Where is money flowing today?

Data Source: Finviz

Be in the know. 15 key reads for Thursday…

- Boeing Stock Upgraded — Again. Analysts See a Turnaround Coming. (barrons)

- Here’s How Markets Might React If Biden Picks Lael Brainard as Fed Chair (yahoo)

- Boeing upgraded to Overweight from Neutral at JPMorgan (thefly)

- Alibaba Outlook Disappoints After China’s Slowdown Hurt Sales (bloomberg)

- Defensive Stocks’ Time Is Coming. 3 Healthcare Firms to Consider. (barrons)

- Spinoffs Are Nothing New, and No Cause for Alarm (barrons)

- AstraZeneca Says Preventive Covid Antibody Drug Reduces Risk by 83% (barrons)

- 4 Beaten-Down Biotech Stocks That Could Take Off (barrons)

- Amazon to Stop Accepting U.K.-Issued Visa Credit Cards (wsj)

- Turkish Lira Tumbles After Erdogan Renews Call for Unorthodox Rate Cuts (wsj)

- Iran’s stockpile of near-weapons-grade nuclear fuel has jumped significantly, according to a confidential report by the U.N. atomic agency. (wsj)

- The S&P 500 will hit 5,000 early next year as global supply chain pressures begin to ease, JPMorgan says (businessinsider)

- Goldman Sachs lays out the best investments to buy in 2022 — and what to avoid — when rising interest rates and higher taxes slow down stock market gains (businessinsider)

- Oil near six-week low as China readies crude reserve release (streetinsider)

- Bank of America explains why the energy sector offers ‘inflation-protected yield on steroids’ as prices surge — and ranks how the other 10 perform (businessinsider)

The Luke Bryan “Play It Again” Stock Market (and Sentiment Results)…

In recent weeks’ articles and podcast|videocast(s) we’ve made the case that volatility will pick up in 2022 as liquidity slowly starts to come out of the market. When we laid out the case for 2021 (in January) we were expecting high teens returns for the S&P 500 coupled with low volatility (multiple pullbacks contained to 3-5%). That has borne out (and then some)… Continue reading “The Luke Bryan “Play It Again” Stock Market (and Sentiment Results)…”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Unusual Options Activity – Baidu, Inc. (BIDU)

Data Source: barchart

Today some institution/fund purchased 20,180 contracts of Dec $195 strike calls (or the right to buy 2,018,000 shares of Baidu, Inc. (BIDU) at $195). The open interest was just 1,189 prior to this purchase. Continue reading “Unusual Options Activity – Baidu, Inc. (BIDU)”

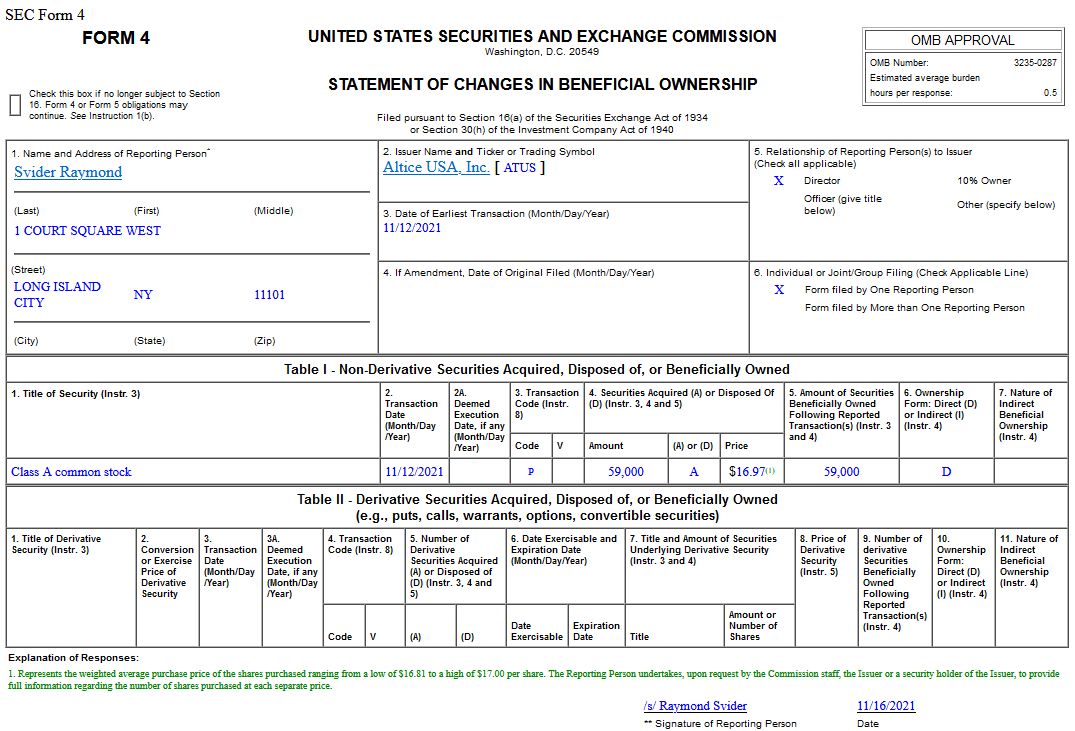

Insider Buying in Altice USA, Inc. (ATUS)

Where is money flowing today?

Data Source: Finviz

Be in the know. 20 key reads for Wednesday…

- Wells Fargo upgrades Boeing on positive risk/reward after underperformance (thefly)

- Is Japan still a value trap? (ft)

- Biden-Xi Talks a ‘Good Beginning’ to Avoid Clash, Kissinger Says (bloomberg)

- $8 Billion Takeover Offer Could Avert One of China’s Biggest Potential Corporate Failures (bloomberg)

- Stocks are set to rise 10% next year as corporate earnings continue to grow, Goldman Sachs says (businessinsider)

- UBS breaks down why beaten-down stocks will finally shine in early 2022 as high-growth names falter — but lays out why investors should make the opposite trade over the next 5 years (businessinsider)

- Who Will Be the Next Fed Chair? Here’s Why Brainard Is Gaining on Powell. (barrons)

- Baidu Posts Sharp Loss but Revenue Rises 13% on Cloud Growth (barrons)

- Brainard Is an Inflation Skeptic Who Sees Poverty Reduction as Key (barrons)

- Iran Resumes Production of Advanced Nuclear-Program Parts, Diplomats Say (wsj)

- GE Pounces on Surging Healthcare Demand With Spinoff (wsj)

- China to Ease ABS Curbs; Hui Injects Funds: Evergrande Update (bloomberg)

- Secretive Chinese Committee Draws Up List to Replace U.S. Tech (bloomberg)

- Short Sellers Giving In May Be a Bearish Signal (bloomberg)

- Goldman’s Solomon Says Market Greed Is Now Outpacing Fear (bloomberg)

- Bill Hwang Made a Huge, Secret Bank Bet Before Archegos Collapse (bloomberg)

- The Biden-Xi meeting left one big question unanswered, says analyst (cnbc)

- An investor hailed as ‘The Chinese Warren Buffett’ just revealed a $245 million stake in Berkshire Hathaway — and now counts Buffett’s company among his biggest bets (businessinsider)

- This Treasury dealer says the market has it entirely wrong on the Fed and interest rates. Here’s why. (marketwatch)

- Boeing lands 20 freighter orders, plans new conversion lines in UK, Canada (yahoo)