosts Its Earnings Outlook and Dividend Payout. (barrons)

- The Bond Market Is Watching for a Fed Mistake. Check the Yield Curve. (barrons)

- Credit Suisse boosts S&P 500 target, citing strong economy and stalling stimulus legislation (marketwatch)

- Beijing Reins In China’s Central Bank (wsj)

- Fewer Americans quit their jobs in October as openings rose again (nypost)

- S. Jobless Claims Decline to Lowest Level Since 1969 (bloomberg)

- China Is Slamming Shut Its Window of Opportunity (bloomberg)

- Joe Manchin sounds fed up with Biden’s spending plans: ‘We’ve done everything that we can to help people’ (businessinsider)

- Hormel reports record sales (marketwatch)

- China Evergrande Defaults on Its Debt. Now What? (nytimes)

- China’s Central Bank Is Under Pressure, But to What End? (wsj)

- Alibaba Stock Looks Like a Screaming Buy. Jump in at Your Own Risk. (barrons)

- Economists predict complete ‘taper’ of Fed bond buying by end of March (ft)

Chair Powell: Chance to be a Hero or Zero…

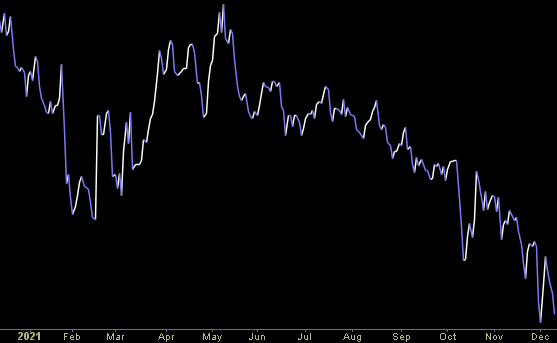

Last week, in the midst of the Omicron/Accelerated Taper fears/selloff, we suggested the market was due for a bounce. The indicators we pointed to are as follows (click on image to see original article from last Wednesday night): Continue reading “Chair Powell: Chance to be a Hero or Zero…”

Hedge Fund Tips (PCN) – Position Completion Notification

Where is money flowing today?

Be in the know. 15 key reads for Wednesday…

- Pfizer Says 3 Doses of Its Vaccine Are Effective Against Omicron (barrons)

- Manchin Won’t Pledge to Support Biden’s Spending Bill (barrons)

- Looking for Good Stocks With Big Dividends? Here’s Our List. (barrons)

- Southwest Airlines Has Good News on Revenue, Fuel Costs (barrons)

- Volkswagen Considers Porsche IPO to Fund Electric-Vehicle Transition (barrons)

- Here’s how much the pandemic has been worth to the average American household (marketwatch)

- Meta Stock Has Gone Nowhere in Weeks. This Analyst Sees an Opportunity. (barrons)

- China Will Soon Lead the U.S. in Tech (wsj)

- Mortgage rates dip for the first time in a month boosting applications (foxbusiness)

- Raytheon Technologies (RTX) Announces $6B Share Buyback Program (streetinsider)

- Crypto Is ‘Top Contender’ for Correction, Money Managers Say (bloomberg)

- Nissan Is on ‘Good’ Path With Profits, Electrification, COO Says (bloomberg)

- The Next Fed Meeting Will Offer More Surprises (bloomberg)

- Cramer’s lightning round: Illumina and SoFi are buys (cnbc)

- Legendary investor Peter Lynch breaks with Warren Buffett, warning passive investors they’re losing out and backing the best fund managers to keep beating the market (businessinsider)