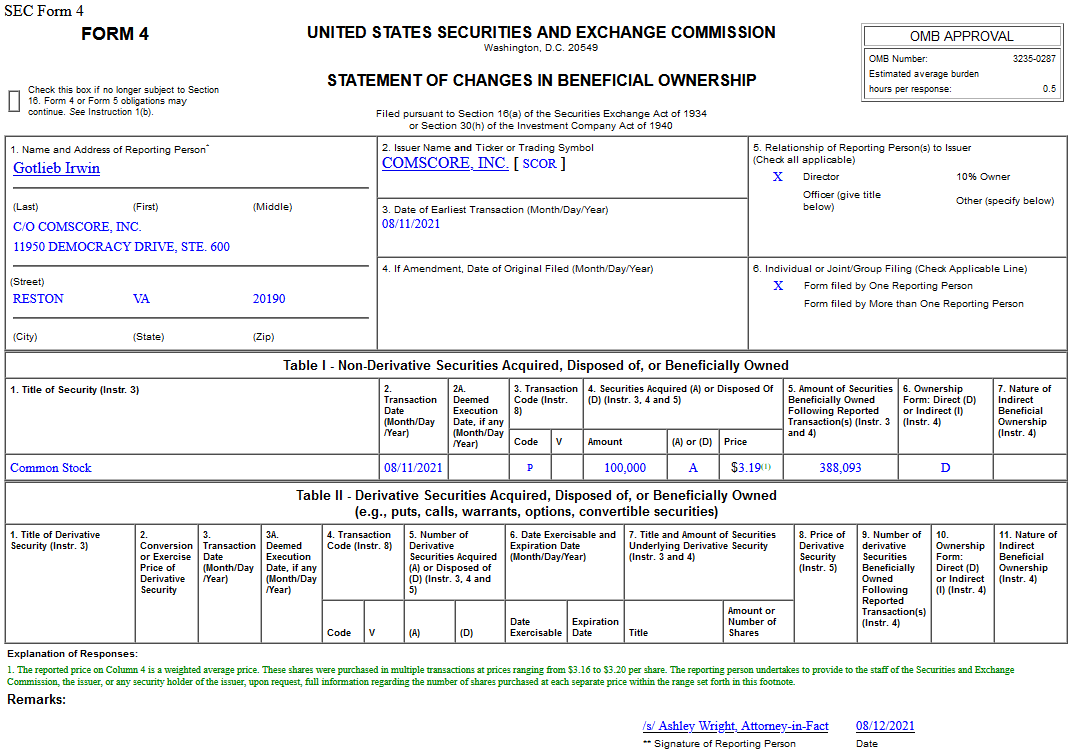

On Aug 11, 2021, Irwin Gotlieb – Director of comScore, Inc. (SCOR) – purchased 100,000 shares of SCOR at $3.19. His out of pocket cost was $319,000.

Hedge Fund Tips (PCN) – Position Completion Notification

Where is money flowing today?

Be in the know. 10 key reads for Friday…

- Productivity Will Battle Inflation an Send Stocks Higher, Says Ed Yardeni (Barron’s)

- Rocket Earnings Fell Short, but the Company Expects Mortgage Demand to Remain Strong (Barron’s)

- Ways to Gear Up Your Portfolio for Inflation Concerns (Barron’s)

- Disney Posts a Rebound as Tourists Returned to Its Theme Parks (Wall Street Journal)

- Home Prices Jumped Across the U.S. in Second Quarter (Wall Street Journal)

- S. consumers suffered a ‘stunning loss of confidence’ in early August, University of Michigan survey finds (MarketWatch)

- ‘Memory – Winter is Coming’: Morgan Stanley Downgrades Micron (MU) to EW as Supply is Catching Up To Demand, Prefers Samsung (SSNLF) (Street Insider)

- Dan Loeb’s Third Point Gets a Taste of Its Own Activist Medicine (Wall Street Journal)

- Disney+ reaches 116 million subscribers, and its parks division returns to profitability. (New York Times)

- Yardeni Says ‘Roaring 2020s’ to Continue, and Stock Bulls Agree (Bloomberg)

Tom Hayes – Quoted in Reuters article – 8/12/2021

Thanks to Devik Jain and Ambar Warrick for including me in their article on Reuters today. You can find it here:

Thanks to Devik Jain and Ambar Warrick for including me in their article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

Unusual Options Activity – Activision Blizzard, Inc. (ATVI)

Data Source: barchart

Today some institution/fund purchased 9,810 contracts of Jan $90 strike calls (or the right to buy 981,000 shares of Activision Blizzard, Inc. (ATVI) at $90). The open interest was just 2,836 prior to this purchase. Continue reading “Unusual Options Activity – Activision Blizzard, Inc. (ATVI)”

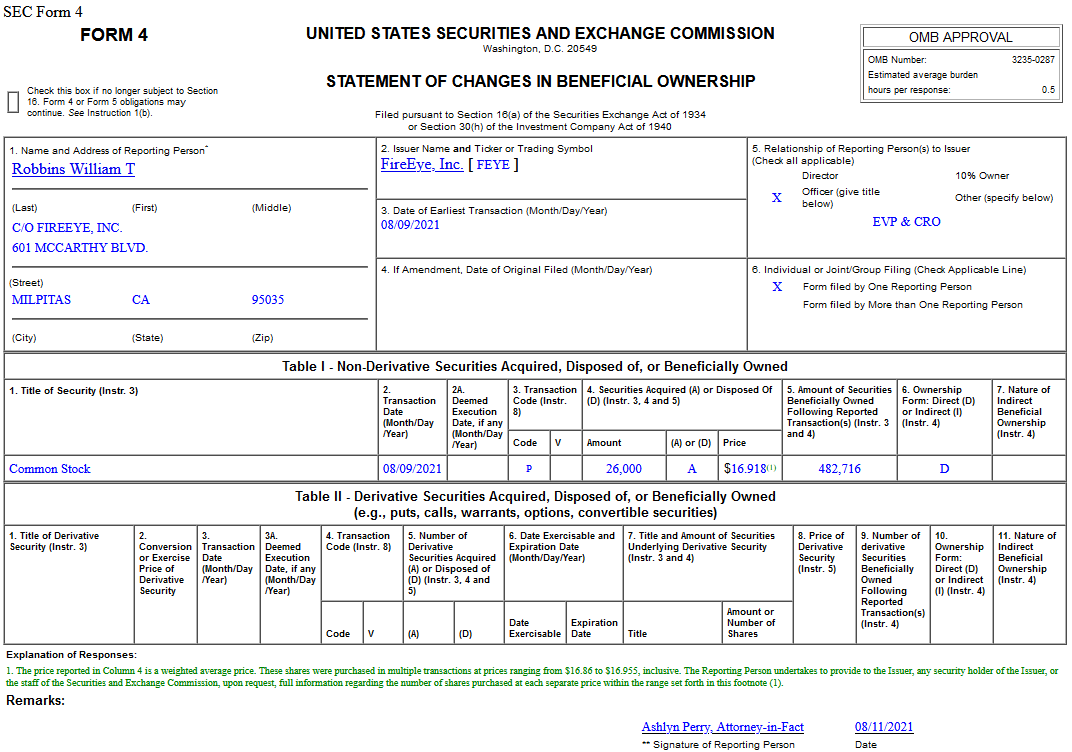

Insider Buying in FireEye, Inc. (FEYE)

Where is money flowing today?

Be in the know. 20 key reads for Thursday…

- How A Retail Maverick Turned Boot Barn Stores Into Pure Gold (IBD)

- Just Eat Takeaway (GRUB) Gains as Seth Klarman Hedge Fund Buys a $645 Million Stake, Shareholders Says Stock ‘Deeply Undervalued’ (StreetInsider)

- App Store Competition Targeted by Bipartisan Senate Bill (Wall Street Journal)

- How Millennial Investors Lost Millions on Bill Ackman’s SPAC (institutionalinvestor)

- Manchin warns of ‘grave consequences’ if Democrats pass $3.5 trillion package (MarketWatch)

- Feeling the Inflation Heat. The Energy Report 08/12/2021 (Phil Flynn)

- Crypto wars: Biden administration at war with itself over regulation (Fox Business)

- Bumble, Match Have Love Left to Give (Wall Street Journal)

- Banks Are a Good Bet if Interest Rates Spike (Barron’s)

- Merck Spinoff Organon Is Supercheap and It Just Set a 3.7% Dividend Yield (Barron’s)

- China unveils five-year plan to strengthen control of economy (Financial Times)

- Baidu Earnings Beat Expectations. Why Its Stock Is Dropping. (Barron’s)

- Fannie Mae Aims to Make Home Loans More Accessible (Wall Street Journal)

- One Number to Gauge Where the Economy Is Headed (New York Times)

- Liquidity Is Evaporating Even Before Fed Taper Hits Markets (Bloomberg)

- S. Initial Unemployment Claims Drop for Third Week in a Row (Bloomberg)

- Palantir revenue jumps 49% in second quarter (CNBC)

- Labor shortage gives retail and restaurant workers the upper hand—for now (CNBC)

- Billionaire ‘Bond King’ Jeff Gundlach warns inflation is worryingly high — and official readings are understating the problem (Business Insider)

- How Do Baidu’s Q2 Numbers Stack Up Against Google? (Benzinga)

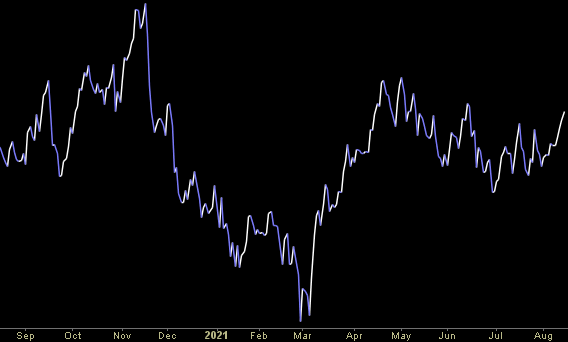

The Yogi Berra “Deja Vu” Stock Market (and Sentiment Results)…

This week we chose Yogi Berra’s famous quote, “It feels like deja vu all over again” to describe one aspect of the current market climate. This is in contrast to what many talking heads are saying about China in recent days (also a famous Yogi quote), “the future ain’t what it used to be!” Continue reading “The Yogi Berra “Deja Vu” Stock Market (and Sentiment Results)…”