Data Source: Finviz

Quote of the Day…

Be in the know. 20 key reads for Tuesday…

- VF Stock Surges After Q2 Sales Beat, Profit Swing (footwearnews)

- For fiscal 2024, PayPal now expects adjusted earnings per share to grow in the high teens, compared with an earlier forecast of low to mid-teens growth. (barrons)

- China Weighs $1.4 Trillion Fiscal Stimulus Package, Reuters Says (bloomberg)

- It Has Your Money—and Your Pants Size. Here’s What PayPal Is Doing With Them. (wsj)

- Alphabet’s Search and Spending Is All Wall Street Cares About. (barrons)

- 3 Titans Spent Tens of Billions on AI. Will They Regret It? (barrons)

- Pfizer Rises After Earnings Beat, Guidance Hike (barrons)

- Boeing Moves to Raise $19 Billion in Equity (wsj)

- Bosses Are Calling Workers Back to the Office. That’s Good News for Landlords. (wsj)

- At Boeing and Starbucks, Different Problems but Similar CEO Messages (wsj)

- Estée Lauder Succession Drama to End With Insider Pick (wsj)

- The 25 Best Pizza Places in New York Right Now (nytimes)

- Milei’s Revamp Offers CEOs a Glimmer of Optimism About Argentina (bloomberg)

- China Investors Scour Protest Data for Clues to Next Stimulus Moves (bloomberg)

- CEOs Are Saying This Is as Bad as It Gets for Their Earnings (bloomberg)

- What’s Different Between 2016 Trump Trade and Now (bloomberg)

- Fed goes quiet ahead of its Nov. 7 meeting, with quarter-point cut seen as likely (marketwatch)

- Ministry Of Finance Hints At NPC Fiscal Policy, Reiterates 2024 GDP Goal (chinalastnight)

- JPMorgan CEO Jamie Dimon says ‘it’s time to fight back’ on regulation (reuters)

- Job openings fall to lowest level since January 2021 (yahoo)

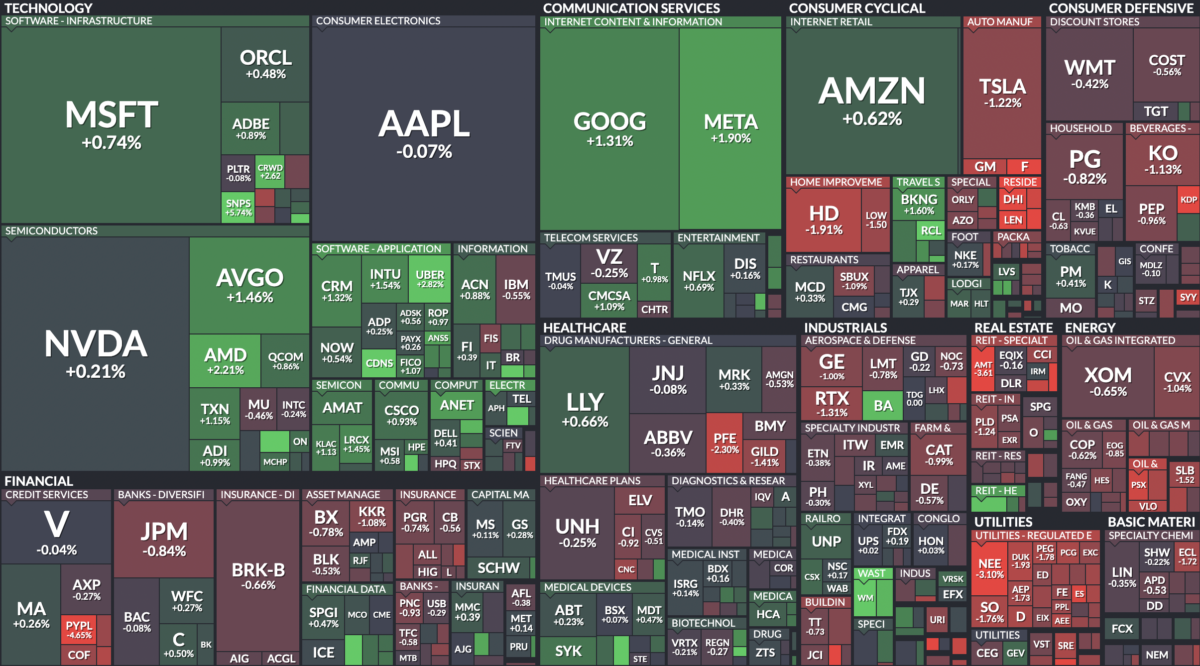

Where is money flowing today?

Quote of the Day…

Be in the know. 11 key reads for Monday…

- PayPal Earnings Due. Wall Street Eyes 2025 Catalysts Amid Big Run. (investors)

- Boeing Is Selling Stock—A Lot of It. The Shares Are Surprisingly Steady. (barrons)

- There’s a ‘generational opportunity’ for investors in this sector, says JPMorgan (marketwatch)

- Ford Earnings Are Coming. They Need to Be Better. (barrons)

- Pfizer’s Activist Battle Might Fizzle—but Its Stock Probably Won’t (wsj)

- Elliott Hunts Bigger Prey, Testing Limits in Barrage of Activism (bloomberg)

- Palm Beach Is Having a Luxury Hotel Renaissance (bloomberg)

- Cut or pause? 2 critical reports will determine what Fed does in November. (yahoo)

- Musk predicts he could save taxpayers $2,000,000,000,000 if Trump wins (foxbusiness)

- Intel invests US$300 million in China chip packaging and testing plant (scmp)

- Alibaba Presents First Full-process AI Product (aastocks)

Quote of the Day…

Be in the know. 14 key reads for Sunday…

- Intel and Samsung explore foundry alliance to challenge TSMC (technode)

- China’s GenZers Are Into Stocks. They Are So Over the Housing Crisis. (barrons)

- Intel Stock Needs an Nvidia-Like Run to Save the CEO’s Stock Awards (barrons)

- Big Tech Stocks Lose Some of Their Aura as Earnings Growth Slows (bloomberg)

- Savers Bid a Sad Farewell to Higher Yields (wsj)

- It’s not just obesity. Drugs like Ozempic will change the world (economist)

- Ferrari 296 GTB: Absurdly Potent, Outrageously Capable (roadandtrack)

- Impact of CRISPR in cancer drug discovery (science)

- Why pros like Rory McIlroy use this practice method to improve their golf swing (golfdigest)

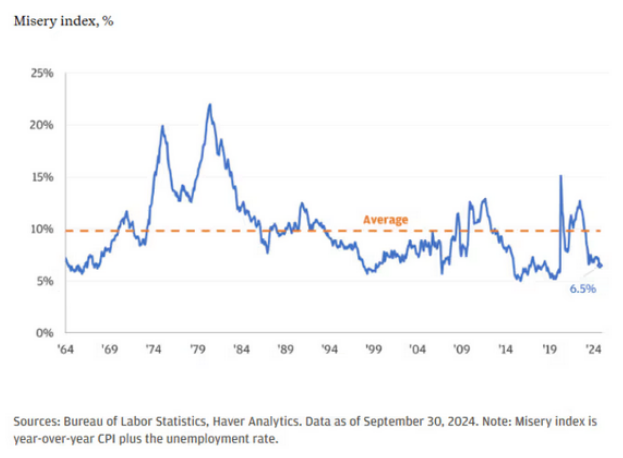

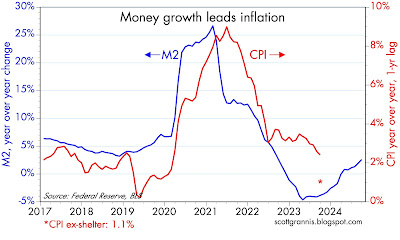

- Slow M2 means low CPI (scottgrannis)

- Consumer confidence seen as key driver for growth (cn)

- China property: Sunac’s multimillion-yuan One Sino Park in Shanghai sells out in 3 hours (scmp)

- This is why David Einhorn thinks Peloton could be worth five times what it is now (cnbc)

- The A.I. Power Grab (nytimes)