- U.S. July Payrolls Increase 943,000, Topping Estimates (Bloomberg)

- Travel Earnings Improve, But Covid Remains a Drag (Barron’s)

- Booster Shots Look Inevitable. The Market May Have Priced That In. (Barron’s)

- Employment Situation Summary (BLS)

- Why There Are Plenty of Jobs and Still Unemployment (Barron’s)

- Nokia Stock Is Riding the 5G Wave. Why the Rally Could Continue. (Barron’s)

- Business Groups Call on Biden to Restart Trade Talks With China (Wall Street Journal)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Where is money flowing today?

Be in the know. 15 key reads for Thursday…

- Businesses Are Loading Up on Credit. Spending Could Follow. (Wall Street Journal)

- Regeneron Earnings Top Estimates. Its Stock May Be Breaking Out. (Barron’s)

- Energy Stocks Look Cheap if Oil Prices Are an Indicator (Barron’s)

- 3 Electric Utility Stocks to Give Your Portfolio a Jolt (Barron’s)

- Watches from Patek, Tudor and Omega Take Gold, Silver and Bronze (Barron’s)

- Want to Build an Online Sports-Betting Empire? Start With a Gas Station Casino (Wall Street Journal)

- Interest-Rate Increases Could Come as Soon as Early 2023, Fed’s Clarida Says (Wall Street Journal)

- CVS, Walgreen results get a boost from vaccinations and COVID-19 tests (New York Post)

- Robinhood Tumbles as Holders File to Sell 98 Million Shares (Bloomberg)

- China’s harsh education crackdown sends parents and businesses scrambling (CNBC)

- Retail investors’ strong ‘buy-the-dip’ impulse will help keep stocks buoyant in 2021, says TD Ameritrade’s JJ Kinahan (Business Insider)

- Kellogg sales rise, beat expectations (MarketWatch)

- 5 Safe Dividend Stocks to Move to Now (24/7 Wall Street)

- Cigna (CI) Q2 Earnings and Revenues Surpass Estimates (Yahoo! Finance)

- ViacomCBS earnings beat driven by streaming as Paramount+ adds more than 6 million subscribers for second straight quarter (MarketWatch)

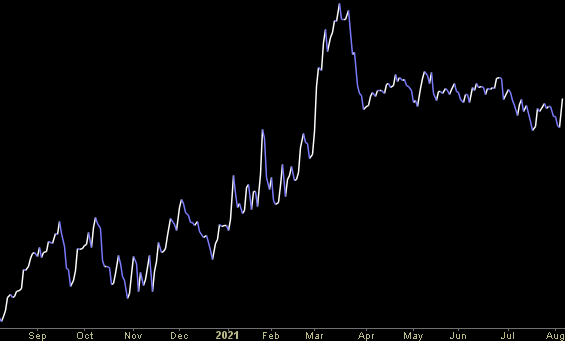

The “August Chop” Stock Market (and Sentiment Results)…

On both Friday and Monday I was on Fox Business – The Claman Countdown – with Liz Claman. Thanks to Ellie Terrett and Liz for having me on. In both of these segments we discussed the seasonal period of choppy markets that historically occurs in August and September. Continue reading “The “August Chop” Stock Market (and Sentiment Results)…”

Where is money flowing today?

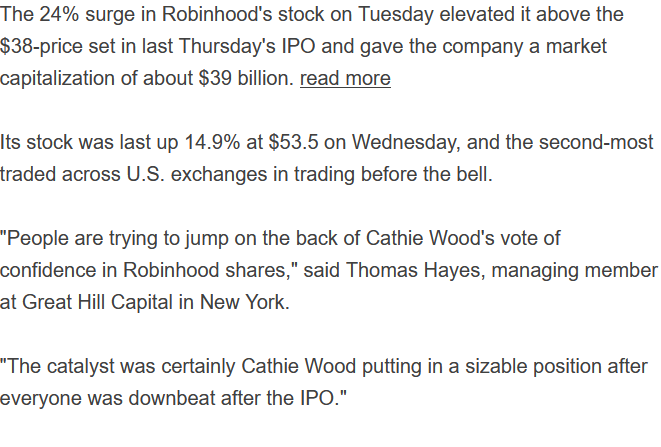

Tom Hayes – Quoted in Reuters article – 8/4/2021

Thanks to Sanjana Shivdas for including me in her article on Reuters today. You can find it here:

Thanks to Sanjana Shivdas for including me in her article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

Be in the know. 12 key reads for Wednesday…

- FDA Looks To Grant Full Approval To Pfizer’s COVID-19 Vaccine By Early September: NYT (Benzinga)

- As China’s recovery wobbles, economists expect more policy easing (Reuters)

- Tencent Selloff Shows Deep Scar Tissue in Chinese Markets (Wall Street Journal)

- Lyft Makes Its Move in Race for Profits (Wall Street Journal)

- SoftBank acquires $5bn stake in Swiss drugmaker Roche (Financial Times)

- 6 reasons stocks could surprise to the upside this month despite historically meager returns in August, according to Fundstrat (Business Insider)

- Natural Gas Is Looking Like This Summer’s Hottest Commodity (Wall Street Journal)

- Alibaba Earnings Were Pretty Good. Why the Stock Has Dropped — Just Like Amazon Did. (Barron’s)

- CVS Health raises forecast for year, tops analyst estimates with strong second-quarter sales (CNBC)

- 5 Favorite Dividend-Paying Banks to Buy Now With Q2 Earnings Over (24/7 Wall Street)

- Mortgage rates fall below 3% for first time since February – MBA (Reuters)

- People Have Been Buying Defensive Stocks. (Barron’s)

Unusual Options Activity – Alibaba Group Holding Limited (BABA)

Data Source: barchart

Today some institution/fund purchased 2,522 contracts of Jan 2023 $190 strike calls (or the right to buy 252,200 shares of Alibaba Group Holding Limited (BABA) at $3190). The open interest was 1,708 prior to this purchase. Continue reading “Unusual Options Activity – Alibaba Group Holding Limited (BABA)”