TD Ameritrade Network Appearance – Thomas Hayes – Chairman of Great Hill Capital – July 28, 2021

Be in the know. 23 key reads for Wednesday…

- China State Media Seeks to Calm Investor Nerves After Stock Rout (Bloomberg)

- Boeing (BA) Earnings Beat Marks a Multi Year Inflection to Potential Upside Surprises (Street Insider)

- China Convenes Banks in Bid to Restore Calm After Stock Rout (Bloomberg)

- China state-owned daily urges calm after market rout (Reuters)

- Pfizer Stock Lingers In Breakout Territory After Hiking Its Covid Vaccine Outlook (Investor’s Business Daily)

- Boeing Stock Jumps After Surprise Profit. What’s Behind Its ‘Shocking Beat.’ (Barron’s)

- Apple Earnings Crushed Expectations. Why the Stock Is Dropping. (Barron’s)

- Inflation and a Slowing Economy Will Take Center Stage at This Week’s Fed Meeting (Barron’s)

- Could a New CEO Lead to a Stock Split at Amazon? (Barron’s)

- Pfizer Covid Vaccine Sales Boom and More to Know From Earnings (Barron’s)

- Alphabet Earnings Clear a High Bar (Barron’s)

- Durable-Goods Orders Advanced in June as U.S. Economy Continues to Grow (Wall Street Journal)

- Microsoft Posts Another Quarter of Record Sales Driven by Cloud Growth (Wall Street Journal)

- GE’s Turnaround Rides a Pandemic Rebound (Wall Street Journal)

- What to Know About Robinhood’s IPO (Wall Street Journal)

- 15 of Italy’s best luxury hotels that are well worth the indulgence (USA Today)

- Blinken Sets Humble Tone in Asia as U.S. Aims to Boost Ties (Bloomberg)

- Pfizer sells $7.8 billion in Covid shots in second quarter, raises 2021 guidance on vaccine sales (CNBC)

- Stock-market investors are ‘staring down the barrel of seasonal weakness for next 3 months’ (MarketWatch)

- Here Comes China’s “National Team” To Bailout Markets (ZeroHedge)

- Raytheon (RTX) Gains on Beat-and-Raise, CEO Says Next War Will Be Fought in Cyber Space and Then Outer Space (Street Insider)

- Mortgage refis spike as 15-year fixed rate hits lowest since 1990 (Fox Business)

- Billionaire investor David Einhorn says inflation isn’t going away – and expects rising prices to boost his stock portfolio (Business Insider)

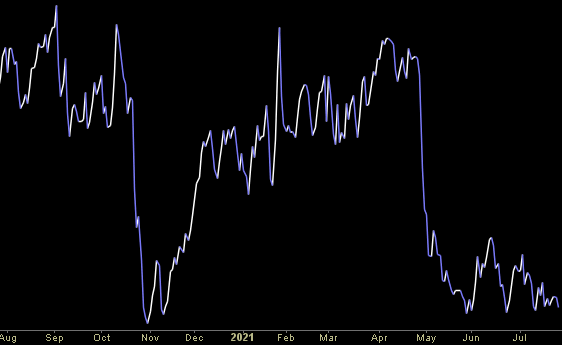

Where is money flowing today?

Hedge Fund Tips (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 20 key reads for Tuesday…

- GE’s Earnings Were Strong. It Could Push the Stock Out of the Doldrums. (Barron’s)

- China’s Crackdowns Have Been Swift. Which Stocks Could Be Hit Next Is Anyone’s Guess. (Barron’s)

- 8 Delta Variant-Busting European Stocks That Analysts Love (Barron’s)

- 6 Big Energy Stocks That Offer Yield (Barron’s)

- Intel Lays Out Chip Manufacturing Plans Through 2025 (Barron’s)

- 5 Oil Stocks That Come Into Earnings With a Lot to Prove (Barron’s)

- A Key Gauge of Future Inflation Is Easing (Wall Street Journal)

- S. Population Growth, an Economic Driver, Grinds to a Halt (Wall Street Journal)

- Chinese Education Stocks in U.S. Rebound After Sharp Selloff (Bloomberg)

- GE lifts full-year free cash flow target on recovery hopes (CNBC)

- S., China Leave Room to Talk After Contentious Meetings (Bloomberg)

- Investors Aren’t Playing Defense, but the Military Splurge Isn’t Over (Wall Street Journal)

- Raytheon stock rallies after profit, revenue and FCF beats and raised outlook (MarketWatch)

- Krispy Kreme (DNUT) New Research Coverage Mostly Positive as Analyst Says the Best is Yet to Come (Street Insider)

- S&P 500 Dividend Yield Lowest in 20 Years: 5 Blue Chips to Buy Now With Huge Dividends (24/7 Wall Street)

- These beat up stocks are poised for a big rally: Goldman Sachs (Yahoo! Finance)

- Psst! Paul Glazer Is the True King of SPACs. (And He Would Prefer You Didn’t Know That). (Institutional Investor)

- Chinese tech stocks sink as regulation fears hit Tencent (Financial Times)

- Campbell’s Soup Redesigns Iconic Labels, Launches NFT Collection: What Investors Should Know (Benzinga)

- Home prices broke records in May, according to S&P Case-Shiller (CNBC)

Unusual Options Activity – Las Vegas Sands Corp. (LVS)

Data Source: barchart

Today some institution/fund purchased 7,942 contracts of Dec $45 strike calls (or the right to buy 794,200 shares of Las Vegas Sands Corp. (LVS) at $45). The open interest was just 189 prior to this purchase. Continue reading “Unusual Options Activity – Las Vegas Sands Corp. (LVS)”

Where is money flowing today?

Be in the know. 15 key reads for Monday…

- China’s Digital Yuan Puts Ant and Tencent in an Awkward Spot (Wall Street Journal)

- Retailers Have Back-to-School in the Bag (Wall Street Journal)

- What’s Holding Back China’s Recovery? The Kids Aren’t Alright (Wall Street Journal)

- Hedge Fund CIO Explains When To Take A Profit (ZeroHedge)

- China blames US for ‘stalemate’ in relationship during tense meeting (FoxBusiness)

- China’s education sector crackdown hits foreign investors (Financial Times)

- US shale dealmaking wave is transforming the industry (Financial Times)

- Can a new commodities boom revive Brazil? (Financial Times)

- SoftBank Vision Fund’s bet on Didi falls $4bn into the red (Financial Times)

- Second quarter earnings are all about 2019: Morning Brief (Yahoo! Finance)

- China Unloads Grievances in U.S. Talks, Says Ties in ‘Stalemate’ (Bloomberg)

- FICO Score’s Hold on the Credit Market Is Slipping (Wall Street Journal)

- Here’s a Leveraged Way to Play Tripadvisor at a Discount (Barron’s)

- U.S. Set to Push Global Economy Over the Recovery Line (Wall Street Journal)

- China’s Tech Regulator Orders Companies to Fix Anticompetitive, Security Issues (Wall Street Journal)

Be in the know. 11 key reads for Monday…

- Charlie Munger – Daily Journal Corp. (Portfolio Update) (dataroma)

- 10 Best Dividend Aristocrats to Buy According to Hedge Funds (Insider Monkey)

- S., China Head Into First Talks in Months Still Trading Blows (Bloomberg)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- S. Swimmers Win Six Medals in Their Best Olympic Start Ever (Wall Street Journal)

- As moratoriums lift, will America face a wave of foreclosures and evictions? (Economist)

- Caeleb Dressel Isn’t Just The Next Michael Phelps. He Might Be Even Better. (fivethirtyeight)

- 100+ Years of Olympic Opening Ceremony Highlights (Town & Country)

- Fed’s MBS Buying High on Agenda as Officials Begin Taper Talk (Bloomberg)

- Traders Seek Growth in Emerging Markets as Recovery Angst Builds (Bloomberg)

- Big tech companies retake market reins with earnings on tap (Reuters)