- China Guides Mutual Funds, Insurers to Invest More in Stocks (bloomberg)

- China urges state-backed funds to buy more stocks amid market slump (cnbc)

- Saudi Leader Offers $600 Billion Investment Pledge in Trump Call (bloomberg)

- One by One, World Leaders in Davos Fall in Line in Trump Era (bloomberg)

- As Trump Lobs Tariff Threats, White House Maps Trade Overhaul (bloomberg)

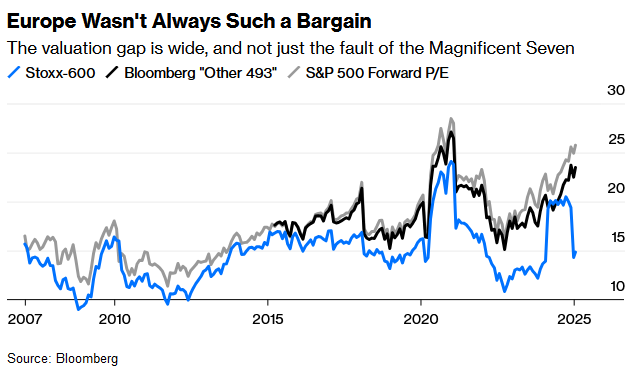

- Cheap, Not Trump, Is Why European Stocks Are Spiking (bloomberg)

- Stock-Market Bulls Are Staring Down Positioning for Rally Clues (bloomberg)

- Trump Maps Pivot From Quick Wins to Harder, ‘Solvable’ Problems (bloomberg)

- Musk Pours Cold Water on Trump-Backed Stargate AI Project (wsj)

- Why Markets Love the Latest Raft of Earnings (barrons)

Tom Hayes – CNBC Indonesia Appearance – 1/23/2025

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Tom Hayes – CGTN America Appearance – 1/21/2025

Where is money flowing today?

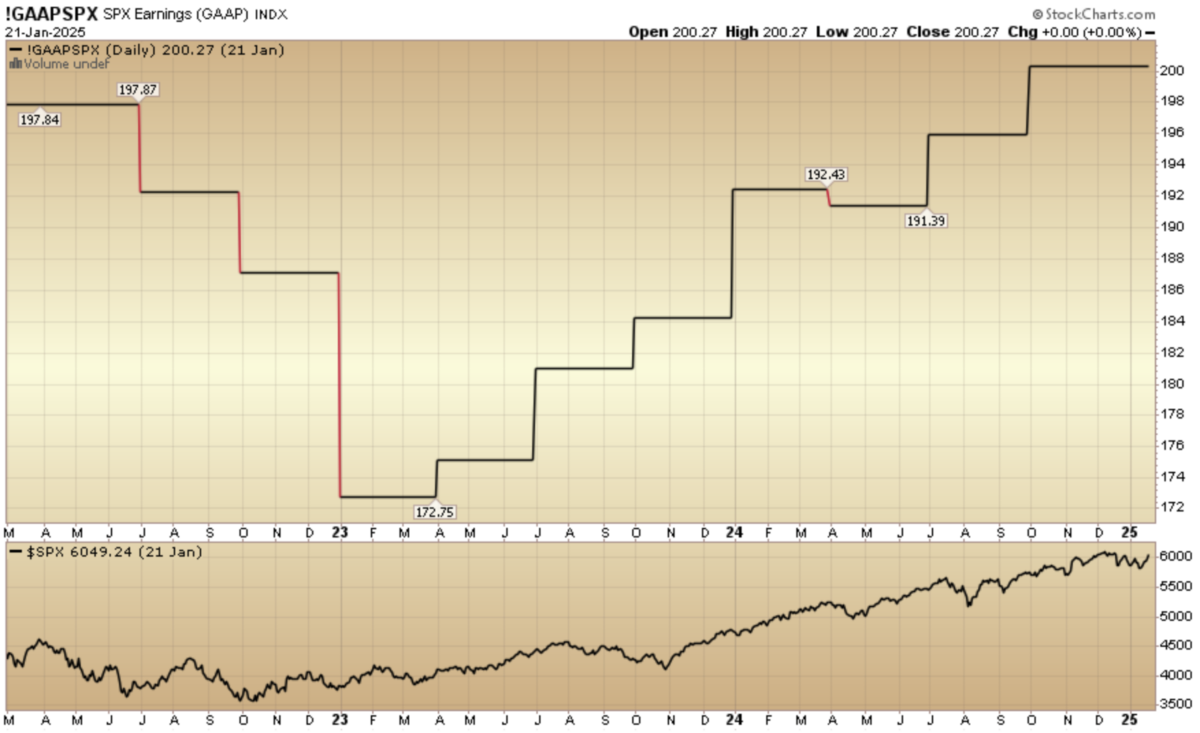

Indicator of the Day (video): S&P 500 GAAP Earnings

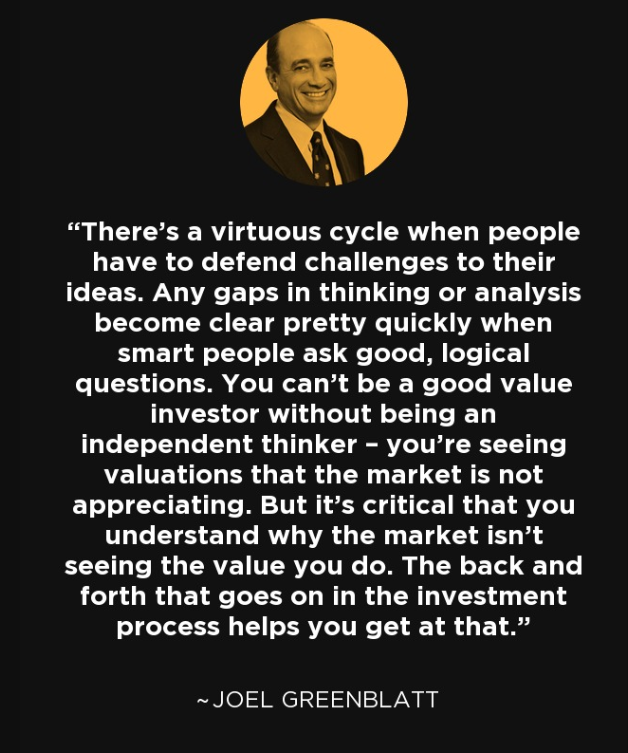

Quote of the Day…

Be in the know. 37 key reads for Wednesday…

- BofA Says Benign Trump Policies to Spark Rally in Stock Laggards (bloomberg)

- China’s Social Security Fund Told To Buy Stocks (chinalastnight)

- China Eases Rules for Long-Term Funds to Boost Stock Market (bloomberg)

- How Javier Milei’s Tough Remake of Argentina Made Him a MAGA Hero (wsj)

- Putin and Xi Stick Together in Video Call After Trump’s Inauguration (wsj)

- 20 value stocks primed for rapid revenue growth (marketwatch)

- Trump’s dream TikTok deal could set a blueprint for doing business with China (nypost)

- Here’s the key date to watch for Trump’s tariff policies, one analyst says (marketwatch)

- Trump’s Day 1 executive orders target EVs, inflation, immigration. Here’s what could come next. (marketwatch)

- Opinion: Trump’s first 100 days: What he must do on trade, immigration and tax cuts (marketwatch)

- Opinion: Faster growth can fix many of America’s problems. Here’s how Trump can succeed. (marketwatch)

- Is it time to shift to a value-focused investment strategy? (yahoo)

- Jamie Dimon says US stock market ‘kind of inflated,’ critics need to ‘get over’ Trump tariffs (nypost)

- Americans flocked to this southern US state in droves in 2024 (nypost)

- Trump Threatens 10% Tariff on China, Cites Trade Deficit With EU (bloomberg)

- US Mortgage Rates Drop to 7.02%, First Decline in Six Weeks (bloomberg)

- Einhorn says the market is at the fartcoin stage of the cycle. His fund bought Peloton and made these moves. (marketwatch)

- New Tariffs Didn’t Come on Trump’s Day One. A Trade War May Not Be in the Wings. (barrons)

- Trump ‘Uncertainty’ Claims a Victim. Ford Stock Catches a Downgrade. (barrons)

- Davos Reaction to Trump 2.0: Buckled Up and Ready for His New Term (wsj)

- Musk Pours Cold Water on Trump-Backed Stargate AI Project (wsj)

- The Alcohol Industry Is Hooked on Its Heaviest Drinkers (wsj)

- Five Things to Know About Trump’s Energy Orders (wsj)

- A List of Trump’s Key Executive Orders—So Far (wsj)

- Trump Keeps China Guessing on Tariff Threats (wsj)

- An Anxious Federal Workforce Bids Goodbye to Job Stability and Remote Work (wsj)

- Trump to Spur US Tech Deals Boom, Qatar’s $510 Billion Fund Says (bloomberg)

- Why Trump Is Pledging to Refill the US Oil Reserve (bloomberg)

- TikTok Saga Shows Americans Can’t Be Bothered to Take On China (bloomberg)

- Trump Says He’s Open to Elon Musk or Larry Ellison Purchasing TikTok (bloomberg)

- Jamie Dimon says Trump’s tariff policy is positive for national security so people should ‘get over it’ (cnbc)

- A Chinese startup just showed every American tech company how quickly it’s catching up in AI (businessinsider)

- S. investors liked the Stargate AI news. Asian investors loved it. (marketwatch)

- All Federal DEI Offices To Be Closed By Wednesday EOD, Workers Placed On Paid Leave: White House (zerohedge)

- Extremes Become More Extreme, Then Revert To The Mean (zerohedge)

- Trump highlights partnership investing $500 billion in AI (apnews)

- China directs funds to stabilise stock market amid Trump tariff threats (scmp)

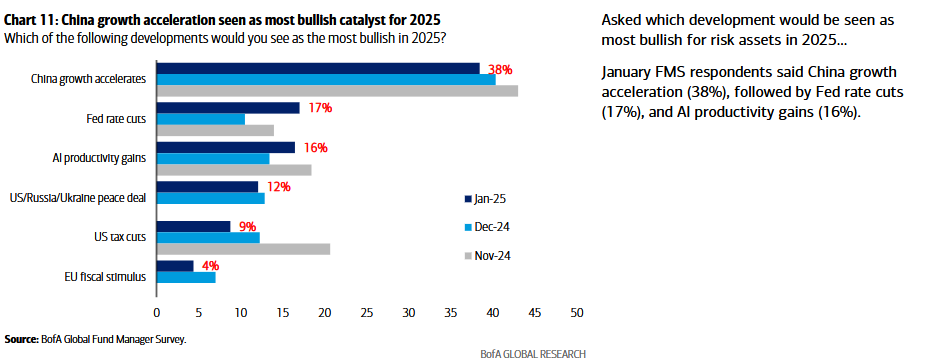

January 2025 Bank of America Global Fund Manager Survey Results (Summary)

The January survey covered 182 institutional fund managers with $513 billion under management. Continue reading “January 2025 Bank of America Global Fund Manager Survey Results (Summary)”

Tom Hayes – Yahoo! Finance “Stocks In Translation” Appearance – 1/8/2025

Yahoo! Finance Appearance – Thomas Hayes – Chairman of Great Hill Capital – January 8, 2025