- Alibaba, Tencent Look Cheap Even With China Crackdown Risks, NYU Professor Says (Bloomberg)

- US August payrolls rise much less than expected, while wages heat up (Reuters)

- Why 5 of the Highest-Yielding Dividend Aristocrats May Be the Safest Bet for Rest of 2021 (24/7 Wall Street)

- Why European stocks may be a good alternative to high U.S. valuations (MarketWatch)

- Investors Are Ignoring the Tax Elephant in the Room (Barron’s)

- US added 235K jobs in August, way below expectations of 720K (New York Post)

- The Hard Road Back. The Energy Report 09/03/2021 (Phil Flynn)

- Joe Manchin Calls for Pause in Democrats’ $3.5 Trillion Spending Push (Wall Street Journal)

- Alibaba Pledges $15.5 Billion as Chinese Companies Extol Beijing’s ‘Common Prosperity’ Push (Wall Street Journal)

- Here’s the chart that shows what’s about to happen in the jobs market (marketwatch)

- The Netflix Show That Turbocharged Formula One (Wall Street Journal)

- China’s stock trading volume surges above 1 trillion yuan for weeks as other investment options dry up (CNBC)

Thomas Hayes – Channel NewsAsia – CNA Singapore TV Appearance – 9/2/2021

Hedge Fund Tips (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Be in the know. 14 key reads for Thursday…

- Bill Gross Says Bonds Are ‘Investment Garbage’ Amid Low Yields (Bloomberg)

- China Economist Is Rare Voice of Caution on ‘Common Prosperity’ (Bloomberg)

- 7 Defense Stocks That Still Offer Value Now That the U.S. Has Left Afghanistan (Barron’s)

- 2 Good Reasons the Stock Market Isn’t Ready to Blow Up Yet (Barron’s)

- Heading Into Jobs Report, It’s Back to a Bad News Is Good News Market (Barron’s)

- Chinese Firms Rush to Embrace ‘Common Prosperity’ Slogan (Bloomberg)

- Record-Breaking. The Energy Report 09/02/2021 (Phil Flynn)

- Alibaba Pledges $15.5 Billion to Xi’s ‘Common Prosperity’ Drive (Bloomberg)

- How to Deal With Above-Target Inflation: Raise the Target (Wall Street Journal)

- Energy Traders See Big Money in Carbon-Emissions Markets (Wall Street Journal)

- Here’s why experts believe the U.S. is in a housing boom and not a bubble (CNBC)

- Baxter (BAX) Acquires Hillrom (HRC) for $156/sh or $12.4B Including Debt (streetinsider)

- Worried about ‘value traps’ in stocks? GMO says ‘growth traps’ are even more painful (MarketWatch)

- Robinhood investors are propping up this stock market, says JPMorgan (MarketWatch)

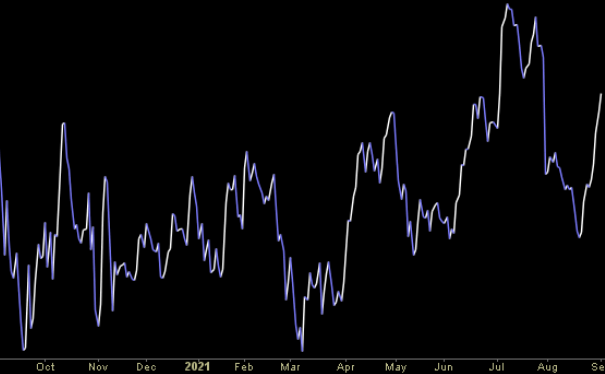

The “Chasing After You” Stock Market (and Sentiment Results)…

With the market looking and feeling extended at these levels, the song we chose to embody current market sentiment for the week is Ryan Hurd and Maren Morris’ 2021 hit, “Chasing After You.” This has effectively been the theme song for managers who have been skeptical of the market rise all year and were repeatedly forced to chase up: Continue reading “The “Chasing After You” Stock Market (and Sentiment Results)…”