Data Source: finviz

Be in the know. 10 key reads for Tuesday…

- $15 Billion In Inflows Every Single Day: Goldman Bets It All On A Meteoric Year-End Meltup (zerohedge)

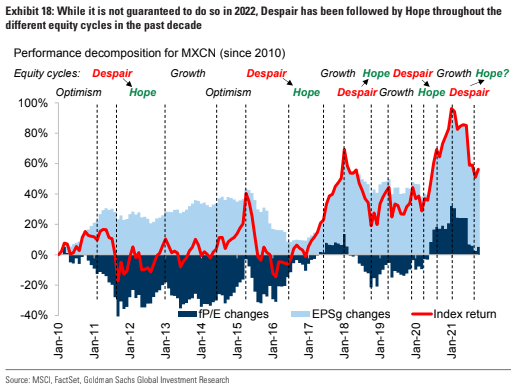

- As Markets Brace For Beijing Easing, Chinese State Media Unveils 25bps RRR Cut Before Year-End (zerohedge)

- Goldman Sachs Loves These 5 Buy-Rated Stocks With Accelerating Sales Growth for 2022 (247wallst)

- Buy Boeing (BA) Stock as Selling Seems Over-done – Seaport (streetinsider)

- U.S. taps Strategic Petroleum Reserve in bid to push down gasoline prices (marketwatch)

- Energy Stocks Can Make a Comeback. Oil Is Down but Not Out. (barrons)

- 4 Energy Stocks Pumping Out Tons of Cash (barrons)

- The Dogs of the Dow Are Ending 2021 With a Whimper. Why Next Year Could Be Better. (barrons)

- Investors will overcome a rising wall of worry to push the S&P 500 beyond 4,800 by year-end, Fundstrat says (businessinsider)

- “Rounding Error” – Oil Prices Surge As Biden SPR Release Backfires (zerohedge)

Where is money flowing today?

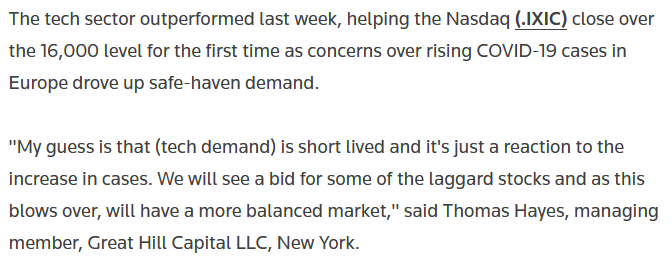

Tom Hayes – Quoted in Reuters article – 11/22/2021

Thanks to Devik Jain and Ambar Warrick for including me in their article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

Be in the know. 8 key reads for Monday…

- Alibaba Stock and Others Fall After New Chinese Scrutiny. Why the Worst May Be Over. (barrons)

- KKR Offers $12 Billion to Take Telecom Italia Private (barrons)

- It May Be Time to Buy China’s Bonds—Carefully (barrons)

- Supply-Chain Problems Show Signs of Easing (wsj)

- Why Japan Appears Immune to Global Inflation Surge, So Far (wsj)

- As Hopes for Nuclear Deal Fade, Iran Rebuilds and Risks Grow (nytimes)

- Please Release Me. The Energy Report 11/22/2021 (Phil Flynn)

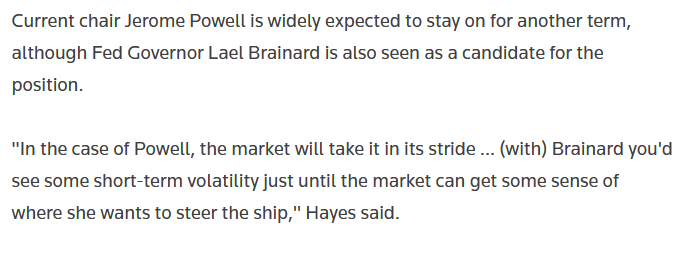

- Biden Keeps Powell as Fed Chief, Elevates Brainard to Vice Chair (bloomberg)

Be in the know. 10 key reads for Sunday…

- How Will the COVID Pills Change the Pandemic? (newyorker)

- Wall St Week Ahead Investors bet on second wind for lagging U.S. small caps (reuters)

- ECRI Weekly Leading Index Update (advisorperspectives)

- Global Supply-Chain Problems Show Signs of Easing (wsj)

- Modern Monetary Theory Isn’t the Future. It’s Here Now. (wsj)

- Takeaways From the Biden-Xi Meeting (cfr)

- ASML, the Obscure Powerhouse at the Cutting Edge of Chip Technology (bloomberg)

- China Junk-Bond Bargain Hunters Trigger 388% Surge in ETF Assets (bloomberg)

- Kissinger Doesn’t See China Invasion of Taiwan in Next Decade (bloomberg)

- Ferrari Pays Homage to 1960s Race Cars With Slick Model (bloomberg)

Be in the know. 22 key reads for Saturday…

- Goldman Sachs Upgrades China Equities (GS)

- As China Changes, Investors Can Still Win. 13 Picks From Our International Roundtable. (barrons)

- Brainard’s Odds to Be Nominated as Fed Chair Have Improved, Says This Analyst (barrons)

- For This Utility, Regulation Can Be a Good Thing (barrons)

- Boeing 787 Deliveries Are Delayed Again. There’s More Behind the Stock’s Slide. (barrons)

- Falling real yields are a key to the stock-market rally: What investors need to know (marketwatch)

- Here’s what history says about stock-market performance during the Thanksgiving week (marketwatch)

- As Musk Sells, Uber CEO Buys $9 Million in Shares (barrons)

- Turkey’s Currency Crisis Raises Cost of Living, Threatens Financial System (wsj)

- Investing legend Mario Gabelli weighs in on markets, conglomerate break-ups (youtube)

- Charting the Global Economy: Retail Sales Firm in U.S., China (bloomberg)

- Unrest Is Spreading in Europe as Coronavirus Lockdowns Return (bloomberg)

- China Fines Alibaba, Tencent in Latest Antitrust Investigation (bloomberg)

- Citadel CEO Ken Griffin pays $43.2 million for Constitution copy, outbidding crypto group (cnbc)

- Two Democrats Oppose Powell for Fed Chair, Citing Climate Change (wsj)

- Japan Plans $490 Billion Stimulus to Jolt Struggling Economy (wsj)

- The Art Market Surges, Selling $2.3 Billion in Works (wsj)

- China’s Big Commodity Inflation Scare Is Easing — For Now (bloomberg)

- Everything in the House Democrats’ Budget Bill (nytimes)

- Ray Dalio Says, ‘If You Worry, You Don’t Have to Worry’ (nytimes)

- Watch CNBC’s full interview with Liberty Media Chairman John Malone (cnbc)

- Ray Dalio Brilliantly Explains The Big Debt Catastrophe (youtube)